Do I have any regrets?

Yes.

My main regret is that I should have known about investing and trading when I was younger. I should have started actively investing when I was in my teens.

In this newsletter, I will share my thoughts on the concept of investing – as I see it. I will share some key lessons based on my personal experiences.

However, before we go there, let me briefly recap how my AI-generated levels did last week ;)

Each one of these ideas and levels was shared in real-time in my weekly plan; there was no question of hindsight. You are most welcome to check the weekly program from the 4th of June.

Let us recap now…

Starting with AAPL- my two focal levels were the low and the high of the week. AAPL closed at nearly 181 for the week.

In VSH, it gained about 3% on the week.

TGT, we saw a good bounce earlier last week, and it sold down to close right at my LIS this week. More on this later.

BUD stock barely changed on the week, having risen about 2.5 dollars from my 53 LIS.

CVNA was the star of the price action this week. Many weeks ago, I shared that I was bullish on CVNA at 3 dollars before it exploded to almost 30. I also called for caution near 30 bucks as I felt it may be offered. The stock then fell about 25% from the weekly highs to close near 19. More on this later.

BAC was up about 2% on the week.

TSLA was another star of price action this week. I shared 216 support levels on TSLA, which happened to be the low of the week before it pushed higher, almost 250 dollars. More on this later.

I was also a bull on nasty bank stocks like WAL and PACW near 25 and 4, respectively, and PACW rallied above 40 this week after many weeks, closing up about 3%.

Now in my favorite market of them all - in the S&P500 Emini, the weekly high was the exact LIS shared by me last weekend. And the low was very close to the lower LIS shared by me.

Nasdaq NQ also remained between my two levels shared earlier. In fact, the NQ level was very close to the high of the week. We tried to take it twice and failed every time.

In some other names, before the crypto rout even developed, I had a bearish bias on crypto stocks like COIN, which plunged more than 25% the very next day.

Generally, I am not a fan of some of these names like BITCOIN at 32500 which has now sold off about 20% from this key level (at the time of this post).

In the next section, I am going to share my personal opinions on investing. This is really something that is very subjective and personal, You can skip to the levels section if you would so like.

But before we get into that, I need to understand if investing is essential for me, and what factors prevent me from becoming a good investor.

What is a good investor anyways?

What is an investor? Good or bad, we discuss it later.

Any person or entity that allocates capital with expectations of a return down the road is an investor. Investments are made with a for-profit in mind, over an extended timeline. Investments can generate income, can create positive cash flow, can pay dividends, and they can pay rent. When you invest, you are investing for discounted cash flows at the end of the day. Many may disagree with me, but this is how I see it.

Due to this underlying driver for investments, the investment time frames tend to be longer. And I would say that the amount of capital at risk also tends to be conservative.

I do not confuse investment with speculation. Speculation or trading is the same thing. Speculation does not care about any future earnings or dividends; its sole aim is to profit from a price movement of the underlying asset.

Now I firmly believe that anyone can be a good investor. However, being a good speculator is a niche game. A speculator is a professional - like a doctor, an engineer, or a chef.

Being an investor is a good habit; it is being a good planner, it is being financially savvy. And I think everyone should be financially intelligent.

In the West, and now more and more globally, the sense of quick results and instant gratification is pervasive.

We see this in the fitness industry- wanna get leaner? Get a tummy tuck. Or pop some fat-burning pill. Working out every day, sweating, and lifting is for suckers when we can pay for surgery and get sculpted. We see this in the food industry with a proliferation of 2-minute meals in supermarkets and fast food on every street corner.

These fads are everywhere, and investing and trading are not any different. The sense of entitlement to get rich is everywhere. When we see influencers peddle their wealth openly on social media, it only pushes people more to find a holy grail that can deliver massive results with little or no effort.

I highly doubt that such a holy grail exists. The only one getting rich instantly is someone with insider information, and last I checked, that is illegal. Unless you are a politician. If you are in politics, maybe a different set of rules apply to you. Especially if you are a politician in power. But I digress.

This newsletter is not for anyone who is searching for a holy grail. Actually, no newsletter can give you the holy grail because there are no holy grails – sooner or later, you will find out, as I did after I have been active in these parts for over 20 years.

