Hey guys -

Happy Memorial Day, and forever grateful for those who served and made the ultimate sacrifice in service to the rest of us.

Hope everyone got some time over the weekend to unwind and prepare for another week in the pits. The US derivatives markets will open in a few hours for an early halt tomorrow. The NYSE is to remain closed.

This weekly post is crucial and talks about Option Pricing and some personal opinions on the technical structure. You may not wanna miss it.

I warn you that this is a boring post. There are no fancy photos or spicy stories. It is math and graphs. You may want to grab coffee before you begin.

Let us get a couple of admin things out of the way and then dive into the levels for this week.

This is going to be a little bit of an educational post. I got some questions on how some of the puts which are supposedly ‘longer term’ are faring poorly. These 'long terms’ puts in question are actually a month out to expiry. I am not in these puts, but I will share my personal opinion on how I see this price action in the context of 1-2 months out. I also do not believe that 1-2 months is long-term. For me, the long term is a minimum of 3/4 months to one year. Below that, I consider it intermediate to swing time frame. Short-term is intraday for me. I want to share some thoughts on related markets and how I use multi-time frame analysis to derive some of the levels. My last educational post was for founders and was very well received in terms of value add (about the IB structure). This one is free for all subscribers, but the next one may be for Founders only.

I always strive to maximize what I share regarding order flow and Price Action education with folks. However, in order to remain focused and not distracted, I do want serious traders and committed participation. To that end, I will raise the price of the subscriptions by a little more. No one who is currently subbed in the $30 range will be impacted. They have been grandfathered in. These prices may be revised later once I see the market sell down to some of my favorite levels.

Notes from last week

My primary expectation was to see an extensive and large range in the S&P500 within the 4230 and 4120 areas. This was the case indeed, as 4230 was the high of the week, and we came very close to 4110 as the low of the week.

In addition to the S&P500 levels, I shared 13600 as a key NQ level which was the exact low of the week as well. Following were some of the other levels called by me in the prior weekly plan-

PDD earnings bull at 60. This was in fact the low of the week, and we rallied about 20% on Friday from this level. Up 20% in one day!

PLTR: Palantir had already doubled off my $6 level, but then this week it came back down to that crucial $10 level and rallied to close the week above 14. About a 40% gain within a week or so.

SNAP: Snapchat had a very strong rally off my $ 8 level, having closed now above 10. $8 has been shared as a long-term level by me, and I think it is a candidate for M&A at some point.

AVGO: This gained another 10% on Friday. I had shared AVGO at 600 only a few weeks ago, and it crossed 700 recently and added another $100 off that level.

SMCI has been unreal. Originally shared by me at 60 areas, it has risen more than 350% this year alone! It is now trading above 200! Insane action. Complete FOMO. See below.

LRCX up 20% in 2 weeks!

This week also, I will be sharing my personal views on many of these names like PLTR, NVDA, DIS, Tesla TSLA 0.00%↑ , and many more stay tuned.

Let us dive right into the educational content now, specifically in terms of option pricing and expiry.

The way options are priced is a fairly complex process, and the folks who invented these models were awarded Nobel prizes for their genius contributions. However, from a layman’s perspective, options are heavily impacted by a few key things.

Option Delta - Delta is a metric that measures how much an options price will change for a given one-point move in the underlying asset. This one is fairly well understood by most. I hope.

Options Gamma - Gamma is the delta of the delta or in other words, it measures how much the rate of change of the underlying delta will be per point move in the underlying asset. Delta and Gamma hedging is often used to protect against the moves in the underlying assets. Gamma values are between 0 and 1. To take an example, if ABC is trading now at 100 dollars and its June $100 Call is priced at $3 with a Delta of 0.5 and a gamma of 0.05. How to read this info? Delta component of this option means if the price of ABC goes up by a dollar, then Delta will add 0.5 to the option price for each $1 change in the price of ABC, and the gamma component will add a further 0.05 to the price of the option, for each $1 change in the ABC. So, if ABC goes to 102 now, what is the new price of the option? $3+0.5X2+0.05X2 = $4.1. Double-check the math there as I did it without a calculator but you get the idea. As the spot price goes up, the delta becomes more and more positive by the amount of gamma. As the price goes down, the delta of the option becomes less positive minus gamma. Both Delta and Gamma are most sensitive to the at-the-money or in-the-money options and are far less responsive to far-out-in-the-money options. Further, gamma is the highest for at-the-money options when the delta itself is between 0.4 to 0.6. For me this is the sweet spot for option price. It is near 0 for options that have Delta near 0 or 1. This means that for out-in-the-money options, the gamma is not moving as fast. Or in other words, the price of the option for far-out-in-the-money options is the slowest to react and, many times, does not change much. This is why we see even when we are right in our direction if our strike price is far away, the price of this option barely changes. When the price of the underlying moves unexpectedly, and it moves very in large amplitude, this is often what gives rise to the term gamma squeeze, which does not let the dealers in many of these assets adequate time to hedge. These dealers may have been short stocks via selling calls and could not buy or borrow those stocks back at any price as the market rallied sharply. AMC and GME from 2021, anyone remembers? We will see why these metrics are important shortly.

