Hey traders-

Enjoying the much needed downtime? I know I am. Diving thru the data, looking for any edges and hidden clues. Sharpening the axe.

One thing that I have talked about previously and I want to reiterate is the role of volatility in dictating our strategies when it comes to shorter time frames like the 0DTE.

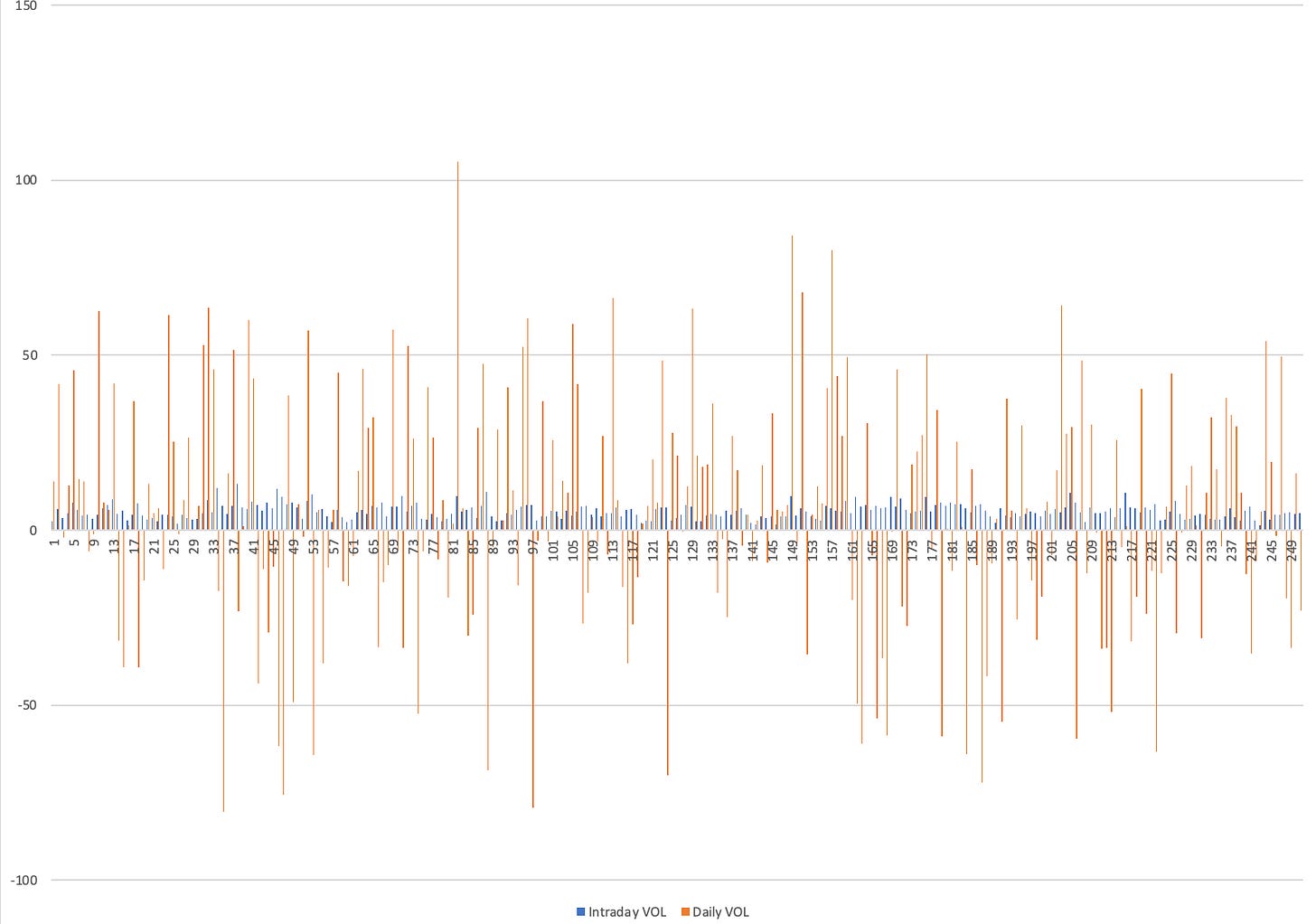

See Chart A below for some interesting insights. Other than the fact that the volatility is collapsing, which portends a large spike in volatility soon.

For Chart A, I used the intraday Emini continuous contract going back a year, and calculated two things:

A) What is the Daily volatility when measured from Open to Close.

B) What is the intraday cash session volatility for each session, using 30 minute auctions.

The results?

Fairly stunning. Here are a few key points-

The average Daily move has been 26 dollars for the past 250 trading sessions!

There has not been a single day where the volatility exceeded 100 dollars on the downside in last one year. In fact the worst was about 80 handles- a mere 1.6% more to the downside.

In fact, there only have been 39 sessions out of last 250 trading sessions where Day’s range exceeded 50 points in absolute terms.

Intraday situation is even more dire. On average, over the past 250 trading days, the market moves barely 4.9 dollars on average intraday, using 30 minute auctions.

In fact there have been only 12 sessions in last 250 trading sessions when the average intraday volatility exceeded 10 dollars. That is 5% of the trading days we get some decent intraday volatility. 95% of the days we were watching paint dry.

Results would be roughly the same whether you measure volatility as Close to Close or High to Low. I used Close to Open.

These numbers are stunning in terms of how boring they are. But they also offer some important clues.

The clues can be used to construct our intraday trading strategies. Now while I think trading strategy is something deeply personal and reflective of our personality and style, I do think these numbers paint the picture of what not to do. In terms of risk management.

If the Daily range is on average 26 dollars, it suffices to say a decent intraday risk can be about 20% of that range. Or about 5-6 dollars. Many times we get caught up in sudden moves, or just execute poorly- the question then is that is taking on a heat of 10, 15, 20 points (intraday) supported by data we have? No. It is not. Atleast it is not supported by long term data.

Some other implications of this data are: A) most tradable days tend to be when the range is higher than 40-50 dollars on average. B) When range extension does occur, the average of the Daily range over past 250 trading sessions can come in as Support when breaking out of range or resistance when breaking down below. Other similar strategies can be derived which are beyond the scope of this post.

Now you can agree with this or disagree, the fact is a lot of large traders and market makers will think like this, becoming a self fulfilling prophecy. Humans are ruled by law of averages.

What does this say about technical analysis?

This has implications for technical analysis as well. Volatility or lack there of will drive orderflow and orderflow will drive technical analysis. It is not the other way around.

For instance, if a trader relies on buying when RSI is below 30 or selling when RSI is above 70, is this system going to act the same way when average range is 15 dollars versus it being 60? Will your stop loss and target remain the same, regardless of average volatility?

The current range, while a year or so long now, is still very short term. Historically, this range can be around 80-100 as it was in 2020, or 2022, or can be elevated into 60-70 dollars a day, as it was for most part of 2016 to 2020. It was around 60-70 even back in 2008 but then know that the S&P500 itself was in 600-800 handles back then.

This is why any technical analysis needs to constantly evolve. To match the volatility.

As traders, we have to constantly evolve. Trading as a profession is very much like a software or a Medical profession. You have to constantly evolve and sharpen your skills.

Levels for tomorrow

The markets will remain open for regular business on Thursday and Friday.

For the Thursday cash session, my key level remains 5528-5532. We are now 5563.

Scenario 1: If we get some sort of volatility release, I think if 5528 is tested, it may be supported for a more back to 5550s.

This is it, just wanted to share something that popped up on my radar. If you like it, like and share. Sharing is caring.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.