Traders-

This was a frustrating week to trade for directional traders. We got used to directional moves over last several weeks and perhaps this may have been the most choppy few days to trade in over 2 months! With the exception of Thursday when we tried to break out, the entire week was capped by 4271 and 4425- both key orderflow levels shared by me last week.

Stocks which I recently shared on this newsletter like NEM, VALE, ADM continue to do well. I have my 2 cents later if I believe they continue to do well or reverse the trend here.

If you dont see all the charts come thru in this email, please OPEN this post in browser and view all charts there!

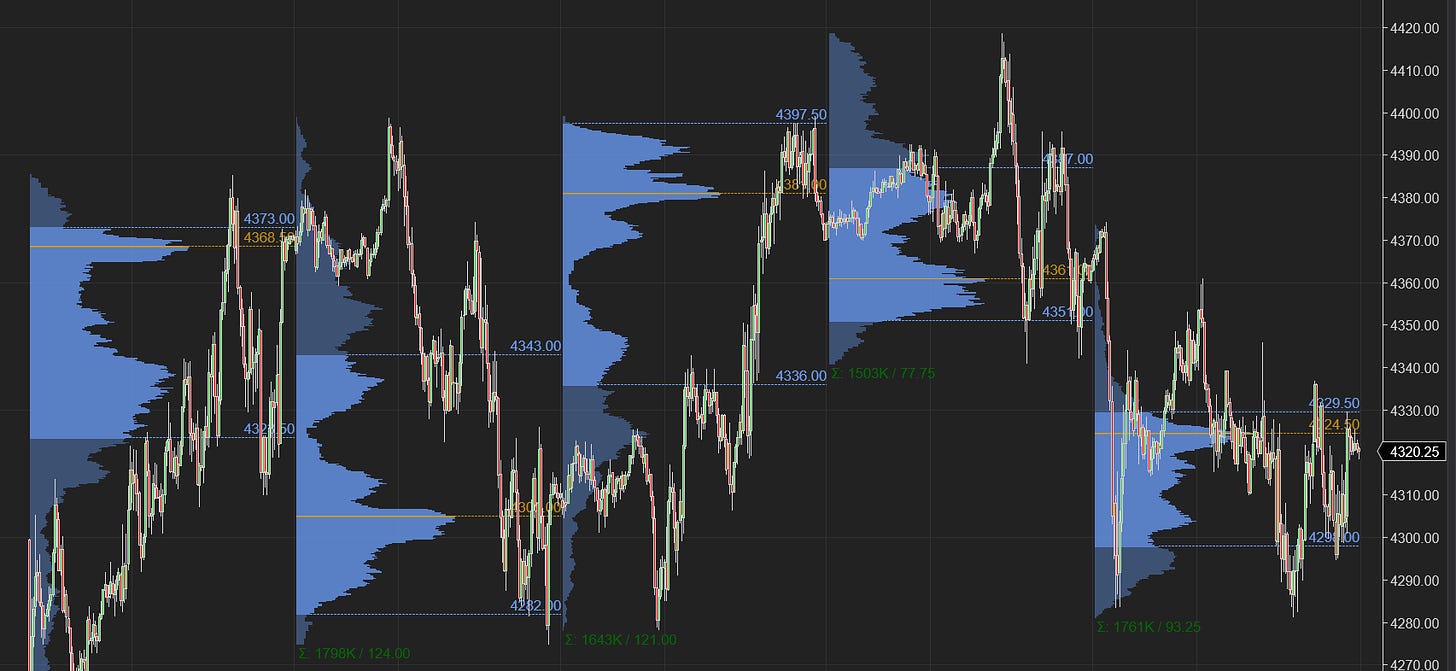

Chart A shows even the intraday moves have been pretty choppy, with the exception of Monday and Tuesday which we called to the tick in this newsletter.

From last week, my primary expectation was that the dips may get bought. My LIS for this week was 4234/4251 which we managed to trade on that Sunday night gap down itself and did not quite retest throughout the week. 4251 was an amazing level which helped launch us to 4385 the very next day.

4425 then became resistance this week- both levels shared by me in this newsletter.

Here is the link to prior week's plan

As the weeks go by, and we see the price shocks in various markets, whether that is the grains, or energy, or materials - all staples of every day life, we see a gradual shift in expectations when it comes to inflation and Central Bank response.

Not even a year ago, everyone was talking about “transitory inflation”, how it will come and magically disappear in a few weeks and how we will all ride the coattails of 2% inflation forever into cushy retirements.

Well, within a matter of couple of months, we have gone from inflation that was supposed to be transitory, to chronic inflation to now stagflation. This is where you have chronically high prices and chronically depressed economic activity.

The 11th largest country and one of the largest energy and agricultural exporter has been turned into a pariah state. No one understands the long term effects of this, atleast not at this very hour. And the direct result of these events is many of the European indices are now in a bear market with most leading US indices in correction zone , off 10% or more of their recent highs.

This may just be the beginning.

Note: next sections are for paid subscribers. You can either subscribe or become a FREE member simply by entering your email. There is lot of cool free stuff as well which gets delivered to your inbox every week.