Good Morning Traders-

This was a tremendous, action packed week that saw whipsaws on both side of the equation with a lot of traders getting caught off guards, especially when it came to the mega cap earnings.

I remained on right side of the tape- whether that was the ER of TSLA, META, MSFT, or GOOG. Each one of these was shared here in the Substack.

Highlight of the week though was the TSLA ER.

TSLA missed both on revenue and EPS, but that did not stop the stock from rallying about 20% on the week and ended the week near 170.

You can put whatever spin on this ER, but in my view the stock was oversold technically and would have bounced regardless. However, I think what really helped it shine was the pivot from Musk himself who was focussed on the call and pivoted the company from a car maker to an AI robotics company instead. Musk has a large fan base and this was enough to rally the troops and support the stock. It also did not help for the bears that the short interest was quite high.

So anyways, at start of the week, TSLA was an EV company which was 2nd worst performing in the S&P500 index, with story being that the EV is dead. It ended the week positioned as a “growth company” which has its better days ahead of it.

Is TSLA a growth company?

Absolutely. 100%. And this is why it commands such high multiple. Even at 170 now, it commands a 49 forward PE. Worst performing mega cap with the highest PE ratio at time of this blog.

This means the market is already pricing TSLA as a growth company. And a very strong growth company at that.

Our aim as traders is to look beyond the hype and narrative. Our aim is to look at something more tangible than fables built in mile-high castles by charismatic CEOs and try to determine if a given price is fair or not.

So let us look at some numbers.

I am going to use the 12 month rolling period as the baseline for this analysis rather than use the quarter which can be volatile.

TSLA made about 10 billion dollars in profit on the most recent 12 month period, and had a revenue of about 96 billion dollars out of which about 85 billion was the cost of goods sold (COGS). While 10 billion dollars in profit is nothing to scoff at, when you compare this to other tech darling, MSFT for instance, MSFT made 75 billion dollars in profit on a revenue of 220 billion, with its COGS being a mere 65 billion USD.

MSFT sells at a PE of 30. Now you can argue all you want if TSLA has a greater chance of growth in next year to two years, compared to MSFT. I think I know which one will do better in terms of growth. And it will not be TSLA.

So may be as a growth company, TSLA has better growth metrics. Let us dive into those.

MSFT grew its sales by 20% on the year. TSLA? -15%.

Could it be that TSLA had a better quarter than MSFT?

Nope.

So in essence what I am saying is for TSLA to justify its 50 multiple, the EPS has to increase from somewhere. A surge in profits has to show up on the income statement. Else it is a wildly, insanely expensive stock. Based on fundamentals alone, MSFT despite its 40% surge in price over the year, is cheaper than TSLA with its 9% increase.

All this can change if TSLA has a NVDA moment.

May be we wake up on Monday and FSD is approved for use by the regulators and TSLA is licensing this application to drives and carmakers around the globe. Robotaxis are seen everywhere. An instant spigot of billions of dollars in revenue stream is opened up. TSLA moons.

Possible but how likely? Is is possible or plausible in next year? In next 2 years?

In meantime, the the gap between COGS and actual profits for TSLA will continue to grow. So I think for TSLA to build on these gains, it has to see the dollars show up on its balance sheet. Else what you see is as price of stock rises, the PE also balloons. Now mind you, PE always is not the absolute truth. It is a construct made up by accountants. TSLA in past used to have a 1200 PE. But that was also 2020. This is 2024.

