Hey guys-

The primary expectation this week was to sell down into low 4830s after Powell tried to create a sell off and see the rally attempts capped at 4930.

I was correct in assuming that the sell off will be brief and bought, however the deeper dips into 4830 never came and we low ticked into 4870 to end the week at 4970.

The week took out the prior week’s high and closed about 30 dollars higher above a key order flow level.

This week’s main risk event is towards mid of the week with 30 and 10 year bond auctions. Another event risk could be on Sunday night with Powell on TV in the 60 minutes show. I assume he will say nothing more than what we already know but still remains to be seen. If his comments cause volatility, these dips I think could be bought. Powell right now has a credibility issue and the market does not buy his hawkish stance. I think with the national debt at 34 trillion, it is not possible for Powell to do much more but tow the line and cut aggressively. Now it is whole another post that rate cuts may not be so bullish, unless they come accompanied with another bout of higher inflation. Powell is done raising rates, he has to cut aggressively. Only open question is when he will actually reverse his stance on the QT. And if his actions will cause another rise in inflation.

In other news, there has been an uptick in the Middle East conflict with the US playing a larger role in the region. So far this conflict is contained, but remains to be seen what shape this takes over next week or two. These small scale skirmishes tend to be bullish in past. I would not read too much into it, at this time.

In related markets, the below markets have potential to cause pressure on risk on names like SPY and QQQ:

AAPL

TLT

GLD

Current intermediate context remains that the market may find support on dips on lower levels.

But at what levels?

Let us take a look at some of the key levels which may remain in play this week.

On Friday, the market top ticked at 4980 and closed a few handles below it. The most important auction past week was that of the Wednesday with the FOMC. As is with the key levels, they have a tendency of revisiting and this week may be no different.

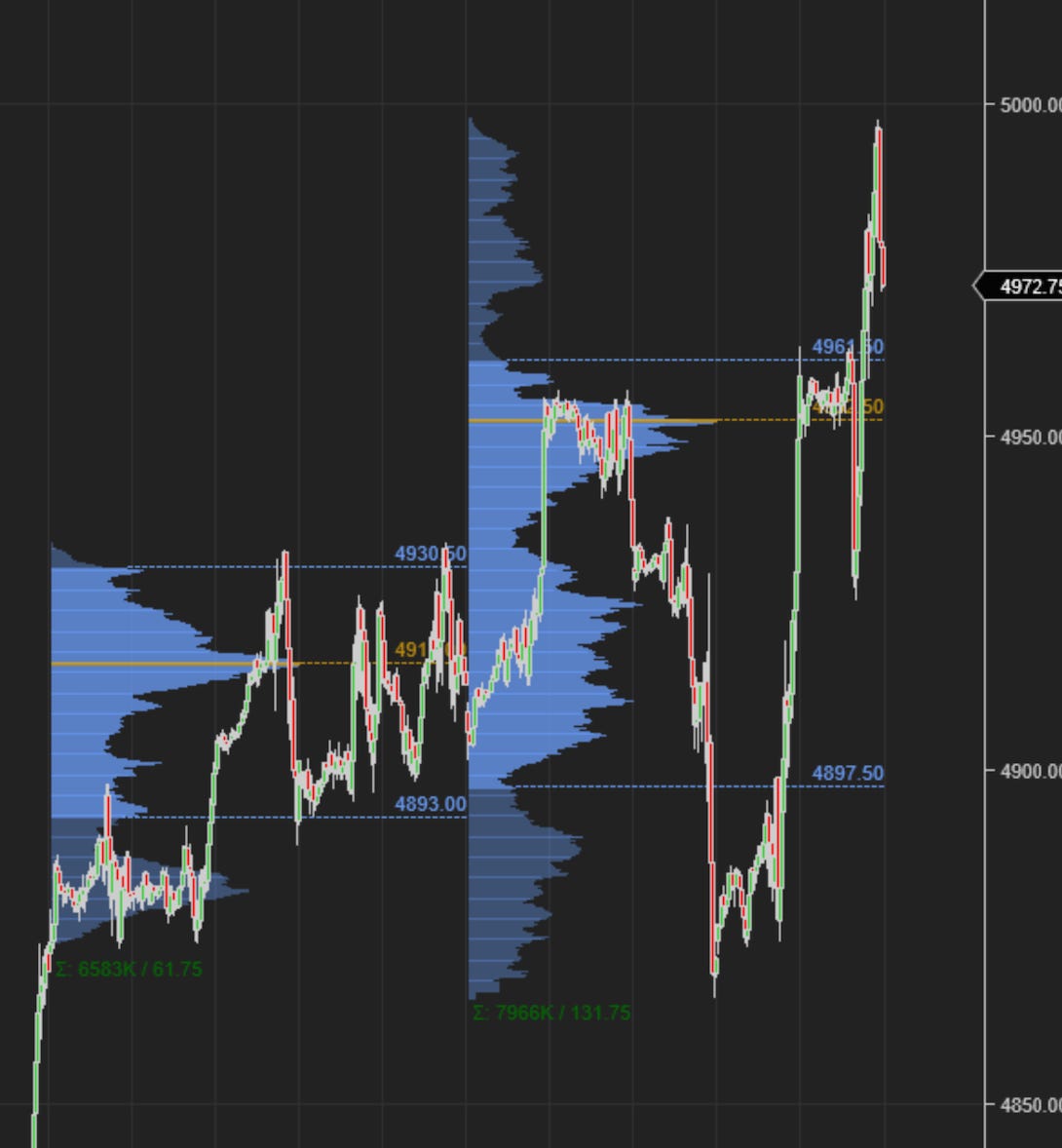

Chart A shows overlapping value areas for the 2 weeks, indicating potential for support near Value Area lows from prior week.

