Good Morning Traders-

I have been on the road for last few days but it is always my goal to send out what I have been thinking about the markets and share my levels with folks regardless and this week is no different. I see the high inflation take it’s toll on hard working folks in a variety of industries from travel and leisure to energy, health and housing.

This toll is being felt heaviest in anything that is reliant on travel and shipping. So far the sectors like wholesale and technology have been spared the rod.

In this letter I want to touch upon some of these related markets and share my thoughts of the implications of these high prices on economy and the markets.

Share my thoughts on earnings of DOCU and NIO earnings

Share my 2 cents and where I see AAPL and TSLA headed next

Share some names like ENPH, AMT, my views on Bitcoin

S&P500 levels and thoughts for this week

Subscribe below before the prices go up, they will not remain so low for so long.

From my post last week, my expectation was a range forming at 4200 with lower end being 3970. While the upper end of the range held quite nicely, we did not get to trade down to 3970.

Read all about it over here: previous plan

Starting with quick recap of the previous weekly auction:

My main expectation was for the market to remain supported between 3970/4000 to 4200 ahead of the FOMC on the 15th in context of a larger time frame range formation of 3800-4200. We saw each and every rally attempt into 4200 getting sold, however what I did not see was that sell into 3970/4000.

At it’s lows we could barely dip into 4070, whereas the high was a couple of points above 4200. On the intraday basis, things were not that bad and I thought all of the 4 trading days this week were tradable but not so much for any one wanting a nice, linear directional move.

This week on balance was similar in characteristics to any week in Summer time as the volatility can come to a grinding halt in Summers, with an average week moving may be 100 points if it is a good week.

Regular readers know I have been bearish on the S&P500 from January at 4800. I have shared distinct ranges that formed in S&P500 at 4200-4600. At this point in time I think S&P500 is carving out a range between 3800-4200 and this week’s action did nothing to change my point of view.

Few other things on my radar:

Finding new ideas is very hard when the general market is soft. Shorting stocks outright and naked IMO is not for everyone and I DO NOT share those kind of ideas unless there is a compelling reason around earnings or some other corp event.

So this is a list of a few things that popped up on my radar with the caveat that the general market has remained weak which has lessened the number of stocks in my universe of ideas.

What is on my radar is driven by my philosophy that right now anything hard like Real Estate, utilities, miners may be better than holding any thing that is fluff - for instance crazy value growth stocks, crypto coins etc. I have not yet seen the signs that this philosophy needs to change for me any time soon personally and this is what I am happy to share with the folks. Folks know I have been very bullish oil stocks this past year too and they look good too however I am starting to note a lot of insider selling in these oil stocks which can be a leading indicator and I personally do not like all this selling by the insiders. This is not to say they will crash outright, but it may be beginning of the end (3-4 months out).

Bitcoin

Bitcoin has stalled here near 30000 dollars and has not made much headway lower. I think as long as it remains below 32000, it is likely going to test lower prices around 23000 dollars. If 23000 support breaks, I can see it trade down lower into 17000.

AMT

AMT is one of my stocks shared earlier which came under quite a bit of pressure but is now back up to my original levels.

I think this stock is going to make a run towards 290 as long as we hold above the long term trend line at 260.

My stock forecasts are not 0DTE calls. These can have a time frame of few months to even a year or more.

VICI

This REIT is another name which I think may benefit from current inflation and macro situation.

It is 31 or so right now, but I think it has a decent support around 28. Read my blog post on Inflation and what kind of plays can do well in this environment.

AAL

A tactical play on the airlines, for example AAL and UAL could be the break of this trendline below. I think these airlines have all sort of headwinds, no pun.

If these fuel costs stick here above 120 to the barrel, this is going to hurt the airlines

The fare prices as high as they are, this price gauging by the airlines does not help them

The staff shortages, the poor service etc all pile on

AAL is now trading 16 and change but I do think it is a bit pricey given everything else and could test recent lows at 13.

If you like my ideas, feel free to share them with folks like your self. This is a “word of mouth” newsletter with no sponsorship.

ENPH

Speaking of growth and value, I think ENPH has been showing interesting accumulation patterns and could be poised for a run once/if the general market stabilized. It is now 197 and cannot rule out more volatility on this but definitely something that caught my eye for a longer term.

DOCU earnings

DOCU is a little tricky to call for me personally. This stock has been in the dog house. It is trading 83 right now . They have never made money however I think from valuation view, 70 is a nice mark for some one with a long term view (5 year). If I was extremely short term, I do not wanna be bearish on this ahead of the EPS. I think it may rally to 100+.

NIO Earnings

I think the market is too optimistic about these Chinese stocks. I frankly do not like NIO where it is trading now 19, I think if it goes to 20-22 it gets sold. I think 11-12 dollar is a decent range for NIO for me personally.

Gold (NEM)

Look I have been a gold bug since 1500. It is now come under pressure and Gold stocks have taken it on the chin. NEM fell from 80 plus to almost 60.

I feel these gold names are under tremendous manipulation. But I see them as a good hedge for me as I think they will out perform over next several years. It is now 68 but as long as 60 holds, I think NEM may trade 100 and beyond. Again not a short term call. Most of my stock forecasts are long term.

My thoughts and levels on S&P500

Personally my analysis shows the issues with S&P500 in general have not gone away yet. If I look at the resurgence of oil, the strength in these utilities, and the weakness of bonds and gold, this tells me 2 things:

The market does not believe that the FED is ready to pivot any time soon

It tells me the inflation may be here to stay

Due to these factors, I remain a S&P500 bear in longer time frames and I think that the rallies in S&P500 will be sold.

Last week was a respite for many from volatility but I do think this volatility may soon be back as we head out into the Fall months.

Fundamentally for me to change my mind, a couple of things have to happen:

Bonds have to stop hemorrhaging. This means something like TLT has to take out 120 and close above it.

I think Oil needs to come down to 105, ideally 100 and below.

With Oil at 120, I think it is a very potent bag of troubles for anything sensitive to high inflation, like the growth stocks.

Talking of growth stocks…

TSLA

Tesla has a good week between my levels 722 and 780 however I think longer term Tesla will probably take out its recent lows at 620 . My LIS (line in sand ) on this will be 780-790.

AAPL

AAPL as expected by me has carved out a range here between 140-150. I think this stock may languish here for more time before it trades lower after its Q2 earnings in late July.

My estimate is that 120 may be a decent price for it. It is now about 145. I do think AAPL gets sold on any rallies as well. The bigger moves in AAPL in my opinion (IMO) will come in Fall, around August.

This brings me to my favorite topic: S&P500 levels

While I remain a longer term S&P500 bear, I think it may have some more short term hoops to jump through to get going.

I have divided my thoughts into 2 distinct sections.

Balance scenarios:

On Friday we closed at 4110. The action suggests to me that the Emini wants to test what is out there at 4040 before anything else.

I think that we may test 4040 in early part of the next week. What happens then may depend on the following.

I think if we test 4040 and then close above 4090-4100 in the Daily (D1) time frame, we may then go retest 4200.

Weakness scenarios:

If we test 4040 BUT are not able to close above 4100 in D1 time frame, this may cause more weakness to under 3950 orderflow level.

Thus my key levels to start the week will be 4040, 4090 and 4200.

If we close the IB session on Monday above 4110, then I think this would be a bullish instance and we could retest 4170 orderflow level.

Emini closed the week at 4110 on Friday.

Overall I do think it may be harder to close below 3950 this week as we await the CPI on Friday and the big ticket FOMC next week.

Chart A : Weekly Auction in Emini below. While this is a stubby, balance profile, I think this slightly favors the bears. Profile shapes like this could be inconclusive and I will not read too much into this. However, this most likely does not portend well for trend continuation.

To summarize, I am favoring a soft opening on Monday and a test of 4040. Bears ideally want to keep the momentum going by not closing above 4100 again next week.

Bulls will have done a good job if we remain above 4110 on Monday at the open.

With CPI and FOMC days away, outright directional days may be harder to achieve with potentiality 3950 cap the downside and 4256 potentially cap the upside.

Let me know what are your thoughts and how would you like this to play out.

New readers should get acquainted with my educational material here at the link below. In particular I recommend you read volume profile and my work on the TRIN, Tic TOP etc. I regularly update this educational content so make sire you check back to see if any thing new is added.