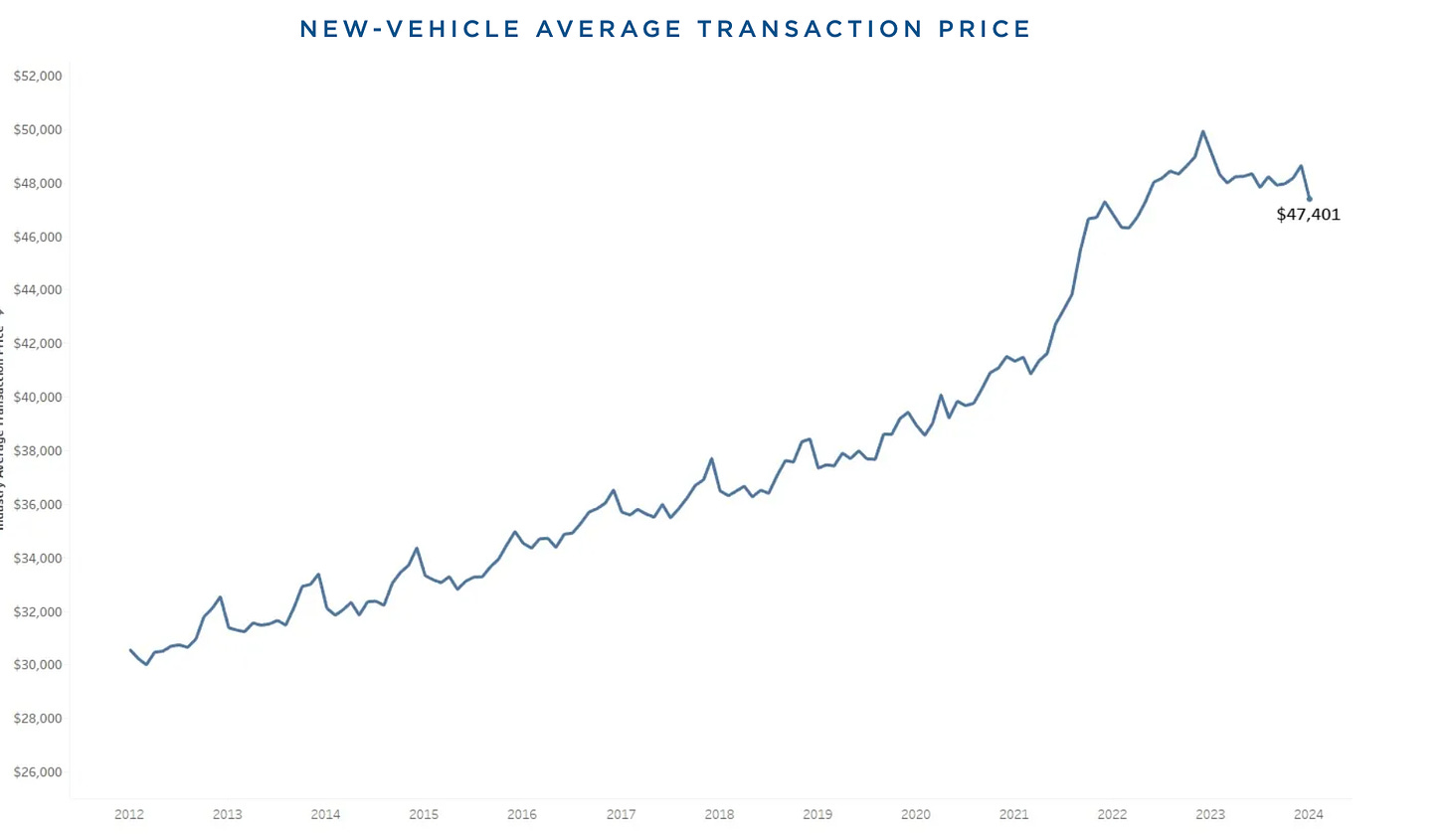

Let us worry about robot taxi and FSD once it is here. For now let us focus on the primary product of TSLA which is the EV. Look at Image A above. A cursory glance of this chart indicates much lower prices for cars to come. I would not be surprised on average 10-15% price reductions in next year or so. If you are in new car market to purchase a vehicle, I think it makes sense to wait. When you look at car prices nowadays, whether that is a GM, Ford or even a Toyota, the prices make absolutely 0 sense. I think car prices are on verge of a collapse and great deals can be had for anyone who waits another year or two.

Let us say I am completely off in my valuation model of TSLA. Let us say that Robotaxi becomes a hard reality by end of the year. May be end of 2025. This does not mean that bulls have missed the bus. If Robotaxi becomes indeed a reality, and the stock jumps to 300. Even 500 from here at 170, I think this will still be a tremendous buy. In fact the stock is not going to stop at 500! It is not going to stop at 1000 (due to the scope of this Robotaxi development) in my opinion.

And this is what differentiates me, my style from the hype artists. I have seen this movie enough times before to know the subtle differences between hype and be able to see the profits show up on the quarterly earnings. Once AI narrative took hold, NVDA was not expensive at 300. It was not expensive at 500! SMCI was not expensive at 250!

Only a week ago EV was dead. BYD was going to drown the American carmakers with cheap EVs. TSLA was going to 15! Whatever happened to that story now? Everyone is now convinced that Robotaxi is around the corner ready to pick us up for that next trip across the town. I say Not so Fast!

I wanted to share this fundamental headwind for TSLA before taking about the technical levels. Technical levels are useful in the short term. Fundamentals will eventually prevail.

Now on the technical side, the stock is here at its 50 DMA around 170. Beneath us, you have 160 level which is important. So I think you are going to see a push and pull between these 2 levels and as long as 160 level holds, which means we do not see a Daily or weekly close below 160, this stock is trying to go higher into 180s. Remember, a lot of traders trade the momentum. They are not looking at where this thing will be a year or 2 from now but where it will be 2 days or 2 weeks from now. They are able to react if we start hanging here between 160-170 and react faster if 160 gives up. So as long as 160 holds on TSLA, I will not be surprised if we were to go test 180-182.

While this is swing time frame, if you are a longer term bear, even a 160 break should not cheer you as much as a retest of 137 will. If I am a longer term TSLA bear, a retest of 137 is welcome news. If and when this happens, I think this should lead this stock to retest its 2022 lows at 100 and may be even below and find a long term bottom as it approaches $80 area.

