Traders-

The S&P500 market for the most part last week remained within the 2 key levels shared by me. In fact, the high of the week in S&P500 Emini and the low of the week were shared by me last week.

But before I do a detailed recap of the prior week’s action, let me share some thoughts on what is currently in the driver’s seat for the US markets.

The markets are driven by themes. There are at any given point in time, major forces acting on this market. Some of these are discounted already in price, whereas there are a few which are not reflected yet.

You have to be ahead of the curve when arriving at these themes. If you can, then you can often foresee major market movements before they happen.

For instance, last year at the beginning, it was all about the supply chain woes due to deglobalization, inflation, and the war in Ukraine. In the latter half of the year, it was a market pricing in an inflation peak and easing supply chains.

It is a few weeks from the Summer of 2023 now and I see some people are still running with those same old themes from 2022 like inflation. That is just not where the puck is going to be.

So where is it going to be?

Well, could it be the US default?

Yes.

It is highly-highly unlikely but it is not impossible.

So yes, I think the US debt ceiling debate and the looming question mark on whether a US default is on the cards is one of the major themes going into the next few weeks.

Below I think are some other key unknowns -

The US Recession likelihood this year.

The ongoing banking saga.

I personally do not think inflation is a major current concern of this market at the moment. If it was, then this market should already have cleared 4200-4300 by now. There were several chances - a lower-than-expected CPI. A far lower than expected PPI. A collapse in any and various PMIs. All of these events gave a clean chit to this market to break out of 4200 resistance, yet it could not!

This shows this market is not that worried about inflation. It knows it has peaked. The market knows the FED will soon cut rates. So that is not an unknown either.

There is some other little pesky unknown (or unknowns) that is tugging at the heartstrings of this market and giving it bouts of anxiety.

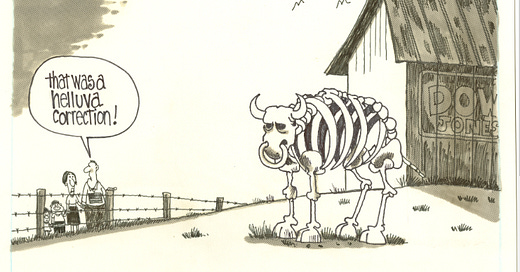

These 2 big unknowns are a) the US debt ceiling drama and b) the US recession likelihood. I do not think either of these is priced in. The fact that as we head into the debt ceiling showdown, the market is in a 40-42 day balance now, gives it an enormous amount of fuel to cause a major large-scale move.

Let me spend a few minutes now to share my own personal viewpoint on both of these unknowns and how I may be positioning for it as well as my thoughts on what happens if the US were to default.

Let us first address the US default question.

US default, if one happens, will be very short-lived. I think the default will spur the US Congress to act and they will within days of default either raise the debt ceiling or suspend it altogether. Now while the default may be short-lived, its impact on financial markets will be catastrophic.

You are basically saying the United States will not pay its creditors and will not let them repatriate their debt. This has never happened! Well, the US has technically come close to default about 5 times in the last 200 + years but has actually never reneged on its obligations to its creditors.

The current Credit default swaps (CDS) on the US treasuries are at the highest levels they have been since the 2008 Great Financial Crisis (GFC). This does not automatically signal a default but instead points to it as a possibility.

A US treasury default will appear as the treasury failing to make an interest payment on a bond, or not redeeming a particular bond. Even if the US were to go into default for a very brief period, let us say, just a day, any missed payments have the potential to wreak havoc on the international markets, including the US S&P500 market. This is possible even if the treasury misses interest payments on just one bond. Even though this does not mean the treasury will not repay the other bonds, it still begs into question the various bonds kept as collateral and on various books. The US government bonds have different maturities and attributes and a default on one bond does not automatically mean other bonds will not be paid but it still devastates the country’s credit ranking.

In my view, even a brief default of such nature could cause an immediate volatility event in the likes of S&P500 market, which would trigger a price limit down event in S&P500 Emini.

I personally think the market is not fully pricing in a probability of default, howsoever small. I think the market is not even worried about a government shutdown, howsoever brief. I think it will be a tough sell to the House Republicans to raise the debt. One reason is just due to the composition of the chamber. There are other reasons potentially like the Title 42 expiration. This could potentially be a catastrophic border control failure and this will also be a very public and visual failure, especially in the border states which tend to be strongly Republican. This will add pressure on the GOP lawmakers to not support any debt ceiling increase unless significant concessions are obtained.

