There is very little structure inside the markets. A casual observer of these markets could be forgiven to think that short term markets moves are for most part random.

The structure has to come from within the trader. As traders, we need to come up with an objective measure to view these markets else we will forever chase randomness.

For me, price and order flow provide this structure. Price and time are fundamental building blocks of markets. Price is what allows us to view the randomness, the noise from a logical context. This is not to say that price is always right, it often is not. However, without price, we have no way to look at these markets from a structured perspective.

The other dimension to this equation is the time. Or rather time frame.

Time frame is what allows a trader to frame the risk.

What do I mean by it?

Let us take example of recent price action in NVDA.

Only early last week it was trading at 650.

A day later it traded up to almost 850. Whether some one bought it at 650 or bought at 830, the outcome of such a trade depends on time frame. A NVDA buyer at 830 may not be wrong, even though is is now trading well below 790s, as long as they have a specific time frame. It is quite possible this stock could still rise to 830, and may be even rise higher above that level. Within a short time frame.

However, for that same buyer at 830, if they bought it from a longer time frame, this decision may or may not be a smart move. You have to frame context from a view point of where this will be in 5-6 years. Is this stock going to be a 2 trillion dollar company 5 years from now, or a 10 trillion dollar company or back below 1 trillion valuation? From an investment point of view, if I did not have NVDA at 100, I did not have a single share at 300 or 500, is it a wise move to make my first NVDA purchase at 800? I think it is not but only time will tell.

SPX/ES levels

Using the price and ordeflow framework, let us glean at some clues that the market may have offered us this last week:

My primary thesis was that we could see dip buyers at 4960 which was the correct call. We broke out of 5060 finally and traded up to 5123 (on the emini index) but this high was sharply rejected.

On the NQ side, we tried to make a new contract high but did not hold it.

Sharp sell off in the Dollar index which failed to hold the lows.

Similar rejection action in momentum darlings like SMCI.

AAPL and TSLA etc had a chance to rally but were not able to hold the gains made later in the week.

Other than this, the volume in last 3 weeks has really dried up. I think had it not been for the NVDA earnings, we will probably at this time be trading closer to 4700 than 5100.

S&P500 bull is an old bull now.

This market is breaking out of this base with an index-wide PE of 23 (latest quarter).

While this is not very high historically, there are 2 factors weighing on this:

The volume on this breakout is very low.

The market is breaking out on a PE ratio of 23 when the FED has not yet started cutting rates. It is one thing to break out when the FED has either started cutting or is done cutting. Here we have a situation where the FED has not promised anything. Or well lemme rephrase- the FED has only promised that they will not raise rates any more. In my view they really have not promised any rate cuts, and the rate cuts predictions have come down from 7 rate cuts this year alone to 4 now if we are lucky.

Technically, I do not like such breakouts on smaller than average volume. This makes me believe this is more likely to be a top formation than start of a brand new bull market here.

These are facts and not my opinions and can be verified using price history. To derive our levels for next week, we are going to leverage these price based facts rather than our opinions.

To form a framework for next week, here are few things I will use:

5060 remains an important level as it is a recent break out level and those always tend to be important levels.

On the upside, the sharp rejection at 5120 will have to be repaired along with weakness in the Dollar index.

Using this context, I will say 5120 and 5060 will be my key levels for the week ahead.

Scenario 1: I think the underlying theme next week may be that of weakness, unless we can start repair work above this 5090 area where this market is trading at the moment. I think if 5120 holds, this level could present resistance for push lower into 5060.

Scenario 2: If we are able to take out 5060 on the downside, I think we can get a pretty quick ride down into 5004 area.

How I view these levels

In intraday time frames, I want to share a brief blurb about how I view these levels that I share on a day to day basis. Now I derive these levels by watching Level 2 data on markets like ES and NQ. I do not use any charts or indicators, but in this post, for sake of education, I am going to share an intraday chart.