Look these type of price confirmations are key. This is where many of us traders get bagged or trapped. Is 170 a good confirmation for bear? May be for a few dollars it is.

Is 160 break then a god confirmation for bear? Yes, may be for another few points. But the top notch confirmation is 137 retest. This will be a much better confirmation personally for me that this is headed much lower. I know it may sound counter intuitive that 170 is much higher than 137, so for a bear it makes sense to be bearish at 170. However, the risk to the bear is also the highest at 170. Much higher than at 137. This is just how auction market concepts work- I use them in my trading and I am happy to share with traders, like yourself.

Outside of the technicals and fundamentals, you have the intangibles. TSLA only has ever made 25 billion dollars in profit in its life of 14 years as a publicly traded company. Ever. Now the CEO wants a 50 billion dollar bonus for this awesome job.

For context, NVDA makes 30 billion dollars in a single year. Huang in contrast made 20 million years total in pay last year. A mere peanuts compared to 50 billion!

MSTR Earnings

Microstrategy will report on Monday, after close.

The stock has been in a free fall from its recent highs at 2000 and has lost nearly 40% at time of this blog, to last trade around 1280.

I myself was bearish on this at 1500 before it almost traded down into 1100.

With a STOCK like MSTR, head of its ER, even a 20 DELTA Call or PUT is well around 30-40 bucks. Option market is pricing in a 10% move on ER which I think is low.

I personally think if this stock sells down into 1150-1200, it could be supported for a move higher into 1500. I may assess the earnings day move to see if any option makes sense, may be 1500 Weekly call makes sense if this stock opens gap lower on Tuesday. I will send an update via chat room below if anything makes sense but for now I believe 1150-1200 could be supported on a dip. I do not expect any type of stellar earnings from this company. This is now a shell company whose fortunes depend on fortunes of Bitcoin.

This is how this company will position itself on Monday. They will say “look our earnings are not great, but look at all this Digital Gold Bitcoin we own”.

They will highlight the book value of the company where they own about 15 billion in Bitcoin rather than showcase their earnings which are going to be rather meagre in my view.

Speaking of Digital Gold, let us pivot to the Real Gold.

I have been a long term Gold Bull in this Substack when it was around 1600-1700. It recently traded new all time highs around 2400 but has since retreated.

I have been a bull on Gold and Silver stocks like NEM, SLV etc from 30 and 17 respectively which made new highs recently.

There is a divergence in Econ data that we are seeing recently- while the GDP in the US has shrank to 1.6% from an expected rate of about 2.3%, at the same time, metals like Copper and Gold have been making new highs. The way I read this is that the US is in recession at the moment. I think the way this manifests will be weaker growth in next few years, and the central bankers from the FED to Bank of Canada, to the BOE will soon embark upon a series of drastic rate cuts to spur the economy in an election year to help their favorite politicians keep their jobs.

This in theory could lead to higher prices for things that matter- Copper, Gold, Land, Oil. A higher price in basics, along with slower growth is a perfect recipe for Gold to continue to rally and a correction in the FIAT currencies.

Think about this for a moment- Gold is making new highs at a time where the US dollar has relatively remained buoyed. When the Central bankers cut rates and politicians devalue their currencies to spur growth, along with subdued growth that shows up in GDP, this is a perfect storm for precious metals like Silver and Gold.

Remember, Gold is the ultimate forex/currency. It has very little if any correlation to the stock market, it has extremely limited supply. And in theory, infinite demand. And you do not need a smart phone or internet connection to own Gold.

Due to these factors, I remain optimistic about gold and silver, and I think these have much more room to run in the long term. And in the short term as long as 2250 to the ounce holds on Gold, I think we may retest 2400-2500 area. It is about 2330 now.

Value versus Hype

While I think there is a lot of fluff in the general index, value names should be supported even during slower growth periods.

These look like your WMT, for instance.

WMT has started consolidating here at the 60 area now. I think as long as it holds 55-56, this may be headed higher into 80+.

Another name in value is UNH. Where did UNH recently bounce off?

$450 Orderflow level. I think this is a great level and as long as it is held, I expect the stock to clear 500-510 area and then trade higher into 530.

SMCI

SMCI is another stock which has insane earnings move expected when they report on Tuesday. The stock is about 860 now.

Look, AI game now is consolidating as it becomes clearer who is a winner and who is an also ran.

Is SMCI an also ran?

What we are seeing now is more clarity or rather new winners emerging when it comes to AI. This is why we see GOOG made insane moves on earnings. I was a bull on GOOG at 150 before it rallied into 180 almost post earnings. I think this trend will continue and some of the capital may get reallocated as traders become more convinced that GOOG is playing catch up nicely to MSFT or NVDA seems to be the winner take it all when it comes to the SOX side of the house. Hence explains the action in AMD, INTC etc.

SMCI earnings on Tuesday. This is how I view its price action this week: