Hope everyone had a good downtime over the weekend and is back for another fun week with the NYSE.

Let us quickly recap a few things -

I had a bearish bias on DJT on the week and shared the 24 PUT for 9/20 around 3 bucks. This PUT did double around 6 dollars at time of this post.

SQ: Bullish CALL on SQ which did rally all the way up to 68 before giving up some gains on the week.

Had a bullish bias on CRWD and other Cyber Sec stocks, which did rally into almost 285 before giving up some of its gains.

OPEN was also a bullish call by me last weekend and it did rally into 2.6 from that 2.3 but then gave up its gains later in the week.

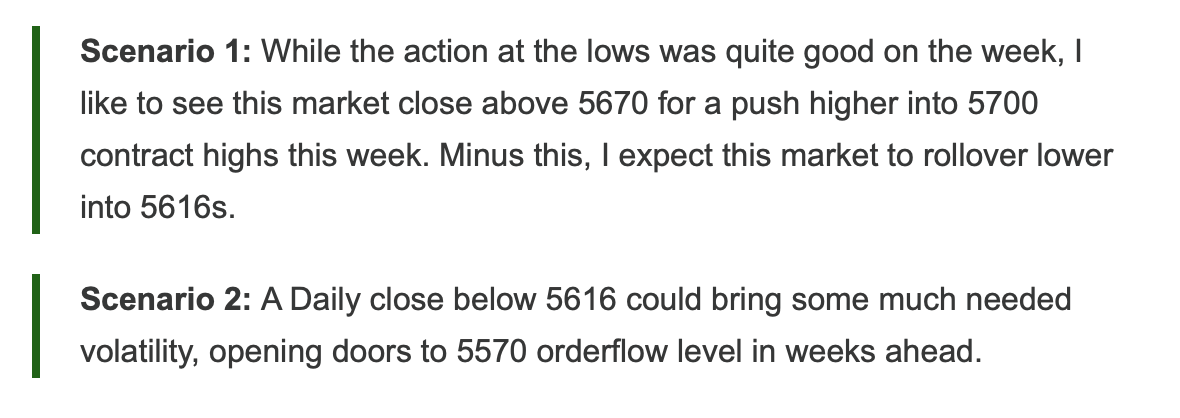

Cherry on the cake is my levels on SPY. On the Emini SPX side, I shared 2 levels. These 2 levels coincidentally were the high and low of the week. I had a bullish bias on the week, calling for dips to be supported.

See below.

While these 2 levels were published last Sunday, you can see the precise nature of these levels when you compare the weekly price action against these 2 levels.

As far as risk events go next week, I am particularly interested in Japanese bond auctions on Monday night as well as the Payroll data on Friday. BOJ also has a rate decision on the 18th which is going to be extremely important. If you look at the recent releases, they have leaned on hawkish side and any strength in Yen coming out of this is bearish for the indices such as SPY and QQQ. You can note the calendar and next releases, press statements etc at the link below.

Levels for the week

From a weekly auction, I like to say that the bulls have an upper hand here above 5630.

We closed on Friday at 5650.

Technically, I like to think of this as a breakout above 5630 therefore, if I am a bear here, I like to see a Daily level close below 5630.

Scenario 1: I think this is a technical breakout as long as 5630 holds, and I do not want to be bearish, unless we see a close below 5630. This could target recent highs at 5703. We last traded 5650 at Friday close.

Scenario 2: A Daily close below 5630 may target recent lows near 5570.

Tactically, this being a short week, due to the long weekend, these tend to be bullish, based on last several closes.

Then you have the NFP on Friday, so there may be little impetus to see that Daily close below 5630 until we see a significantly weak NFP print. If I am bear, I think unless we begin to see Daily close above 5703-5711, that could be a better spot for a move down into 5630 rather here at 5650.

Some other key markets to watch this week are going to be the likes of Oil market, the USDJPY, the 10 year rates etc.

With the Oil down into 73, and USDJPY higher back at 146, this could be viewed as short term plus for the risk on stocks. However, as we approach that BOJ rate decision, it is unlikely to see USDJPY remain perched here above 150- this current bout of life in USDJPY may be the 100 dollar technical bounce on the $DXY. With Oil back here at 73, I think it makes a case for a test of 67-68 per barrel (WTI). With everything else going on geopolitics side, these 73 Oil prints point to a weaker than perceived economic situation. This could be confirmed as early as Friday when those Non farm payrolls (NFP) hit the wires.

Is it a 50 or a 25 BPS on the 18th?

So the FED chair has made it amply clear last week at Jackson Hole that he is an extremely reactive technocrat who will be willing to make snap decisions based on day to day data points.

Make no mistake even the FED is not convinced what these rate cuts need to be as we enter September shortly. No one knows if it will be 25 or 50 BPS but it will most certainly not be 0.

I think this is going to come down to Friday. Further, I think this will be a 50 BPS cut. I do not think this will be a 25 BPS cut. I am leaning on a 50 BPS one, followed by another 25 BPS before year end.