The holy grail equals certainty. There is no certainty in this world. There are only probabilities.

Many children believe in Santa Claus. But after further examination and a few years, most of us realize Santa Claus is not real. At least I hope most of us readers believe he is not real ;)

I am an investor or a speculator. Or both.

Contrasting my investing thesis with my speculation thesis- speculation, in my view, tends to be small time frames. From a few hours to days to maybe a few months. If I buy an option call or put, and it is up 150-200% within days, to me, that is speculation. In speculation as well, I am risking a fixed amount- my risk is defined before I get in. If I do not know my risk, I am neither a speculator nor a trader. I am just a gambler.

Another key differentiator for me between investments and speculation is leverage. In speculation, like in futures or options, massive leverage, often 1:50 or even more, is available. For me, the margin of error is extremely small in such trades. Therefore the risk must be fixed, IMO.

I am sharing this simply as my understanding of investment versus trading concepts, my framework of investing. This is not the only way, this may not even be the right way, but I am comfortable with it. And I do not mind sharing this as my journal.

My investing framework starts with savings.

Yes. The first thing I do as an investor I need is savings. I believe very strongly in paying myself first. If I earn 10000 bucks a month, I pay myself 1000 on day 1. No exceptions to this rule! Good investors often have little to no debt. In fact, I view even mortgage debt as something to be avoided, but that is a different conversation altogether.

So I pay myself a dollar before I even think about spending a cent.

So many folks believe in spending first, thinking they can save what’s left. I think this is a recipe for disaster, and you end up saving nothing.

The second level of my investing foundation is the timeframe.

The sooner I start as an investor, the farther I will go. Yes, you can begin at any age. Investing and savings are for everyone regardless of their age– but I think if you start in your early 20s, it is always always better than, let us say, starting in your 60s which traditional society considers retirement age. I personally do not believe in retiring at all- if you love doing something, why would you stop doing it? At any age? The power of compounding is the 8th wonder of this world.

So how is this investing thing different from the trading thing?

In investing, I do not need to know what is going to happen next. In trading, I can not know what is going to happen next. As simple as that.

It is all about consistency for me. I have done this for two decades and think I am just starting – I have another 4-5 decades of doing this. Every single day.

I am not in it for the 0DTE thrill of it. If you are super new to it and young, you are looking at 50, 60 years ahead. You can decide you want to take the path of patience and consistency, or you are in it for the thrill of it. If you are a thrill seeker, may I recommend the 99-dollar weekend special flights to Vegas instead?

Note: I am strictly speaking about investment timeframes, not day-to-day trading here.

Let us say I am a 30-something investor, and I have invested in S&P500 via a low-cost ETF, maybe a VTI, maybe something like a VOO or SCHD- all of them extremely low-cost indices.

Do I care if S&P500 today is trading at 4300 or if it is 3300? That is a 20-25% price-action band. To give you context, on average S&P 500 has moved about 13% a year over the last 100 years. So in terms of investment time frames, it is a pimple on a mosquito. It is a blimp in history.

I personally do not even think inventment should be timed or can be timed Once you are out, it is hard to get back in on the saddle.

Timing, in my view, is the bane of an investor and a boon for the brokers.

Where you need to be highly good at timing, I think, is in active trading.

Let me share 2 examples of how I see investing in terms of the time frame and the power of compounding.