Implied Volatility - implied volatility is the expected move of the option over its life. It is expressed as a percentage indicating a standard deviation move of the option over the life of the option. When implied volatility increases, the delta, and gamma of in-the-money options goes down When implied volatility decreases, the delta and gamma of in-the-money options increase. Further, when Implied volatility increases, the options price also has to increase. When IV comes down, the option price also comes down. Many options traders sell options when IV is extremely high and buy them when the IV has come down. IV rank is another important tool to gauge if the high IV% is abnormal or regular. IV rank can be measured between 0 and 100% and indicates the rank of the current IV in terms of its IV within the last year. So if TSLA has a current IV of 40% and an IV rank of 0%, it means this is the lowest the IV has been in the last one year. Conversely, at 100% IV rank, it is the highest the IV has been in the last one year. There are several strategies that can be drawn from this interplay between Delta, Gamma, IV and IV rank which are beyond the scope of this journal.

Open interest - now Option OI is also something I keep track of rather than follow some other popular metrics like the Put to call ratio, which I do not find useful. I like inherently liquid options with a large amount of OI. Do I really want options with 200-300 OI? Not really. The current day’s volume to the OI is also a very important metric for me. I do not ignore when the current volume to OI ratio exceeds 100-200% or even more.

This is not a comprehensive list of everything- it includes several other things like the risk-free rates, yields, and so much more, but I use it to analyze the options.

Technicals

Now why do I share this? What is the purpose of this? My purpose is to only consider options that make sense in light of the above metrics when married with the underlying technicals and order flow. For the sake of an example, let us consider the recent action in S&P500 or SPY.

For purposes of this example, let us only consider the past one month of action in SPY. I am assuming the time frame for the option I want to trade is one month, so it makes sense for me to see what this market has been doing for one month. If my time frame was one day or one week, will it make sense for me to analyze technical action over the last year? Think.

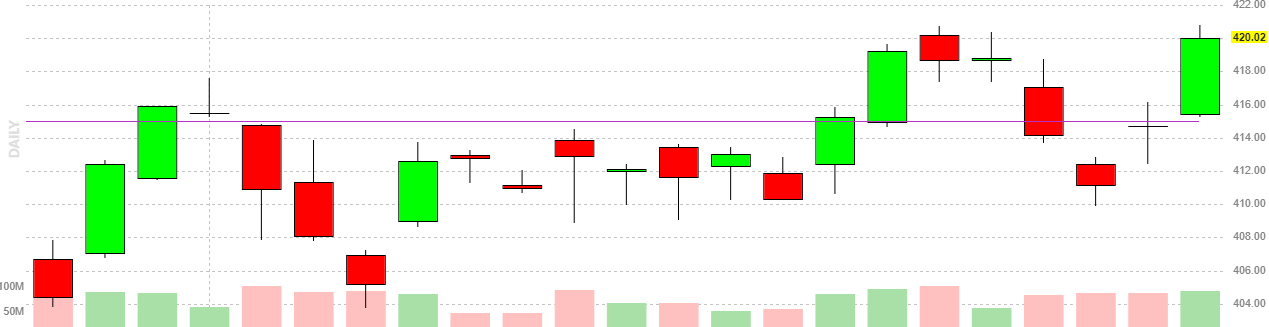

Chart A below.

Observing Chart A with 0 indicators or trend lines or any other means, anyone can see that the market is A) rangebound B), for whatever reason, it likes levels at 4050, 4100, and 4200. Maybe these are order flow levels.

These are objective facts (the market has been flat for a month), not my opinion. Now let us say, last week, the market sells down from my levels above 4200 to 4100. There are a handful of higher probability occurrences once this event has happened -

The market can sell down from 4100 to 4050.

