Traders-

This was yet another weak week for the bulls and a good week for the OrderFlow where the market continued on to it’s bearish momentum on the downside.

Tech stock heavy QQQ shed 4 % and SPY shed more than 3% on the week. Emini S&P500 is now at time of this post down about 450 handles from where I reiterated my bearish bias and shared reasons with folks in this newsletter why I was not too keen on the bear market rally of last month.

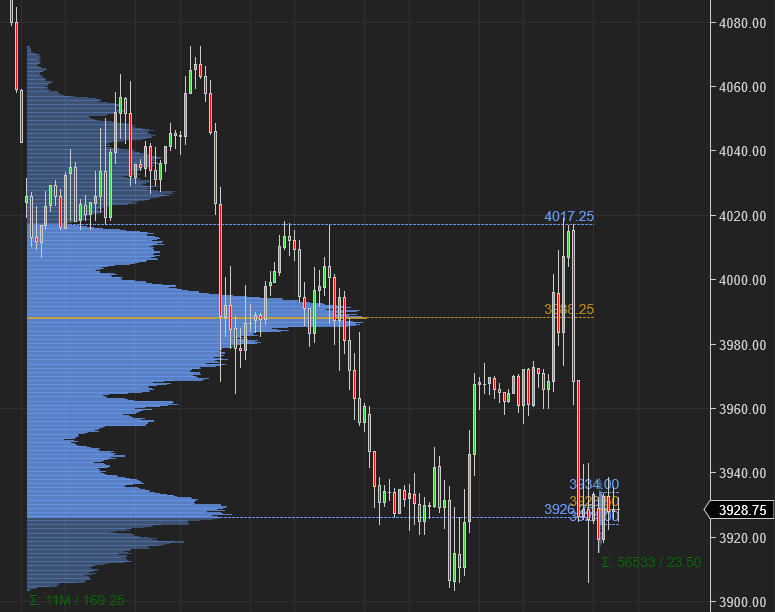

This good week was wrapped up on Friday by my levels such as 3970 and 4010, where the S&P500 market could barely peek it’s head above 4010, despite a weaker than expected economic data from the Non Farm Payrolls (NFP).

Before diving into this week’s levels and some other ideas, I want to recap this week’s primary bias and how my other ideas did for transparency.

My primary bias for this week was we may stay offered below 4060 and could see a test of 3970-4000 and that a test of 3970 may lead to a small bounce retesting 4000-4010.

This was indeed the case as on Monday we gapped down from the prior closed, bid up to 4060 area and found sellers to target 3970. This level then provided some relief to the bulls before breaking and closing below it on Friday.

Here is the full link to my last weeks plan.

Click here for educational content for OrderFlow traders

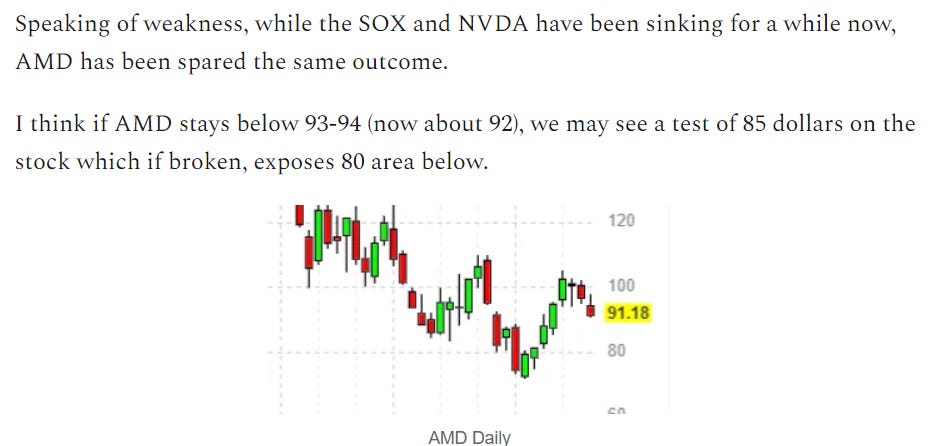

On top of this, I was also quite bearish on NVDA and AMD.

See below.

AMD and NVDA stock actually collapsed from my bearish levels eventually settling around 80 dollars.

Not only was I bearish on SOX, I was also a bear on GOOG, Bitcoin, TSLA etc . TSLA had that close below 290 which was a key level shared with Substack folks and led to a 6% plus decline on the week, testing as low as 262 bucks before eventually closing at 270. Later on the newsletter I will share my thoughts on where I see TSLA go next.

If you want to receive upto 5 weekly updates from me, consider subscribing below for subscriber exclusive content.