Example A: The market takes off after I buy

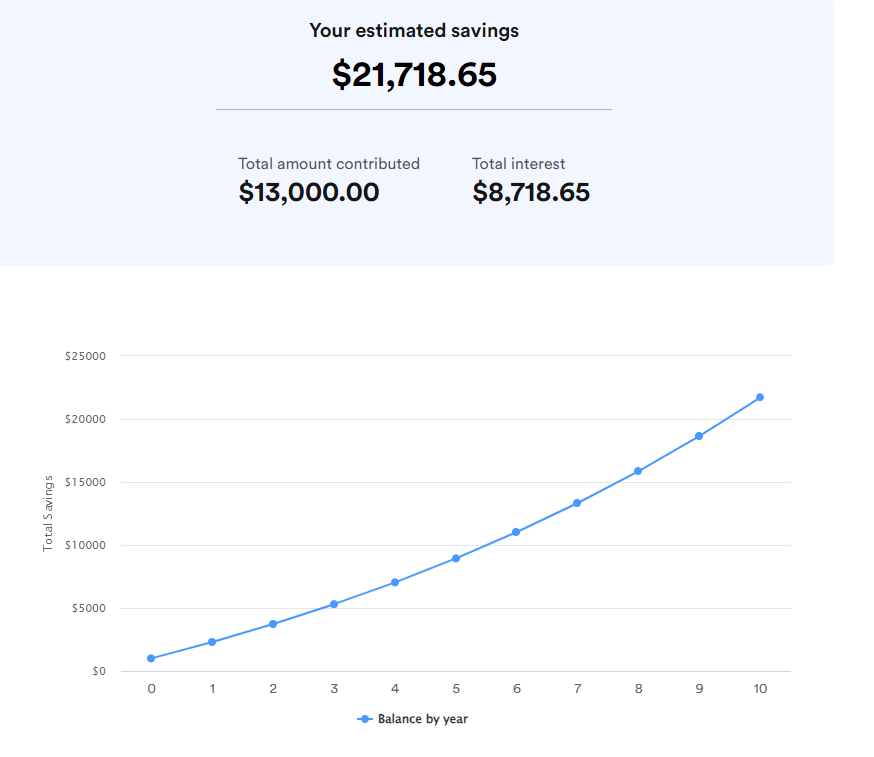

In this example, I am Investor A who has bought 1000 worth of S&P500 at 4800 prices via a low-cost ETF. Further, my time frame is 10 years, and I will contribute 100 dollars to this every month. Gains and dividends are reinvested. I assume a modest rate of return from S&P500, which is around 10% a year for the sake of this example.

How much do I end up with after 10 years following this regimen? 21718.65.

Example B: Market tanks after I buy

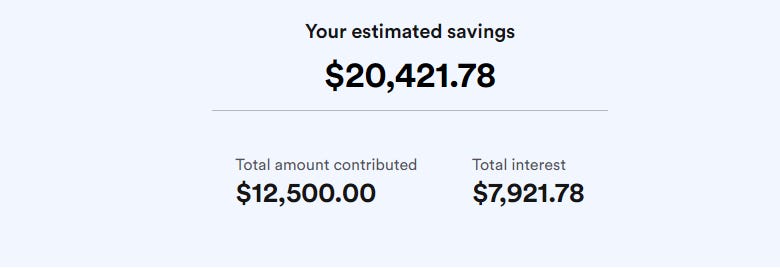

Now let us do a thought exercise. Let us assume Investor A is so unlucky that the moment he or she buys that 1000 worth of S&P500 at 4800, the pandemic hits the very next week, the stock market loses 50% in the next few weeks, and their initial investment is cut to 500 from 1000. However, he/she still believes in the power of compounding and continues to DCA as planned at $100 a month. Is it over for him or her? Is s/he finished now?

Well, they are left with a grand total of 1300 dollars less than the prior example. A mere 5-6% difference despite taking a 50% haircut at the start.

When you expand these time frames from 10 to 20 to 25 years, these results become even more astonishing.

This to me highlights that timing is of little consequence. What matters more is the time-in and consistency of DCA.

Big Bang versus DCA

From the above examples, let us say I was able to save up a lump sum. For an index like S&P500, very rarely does a 3-5 year period go by that we do not see a 30-50% drawdown.

In the last two decades alone, these drawdowns have been common in my experience.

So, when these drawdowns do come every now and then, if I have a larger amount saved up, I could 1) increase my DCA frequency and size. So, for instance, if I DCA 100 bucks a month when S&P500 makes new highs, I could do a DCA of 250 a week when the S&P500 is down 30-50% with increasing size as it approaches that 50% drawdown. 2) I could altogether decide to employ larger capital once the S&P500 has shed 50% or more.

Note - these are simply examples for illustration purposes. I picked S&P500 because this market has existed for several decades and has on average, generated returns above the average inflation rate over a similar period of time.

