Hello Traders-

A quick recap of last week’s levels and ideas before a deeper dive into what I am watching this week.

Here is the link to the plan if you have not yet reviewed it.

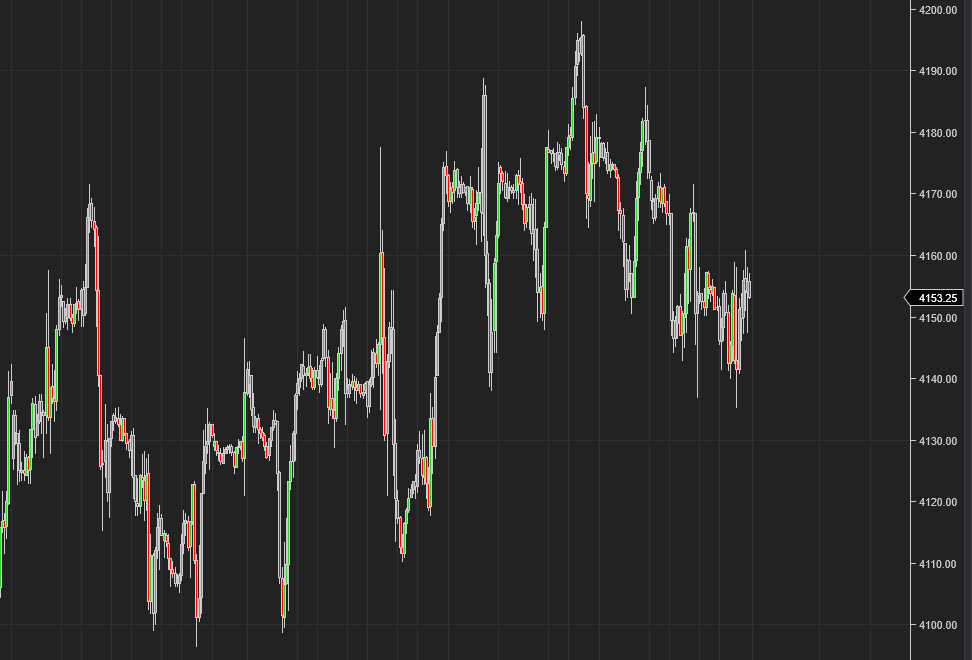

On the S&P500 Emini side, my main expectation was to see more range-bound action between 4200 and 4100. I did not see enough catalysts this week to break this range.

In fact, this week we saw quite a bad bunch of economic data which would have normally translated to ‘bad news is good for stocks’ but yet the market was not able to break out of the rut.

Speaking of the rut, this is what this market has done all this month. We are now in week # 4, and historically, April is said to be a strong seasonality-driven month for stocks.

Chart A below shows a market that is in no hurry to go anywhere. April should have been a great month for stocks in terms of seasonality but has turned out to be a flop.

The market movement has seen drastic declines from their long-term averages. One key measure of market movement is ATR or Average true range. This is now below 30.

Why is ATR important?

ATR is used by a lot of programming algos and traders. They only trade when ATR is within a certain threshold and at many times will simply stop trading. So ATR is always something I keep a track of in almost all markets that I trade.

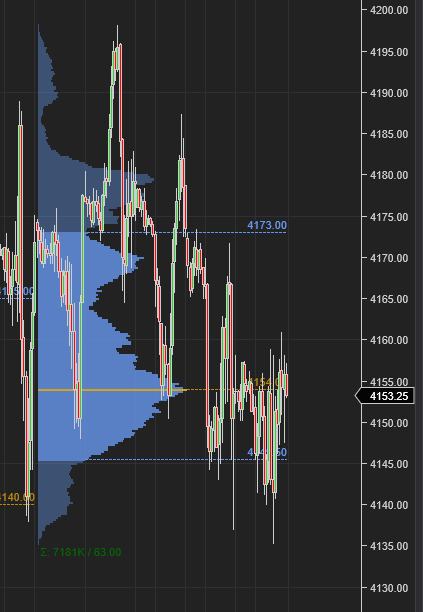

Out of these long-term trends, however, my daily levels have been quite spot-on in terms of containing the session highs and lows.

These Daily levels are shared with folks one day before the cash session and in a lot of instances, the highs and lows come very close to these levels. Last week was no exception.

From my weekly plan, the market did not spend much time above the upper line in the sand (LIS) at all and in fact, all attempts to take it out failed.

On the lower level which was near 4100, we came close but could not quite test it.

Some other ideas that did well

MARA was an excellent call shared by me in last week’s newsletter. I saw resistance come in at 13 bucks with LIS near 14 for a test of 9 bucks. This entire range was traded last week. The stock closed below 9 bucks on the week, having lost about 40% of its value from the level I shared earlier.

I was also a Bitcoin bear at 30000-32000 which is a key zone for the crypto coin. Bitcoin lost about 10% of its value at this level this week alone.

On the medium time frames I have been a TSLA bear from 215 and specifically for this week’s ER I was bearish at 186-192 which was last week’s closing print. We sold down to 165 which was my weekly target for TSLA ER. For Friday's session, I had expected some support to come in at the lows but the stock was overwhelmed by selling pressure to close the session near 165.

Long-term calls by their nature take a long time to materialize.

I want to highlight this using a few recent examples.

Housing sector. I made a bullish call on XHB and higher-end homemakers like TOL, several months ago. This was near 60 bucks. XHB closed near 70 this week.

BAX- I had called BAX oversold several months ago near $37-39 bucks. The stock was in a severe downtrend at that point and it made no sense to be bullish on its whatever. That stock today closed above 45.

SAP- This is another good example where this stock was bullish for me at 125 several weeks ago. At that point, it made no sense due to the war in Europe and the inflation picture there. Yet that has not stopped SAP to rally 10% within a few weeks.

This newsletter, which is my personal journal has broadly speaking 3-time frames at play -

Active intraday

Tactical, swing time frames are applicable for earnings or one-offs like MARA and banking crises calls to name a few examples.

Long term. Most of the stock names I share fall into this bucket unless specifically called out. Since I use macro and/or fundamental info to call these, I do not expect these to work out in a week or a day or two. These can take several months out. Could be even a year out.

This is important to recognize. If I subscribe to a newsletter, it is easy to assume all 10 are like me in terms of their time frames and goals. If I am scalping, are all 10 scalping? That is not the case. Out of 10, maybe 2-3 will be intraday time frames. The other 3 can be swing time frames. The other remaining could be placing one trade a year. This is the thing about markets. Each and every player is unique. Everyone has a different style and a different goal.

If I can not recognize my time frame, then I will remain confused. Again, if I trade only intraday with a 5-point stop, then what do I care where the next 500 points are going to come from? And if I trade for 500 points, what do I care what the market did today, was it up or down 40 points?

Generally, there should be more premium on good, intraday information as it is the most time-sensitive. You do not want hour-old information. You need it right then and there and I think there must be a far higher premium on such information if it is actionable and potent.

From an event perspective…

Tuesday is the Central Banker consumer confidence from the US which is key and the Australian CPI which will be key later in the night.

On Wednesday, the EIA inventories will be crucial for oil markets.

On Thursday, pended home sales and the GDP from the US. However, I will be far more interested in Japanse monetary policy statement at night. Japanese Central Bank, believe it or not, is still doing QE in face of 40-year high inflation in Japan. Their inflation rate is still low at about 4%, however, Japanese demographics and society are extremely different from let us say the US. For one, the demographics are older and are much more homogenous. There is extremely little if any immigration in Japan, at least permanent. Some of these factors make the Japanese very averse and vulnerable to inflation. Even 1% inflation in Japan is frowned upon. However, the Japanese power center, especially the Central Bank there is very much under the influence of the US and other Western G5. This means they have enacted policies that stoke inflation fires. I do expect the policy to be fairly dovish keeping in line with recent trends. The latest Governor is just a paperweight and I do not expect much to fight inflation. This may set the tone for Friday's session so I wanted to share some context on this news event.

Friday will be the crown jewel of all news events - the core PCE index.

There are also several major tech earnings next week which I will address through the Daily newsletters.

These events collectively lead up to the May 3rd FOMC as well as pit us against the seasonality forces otherwise also known as ‘Sell in May and Go Away’.