Final thoughts

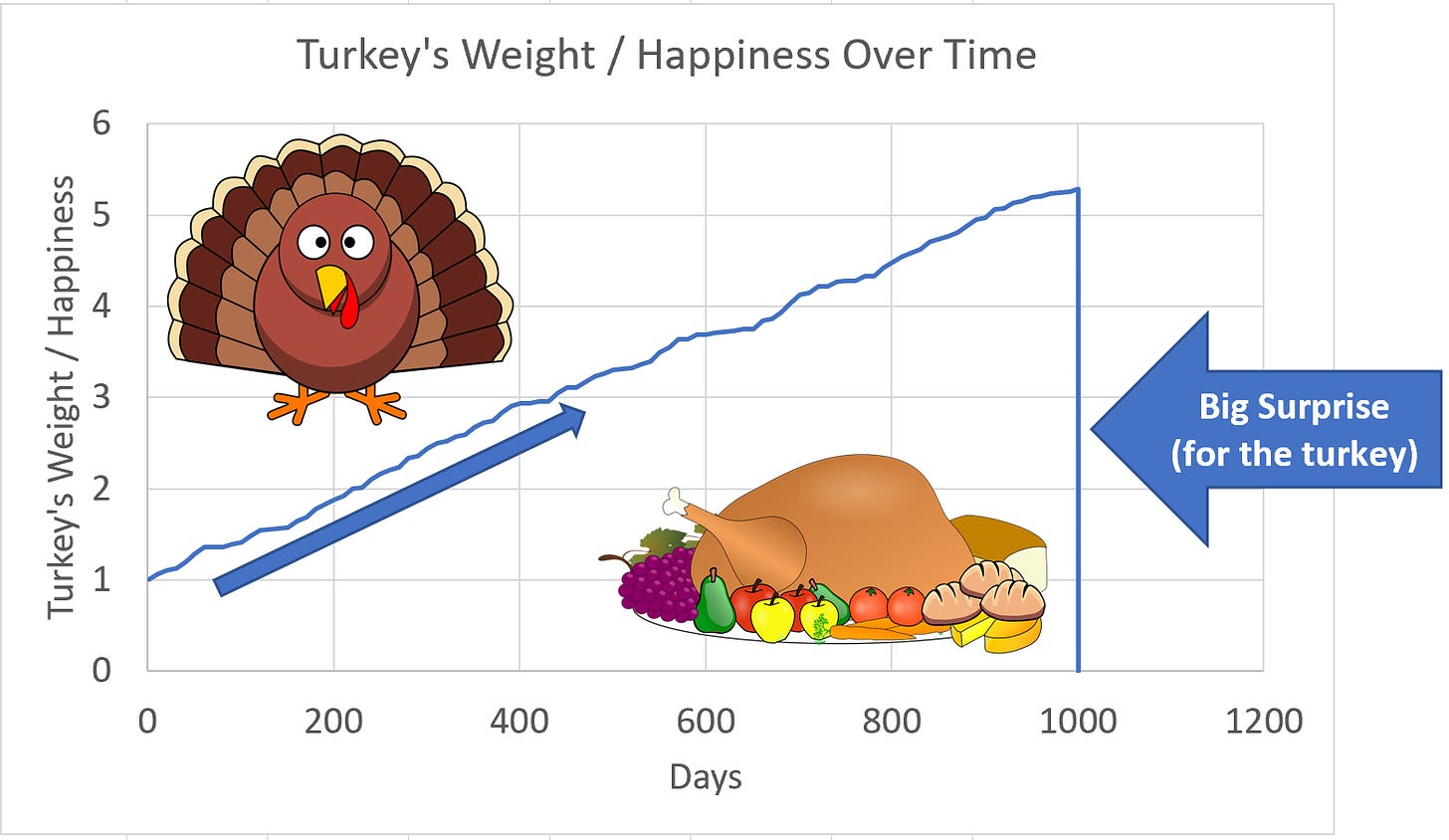

A lot of the times , folks have a survivorship and recency bias in everything and markets are not inured to this bias. This bull market has lasted extremely long and it has left an indelible mark on people’s psych. Most of the analysts IMO have not even seen anything but a long, continuous bull market their entire career.

S&P500 market is very liquids and therefore it is very prone to churn and balance. Right now the macro has deteriorated. We have the country divided in the haves and the have-nots, perhaps more starkly than ever before.

This is temporarily favoring affluent parts of the society and their spend on items like AAPL, and LULU , ULTA to name a few.

However, if oil remains this high, if global food shortages worsen this year, very few sectors and industries will be able to thrive in this.

While stocks sold off and got softened last month and two, I do think they are still very overvalued and my own scanners are not finding very good opportunity at the moment.

Hope this post was helpful. Feel free to share and spread the orderflow message of the tape.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

I prefer to keep things simple when possible and a hawkish fed who seems to want the market lower is about as simple as it gets. Lacy Hunt the economist points out the price inelasticity of stocks. For ever 1 dollar removed, prices drop by 5 dollars. And vice versa. While the previous two years saw excess liquidity, we are now on the opposite situation. As an investor, the simplest strategy is to simply step aside and watch until the fed pivots. Meanwhile, I bonds offer some protection against inflation.

Fantastic view for the week. Nothing short of my personal expectations. I wish everyone in here a lot of discipline and sustainable gains.