Myths and delusions about “softish landing”

I think a lot of folks were hoodwinked last month into FOMO and buying that top at 4200-4300 because they believed the siren song of “softish landing” egged on by Powell himself amongst many other so called experts.

I called out that that question of a FED pivot or even a soft landing does not even exist as we are in one of the worst macro shapes as far as I can recall.

Remember, when you look at the Europe, there is no question of soft landing for them. They are in this grip of energy inflation catastrophe which may get worsen. Europe is one of the largest trading partners of the American S&P500 corporations and this will worsen the earnings of these companies IMO.

I personally think until this energy pricing situation is resolved and unemployment creeps back above 5-6%, I do not see a FED pivot or any landing - soft or or a hard one.

Risk events and Macro scene for next week

The markets will re-open in earnest after the long weekend on the Tuesday and the first key event will be the ISM Services PMI at 10 AM CST. This is followed by Mester and Brainerd speak on Wednesday as well as Bank of Canada rate decisions on Wednesday.

The most important event IMO for the week is on Thursday with the Powell speak at 810 AM, a few minutes before the US cash session open. We also have the ECB presser on the same day.

A 20 Year high in the US Dollar

As if the energy inflation was not enough, the US Dollar made a new 20 year high this week. I have been a dollar bull from a while now and most recently I shared 103 level on US dollar as support which if held could target 110.

We traded 110 today. I have also been very bearish on EURUSD. It traded below .99 this week. This also happens to be the ECB week and should add more fireworks to the mix.

A rising US Dollar is also not the best friends with risk-on assets like Bitcoin. Bitcoin was billed as the ultimate inflation hedge but has failed to live up to it’s expectations.

I have been a Bitcoin bear since 60000 dollars and most recently I reiterated my bearish bias at 25000 dollars.

It is now trading below 20000 at around 19500. I do think it is going to retest it’s recent June lows at 17500 which if broken may target $12000.

Longer term, unless the energy situation and the Dollar weakens, it will not surprise me if Bitcoin were to trade the $3000 range. For a lot of these risk on assets’ survival, the dollar must weaken. This is possible if the US government continues to mindlessly spend on programs that are inflationary , and politically force the FED to pivot and give up it’s pretense of fighting inflation. This will lead to unprecedented inflation and cause a crash of the US Dollar. When that happens, there will be distinct signs on the tape and hopefully OrderFlow will be able to catch them and share with folks here.

An update on Gold and Oil

Look, here is the thing.

It does seem this bear market in S&P500 began in earnest started with the Russian sanctions/war and will end with end of this war and sanctions.

I do not believe it is possible to avoid a massive recession and lower the energy prices (inflation) at the same time. Right now there is just a weird mix of forces acting as tailwinds on the energy prices. This is the refusal of western politicians to acknowledge the reality, there is enough energy in the US but the current political environment will continue to discourage it’s consumption and rely on propagating unsustainable policies and importing energy from outside, often from regimes which want to use this against us.

Therefore I think the energy prices may remain high and in fact they may remain high even if there was a big downturn in the US economic situation.

The Crude oil as expected by me at 90 last week softened to around 86 but was not able to take out the lows at 85.

I will now expect that the 86/87 support level I shared here in Stack many weeks ago is still intact and as long as we do not close below it, we may see a retest of 100 dollar crude again.

This is true for the oil stocks like XOM as well , which sold down a bit to 93 but was not able to take it out. I think as long as that 90-93 holds, we may have a tendency to see a 100+ on XOM.

Gas prices have definitely softened a lot in last few weeks but have kind of stopped going down any further. Additionally, the diesel prices have not budged much at all and I still see 7-8 dollar diesel in many places. Diesel is 5 dollars to the gallon in even cheaper markets so it remains high.

I think with the US SPR reserves about half gone, the US could be vulnerable if the oil prices were to spike up in Winters. I think once midterms are concluded in November, regardless of the results, there will be little political willpower to rein in prices after November and these price spikes may come in Winter time frame.

As far as Gold is concerned, the Dollar strength has been a headwind for it. For Gold stocks, like NEM, the energy prices also have been putting a ceiling on them.

Now I personally do think that NEM is at good levels here around 40 and may be getting accumulated. But do know that the way these programs are coded, they automatically sell and buy based on some parameters like correlations between Gold and Dollar etc

This is not however for short term time frames. It could be 2 years or even more before all the factors line up which will lift Gold to new heights.

My levels for this week

OrderFlow levels killed it last week in the Emini S&P500 which is one of the main markets I trade intraday. My levels were quite spot on 5 out of 5 days last week.

I will hope to build on that good run this week and share what I see on the tape with the folks here.