Good Morning 🌞 Traders,

Friday saw a volatile finish to end the week. I thought there were few clues hidden in the price action which I wanted to share. Following is a detailed note but a quick summary first for those in a hurry:

Summary:

Volatile end and volume expansion to a strong 💪 week.

Key levels are 4515 and 4552.

Potential targets in vicinity of current market action are 4480 and 4600. Slightly biased towards a test of 4480 before next major move.

The 10,000 feet view:

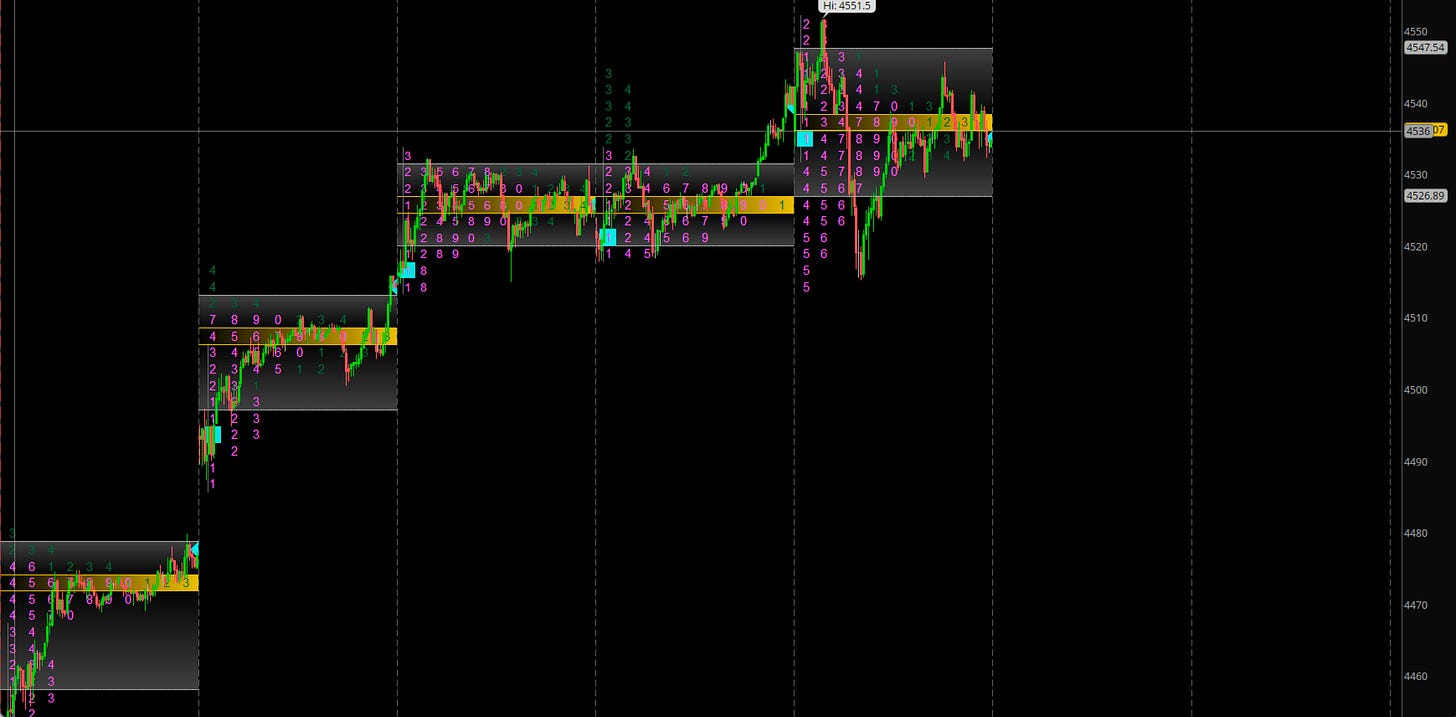

We started off with a strong Monday only to finish Tuesday even stronger (and with a gap up). This was followed by Wednesday and Thursday auctions taking a rest and carving out a 2-day balance. This is what made me believe Friday’s sell off below 4515 will be quite hard to achieve as 4515 represented the Value Area Low (VAL) of previous 2-Day balance. If you don’t know already, see this post for an understanding of VAL: What is VAL?

