Hi Traders,

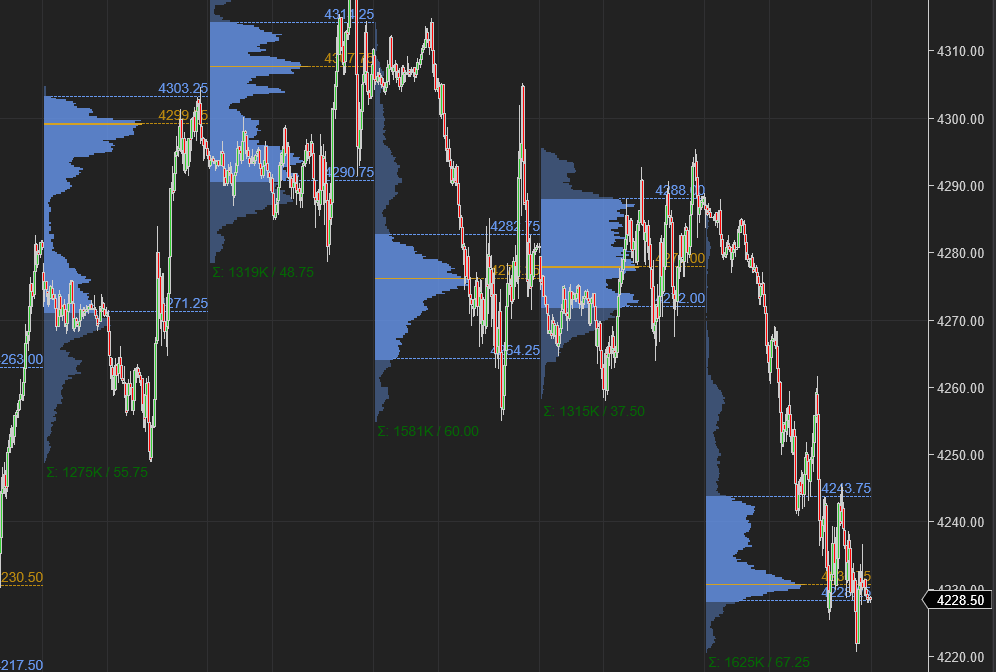

At the start of last week, in my weekly plan on Sunday night, I shared some support levels below 4200, however, I did not offer any levels on the Friday close near that 4300 level. I had mentioned that due to the nature of the auction the week before, I really did not have any levels to offer on the resistance, and I wanted to see the Monday open before I offered any input.

Well, as soon as the week opened, the picture started becoming clearer to me and I listed 4260is as my support level for the first half of the week and I offered 4325 as potential resistance on the top side - with a couple of Substack exclusive levels in between, like 4300.

The first half of the week, these two levels were extremely helpful as the market bounced back and forth here.

Then on Friday, I offered 4290is as the resistance level if the auction opened below it and I said the targets could be 4230 and lower. This was an extremely good level as this proved to be high of the day and the low of the session came in a little bit below 4230, and we in fact closed the session a couple of points below 4230.

Overall a tremendous week for the OrderFlow!

I was not only excited for the levels but also for the fact that the volatility and volume finally picked up, I had called last week that these auctions with 1.2-1.25 million lots so close to the 4300 level will have hard time holding up and I was right.

I also shared this blurb about the 4300 level for the sole reason that it is not always necessary to predict or know where these levels will be- once the auction gets started, often times it gives very important clues as to where these levels may be and this week was a perfect example of this.

Now, the S&P500 market had good volume and good action on Friday but the volume is still lower than what I expect a good directional market to have. I will cover this in much more detail in subsequent sections, however, see Chart A below.

We closed within a whisker of my weekly support level at 4196.

This level is key for many reasons but the most important reason being this is the 2nd end of the SOC (Scene of Crime) of the CPI read on Wednesday, the 10th. Look at this massive LVN (Low volume node) between 4130 and 4200is. While the market below this is fairly well contested and has heavy volume but the action past 10 days or so above this has been on low volume with many days registering only 1.2 million lots or so. Emini S&P500 is a thick market- any thing less than 1.8-1.9 M lots in this volatility to me is low volume.

I share these tidbits about the price action and volume from time to time for educational purposes as I assume some folks may be new to the Price Action based methodologies. Let me know if this helps or we should straight get to the levels and scenarios.

Not only was the Emini S&P500 market very good this week, many of my other names shared here in this newsletter saw extremely good action. This was not true in any one market, but true in a variety of markets - whether that was energy, futures, equities, FX or bonds.

Admin stuff

I want to recap these names from last week for sake of transparency, however let me first take care of a couple of housekeeping things.

