Folks-

In this installment, my weekly thought on S&P500 and why I think we may soften up a bit again. As well as a few thoughts on Gold and earnings like SE this week.

Let us start with a recap of the prior week’s action, my calls and how they fared.

Starting with Bitcoin

Bitcoin, I was bearish at start of the week around 35000, a bias I have had since 51000 from late last year and Bitcoin started falling at start of the week and briefly traded below 27000.

Around this point, it coincided with the lows I expected in S&P500 for this week , that is around 3900, I started becoming bullish on Bitcoin as I expected the sell off is over done. This also made me have a bullish bias on some associated Crypto plays, like COIN. I had been bearish on COIN actually before it’s earning at 85 which I shared here in the substack. However I turned bullish on it before its ER which in hindsight was a bad call. It fell down as low as 55 I believe after the ER.

While it recovered most of its losses in last couple of sessions, giving sort of a second chance to get out of bad trades, it fell prey to heightened sentiment and negativity. Now at time of this post, Bitcoin is again trading around 29000. COIN is now back below 70 again.

If I were to put my Bitcoin call in context of time frames- while I think the lows are a little unfair as they coincide with my thoughts on broader market being where it is in short term, which I think is oversold too, I am not a longer term Bitcoin bull. I think it has strong resistance at 40/42K and if it gets there it may sell off. Ultimately, I believe Bitcoin will trade below 10K.

See Bitcoin had a very good chance this cycle to break away from its correlation with both NQ and SPY. If Bitcoin was up on the year or even flat, this would have been a very good development for this industry. The fact that it is down 40% while S&P500 is down 15, cements its status as yet another very high beta tech stock - not some value store or inflation hedge. No one has historical references for Bitcoin from the 1980s- for the obvious reasons but its current action is paving its way for where it may be headed next and that may be lower.

It is a risk asset (and I am being a little liberal with my use of word the asset but let me be kind to it for sake of this letter) and like all risk assets, it is largely a function of liquidity or lack thereof. Forget about how scarce or abundant Bitcoin it self is- let us assume for a second it is scarce like the # of stocks of AAPL or # of townhomes in the US— all risk assets compete with each other for liquidity. Am I to believe the liquidity that is available at this time to be put to use in risk assets, am I to believe that those dollars will be equally allocated to the likes of GOOG at 2200 and AAPL at 140 and also Bitcoin at 30000?

I don’t think so.

And due to this, I believe Bitcoin has lower to go. I think I will not be surprised if it were to trade below sub 10,000 in a year or two. Again, know the context of my call and know the context of my timeframe. While Bitcoin could and did bounce a 10-20% of these lows, I think it has these issues which may keep a lid on it going above that key 40K handle. There is then also the question of what differentiates Bitcoin from let us say Dogecoin or any of the other 1000s of crypto? I am sure there are elegant technicals reasons that the supporters of Bitcoin can furnish but the logic and reason go out of the window when folks are in panic and right now as far as I am concerned reasons like the superiority of its lightening network or the first mover advantage just do not cut it for me. It will not change my mind that it is headed lower.

Speaking of the time frames

All my calls need to be taken in context of the time frame. Understand the difference between Trader Tic, Investor Tic and may be even a Swing Tic.. For instance, I shared two levels on Friday. 3925 and 4030. I have also shared a key level of 420 on this substack. If I am calling 4030 as resistance, it does not invalidate my thinking that 4200 is still a key resistance. However 4200 is a resistance on weekly time frames where as 4030 is applicable on Friday time frame perspective. Knowing the time frames is the difference if my risk will be 10 points or a 100 or a 15/20% of the 1% of account size! I just wanted to put it out there in case any one else wondered why I am bearish on Friday at 4030 where I am expecting a 4200 as well on a longer term swing basis.