Outside of this concept, I will have discretionary investing, where I may decide to invest 1-2% of my account on some special name like a TSLA. There may be several reasons for it, but the main ones for me will be a breakout of a large base of multi-timeframe consolidation or a young company with the below characteristics -

Is it in a mass-selling market (like gadgets, travel, and insurance, to name a few)

Has some sort of a MOAT (barrier to entry) . Railroads, iPhone makers, oil refiners, theme parks, plane makers, and specialized chip makers are some examples of MOATS where the barrier to entry is very high due to either the cost or the technical know-how needed.

Has strong margins. High margins (30% or more often indicate a strong MOAT, but also can attract competition).

Low or no debt, 20% or higher year-over-year growth.

Outside of this, I do not want to complicate it. Yes, I do use some other techniques like sector rotations and cycles but those are rare. I do like to share these names often as and when they show up on my scanner in this Substack.

Why do I share this today?

As an educational blog, I am committed to sharing everything I have learned from my mistakes and my wins in the last two decades with subscribers, which is a step in that series. Of course, these examples assume the S&P500 (general market) will continue to do what it has done in the last 100 years. That assumption may be very wrong.

However, when you look all around us, indeed, truly financially free people own assets; they hold real assets rather than drown in debts. We can all learn from them, and we can learn from them at any stage in our own lives. I want to be financially free, and I want everyone who can read this to be financially free and inculcate good habits and long-term views. I hope I was able to share my personal views thru this blog today!

If there is one thing you can take away from this blog - it is that being an investor is a lifestyle choice. It is a way of thinking. And being a trader or a speculator is a profession like doctors, dentists, and accountants. Do not mix the two. This is why we have job adverts for traders and analysts and we have great investors who employ other people.

Alright, folks, this is it for now! Next week is CPI and FOMC, and I won’t be sharing any other levels as I expect there to be a lot of volatility, Bye!

Nah, just kidding; next section, I am sharing some personal favorite levels and themes. Hope you enjoy it!

But before we go there, a quick note on housekeeping and admin stuff.

Folks, first things first- I do not control billing or any other admin stuff other than setting the pricing. Everything else is via substack support which I think is the best back-office support in all of North America. Contact them via email if you have any back-office questions. Please, if you DM me, I will not be able to respond or help as I do not have access to the backend.

Now talking of pricing, this journal is not the one with Black Friday deals every Tuesday. Price once set or raised, can not roll back but I may offer 2-3% off from time to time to celebrate American holidays to students and any one who wants to try it out. I am confounded by the fact that I am only charging 30is dollars for this information that I am sharing- a result of 20 years of experience. To be frank, I am not very happy about this, and I am considering alternates. I do want to share more educational content like this with other traders if for nothing else, just the camaraderie and community building – but I am not on board with it being free. Free things are often not valued. The best things in life, like air, are free but for the second best like orderflow, everyone else must pay a subscription😊 I polled the readers to ascertain the fair value of this blog (based on their views). The majority (over 60%) favors $49-$99 or higher monthly. If this market remains active in the next few weeks, I will raise the publication price to $49 monthly. No one who is already subscribed at current levels will be impacted. I do not think every week can be this action as the last two have been, but I want to see how it goes before making the final call. Stay tuned. With this admin stuff out of the way, let us jump into the S&P500 levels and context for next week

CPI and FOMC on Tuesday and Wednesday, respectively. That is the main event risk.

Look at Chart B below.

Last few weeks, the S&P500 has had a good correlation with the Dollar Index. Lower-than-expected inflation as well as the stronger dollar is something this market appears to like.

My key CPI scenarios will be leveraging this relationship.

I do think a lower-than-expected CPI but with a lower dollar could not be after all so good for the STOCKS.

If you are a bull, you want to see CPI come in lower around 4%, and the dollar remains supported near this 102 area.

Bears want to see an uptick in the inflation numbers along with a stronger dollar. But I think a Dollar collapse following a soft CPI may also aid the bears.

Usually, CPI and FOMC by themselves are quite volatile events, however, now that they are back to back the next week, it may be extra volatile.

This type of volatility may be choppy and trendless. This makes forecasting any type of directional plays tougher - especially days in advance. I will be sharing more context and my views on these events as we get closer to them here.

However, for now, my key weekly levels are going to be below: