Hi traders-

I am excited to publish yet another weekly plan. I hope you are as excited to read it as I am to write it!

Let us get the recap of the prior week out of our way first. In this installment of the weekly plan, I want to share 5 main reasons why I do not think this bear market is over yet. On top of that, I am going to share a key level in the S&P500 where I will personally begin buying for my long-term accounts.

I am also going to try and answer my personal viewpoint on why I do not think this is QE and why I do not think this is some new bull market.

Let us deal with the S&P500 Emini first.

On the weekly time frames, I was wrong.

There is no way to sugarcoat it. I believed 4070 will come in as resistance. It briefly held the market for about 40 handles on Thursday before breaking out higher on Friday and ended the week close to 4150.

On the intraday time frames, my levels held the auction on both ends, from Monday thru Thursday, except on Friday when I did not share any intraday scenarios. I have been hosting a personal event and was not very active during the latter part of the week.

Here is the link to the plan, you can read it if you have not.

Let us talk about why I remain bearish on longer time frames.

What does it mean anyways, staying bearish?

To answer this question, I look at it from the lens of Investor Tic, rather than Trader Tic.

If you are a longer-term reader, you will recall I have been an S&P500 bear from the 4800 level back in January last year. We sold off about 1300 points, to a low of about 3500 before rallying hard, back to 4200. Amidst this, I have been bearish and bullish on swing time frames, however, I do not think we have seen the bottoming lows yet. While it is not possible to precisely call for a low, there are a few signs that I will watch:

Auction characteristics- the first & foremost red flag for me is the nature of the auction here at the highs itself. I am not a chart-based trader, I do very little technical analysis using screen-based tools. Most of my calls are based on watching the actual trades at the bid and at ask throughout the day. Based on the recent few auctions, I can not get behind this move to the upside. Remember, I was bullish during the recent bank crisis at 3800. The main reason for my bullish bias for me then was what I saw on the tape. I do not see that here now.

The FED- I have observed this FED for over 20 years now. I do think they clearly communicate with the market when they want the market to go higher. I do not think they are at the moment. They do not leave it up to the imagination- when the time comes, they communicate clearly, in no uncertain terms. I also think the tech stocks are rallying because of the market view that the FED is doing another round of QE. I do not think that is the case. Read below for more details.

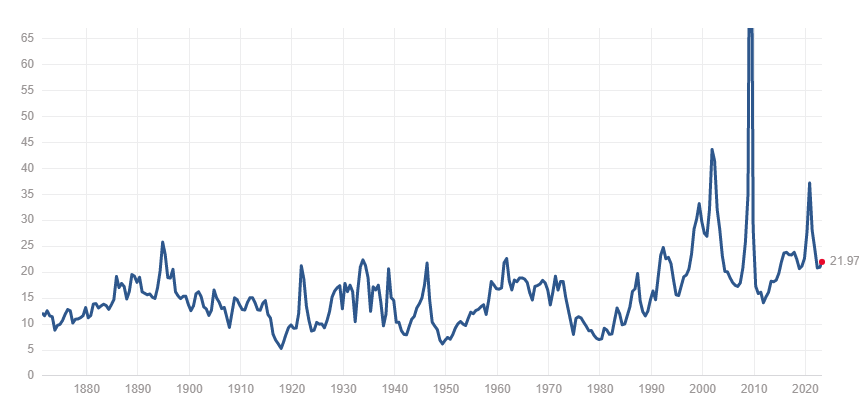

Volatility-based capitulation - In recent bear markets, going back almost a decade, I do not remember an ultimate bottom with VIX below the 40 level. I think we could see VIX above 30-40 again and that could be one sign of the beginning of the end of this bear market.

Unemployment - the unemployment rate remains low. This is great for folks, but not a big enough motivator for the FED to do anything about their current policy path.

Valuations - Chart A below. S&P500 multiples remain relatively high at 21. Long term average for this for me will be near 14-15. These valuations matter especially when you are pricing in the index as if a) the post-COVID stimulus is still around. b) the S&P500 earnings will remain high despite higher inflation and lower stimulus c) and consumer spending will remain buoyed despite record credit card debt and recession.

So, what are some of the levels where I could start buying for my long-term accounts and what instruments could I consider?

For my long-term accounts, I personally like names with very little active management, extremely low cost, very high liquidity, and relatively higher yields. See the section below for the precise levels where I may start buying for my accounts.

My thinking right now is not entirely based on technical analysis.

The charts look great, no doubt. The good thing is I do not give a lot of weight to the charts in my own analysis. My primary bias is based on a study of Orderflow (basically time and sales data), a pinch of common sense, and my quest to answer one key question: is this QE v5?

Based on my analysis, this is not QE. Therefore, I do not think this is a new bull market.

What is QE anyways?

I want to share a few notes on this topic. You can draw your own conclusions. The conclusion I drew from this was this is not a QE in the traditional sense. I tried to keep the narrative in plain English for the benefit of a layman - some of the terminology differences may be down to semantics. I avoided technical jargon. If you want to read more, read the FED’s 150-page tome on how they execute monetary policy :)

To understand what is QE, we need to know how the FED executes Monetary Policy.

I think it is very important to differentiate if the current US central bank actions are QE or not, to help understand the path of least resistance in this market. Some of you may already know the inside plumbing of how the FED (or any modern Central bank for that matter) executes its monetary policy and can skip ahead to the next section.

This is an extremely complex concept and this is just to paraphrase hundreds of pages of how the FED mechanism works for sake of brevity.