Here is why-

Consensus is for the jobs number to come in at 164K. If we indeed come in at 164, and unemployment rate at 4.2%, then it may be a foregone conclusion that we get a 25 BPS.

However, I tend to believe if we get a 4.4% on the unemployment rate, along with jobs gains below 110K, this I think opens doors to a very panicky FED shedding 50 BPS in a few days from now.

Is this a well thought out plan by this FED?

No.

Not at all. Arguably services inflation has been the hardest part of inflation to shed. You could further argue that the workers , believe it or not, still hold some bargaining cards up their sleeves. I think and I have said this before, that inflation is very unlikely to fall back to the 2% FED desire target and could soon instead be above 3% again.

Come to think of it this way: do you really think we will hit a 40 year high in inflation only to then fall back below 2%? I highly doubt it. Based on historic trends, these inflations waves come and go, and they tend to make one more attempt higher before the underlying forces erode away at the economy, ultimately leading to deflationary pressures.

And I think this is the main reason why despite looming rate cuts, the markets tend to be holding. I do not believe that we are going to go sub 2% without doing some major damage. In other words, I do not believe in any soft landings for this FED.

Other things on my radar

Frankly not a whole lot this week. But if you must look at some of my prior calls, you can note the amount of time for my thesis to come to fruition. These are all long term calls not some daily or weekly swing calls. Some prominent examples-

PM and MO

CVNA

RTX, PLTR, LMT

MMM

BABA

UNH

YOU

PSA

NEM

ISRG

These were all shared here months ago when these stocks were at their respective lows. Not highs, as they are now. Another thing to note is the breadth of this list. They are all from different sectors and industries. None of these are alike. And certainly not all are Big Tech mega caps.

This is not a flex OR shade at other furus who may all be in AI innovation camp, believe it or not but to highlight a couple things. A) we can’t have great setups every week. In fact, most of the market moves come in 8-10 weeks out of the 52 weeks a year. You need to be ready when the setups appear. And B) there are good ideas to be found here but only if you take a longer term view. If you are looking for home runs every day and every week, well there are none. It can be a few quarters to even a year or more for many of these themes to play out.

