Good morning folks-

Slightly abridged but an important post nevertheless. I want to talk about why the LIS (Line in Sand) is so important in context of active time frames AND I also want to share some examples why the themes are so important for any one who leans against these themes to make a decision.

Decision making - whether in the markets or generally in business is highly nuanced. It is not black and white. Whole PHD level books can be written on this subject and I am by no means an expert on decision making. However, in trading, your decisions have to be good else you will not make any money.

I lean extremely highly against LIS and themes to make my decisions. This has its ups and downs. For instance, using a theme in my decision making inures me against reacting too much to the short term price action - up or down. I am not changing my mind every day just because the price is up or down, for or against my primary view.

On the downside, themes are extremely subjective. They can be hard to quantify. This can boggle the minds of many - a lot of us, and I will say most of us are NOT at all comfortable with uncertainty. For most part, we need to know what is ahead. Whether that is what’s on the menu for dinner tonight, or how long is my current project supposed to last, or when is that next big raise on my way. We are for most part Pavlovian dogs to a certain rhythm, a craving for certainty in life.

However, in markets, there is really no certainty. Any thing can happen at any time!

So this creates a mental havoc for those who are especially predisposed to craving certainty all the time. If you are not comfortable with uncertainty, the markets can be an unsettling place. Not knowing what is going to happen next, always petrified of what the markets may do next!

For me personally, if I have a view backed by a theme or a thesis, I need to see the theme play out and my view will remain unchanged as long as the underlying thesis is still valid.

To take some recent examples, back in the Fall last year, I was bullish on the housing sector like XHB and stocks like TOL at 50-55 and 40 respectively.

Names like TOL have doubled since. XHB itself is trading near 75 dollars.

The main reason for my bullish bias was not any technical analysis or charts which looked very crappy at that time for XHB. It was also not the housing sector fundaments which looked even worst. My thesis was simply that you have folks locked in at 2-3% rates which will prevent them from selling their homes when interest rates are now 7% which in turn will cause a severe shortage in the housing supply. This will mean that the new home builders will bring the supply which otherwise will be absent. Housing supply in the US remains anemic. It has remained anemic ever since the Great Recession in 2008. This is especially true in Coastal cities where building new housing can be a monumental task for the developers - the permitting can take years, there are stringent zoning laws, regulatory authorities alone can add 4-5 years to a housing project time line.

Now this was my thesis almost 9 months ago when the charts looked really really bad and the sentiment was even more negative. Fast forward to July 2023 - momentum is now very strong in housing stocks. Everyone can see the charts and the charts are making new highs.

XHB is making new highs and a lot of folks are now very bullish. As far as I am concerned, I do not have a thesis on the housing now at 75 similar to the one I had at 50! This means I am not positive or bullish or bearish yet on the XHB type names - I am just neutral. The reason being I simply do not have a thesis or a theme to lean back on when it comes to this sector, when the sector itself has almost doubled in less than a year!

Similar themes can be based on valuation, fundamental & technical- recent examples where I was bullish on TSLA at 100 and then 190 and 240 are technical & valuation based examples.

Even in commodities like the oil, we see this play out at 67 or so. A lot of folks, in fact the majority was extremely bearish on oil at 67. I thought this could be a great support and we did see about a 700 pip bounce off this in last couple of weeks or so.

As far as the LIS (Line in Sand) goes, it is very important concept and not to be ignored. Simply put LIS is an extremely important level- for me it includes the sum total of all of my analysis and research.

When you look at the levels from last week, these levels were the high and the low of the week for S&P500 Emini ES Market. This means there was a not a single trader any where in the world who was able to or willing to bid one point higher than the high or offer one tick below the low. In other words, buying interest dried off at the high and selling interest dies off at the low.

Now the reason these LIS work is because a lot of traders watch them. There could also be algos which are placing recurrent trades at these levels which means these levels may continue to work until those algos or traders are still active there. The moment they are gone, the level may break. This is why the levels are extremely black and white- they are objective. There is no room for subjectivity with levels, like there is for themes.

Now going back to my level.. every time we come close to it, we are selling off anywhere from 50 to 75 points, this is a sign that there may be other sellers who are interested in this level also. If this was not true, we will blow right past it. This is common sense.

Now, eventually at some point, if we keep knocking on this level, the sellers will get exhausted and the level will give up. Now you have a seller or a band of sellers who have been selling here for over THREE weeks. Remember, I had shared this level on June 18th. I had no idea then it would have become a resistance like it did later. Now these guys have been selling here for over 3 weeks AND all of a sudden we break out of this level, and we are now trading 4520-4525. What do you think these sellers here who have seen this level hold for over 20 days, do now? These are important questions and are part of my preparation for the week ahead.

Whether I like it or not, such is the auction. This is how the markets work as I see them. I am the first to claim I do not know if the level will hold or not, and if it does hold, how long it will hold for. All I know is that this is an interesting & important level. And we can see the results, we continue to see the results, 21 days after I posted this level.

This same thing can be said about all other LIS I share. CVNA? 24/25 bucks. We see what happens. RIVN? We see what happens. TSLA? We see what happens. These are all examples from last one week alone.

Why to share this blurb about the LIS and themes? Because it is really very important. It does not matter what my opinions or what any one is saying. Those are all subjective. But Math is never subjective. It is the truth in context of that moment in time ;)

I share these levels like the ones in RIVN, CVNA, TSLA and many more, almost on a daily basis with the folks here. Join a band of serious, hardcore traders. Subscribe now. You can also refer your friends, and win free sub prizes.

On the news front it was a very quite week with the exception of the ADP and NFP numbers which came in stronger than expected. According to the FED, the inflation is now entrenched in services sector and for them to declare victory over this pesky inflation, they need to see a crack in the wage inflation which showed another uptick on Friday.

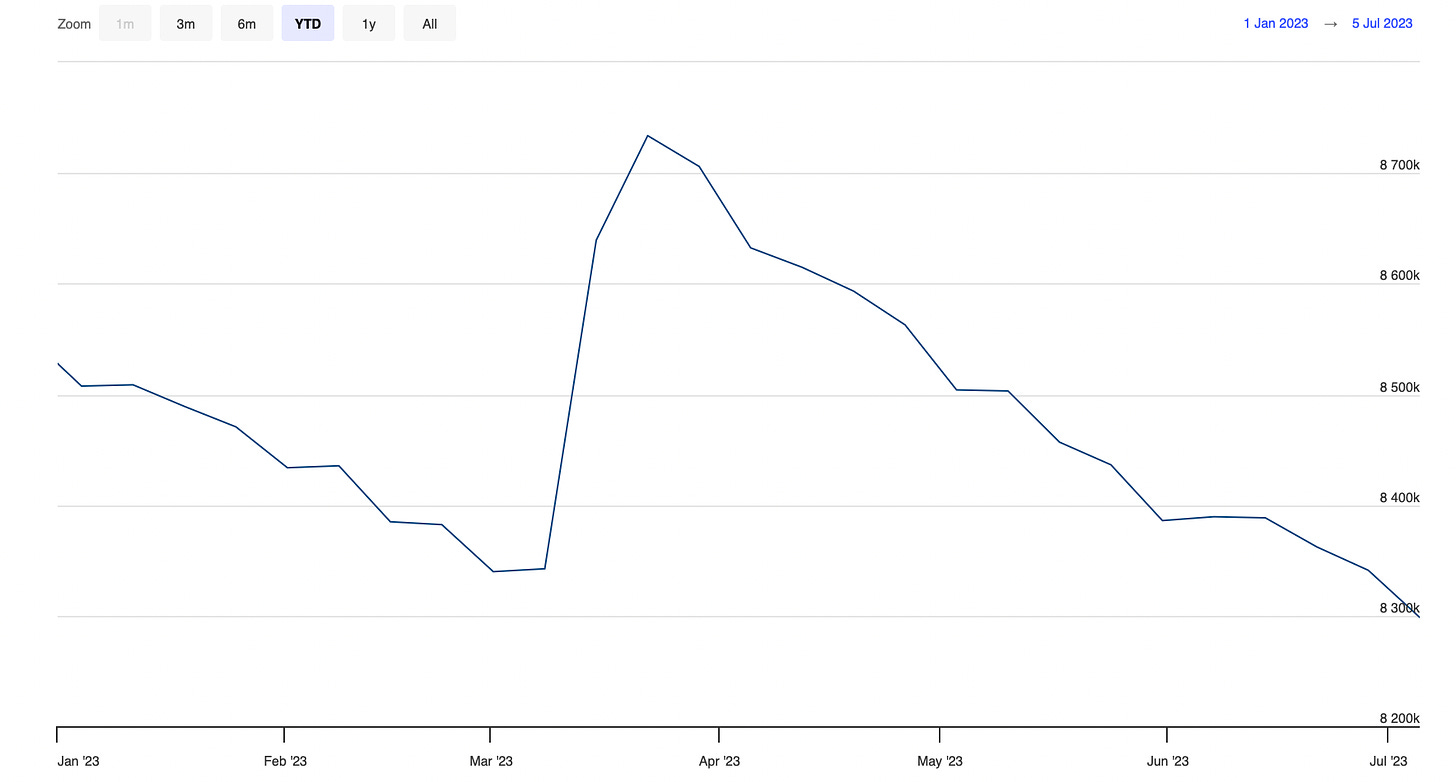

However, I think the most important event which was not very well advertised or covered by the news media was that the total FED balance sheet made a new low this week as far as the YTD calculations go.

The previous low was set in March before the regional banking blew up in the US and the FED had to temporarily pause their balance sheet reduction aka QT.

This past week we made a new YTD low in the FED balance sheet demonstrating a FED that is sneakily reducing its total assets, may be even taking advantage of the recent market momentum so to not rock the boat too hard.

If you zoom out on this chart, you go back several decades, the 40+ year bull market has been backed by a continuous, one way increase in the FED balance sheet. No one knows what the future holds, and it is possible FED reverses its course again, but I think it will take a major systemic failure like the one we had back in March to force the FED to pivot as far as this trend goes.

At 8.3 trillion dollars, the FED owns more assets than the combined GDP of France, UK, India and Japan. Let that sink in.

I personally do think that in long term, the FED balance sheet has one way direction - up. But at the same time I also think it will take a major crisis at the level of 2020 or 2008 for this FED to start a larger QE program again which adds another 3-4 trillion dollars to this massive bubble.

Is that now in Summer of 2023?

From last week’s plan…

I thought it was a very important educational post but I did not see some folks read it as everyone I assume is on Summer vacation. Summer months are fun but should not be a reason to stop learning and to stop growing. Anyways, I digress but I will say if you have not yet read it, go ahead and read it.

My levels in Emini were so good from last week that they were almost the high and low of the week.

On NQ also, I had called 15200 to be in cross hairs again and I was very right as we sold off about 300 points from prior weekly close to dip below 15200 as soon as liquidity came back on Thursday.