In a modern economy, like the US, the government can not create money outright. It has to borrow. It borrows its money through its treasury which does so by selling government debt in form of bonds. That mechanism can be the topic of another post, for this one we will focus on what part the FED plays in it.

While the Government can not create any money out of thin air, the FED can. How does it do it? When we say that the FED has a money printer, does it really? Well, yes and no.

Most of the money in an economic system like the US is created by private & commercial banks like SVB, Chase, and Bank of America, which comes to life through the act of creating a loan. These banks do not create loans for altruistic purposes. They create these loans to earn a yield on the loan and hence make a profit.

When you take out a loan for a home, or when you buy that shiny new 80 grand Bimmer (Metallic Blue) on 6.5% APR loan, you are effectively creating a liability for yourself and an asset for the loaning bank simultaneously. This transaction now creates brand new 80 grand in money in the banking system- pretty much out of thin air, no actual money printing was used in this process. This process when repeated thousands of times a day, amongst a wide variety of customers, creates billions of dollars of new money. These same institutions are also buyers of the US government debt, they own short and long-term treasuries on their books, in addition to several other types of debts backed by assets, such as mortgage-backed securities and corporate bonds.

The lending banks are required to maintain a certain minimum threshold of funds or the so-called “bank reserves” every single day. Based on how the money flows to or from the bank after lending activity can create either a surplus or a deficit for the banking institution. At end of the day, every banking institution must meet the reserve requirements. If you have a surplus, you are good. If you do not have ample reserves - like what happened to some of these banks in aftermath of recent banking crises- you need to borrow this from somewhere.

Where do you borrow so much money every day to meet your reserve requirements?

This is where the banks use a centralized clearing house to balance their flows every day. This is an interbank lending facility where the banks with a surplus can lend their reserves out and the banks with a deficit can borrow overnight. When everything works as it should, the repo market also functions as it should - without any hiccups.

When something really bad happens, then the overnight lending market stops working smoothly or can stop working altogether due to liquidity shocks. We will come to it later.

So the FED can, in theory, control the creation (and destruction) of the money-creation process described above.

How?

Via two broad methods.

One is to set a target reserve funds rate. This is the interest rate they set in every FOMC meeting which then directly influences the overnight repo facilities in terms of what interest the participating banks charge each other for lending. When the FED lowers interest rates to almost or near 0 %, in theory, this means the banks can also easily find more creditworthy borrowers to make loans to. When the rates are lower, the payments on the loan are also much lower. It is far easier to take out a loan and pay it. When the rates are higher, the payments are also higher, fewer people take loans which means lesser money is created in the banking system. This system works well when the lending rates in this overnight lending facility are relatively low and liquidity is ample. However, there are times when there may be a liquidity crunch as we saw a few days ago with the bank failures. In such times, the overnight market can either shut down or the rates can rise a lot to shut down any borrowing, causing the banks to not meet their reserve requirements.

When this happens, the FED has some other tools up its sleeve.

The other way the FED influences the overnight rates is by buying short-term treasuries from commercial banks- thereby creating liquidity and adding reserves to the banking system. This is extremely common and is known as “open market operations” by the FED. This is a very common way the FED implements its monetary policy goals. Some call this “printing money”.

If you are with me so far, whatever we discussed thus far is not QE. It is the conventional way of doing business that has been done for decades.

This system begins running into issues when the interest rates approach 0. This also is not enough in scale when we have a huge crisis like the 2008 Great Financial Crisis (GFC).

This is where the QE comes in.

When this system stops working, the FED embarks on an experimental, nonconventional way of providing liquidity. It begins buying or swapping longer-term bonds, corporate bonds, and in many cases mortgage-backed securities on a massive scale of trillions of dollars.

The theory is when the FED does this, it raises the prices of these types of assets in the private market, thereby reducing the yields on these longer-term instruments promoting borrowing, and stimulating economic activity. This transaction creates a surplus of bank reserves in the banking system and with lower yields the banks must compete with each other to lend out more money to borrowers, driving up economic activity.

This when done on a scale of trillions of dollars is what is quantitative easing aka QE.

A telltale sign of this will be the collapse in yields across the curve, a sharp rise in longer-term bond prices, a spike in the FED balance sheet, and a collapse of the dollar. In recent weeks, the FED balance sheet has exploded again, however, we do not see a collapse in the dollar or a major spike in bond prices - I have my reservations if this is QE. This is not IMO. You can draw your own conclusions. Hope this was helpful.

I will also question the efficacy of this QE, assuming this is indeed QE, at this late in the cycle. Very smart people may not want to borrow here, thereby dampening any effects of this extra liquidity. This could also be quite deflationary when you look at Japan, where this experiment is being done for over 30 years now and their markets have gone nowhere. Net net, I do not see how any of this is a plus. These are the reasons there is no change in my longer-term bearish bias. You are free to draw your own conclusions.

I am personally fairly confident of a recession in the next year or so. I do not think FED will be able to do much to prevent it - QE or not.

Personally, I think QE is a bubble and has burst or will soon burst. QE leads to all sorts of social issues in the US and the world over. To me, QE is the love child of a sinister partnership between Central large private banks and Governments. To enable this, governments around the world have corrupted how the CPI is calculated. For example in the US the CPI does not include the stock, bond prices or home prices - only the rent, If the home prices were included in CPI, real inflation in the US will prove to be 10-15% or even higher. This is massive corruption at the highest levels of our own elected public servants.

This however does not mean the current short-term price action impulse may reverse immediately. Half knowledge is double the dangers of no knowledge. Read my notes below for my exact levels this week. I have ALSO shared below which levels I will begin buying for my personal long-term accounts. Enjoy.