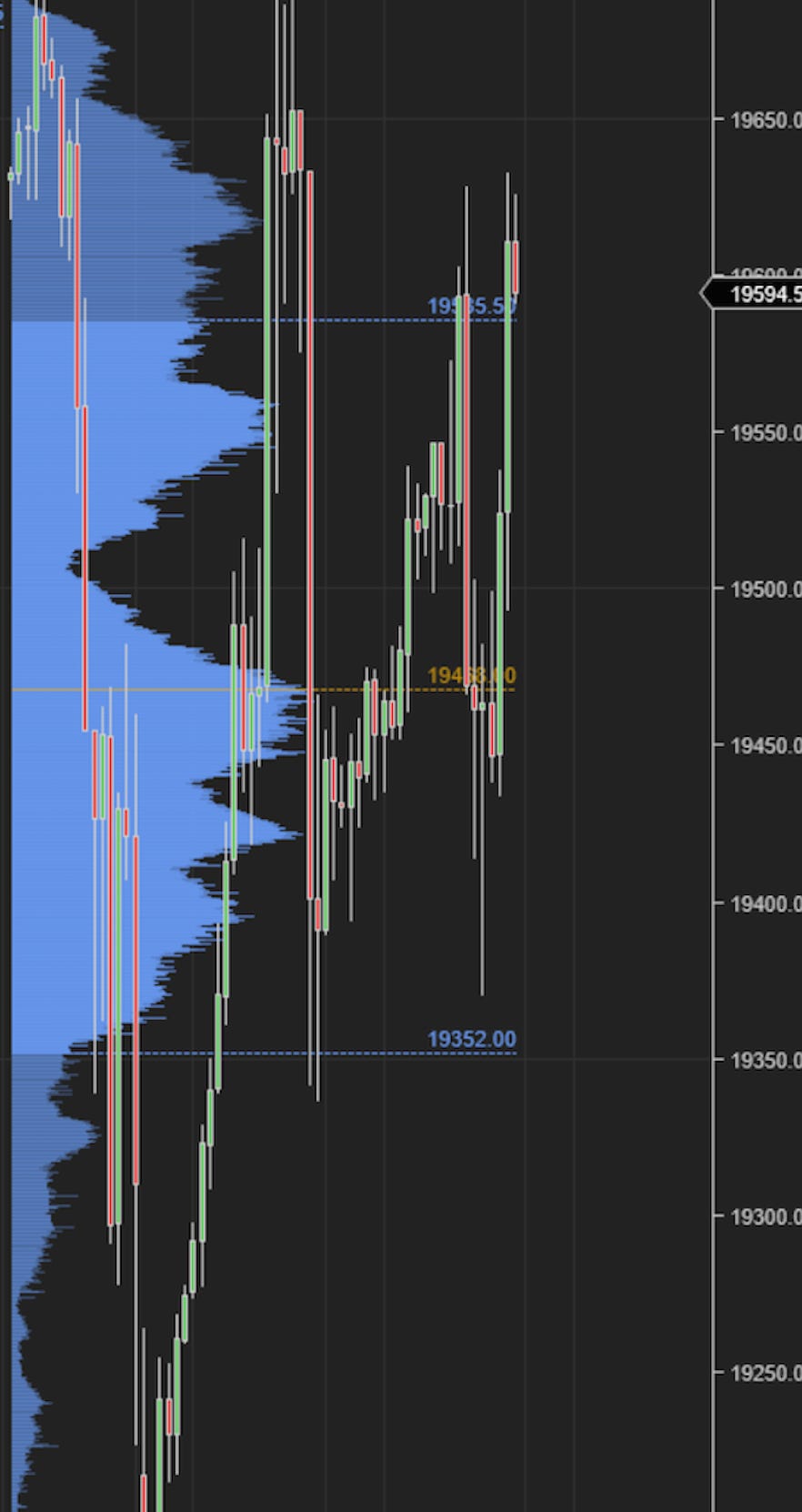

I organize the newsletter ideas in a couple of broad ways. If I sense we have a general bear market in the main indices, like we had in March 2020 or 2022, most of the ideas shared here will lean towards the bearish side. When we have an obvious bull market, mega caps tend to do better like we had in 2023. In last couple of months, mega caps have worked but you would have to be more tactical. For instance, if you get into NVDA at 95 or TSLA at 205. Or an AAPL at 205. The reason I do not think is that we are yet in a bear market in the general indices, but has more to do with some sort of rotation ongoing. So look at the Chart below from NQ.

This whole auction was below the auction from prior week. Normally this will be a bearish signal. However, you need to have some nuance, and I think the reason for this was rotation from big tech into other value type names in S&P500 and Dow Jones.

I think this trend will continue and we need to be more surgical and tactical with these mega cap names, atleast for now.

This leaves several smaller companies which could still benefit from the months and quarters ahead. In fact I will say such companies, being smaller and being established players in their respective industries, could have tailwinds for years and decades to come.

If you notice these type of names, they are not “innovative”. They are NOT AI. They are not crypto. They do not promise to cure cancer.

They are essential businesses that keeps the industrial world humming. We will let the innovation experts chase AI and other castles in the air dreams, our goal is to stay focussed and find interesting companies which are growing and solving real world problems and in exchange, growing sales and making profits.

MLI

From Mueller Industries site:

Mueller products support critical infrastructure and serve a broad range of industries including plumbing, heating, ventilation, air conditioning and refrigeration (HVACR), industrial manufacturing, appliance, transportation, medical, military and defense and electrical. In addition to being the only vertically integrated manufacturer of copper tube and fittings, brass rod and forgings in North America; the Company also has operations in Europe, Asia and the Middle East.

The stock is trading about 70 now but I like the 57-60 level if tested, could be supportive of this stock to push higher into 100 and beyond.

NEU

New Market is a holding company that owns Afton Chemical, Ethyl, NewMarket Services and NewMarket Development. This has primarily 2 main product lines: one is the lubrication business for heavy machinery and the second is fuel additives.

Operating profits rose last quarter due to lower raw material costs but were offset to some extent by lower margins on back of lower sell price. You can read the release below, if interested.

Note that they also took on debt for acquisition but the cost to service debt could be lowered if the FED rate cuts come in full swing. They do have a solid cash flow of half a billion a year and could be more juice to squeeze.

Stock was in a downtrend but recently regained its uptrend. It is near 570 now, but I think any pullbacks into 510-540 area could be supported. I will like to see this push higher into 620-630 area.

GVA

Incorporated since 1922, Granite is one of the largest diversified construction and construction materials companies in the United States as well as a civil construction provider.

The stock is now trading 75, and has a recent breakout from a long term range. On such breakouts, I like to see if recent break out area holds, in this case around 65-67. If this area holds, I see GVA push higher into 100 dollar area.

A company like GVA is embedded deep into California public sector ecosystem and with increasing regulations and natural disaster, this ensures them a steady supply of development projects. At any rate, companies like GVA can be good on any pullbacks as they have lesser competition and their main risk tends to be reversal of political fortunes in case they lose their connections and networking assets.

TSLA

As far as tech growth goes, I still like TSLA.

Remember I first shared TSLA here when it was 100 dollars before it went to 260. It is now trading about 212 but I still like it, unless I begin to see some closes below 190 area.

I think TSLA can be a 300 dollar company, obviously on some favorable political outcomes later in the year for the company. Even if not, I like it on any dips into 190 area.

Have a great week ahead. If you are interested in such off beaten path ideas, like, share and subscribe. I am executing another price hike in October, so this is not a bad idea to get grandfathered in at far lower prices which can never go up for you. Ultimately my goal is for the publication to cost $99/mo as we establish a long term readership. Once grand fathered in, your rates can never go up unless you resubscribe.

ASTS

ASTS rose about 5 dollars from that 25-27 support I shared. I still like ASTS if 25 holds.

I like to see a test of 40. It is now 29.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.