For the week, I am eyeing 4900-4911 as an important zone. The main premise for this bias is that while SPX has made new highs, the more risk sensitive NQ has been a little hesitant. Then you also have relative weakness in some more leading indicators like the IWM (Russel). Due to these factors, I think unless NQ catches up to the SPX, we could see some downward force to retest some of the FOMC lows this week.

Scenario 1: Unless we are able to take out 17800 on the NQ, I favor a retest lower of FOMC levels in the Emini around 4900 this week. They are trading at 17685 and 4970 respectively at the moment.

Scenario 2: If we are able to breakout of NQ above 17800 on Monday, this is a risk on scenario for me and I do not want to be bearish for the week, if NQ remains bid above 17800.

Remember, I am not yet saying we are going to see some sort of meaningful sell action. I am more saying we could see support come in on dips. Where this dip could be? I think it could be near 4900.

And if we give up 4900, this could be near 4830.

For a longer term sell off, we need a catalyst.

This catalyst is not going to be the earnings this quarter now. This is probably not going to be geopolitics. This is probably going to be a rate cut or a rate cut confirmation. SO if and when a rate confirmations does come from this FED, I am not looking to be bullish on QQQ on such an announcement.

These are generally 5-10 day out levels. For intraday action, the daily plans are more geared towards those and the intraday chat is more for intraday levels. Weekly plans are a little bit longe term.

TLT sell off on Friday is also an abnormality which will have to be addressed this week. I assume TLT sold off due to an extremely robust NFP on Friday. This pushes back the March rate cuts to May. I have maintained for a while that March rate cuts are out of the question. However, I feel increasingly sure that May rate cuts are a go.

For this rally to continue, I would like to see TLT take back 98-99 handle as there are a lot of bullish TLT flows at the moment, and retaking of 99 handle confirms this view.

In case, we see more TLT weakness this week, I will need to rethink the bullish TLT bias, which then spills over into risk assets like SPX, QQQ etc.

A few weeks ago I shared bullish levels for NVDA, MSFT, SMCI, GOOG, AMZN, and META. All of these bullish targets have been met. My longer term levels are based on flows as well as fundamentals. We are now trading above all of these levels. I am not saying we can not continue to rally upwards in these names, I am saying based on fundamental valuations we are at the moment above these measured levels now. In each one of these names.

Based on my methodology, this will mean I expect some sort of pullback into support and then another leg higher in these names, or at the very least a retest of these recent highs once that pullback comes. Due to this reason, I am not sharing levels for these names this week but rest assured if we do get a pullback, I will be sharing some support levels in these stocks.

SMCI

SMCI was a blockbuster call by me this year. I shared this at 60 dollars a few months ago when SMCI was an unknown name with a target of about 500. Well, it is now trading a few dollars shy of 600.

It is hard to time these type of stocks on short term, as they are very high beta and are sensitive to moves in the general market.

On the longer term, I think this stock still could go higher. I think this stock could have a decent floor under this near 500 dollars and I will not be surprised if SMCI were to push higher into 700 and beyond. My goal is to share such names with folks on an ongoing basis when the macro and technicals just align and get married. Such calls can not be found every week or even every month, so stay tuned and subscribe for when such calls do show up on my screeners.

SNAP

SNAP is also a substack stock which I shared around 6 dollars before it ran up to 18 this year.

It is now 17 bucks and change.

In terms of industry, it happens to fall under same category as META.

META was an orderflow stock I shared at 300 bucks. See below.

These same above dynamics are still at play for names like META. And by that extension related industry stocks can also benefit.

This is why I remain a SNAP bull as well and I think it could push higher above 22-25 as long as 15 dollar range holds on this.

S

S is another great example of why simply trading higher does not mean its automatically bearish.

This stock was shared by me a few weeks earlier at 20 and is now pushing 28.

I am a Cyber security bull as there are a lot of factors which are helping cyber security, including but not limited to more virtualization, and more AI fueled ransacking of your (and mine) personal data which will necessitate ore safeguards against this.

AAPL has now gone mainstream into Virtualization with their Vision Pro product. What META could not achieve with its METAVERSE, I think AAPL will with its Vision PRO. This has the potential to help smaller AR, VR shops. Vision Pro is going to be a tremendously important consumer product. The cost will come down in next 2 years and I think we will begin to see more folks in their Vision Pros, ridiculous though this sight may be.

S can benefit. This is why I remain a S bull on any pullbacks and this could push higher above 40s.

Earnings

Ford F 0.00%↑

Ford has been languishing here in this range for a while and reports on Tuesday.

It is $12 now.

Just for the weekly OPEX, the $13 calls are 11 cents. $12.5 call are 23 cents.

These looks interesting to me and if Ford beats, with a good guidance, these could increase in value.

RACE (Ferrari ) had a good week, it makes super exclusive cars which have found a niche. Ford is not exactly a luxury vehicle maker and had to pull back on its EV dreams, however it does have the best selling truck globally and its Bronco vehicle model has been a smash hit. if 12 holds, I do not want to be bearish on FORD on its earnings.

AMZN

I was AMZN bull on its earnings near 150. My target was 170 which was hit. I have been a long term AMZN bull at 130. With this earnings, AMZN has planted a seed of “AI” in its earnings transcripts. This could mean AMZN has some more juice to squeeze and I will not be surprised if AMZN were to trade 185-190 post earnings drift.

This is pretty much it for this week. A lot more to come soon. Stay tuned and stay focused. Filter out the noise, and focus only on price action and order flow messaging.

Like, subscribe and connect your substack to mine to receive more levels going forward. Because, why not?

~ toc

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Yahoo, Google. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.