Hey folks -

Last week was a big week where many of my longer term calls came to fruition. Only a few weeks ago it seemed insurmountable but in hindsight, last week was a no brainer. Were you bullish or bearish at 4200? Drop a line below and let me know.

Specifically, we finally broke to the downside and traded some 250 points lower in the S&P500 index from my bearish 4200 call.

Let us see what worked well last week and what did not work as much as I would have liked it to.

Starting with BABA:

I was a bear on BABA at 105 with the understanding that as long as we remained below 105, we could see a test of 80 handles. This was indeed the case as we sold down into 80 handles fairly easily this week.

Nearly all of the Chinese stocks fell this week. Look, I was one of the very first ones last quarter to see and call for the potential for a “China reopening” and that is when I became bullish on BABA below 80 dollars, before it rallied more than 50% within a few weeks!

I was also one of the first and few I believe who saw the “China reopening” trade flounder and we did see this in form of about 20% cut in Chinese equities in recent weeks.

As a thematic trader, I am on lookout for developing themes whether that is the crypto craze, meme stock mania, China reopening, reflation, disinflation - and share them with the folks here.

NFLX

Netflix bearish call played out over several weeks. I was a bear on this name at 360 and it finally traded down into almost 310 this week.

CMG

I had a bearish call on CMG at 1650 which dropped about 200 dollars off that level to close near 1450 this week.

Personally, I do not disagree that CMG has pricing power which is always good in any market. My main issue with CMG has always been that it is priced as a growth company and I do not think it’s multiples make any sense.

It will perhaps make more sense to me at 1050-1200- purely from a valuation perspective.

BA

At 220, I also shared my bearish views on BA stock which has since then come down about 10% off those levels. In my opinion, a lot of the “good news” was already baked in to the Boeing pie and I thought we could sell down into 180-190s. The fact that this sell off came on the heels of great news for Boeing vis-à-vis a large aircraft orders from the Tata group does not surprise me at all!

NSC

Not only I called for NSC to be overbought at 235 but I also called for the stock to be potentially supported at 220. Both calls worked like a charm as we saw a healthy bounce off that 220 on NSC.

NVDA

Initially, before the NVDA ER, I thought we could trade back up to 230 on NVDA when it was trading 210. This was the correct call. However, since then NVDA has remained bid above 230 and refuses to budge - that is not what I expected and I was wrong about the stock.

All of these names are shared almost on a weekly basis here in this Substack as my personal views. It is one of the largest, if not the largest, and the most premier publications when it comes to Substack newsletters. I take a contrarian and quantitative view of the market rather than focus just on the charts and indicators. The posts are objective and actionable rather than theory. Use the trial offer below to read this post for free.

Let us also look at how some of my other calls did thus far from start of the year. You can view the complete list in the link below.

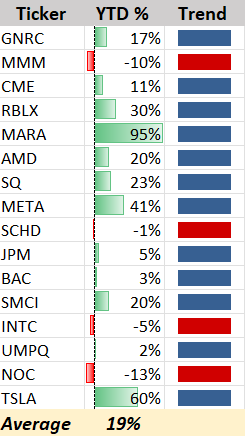

I have summarized these names and YTD performances below in Graph A. These names were much higher than where they are now before the current bout of sell which BTW I called at 4200. More on this later.

So, at start of the year, I was not too bearish on the market, even for the general market at 3900 or so, I thought we could go up to 4100 area. Along with this, I was positive on quite a few names rather than be negative on the market on a whole. In hindsight, this was the correct take. A few of these did very well when you look at them from a YTD performance. A couple of them dropped quite a bit, for instance, NOC dropped 15% nearly (it did better on the updated levels and was up about 10% off those).

On average however, the YTD performance for these is near 20%. See Graph A below. This is NOT the complete list, it does not include any of the recent calls I made, it only includes the list I shared at start of the year (see the post above) and does not include some of the bearish ideas shared by me, like CMG, BABA.

Not too shabby!

In contrast, if you look at the general market, SPY is up 3% on the year. Again, was up about 7% before the sell off but so were rest of these names.

Full disclaimer — while these names are up YTD at this point in time, there are no guarantees these will continue to do well. They may all crash tomorrow! I have now soured on some of these names. These YTD numbers are pulled from the online sources, I do not claim 100% accuracy. Also, the quotes are based on Friday close.

Some of these were much higher earlier when the S&P500 was trading near 4200. Any updates to these names, when I have one, will be shared with folks in this Substack.

The point I am trying to make with this blurb is that yes you can be bearish and bullish at the same time. You can be bullish on specific sectors and remain a bear on most of the market. In fact , I think the days of one way uptrend in the market now may be over for years to come. So this means, this market may remain a stock pickers market for many many years to come.

This may be off-putting for a few people and this may be encouraging & exciting for others. It really comes down to if you are down to learn and play in an environment which is not a secular bull market any more and we can see range bound action for a period of time. We see spurts like this where stocks rally. Find resistance, sell down, get oversold, rally again. Rinse and repeat.

I personally think this is an exciting time to learn new methodologies which are not necessarily chart based, which are more contrarian and quantitative. To that end, check out my educational post below where I have compiled a series of educational posts. It is a long read, so grab a coffee and be ready to take some notes ;)

BTW just on an admin note, there has been an ask for me to compile a list of all of recent calls and share them with the readers. I like the idea and I think it makes even more sense to add my personal LIS and targets. I am happy to do that but just from a delivery standpoint, I think it adds a lot more value and it could be a separate Substack altogether. The delivery of this particular Substack will not change - same frequency, same content due diligence, same rock solid ideas backed by OrderFlow but I may just have a more consolidated feed with all the ideas and their associated LIS and targets in one central location. Either way - no final decision yet but could be something down the road if I get more bandwidth. If it were just up to me, I will say no given everything else, but if enough folks request it, I may as well. If we do end up doing this, the pricing of new Stack will be comparable to some other large Sub providers, as it will touch upon execution, time frames for options and more. Stay tuned!

On the emini S&P500 side, I have been a longer term bear for last 3 weeks +. My resistance zone was at 4060 to 4200. We tried to take out this 4200 resistance many times, and failed every time. There was I think a 8-9 point move against this level back early in the month, however, the market is now down a solid 250 points below this level.

For what it’s worth, this also highlights my point which I have been saying for several years now - in short term options, like 0DTE, it is very hard to get the timing right.

Even when the markets eventually get there, they may get there after our short term options expire worthless. Large moves like this just take time. S&P500 is a juggernaut, it is the global risk sink and it is going to take time to turn around with all the distributions and rebalancing that need to occur. So you may still be very right in being bearish at 4200 but you only bought a few days of time and it took a few weeks to get here.

In options, you are really buying time.

Option premium = cost of time bought + cost of strikes.

You can lower your costs if you go with less time and tighter levels (ATM/ITM) or you could have more time but looser levels (OTM).

The more time you buy, the more you spend on the option. This is delicate balance - you have to have a reasonable chance that your directional bias will be correct and now you have to also strike a good balance with how much time are you going to allow your self for your bias to play out? This is a dilemma for option traders that is alien to the futures traders.

It is this time component that I think is harder to master and is part of your execution techniques.