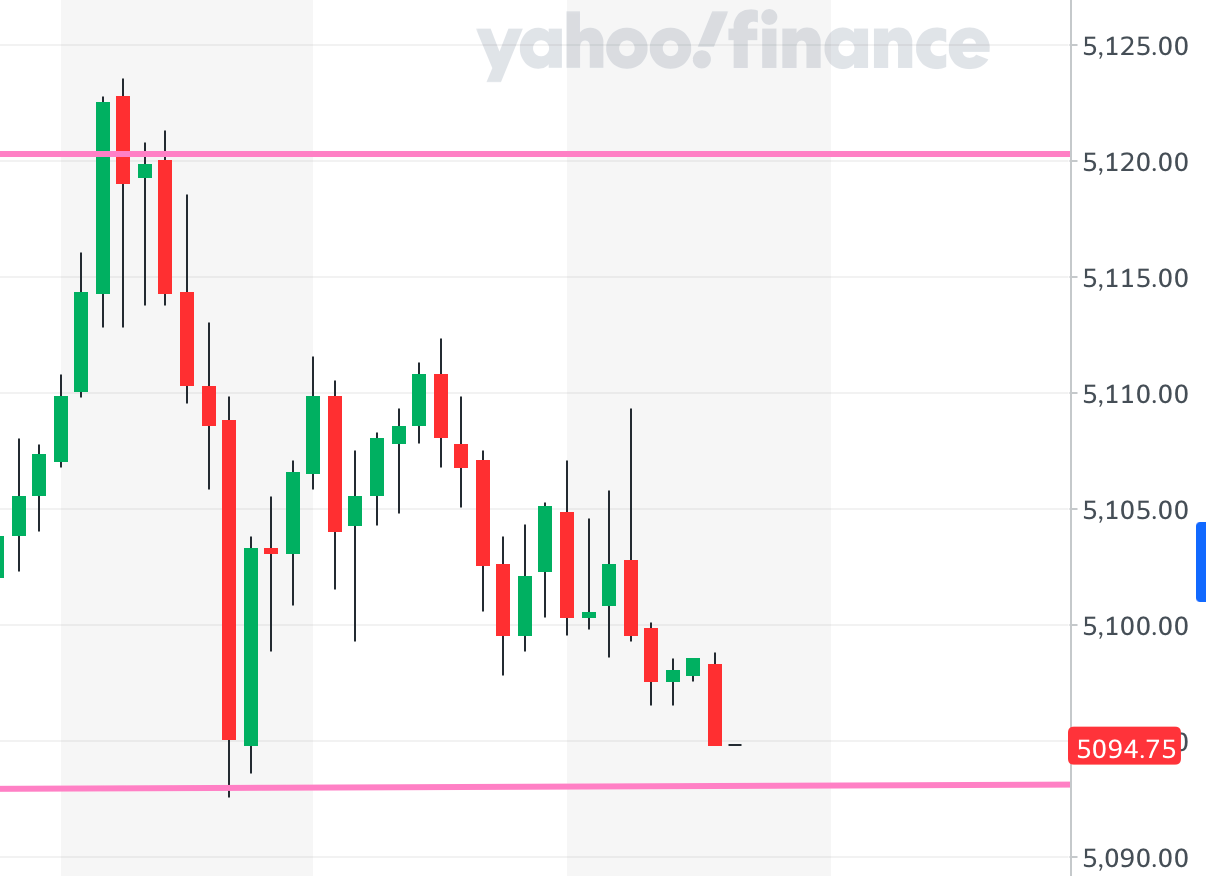

Chart A below.

In Chart A above, I have drawn two horizontal lines at my key levels for Friday. 5090 and 5120.

The context was to see us trade up to 5120, if we opened AND remained above 5090, from Friday’s plan.

In left most section of the Chart A above you can see we opened at 5100 and then quickly floated up to 5120.

Once we get to a key level, like 5120, I am watching for any of the below signs:

A surge of volume.

A balancing action on low volume. Balancing action means a bunch of bars form in the vicinity without going higher or lower.

As we approach 5120, early on in the day, you can see there is a surge of volume and we see a couple of bars with very long tails. Tails mean a wide body candle or bar, with close near the open. This absolutely denotes a presence of buyers and sellers, else we will not see such tails form.