The market can rally back from 4100 back to 4200.

There are many other lower probability possibilities, for instance-

The market can sell down to 3600 from 4100

The market can rally to 4800 from 4100

Probabilities 1 thru 4 are in the context of Chart A. Chart A is based on one month auction. This is key.

Do you understand what I am saying?

Scenarios 3 and 4 above could be highly probable when I expand my time frame from one month to one year, let us say. And if I do so, the option pricing profile changes drastically. First, the 3600 puts that are one year out go up quite a bit.

However, can we agree that 3 and 4 above are not impossible but are unlikely in the context of a one-month time frame?

So now I zoom back to Scenarios 1 and 2 above. I hope you are still with me.

So, my number 1 high probability scenario that the market can trade 4050 at 4100 is still quite probable, but in terms of where the market has been in the last one month, the price of that opportunity or, in other words, the put for that has increased 200-300% or even more from its price when this same put was at 4250 just a 3 days ago.

Similarly, the 2nd opportunity or the probability, i.e., the 4200 call was probably worthless at 4100 or very cheap, however, at 4200, just 3-4 days ago, it would have been expensive because we were at the money only 3 days ago.

I am sharing this example to explain how I see an option price myself. I see it as a probability and nothing more. As I explained above, its price depends on the geeks like delta, gamma, theta, and IV, and how close it is to the strike and expiry.

65-70% of all options nowadays are less than 5 days out to expiry. So, the options with deltas close to 0 or 1 are extremely hard to directionally trade is how I see this problem. I personally think options with 0.4 to 0.6 deltas are far easier to trade in my opinion. This means for directional traders, the 0.4 to 0.6 delta options may be faster to react and change in price. Remember, if the price does not change, it is very hard to buy low and sell high or sell high and buy low. The price must change for the underlying spot to move. Obvious. Isnt it? So why will the option price be any different?

This is where I think all of us need to, at a basic level be able to identify the trend in our chosen time frame. Is it up, down, or sideways? Once we do that, we need to know a pullback or a retracement level that makes sense in terms of recent action as well as the price of the option that’s being quoted.

With this educational section, I have tried to demonstrate how the interplay between option metrics like delta, gamma, etc may interplay with underlying technicals. As more and more volume flows into shorter-term options, it may become harder to exploit options with very low and very high deltas (they may not move).

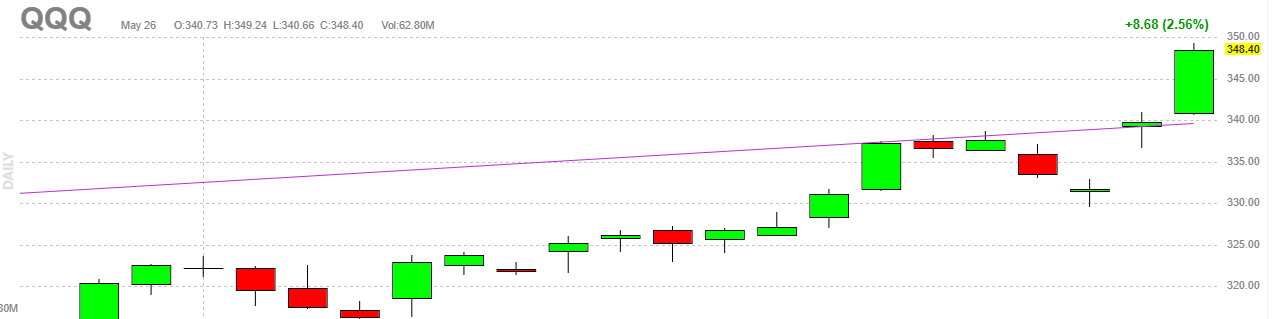

Same 20-day auction in $NQ is below. I spend 99% of my energy on S&P500 every single day, but can you come up with some high-probability scenarios using the chart below in NQ?

Is 11000-12000 NQ a highly probable scenario in the context of this one-month auction if my time frame was 1-2 months below?

Will more analysis make it easier to find higher probability levels?

With this out of the way, let us dive deeper into the levels of some of the things on my radar this week.

If you want educational content like this delivered to your inbox, consider subscribing below. There is no difference in monthly and annual plans, but the Founders get the extra content whenever it is published. Founders will also get exclusive chat when the Substack developers implement these changes.

My key levels for this week

Chart C below was used in deriving weekly levels for this week