Whenever we decide to own something, and at end of the day our investments are nothing more than owning a slice of something bigger, there are always risks which can not be quantified easily, and often at all.

Such risks are often called Black Swans because they are impossible to predict. For instance, if I own AAPL, the iPhone maker may get banned in China, its largest and fastest growing market. If I own a house somewhere as an investment, it may be swallowed by a sinkhole; if I own TSLA, the CEO could be removed from his role.

These are all such examples of risks which are impossible to model or predict, no matter how sophisticated the methodologies employed.

Is there any protection against such risks? Outside of not owning individual stocks, owning just 2-3% of my account in any one stock and only owning an index, I do personally not see any way to protect ourselves against such risks. A nihilist’s way to insure against such risk is that one does not own any assets - but I think that is an even more deadly risk than this (in the long term).

In last 10-15 years, the definition of investing has evolved from taking calculated risks to a brisk confidence that the FED will always have investors’ backs when it hits the fan. There is some merit to this thinking, if you look at all market downturns in past decade or so, they have been benign for most part and the FED has stepped in to support the markets.

But can it continue to do so?

I do not know. However what I do know from past experience is that there are few key metrics which can be used to gauge the frothiness of key markets that I am interested in.

I think these tools or indicators when viewed holistically, not just a snapshot in time can be important gauges to see the level of frothiness in the markets.

Now do they work in all contexts? Not really but that is like any thing else we deal with. For example, PE. It is a very simple metric, the price of stock divided by its earnings. But it can convey important information when viewed holistically over a long range of period as well as comparing it against other stocks in same industry and sectors.

Apple could be a good example. Right now its forward PE is around 30. This simply means that if I buy AAPL at current closing price of about 180, it will take me 30 years to break even my investment, assuming the EPS remains constant around 6 bucks a share.

No doubt, Apple is an amazing company. We all use its products in one form or another. It is growing at a solid pace. Its future looks very bright. It has major institutional sponsorship.

However, everything I just said has been true for last 10, 20 years too.

No doubt. So what ELSE has also been true in last 10-20 years?

Apple used to sell around a 10 multiple. When it was selling at a 10 PE was it not a great company? Was its future not bright as when it is at 30 PE? I don’t think so.

So what changed? The value that the investors want to assign to AAPL stock changed. That changed. This is why folks are ok buying AAPL at a 30 PE else we will be trading lower.

Now going back to my original comment about black swan events; even though there is no way that I personally know to predict these black swans, I think there is a way to minimize my damage if these events were to happen.

I could buy AAPL when the PE is comparable to 10 rather than when it is at 30. This is a personal decision I can make, knowing that AAPL has traded at a 10 PE in past.

I am simply sharing my thought process on this topic as to how I myself see valuations of these companies. Now this example is specific to something like AAPL.

Will I view NVDA with same lens as that of AAPL? No! Because NVDA is a much faster growing company. Same logic applies to TSLA. The growth rate of TSLA is far higher than that of AAPL at the moment which means it will catch up or rather cover the distance to a higher PE faster. In case of an NVDA or a TSLA , I will rather use my key OrderFlow levels like TSLA 100 that I shared earlier or a NVDA 160 that I shared earlier last year.

So, if Elon is removed as CEO when TSLA is at 100, the damage to my account may be lesser than if I had it at 300 or a 400!

These concepts roughly equate to the “Value Area”. Markets can go up AND below the value area, but sooner or later they more than often may have this tendency to revisit these value areas to go in the opposite direction.

Another strategy is my opinion (IMO) could be diversification. However, diversity should make sense and not be based on some idiotic formula.

If I own only TSLA, FSR, NIO, and F, I may have done well this year but that is not diversification.

However, if I have HD, TSLA, BX, MRK, MCD to name a few, then even though I may have not done that great YTD, purely from a diversification perspective, this is better than the previous option.

This is really just an example of diversification. I reality I may have 20, I may have only 5 names I am interested in. There is no hard and fast rule but I do personally think any thing above 20 is over-diversification. Yes such a thing exists. If I am owning 40-50 names, for me personally that is a lot of effort in managing and I may as well just own a VTI or a VYM to name a couple.

My levels for this week

On the general market side, things have settled down. Volatility is near very low levels again. This is something I had called a few weeks ago.

The weekly range has shrunk and any decent action is in the intraday time frames which still have been ok as of this blog’s posting.

I have noticed quite a few interesting things last week, which I am happy to share with folks here. I share my thoughts almost every day with subscribers. Subscribers get these weekly plans, daily plans, chat room access, options, commodities and my thoughts on various things in market for about a dollar a day. If you have not yet, consider subscribing to my newsletter as it helps me grow the reach of message of tape to more folks buried deep in technical analysis mumbo jumbo.

If you are already a subscriber, I must say thank you, you are awesome :)

Look markets are an essential part of our life. We can not avoid or escape them. Directly or indirectly most of us are active in markets. Even for a retired warehouse worker, he or she may not know it but their retirement flows into the markets. They are impacted by markets. So it is always a good idea to get smarter about markets and understand their dynamics.

When I first started getting awareness of markets, the S&P500 used to be 400-500. Today it is near 5000. Old timers before that could remember S&P500 being merely around a 30-50 dollars. Many of us consider markets as a casino. Which is ok with me but if you are one of those people, I can predict with very reasonable certainty that such a person will not be around in a couple years.

There are bold traders and there are old traders but there are not any old AND bold traders.

There are distinctively two key themes I observed last week which I think could have an impact on markets next week or two-

There is noticeable divergence in mega caps like AMZN and GOOG when compared to AAPL and NVDA etc. I had called this out a few weeks ago with my observation that the action in AMZN and GOOG looked good around 126-128 level and that I am not too keen on AAPL price action near 200.

There has been really heavy volume near these weekly lows, some of these flows could be quarterly start and rollover.

Speaking of rollover, my levels quoted from now on will be based on S&P500 Emini December contract. For $SPX levels, please subtract about 50 from these levels. Remember as we get closer to expiry of December contract, this gap will change. It will not always remain 50. I hope every one is cognizant of this and there is no one subtracting 50 from the futures price to get the spot quote. This number changes daily.

Weekly profile has an overlap with the profile from 2 weeks ago. The shape of the profile is mirror image of the shape of the profile from last week.

With this said, my key levels this week will be 4530 and 4450 for $ ES. About 4480 and 4400 on $SPX at time of this post. At time of this post we traded around 4512 on the December emini.

Scenario 1: Generally I think the bulls will need to over come this 4530 area on the emini, else we may fall into 4450. And I think the bears will need to take out 4450 for further raids lower into 4360s.

Scenario 2: My edge case scenario is if we begin closing below 4450 or if we begin closing above 4530. In these instances, I think we could trade 4367 and 4580 respectively.

For the bullish case, I think AAPL needs to step up big time. It has been runt of the mega caps this week and this can not continue if the SPX bulls need some relief. I think AAPL needs to go bid above 180 for the risk-on mood to return this week. On the flip side, if AAPL were to remain below 180, I think it adds more pressure for the general market. I think if AAPL were to get below, and remain below 175, we could see a 167-170 test on it.

This week my personal risk on signal will be:

AAPL above 180, TSLA above 260.

On the flip side, TSLA below 240 and AAPL below 175 could be a risk off signal for me this week.

Another key correlated market to look at this week is DXY- Dollar index.

It is at a key resistance right now.

I think if this resistance breaks, we are looking at a sharp spike lower in NQ and ES.

It will be interesting to see if this breakout in the DXY holds though. Also note that this week is going to be heavy Order Flow from rollover.

The problem with rollover is no one really knows when someone will rollover. So this can happen at any day during the session and ideally the first hour and last hour are perfect spots for large rollovers, but nevertheless can create sharp moves throughout the day for every day this week.

I will also keep an eye out on the bonds this week

Specifically when you look at the 30 year bond in the US and 10/5 year notes for the US, you see they are all on major support.

This I think has been sort of a lifeline for the US stocks as well as there is a hope that the yields will come down from current levels. I actually think that at some point these levels are going to break to the downside and if/when it happens, I think that could be a significant volatility event.

In terms of proxy, I use TLT 90 level as a key reference level.

While TLT and DXY are at key inflection points, as we can see that on these auctions, what I do not know is what will make them break or breakout of these levels. And this is what makes the “when” part so hard to predict. I am the first one to claim I have no idea what will make TLT break that 90 level but I think if it does, it could be significant event not to be ignored.

Now some of the weakness in Emini/NQ may be offset by the likes of GOOG which I think is a superior company in terms of AI but its gains right now are offset by advertising sector which in itself is a victim of slowdown and will take a large hit once recession takes hold. However, I do like GOOG on any dips and I was one of the very few (may be only one) who called the low in GOOG near 80 last year.

Another stalwart is MSFT. I can predict that MSFT will overtake AAPL in market cap for next few years and I think can remains strong as it also claws away some ad dollars from Google. MSFT does not have your typical risks from China like AAPL and TSLA may have. I mean regardless of where you live in world, you still need spreadsheets and Power points and there is no viable competition. Jokes aside, I like what MSFT is doing in enterprise, cloud, AI as well as ad space and I think this will be the next largest cap company.

In terms of news, there is ample fodder this week starting with the CPI and PPI on Wednesday and Thursday and culminating with the consumer confidence on Friday.

Dollar strength also has been an issue for the SPX bulls of late and this is visible in price of Gold as a proxy. Dollar strength is hard for me to accept but I do think Gold has been in a bull market for several years now and I expect this to continue. Now this does not rule out a short lived spike in the US dollar DXY but I do not feel great about its longer term prospects.

On the energy side..

To be 100% clear, I remain an energy bull but I do not mind a short term (st) pullback which I think is good. I think energy as a percentage of S&P500 can still expand. This is especially true if the democrats win in the US again in 2024 which I believe is highly likely. I am not a political person but I like to think and articulate all my scenarios which I am watching and this is definitely a big plus for the conventional energy space.

Note- my call is that the democrats will carry the White House in 2024. I am not saying it will be same White House incumbent. I personally think it is highly likely that President Biden will step down shortly.

It is rather ironic when you look at the oil sector, it has done so well in last 2 years despite or rather inspite of political posturing against the sector. It is funny to see oil do so well and solar comply collapse in last year or so.

I think this could continue and in this sense I believe names like XOM and OXY could have more room to grow.

I shared my bullish bias on these two at 50 and 30 respectively. My target on XOM is 200 and on OXY is 100. My targets will be void if a) we see a complete meltdown in the global economy in next year or so b) if we see republican take back the Presidency and the Congress next year. For those of you who are not in the US, with a Republican controlled US government, it is far easier to produce oil in the US which creates a glut situation and lowers energy prices. For many years, Oil itself has seen support come in near 30 bucks and I have now raised this level to 40. I think 40 is the new 30 on Oil (WTI) and could be new support level for next many years.

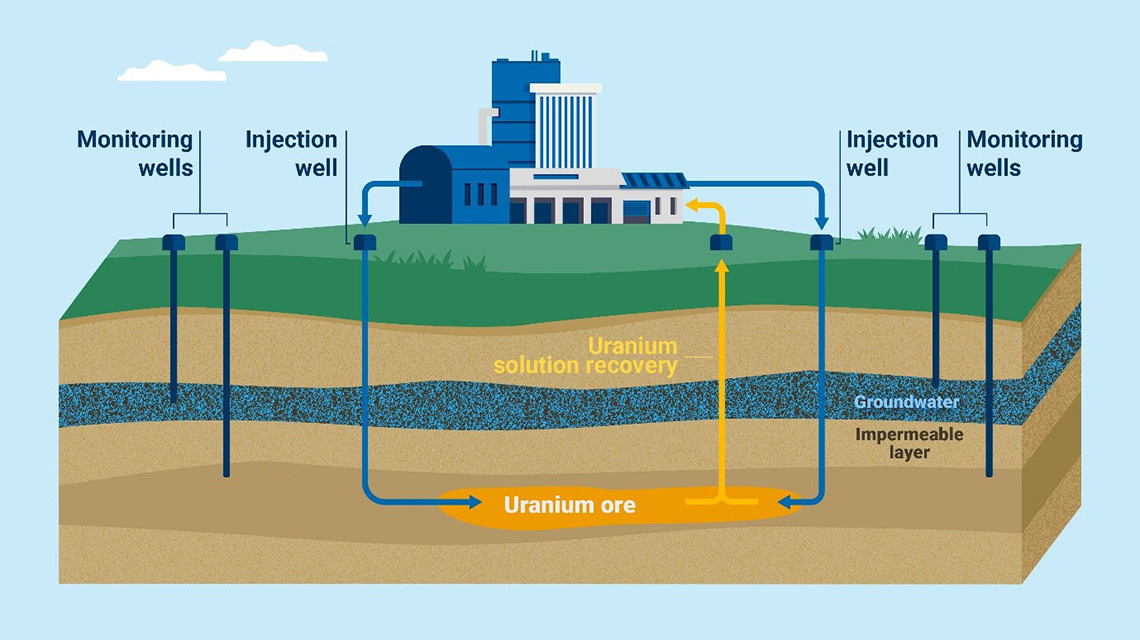

Uranium

Sort of related to the prior section. I was a CCJ bull around 20 before it rallied to almost 40. I think the reason for a bid in Uranium area is that the push into clean energy like solar, wind and EV has not really been very successful. I will say it is flopped.

The main issue is that the technology is simply NOT there in solar and wind is not an easy renewable energy to harness. With the EV, I do think it is impractical in terms of the amount of battery material required which in itself is a nightmare to procure and environmentally it is not that great either. This will especially become more evident if we have any sort of conflict with China.

Uranium fills the gap. You can install smaller reactors which are politically easier to sell to the population as they are perceived to be safer. There is barrier to entry and I think this has helped names like CCJ and it could continue to float up to 50+ due to these factors. Economic downturn does not impact URA sector this much but I think if the democrats remain in power, that is a plus for this sector.

Z

As I called a few weeks ago, we started seeing some cracks in the homebuilder index like XHB at 85 and it is now down slightly from those levels.

Notably I was an XHB bull last year near 50 bucks.

With the housing sector, I think we may run into a situation of over supply next year. Even if the economy remains stable, there are some headwinds for home prices like many cities are banning ABNB rentals which are leading the owners to either lease or sell their homes. Many owners have 2-3+ homes owned. New housing supply which was started last year is now coming online. These are some factors which could impact home prices. There are others too.

One actor in all of this is Zillow. Z is now trading near 52 dollars and I think if it holds 55-60 as resistance, it may sell down to 30-32 area. Housing is notoriously slow to rollover and is often the last one to rollover once the employment scene softens. So I think Z softness could come towards end of 2024, early 2025.

If you are super new to this blog, you can receive these blogs directly in your inbox. Just enter your email below and subscribe.

APLE (NOT AAPL!)

I am not a big fan of REIT at the moment but there are a few exceptions like APLE.

This is small company that owns Hilton and Marriott branded hotels pretty much all over the US. It recently got included in S&P600 index and is therefore seeing some interest. New Marriott and Hilton are now very expensive to build; in smaller cities with 60000-100000 population, it may take about 20 million dollars to build and operate a new 2 star Marriott for instance. These are few reasons I like this REIT though I am overall negative on REIT like O which I had a bearish bias around 65 and has now sold down a bit. These REIT I think will be challenged to continue to pay dividend. They are required by law to pay most of their profits in form of dividend to the stock owners but I think something like O which owns stuff like Walgreens and Targets will have to negotiate leases at lower terms and could see 40s tested.

Can SAVE 0.00%↑ be Saved?

Doubts have been cast about Jet blue’s acquisition of Spirit on anti trust grounds. However, similar acquisitions in the airlines have gone thru. What helps the case is that there is really no monopoly right now in the US.

It is trading near 14 right now and at any rate the outcome of this won’t come until may be end of the year.

I like the action in January 25 MOPEX around 25 strike which is right now offered about 85 cents.

TSLA

With TSLA, the action last few days has been between my levels. The bulls have squandered opportunity to take out my level, the bears have failed to take out the support.

I think if the bulls can not take out 255-260 this week, this could be bearish for stock and we may break 240 to test 220-230 AGAIN on TSLA. It is trading near 251 at the moment (ATM). This is why I continue to think this current bracket is important and could determine the next large leg higher, or lower.

Main issue with TSLA from a macro front is the ability of loan takers to get a loan. Even at 30-35 K for lower end cars, it is out of reach for most unless they take out a loan and I think with current TSLA financing at 6-7%, this is a big hurdle for many to purchase the car. This is why TSLA is not a NVDA or even a GOOG when it comes to mega caps and I think this is why we have been seeing resistance come in near 260 on this name.

NVDA

NVDA right now is trading near 450. I think as long as this 450 holds, NVDA bulls can expect relief. They do not want to see 450 give up in my view (IMO). As long as 450 holds, I think we can see 500-510 on NVDA.

TM

I had shared TM key level around 150 and it has since bounced to near 175 from this support.

TM did not jump all in to the EV bandwagon and long term this may pay off for them. They did not have to pull back on some of the EV models like GMC and Ford back home.

F and TM have about same book value but where they differ is that F has tons of debt compared to its earnings. Ford makes about 4 billion a year and is steeped in debt around 150 billion. TSLA has the best overall debt health with almost no debt.

In terms of Auto sector, I will rank my favs as: 1) TSLA 2) TM. I am not too keen on any others.

TM key level remains 150-160 which could act as support if tested.

TS

Another decent oil and gas name is Tenaris which I think has good technicals. It is trading near 30 right now and I think if 27-30 holds, we could see 50+ on TS.

It has some interest in December 32 calls which has seen bid fluctuate in a tight 2 dollar range and its now trading near low of range at 20 cents.

SPLK

With SPLK shared around 115 by me saw good action and is now near 125.

I think if it were to pullback into 110 it may be supported for a move into 150 area.

This is it for now. Not seeing anything super exciting set up yet but once it does, be the first one to hear from me.

Have a great day!

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.