There are different price limits in the US S&P500 Emini market, dependent on the time of the event (whether it occurs during the nighttime or regular US market hours).

During regular hours of 830 AM to 230 PM, there are 3 limits -

7% Limit

13% limit

20% limit

There are a few price limits between 230 PM and 5 PM. But from 5 PM to the opening the next day, the markets will be halted at a 7% price limit.

The most recent price limit triggers in these markets were in a) March 2020 during the Coronavirus pandemic meltdown and b) November 8, 2016, the night of Donald Trump’s election.

Note - I am not saying there will be a price limit event in the US markets. I am sharing my notes on what sort of volatility we could encounter if the US were to default and how may I position for it.

Furthermore, if the US were to default, I think it will be very short-lived. I think if we get a price limit event, this invariably could be followed by at least another one. In this case, I will be a buyer at the lows as I expect swift and powerful action from those in power to remedy this. I could see this event shave at least 10-15% off the current closing prices. While these are the worst-case scenarios, I do think even a government shutdown could cause volatility in the markets. Combining this with current banking turmoil, high-interest rates, this could escalate and lead to a quick bout of volatility in the US markets as well as elsewhere.

The other specter looming on these markets is the risk of recession later in the year.

While macro and fundamentals are not everything, it helps to be aware of what factors are currently being priced in and which ones are not.

Recession likelihood is rather a low-level risk when you look at the current popular sentiment. The majority of this market right now believes in a soft landing scenario where the FED is able to bring down inflation to 2%, lower rates below 2% without meaningfully denting the employment rate, and without a deep cut to the GDP. This sits at odds with folks saying the majority of the market is bearish. You can not be bearish and not expect a recession at the same time!

The 3rd major risk in my view is the likelihood of more institutional failures, like the recent failure of 4 regional banks. This does not have to be tied to deposit flights or a dip in the value of long-term assets like bonds. It could be anything, from their exposure to residential or commercial real estate for example. If you recall, there used to be a period of time when residential properties across the US were being scooped up by institutional investors back in 2021-2022. These still sit on their books. Then you have the commercial real estate which has headwinds of its own from higher refinance rates, to lower occupancies to mass exodus of businesses/workers from certain markets. These are all potential crises in the making.

Now don’t get me wrong. I am not saying that the market can not go up in the face of uncertainty. It can. I am just saying that in my opinion these risks are not yet fully baked into the current levels. I think if we were to dip into some of the levels I have been sharing on the downside, the risk-to-reward scenario for me looks much better, even with all these risks out there!

On a side note, I am also working on a Founder exclusive post where I will share my thoughts on some key intraday concepts. These are applicable to anyone who is active in intraday time frames. This educational post will focus on how I view the below.

VWAP

Overnight highs and lows

Prior highs and lows

Cumulative delta

HVN and LVN formation and some strategies behind it.

Stay tuned it should be out sometime this week!

Recap of last week

Look at Chart B.

Back at the start of April, I started becoming bearish on the S&P500 index around 4060. Before that, I was bullish on the heels of the banking crises in the 3800s.

My two bearish levels which I shared in early April were 4060 and 4200. From Chart B you can see, over a period of 6 weeks now, the market has remained range bound within these two levels.

You can look at it two ways - one is that 4060 has supported this market over the last 40+ days and the other is 4200 acting as resistance for over 40 days.

This is a very narrow range and it is very uncommon for this market to range like this over such a long period of time. We are coming out of a volatility regime where the average-sized swing was 400-500 points, now down to this 150-point range. It is too early to tell if the market behavior has permanently changed. It may have been due to the advent of 0DTE options. But it is too early to say. 0DTE options in general are not good for any market. Why is that? The 0DTE market is not dominated by the options buyers but by the market makers- Options’ pricing is very complicated compared to the pricing for futures let’s say. Without getting into the Greeks, suffice to know an options price varies heavily by how far is it from the expiry and how the options’ Greeks respond to the price of the underlying instrument. I do think this market is permanently changed with these new options but that may or may not be a bad thing depending on your style. This may mean this market is reverting to its behavior some 6-8 years ago.

I think if you are short-term trading large sizes, this may not be such a bad thing for you. If you go for longer swings on small sizes, maybe it is very bad.

I know a lot of folks especially the indicator-based traders do not pay a lot of attention to the underlying volatility and concepts such as ranges. But these are extremely important in Auction Market Theory which is what I follow primarily as methodology.

Now back to the recap from prior week…

My main expectation for the S&P500 Eini market was to see bears retain their edge as long as we remained below 4170. Both of my levels were the high and low of the week.