This newsletter can take a lot of thought process and if you like my work, feel free to share this newsletter with traders like your self. This is the top finance newsletters and all due to word of the mouth support by readers like you:)

A great way to read my newsletter for free this week. Use the one day trial below or the special discount. Both are valid only for one day and the trial must be cancelled by you within one day.

Let us spend some time talking about S&P500 here on Friday close at 4030

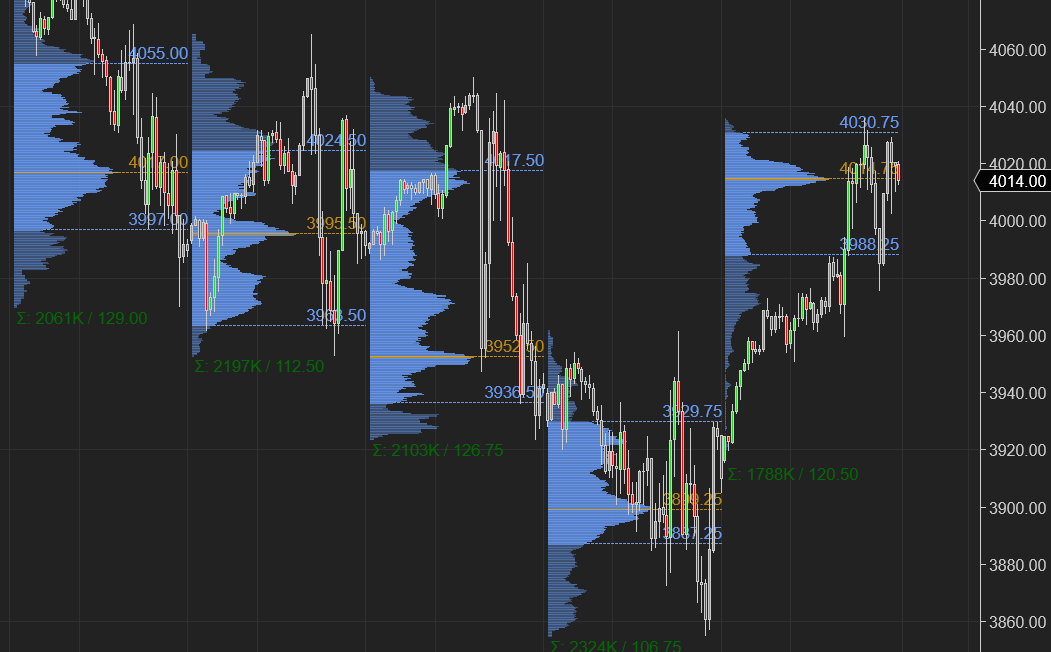

Starting with a Daily Chart in Emini. Chart A.

This is not a very healthy looking chart IMO and gone up to a prior range of resistance- the 3 day balance area top.

Unless we quickly take out this resistance at 4050 ,I will expect more downside here. Notice what’s not helping either is the anemic volume and the P shaped profile. I would think may be the recent lows could be retested or the recent balance area low at 3925.

I am going to use 2 recent references and go from there to build my thought process around where I think we may be headed next week.

I want to start with last Sunday where I issued this post at around 4110 ,I expected us to sell down into 3900-3950 before the buyers emerged and take us back to 4200/4300. Note this sell off was deeper as I mentioned one key related markets which many seem to have ignored based on some queries I got. That related market was AAPL and I was categorical that we do not need a close below 155. That close came and along with it came softness.

Here is the link if you have not yet read it.

I was right on this to the extent we did go down to 3900/3950 but then we went down further into 3850. This was surprising for me. However when we consider the volatility and liquidation events around crypto last week, it made sense. I also called this on AAPL. It was textbook precision on AAPL once we closed below 155 we made a beeline to about 137.

What is a 1-2% overshoot in one market when another market like Ethereum ETH is losing 25% of its value in one day? Or when you look at something like some of the stable coins, they losing all of their value in one dat? My point being, in such turmoil, the script does not always play out to the tick and there are offshoots like this which can test and shake any resolves and methodologies.

So then on Friday we rallied and built up on the Thursday rally off those lows at 3850 , we almost rallied 200 points and only stopped near my 4030 which I shared in this post on Friday early AM. This happened after we closed back in the value area and above 3925. Actually we closed at 3925 on Thursday paving the way for another good leg up on Friday.

BTW if you want to see more such pre market open updates, let me know below. I do not want to crowd the inbox and therefore send an update a day or so but if it makes sense on exceptional days, I can see the point in these intraday updates.

I promise I will go into my thoughts on next weekly action but let me here breakdown why I think what I think at the moment :)

Now this rally while very impressive , did not induce much excitement in some key related markets - like Gold.

Gold has remained under pressure and has now settled so close to 1800 mark. This tells me the market is pricing in a very hawkish FED going forward. More on Gold technicals later.

My calls are not based on only one factor - charts. In fact I do not give much though to the charts anyways. Most of my calls are based on several factors - orderflow in the underlying asset, related markets, sentiment, options analysis, technical analysis, global macro, as well as astrology. Just kidding on that last one :)

On the technical side, I am going to borrow what I said on Thursday about that key 3 day balance from this post.. click here if you have not already read this.

I am not going to repeat what I said about this 3 day balance , read the post again if you don’t know yet, but it will suffice to say there is a key range from last week between 3925/4050 which can decide where we go next. So I am thinking for my 420/430 call to remain in effect for longer swing time frames, this range between 3925/4025 needs to stay alive headed into next week.

What I mean by that?

I think we may try and test this lower end of the range early next week, may be Monday or Tuesday.

It is important that we do not close below 3900/3925 on the D1 (daily) time frame basis. If we do, we will probably retest the lows around 3850 and if broken exposes 3700 below. I think if 3700 trades, it becomes an excellent level for a much longer time frame, from a risk to reward perspective in my humble opinion you are looking at a 3550/3700 (emotional impulse overshoot) on the lower end of a massive range to the top at 4300/4400. Very good indeed for me in terms of risk to reward.

On the flip side, if we stay inside this 3900-4050 zone, it keeps the narrative for a eventual retest of 4200/4300 alive. This is where longer term sellers may re-emerge in my opinion.

Longer term, per my post from last week on AAPL multiples, I think there is a fluff in the AAPL and SPY as long as they have this difference between their multiples. While AAPL significantly sold off from 155 last week to 140 this week, I do not think we are just there yet. I think that number may be 120s to 130s. When we start seeing thee multiple merge or come close, I think we have a very solid bottom in overall market.

At end of the day remember none of this has to play out the way I said it will. I am also one of the millions of market participants. These are all my opinions. I have been active in markets in one form or another for over 2 decades now and I am happy to share my thoughts and opinions with folks and show them an alternate way of looking at things, not just through charts and TA. This is my personal journal to that end.

With this context, here is my key scenarios for next week:

Scenario 1: A daily close above 4050 may be bullish and targets ~ 4200 where I think longer term sellers may enter this market.

Scenario 2: Until we achieve such a close, there may be a tendency for 4030-4050 to act as a resistance and try and test the recent lows at 3900/3925 which could get supported on intraday or even weekly basis.

Scenario 3: it is critical I think that we do not close below 3900. I think if we do we could retest the recent lows at 3850, which is broken can open the door to 3700.

As far as the planned risk events go, I think the US consumer retail sales as well as the Powell speak on Tuesday is very important. As has been the case, Powell may try and pump the market again on Tuesday so as to soften the impact of his “soft landing”. That is something definitely to keep in mind for me.

To be consistent on a daily basis, I need to have a few key levels in mind even before the market starts. Depending on the orderflow + tools like TRIN and TICK , then I can confirm if the levels are being support or rejected. It is not uncommon for me to be bearish and bullish on the same day - in fact I prefer these type of days where I can be both. This only works if I have a plan what I will be looking for at each of these levels and these plans are for that.

A lot of folks have now thought the worse may be over due to Crypto liquidations

I beg to differ, I think the worst it yet to come. This crypto sell off has actually exacerbated the already bad situation. You still have large players like MSTR and ARKK who while maimed are still around. I think they may come under more pain .. unless we were to take back 31000 in BTC. At time of this post this is trading at 30000.

Image Credit: Business Insider

Here are some other factors influencing my bias at the moment:

Some of these factors I feel are not yet fully priced in and will keep pressure on.

The uncertain outcome of Russia/Ukraine conflict. I think there is a chance this may get escalated and that may keep the market jittery for weeks ahead. Here at home , many in the political class are now openly calling for a coup to depose Putin. A coup in a Nuclear armed country engineered by the US is not an idea that thrills me.

Capability of FED Powell to do anything about this inflation. You have the pilot who cannot land the plane- I do not know if that inspires a lot of confidence at the moment.

I am also worried about the Chinese lockdowns. They are cancelling events as far out as Summer 2023. They are sanitizing the airport tarmacs. I believe they are smarter than that- and I think there may be a method to this madness. This may not be in our best interests back home.

I also think while the energy inflation may peak, the food, housing and healthcare inflation may be picking up.

Combined these factors I think may not be fully priced in yet and may have some more work to do on the downside.

Primary argument for bullish case is anticipated FED pivot and relative lower valuations. IMHO, FED pivot alone is not enough as a catalyst and valuations are while low, can be lower still. Drop me a line below and let me know what factors you are watching if any.

To summarize my view on the general market, I think we had been oversold extremely and this bounce did not surprise me. What surprised me was how much lower we could go into 3800s before this bounce (Crypto and AAPL driven). I think unless we were to close above 4050 this week, we may remain under pressure on the S&P500. If we break above 4050, I think we may have resistance come in at around 4200.

In other news..

Well another shoe to drop which no on expected but I had been warning about that the TWTR and Musk engagement got put on hold.

I could see this on the tape and I could see the market was heavily at a discount between the proposed sales price and the actual price and I knew this will not end well for TWTR shareholders. Lo and behold, Elon dampened the celebrations with a single tweet on Friday morning and the stock fell 25%.

I has since then crept back up to 41. However I will think the pressure on this may remain to the downside. Personally I think Musk does not need this. It is a needless distraction. He probably made a decent profit on this already on his trading and should just pay the break up fees of 1 Billion dollars and walk away.

TSLA itself had a decent bounce off around 700 bucks amidst the carnage last week.

I think what I did not like was this close here below 800 bucks. IMO I think this stock may remain under pressure along with rest of the market. It will not surprised me if in coming days and weeks we test sub 700 again. Friday close was around 770.

Look, a lot of investment programs and algos follow some very mechanical rules

What that means is at times they will just shut down. For example a lot of funds will shut down new purchases when the general market starts making new lows. When this happens, I am not going to be the first one in line to open new positions when really there are no plays.

This may be the reason why I am not myself finding really any new good ideas for longer term buy and hold on my personal screeners. Regular readers know that when we had the right conditions - which is to say we had the right accumulation prices and right liquidity conditions aka timing — I shared names like GME at 3 dollars last year, DOGE at half a cent, AMC at 12, LPX I think was shared at 10 bucks, PLTR was shared at 10 as well — this was all before they really took off.

Now will we have those conditions develop again? I am sure we will. However, to say when is any one’s guess. I do think they are certainly not now. Even when you have some of the prices now off 60, 70, 80%, what you are missing is the liquidity. And once you get that, I think that is when you can have some explosive moves. Don’t think we are there yet- but if I see something this will be the place I share first with the folks. Until then it is really wait and watch.

Perspective from investor Tic ..

I am a firm believer in the fact that the returns in the market are function of time in the market rather than any thing else.

And that means IMO a 20 year old woman buying S&P500 at 4800 last year may look like a genius 20 years from NOW and a 65 year old man buying S&P500 here at 3800 today may be a fool only 5 years down the road. Always know your time frame!

Quoting Naval.. the best investments are those you make and then promptly forget about.

Some of my other names , particularly around earnings did ok

OXY, the dip was dippier

I was bullish on any dips in OXY. The dip did come however it was a deeper dip than I expected. The stock has since recovered most of it’s losses and has now closed near 65. My target on this is 68-70. I think oil in general looks toppish. I do not know if that will happen any time soon but my LIS on oil is around 117/118.

For now it seems to be stuck in a range. Now 111.

PLTR was a great bearish call

I was a bear on Palantir around 9.5 pre earnings. This stock got crushed after the earnings and traded very close to my ultimate 6.29 target, I think the low was 6.5, it has since then regained most of its losses to retrace back to 8.5 dollars.

COIN

Coinbase threw me off a bit.

I was bearish on COIN pre its earnings at 85. This stock got hammered after the earnings. However I had some issue with one of the brokers and I actually flipped bull at 75 before the earnings. The stock instantly went against me to 65 and I got out. It did end up rallying hard and coming back to my 75 dollar mark in last couple of days.

As far as the earnings go next week, I will be watching a couple of stocks like the SE

SE used to be very loved by the retail and a momentum darling up until last year but is now down about 65 % on the year. It is now trading around 75. They report earnings on the 17th.

I think the stock is now close to meaningful support (60) and may be oversold in the short term time frames . While the market has been unkind to these growth companies in past, the Risk to reward on this is not bad. Options market is keying in a average move of 20% which is a large move for this stock.

A blurb about Gold before signing off..

I am a big gold bug and I have been a Gold bull from the 1500s. It went up as high as 2050 and has since cooled off , selling down and struggling around 1810. With the dollar making new highs every day, I think Gold may have some more pain to endure. However I think the gold has decent support around 1750 .

I do think Gold bottom is when we see a lot of other pivotal moves- may precede or coincide with the long term bond lows, may coincide with longer term equity lows. This gold softness right now is indicating a hawkish FED but its days may be numbered.

This is it from me for now. Be nimble, stay safe.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Pre market updates please....and thank you😊

I'm a West coast longshoreman and indeed the China situation is beyond strange. I have a theory that China and Russia are colluding against the west with supply restrictions masking it by war and Covid. As the only other way to create inflation beyond supply and demand is supply chain disruptions. Currently at any given time 40-60% of our cargo comes from china, as of 2-3 weeks ago we have experienced a massive slow down at the ports and the yards are clearing of containers where as just a month or two ago there was no space. Its starting to look recessionary at the ports. As we have shipped most empty containers back out to be refilled in china and other locations. Currently, there is around 800 ships waiting to be loaded in China. For context when we experienced the last supply chain crisis months ago. The number was around 200. So not only is there going to be a massive backlog at the China ports. When the cargo does finally arrive in the States we will experience supply chain disruptions on the home front that will dwarf what was experienced at the begining of the year. With the staffing issues at the warehouses and recieving facilities, the rail congestion, along with the truck drivers unable to catch a break and im sure they are getting hit hard right now. As I would estimate 60-70% of them are 1st generation immigrants who are living paycheck to paycheck and just struggling to survive. Will they be there to haul the cargo out? One of the biggest unknowns is our contract. As of June 30th the West Coast Longshoreman(ILWU) will be without contract. I believe East coast longshoreman are negotiating as well but they are (ILA) We have just started negotiations and there is no report of how they are going. I do know this though. We have gone on strike in the past and are prepared to strike if the shipping companies cant come to an agreement with our union leaders. P.S. when we are working without contract the work slows down by about 50%. If china opened today we would start getting those vessels around late June. Just in time for Americas dockworkers to slow down operations and work within our safety guidelines. Anyways, just food for THOT