First is the levels themselves and how I see these levels my self.. let’s say we are talking about Friday at 4260. IF this is my resistance at the open, and the day’s range has been let’s say 40 dollars in the S&P500 , I am definitely very wrong if this level breaks and we are trading up above 4270. First off, these two levels have been key last many sessions. Second off, I have a golden rule of 15%-20% on intraday moves. I will eat the loss if it breaks away from me and goes against me by 15% or so of the daily range. This applies really to any other time frames like the weeklies as well. This is important because if I am bear at the open 4260, and we are now trading 4280-4290, I am not there sitting nursing that loss. I am out!

The 2nd administrative thing I want to cover is about pricing. I feel I have the optimal number of people in this Substack now and I want to raise the bar a bit more to encourage more serious traders. To this end, the new monthly pricing will be 32.99 dollars, effective Tuesday, up about 10%. I may revisit this in future and dial it up a bit more. The breadth and depth of this blog’s content is fairly comprehensive unlike other similar blogs which only cover technical aspects of only one market and I feel it’s only fair that the price reflects that. No one who is currently subscribed and does not resubscribe will be affected by this change.

The annual price remains unchanged - for now. The Founding Member Price will also increase from 399 to 699. The Founding Members should look out for a separate email from me over the next 1-2 weeks with bonus content. No one who is currently subscribed and does not resubscribe will be affected by this change.

I actually do not know yet what we will cover in the private Twitter but I feel I will share 2-3 intraday updates on markets like ES, NQ and CL. I may also share some notes on options flows etc. I usually trade the most active hours in the session and this will certainly not be a signal service- in case any one wondered what this discord will be. FWIW.

Let me know if there are any questions about this change. If you would like to save about 10% every month/year, this is a great time to subscribe before the price change goes into affect on Tuesday AM.

Recap of last week

Since the 1930s, there have been close to 50 “Bear Market” Rallies more than 10 % and the average duration of such rallies was about 40 days, with average return of about 17%.

This particular rally, has lasted about 42 days with a return of about 17% off the lows. I am quoting this research from a BAC ML analyst.

I shared $87 as the LIS on WTI crude this week and it rallied about 500 pips from this level to trade almost 92 at one point.

I had expected Dollar DXY to get support around 102/103 and it rallied strongly to almost 110 of this level. EURUSD I had expected the resistance to be around 1.03/1.04 and it sold off from there to almost back to parity again this week.

I was a bear on the TLT at 120 and it sold off quite heavily near 113 this week.

In fact when you look at all institutional markets with very little retail footprint, like FX and the Bonds, my levels have taken very little heat and have worked very well. When you look at some of the retail heavy markets like the US tech stocks, we see the market has rallied sharply but most of that rally has been caused by 3-4 stocks like AAPL and TSLA. There just has been tremendous buying in TSLA and AAPL by the retail traders in last few weeks. Just tremendous.

Other stock where the retail traders bought billions of dollar of stock was the stock of Bed Bath and Beyond. BBBY.

I sent several warnings on this how I will not touch this with a 20 foot pole at the levels like 27-30. Folks did not care and we sold off, and in fact sold off it a inapt word, we crashed 70% back to 10 dollars on this one name alone, wiping many accounts. Very unfortunate.

Here is the prior weekly plan if you have not yet read it: 8/14 Weekly Levels

Even Bitcoin was not spared when I got bearish on it at 25000 dollars. It actually dropped below 21000 but has now come up a bit at time of this post. Ethereum as well lost about 20% from when I got bearish last week around 1850, trading down near 1550.

On the individual stock side, common sense stocks, backed by orderflow and institutional flows continue to do well. Here are just a few of them but this is a partial list as I shared several more with the subscribers.

UNH: tremendous rally after I shared this at 400 before its earnings. It traded above 450 this week.

OXY was indeed the star name shared by me several weeks ago with folks here around 50 dollars. This stock almost traded up to 75 dollars this week alone. Very good- in combination with other oil names like XOM.

CI, ADM, TH from last week did very well. In fact TH I think was up about 10% this week at some point.

I shared GEO as well at around 7 bucks which rallied 15% within 2 days to come withing an inch of 8.5

NVDA bear idea shared by me at 187 turned out to be the exact HOD of the ticker before it sold off about 10 dollars on Friday.

I will continue to share these names and much more with folks here, but it has to make sense to me. As I said before, if every one out there is chasing a BBBY or an AMC at the highs, do not expect me to join their ranks. I will only share names which make sense to me and I feel they have institutional sponsorship not just running on fumes with a bunch of YOLO short term calls. Once the market conditions are ripe, I can find many of these ideas at once. When the market is dull, then everything else stops moving and we just need to wait for things to align again.

My levels for next week

So, due to the nature of the auction and low volume, this was not a definite week in terms of it’s ability to provide crystal clear clues for next week. On top of that there is Jackson Hole next week which I alluded to last week with Powell remarks scheduled for Friday the, 26th.