Deeper Dive into Friday Auction:

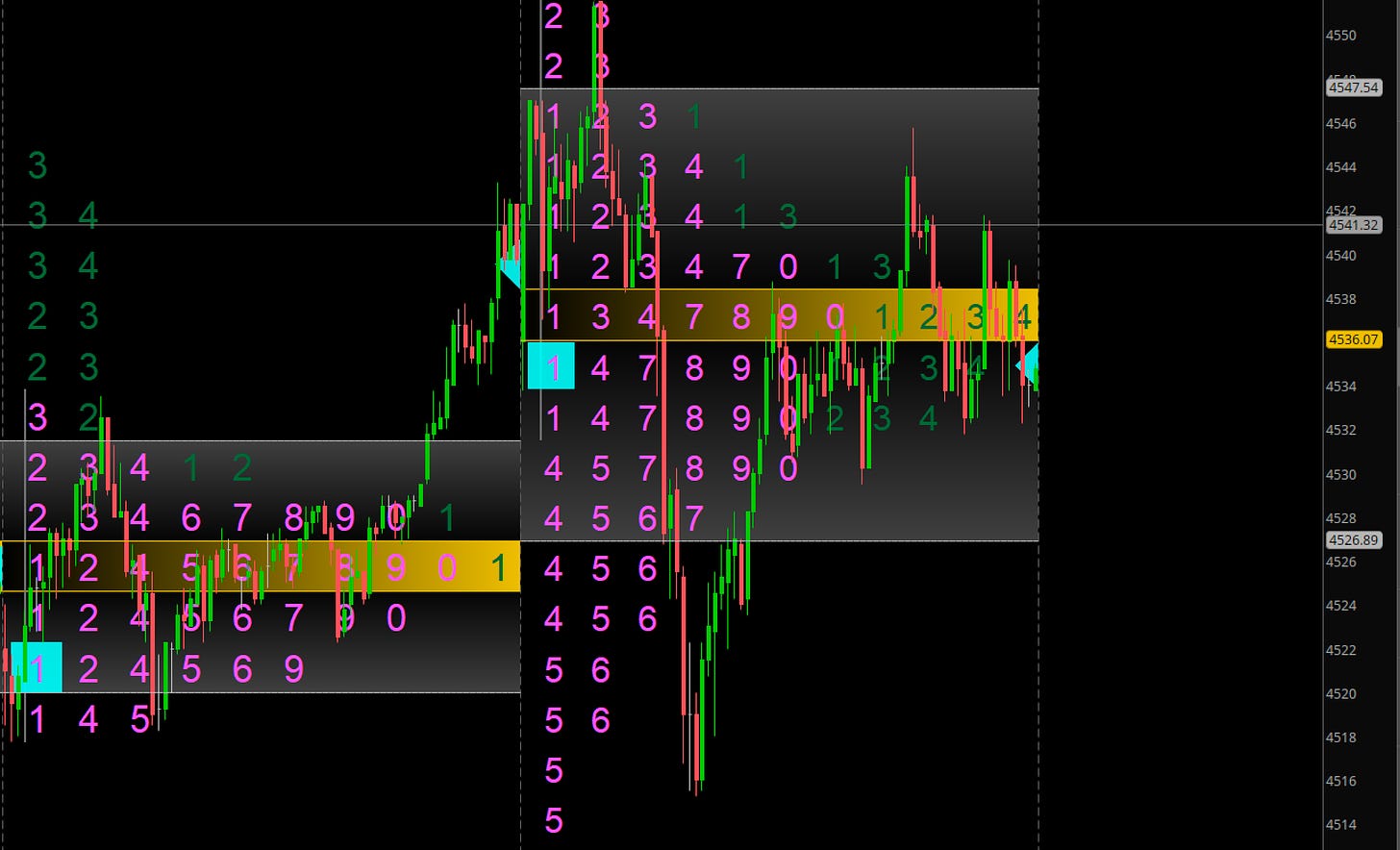

Friday started off strong above my 4535 level (See the link for daily plan issued for 1022: Daily Plan

We quickly bid up to 4552 , however could not attract more buying. Overnight Asian and European lows at 4525 provided some support and once the support broke, we quickly retreated down to test the key reference from Thursday’s auction.

What was this key reference 🤔:

On Thursday as soon as the market opened, it tried to take out 4515. This was thwarted. Few minutes later, there was a 2nd attempt to take out 4515. This was thwarted as well. Thereby putting in a good low for the day which was respected on Friday as well. Friday ended the day at 4530.

Looking ahead:

Putting it all together, Monday’s auction on 10/25 may be a continuation of Friday’s. A test of Prior Low (PLOD) at 4515 may be made to see “what’s out there”. If sellers succeed in breaking it, logical next point may be 4480-4490 cash session gap.

The other end of sprectrum is 4552. A strong open or bidding above 4552 will take us to all time highs and not much resistance until 4600 (a nice round number).

There are major, trillion dollar earnings next week like FB which have the potential to make or break S&P500. I will be providing contextual analysis of these earnings in my Twitter and Telegram so make sure you hop on and join me there as well.

Last but not the least, remember always this post is my personal opinion on where market may be headed. This is my personal journal I pen down to prepare for the next week’s trading and I don’t mind sharing this with my followers and other traders. This should never be considered financial or trading advice. Do your own home work and due diligence 👍

This was my take on what may happen. Hope it made sense. Let me know what you think 🤔 , up or down next week ⬆️ 👎 or both.

Thanks Tic, always love hearing your insights.

Thanks Tic---I freaking LOVE this format. TWTR or TG is great for quick updates during the day but this long format is just awesome.