For DOM traders, this means a formation of LVN. That is to say, very few volume gets traded in these areas as the market sucks up available liquidity.

Such spots are a good place to place shorts or longs, with a mental stop for me a couple of handles above or below the range of such bars.

As you can see we close below this range early on in the morning, and then proceed to sell off into my second key level 5090.

Now what happens at this level?

An ultra high volume bar with a wide body. Immediately after this bar forms, we see a green bar as buyers step in from 5090.

Again, this is a good spot for a potential trade as I now know there is a bunch of activity here. Volume means activity or interest. Either buyers or sellers do not matter, as this is a good spot for a potential trade in intraday time frames.

I have done this exercise using a 15 minute bar. If you average 15 minute bar ranges out, you will probably see an average range of a handful of points. If this is my time frame, then would I be interested in a stop of 10-20, 30 points?

That is silly! As the entire range is about 30 points, the entire session! Yet we see traders take heat of 20-30 points in an intraday time frame. That is crazy.

So, I will probably risk out 5-7 points (15% of so of the range), to see if my thesis is true.

I am sharing this example to highlight that the moves in market in intraday are absolutely random. We as traders only have clues like levels such as 5090 and 5120, and we must watch how the market interacts around these levels.

Now, for bullish continuation, I would have liked to see 5120 gone, and see a few ranges develop above 5120. In that case, 5120 would have then become my key level as support. Makes sense?

So to summarize:

I am observing for tails (or LVN) around such levels. This indicates a lack of supply or demand. For what LVN and HVN means, read my 3 Part series educational post on Volume profile and DOM for subscribers.

I am looking at ultra high volume or range based action. When we see very low volume and very small ranges, this often means no one is interested in these levels. Do you really want to trade when no one else is trading? This makes a trader very susceptible to stop runs and fake outs.

How, let us say we blast out of levels like 5120 or 5090 on extremely high volume, and start consolidating above or below these levels? Am I still bearish at 5120 or bullish at 5090? No. Not until this is resolved by retaking these levels back.

I hope this was helpful.

Serious traders should read this 3 part series and get acquainted with basics of volume profiling.

As far as event risk goes next week, it is a very heavy event risk packed week with the GDP, consumer confidence and PCE numbers on the cards.

Market consensus now heavily is that the FED has vanquished inflation. I am not in this camp yet. Not with insane real estate risk as well as very high energy costs still relatively.

If energy costs were lower, we will see miners such as NEM be in better shape. The fact that NEM has been in the doghouse, is an indication that we are far from beating inflation.

On other side of the question you also have major banks which are on brink.

Back in 2008, when the Great Depression happened, the Treasury and FED embarked upon a mission to force most of the US banks to hoard up on treasuries and lend to commercial and housing real estate.

Most of these banks are sitting upon a stockpile of various US government debt issues, ranging from vast number of instruments and maturities.

Remember, TLT as a proxy of the bond market used to trade 150-160 only a couple of years ago. A vast majority of these debt instruments are held not only by the foreign sovereigns but also by domestic US banks. These are ticking time bombs. I think the US commercial real estate market could take several years to resolve out. The job displacement not only by remote working but also by AI disruptions means that the office space is not coming back for several years to come. As leases mature, companies will abandon them at record pace and the banks at some point will take a huge write down and may be forced to liquidate their debt holdings to shore up their balance sheets. This will be a tsunami for the banking sector and could be sowing seeds of future crisis as we read this. When the push comes to a shove, the US government and the FED by that extension, is likely to save the banks and the bond market, rather than care for a bunch of fat equity bulls.

Other than this I am not seeing a whole lot of setups

Sharing ideas just for sake of sharing them does not make sense to me. There are weeks and months in the year when nothing really is appealing. These are few such weeks. I think there will be an explosion of new ideas and set ups in Spring market and this Substack will be the first one to get a preview of those. So hang tight.

The problem with sharing a lot of levels here at this stage is that a lot of these names, like TSLA or NVDA are very highly correlated to the general index.

So I will like to see a couple of weeks of balancing here above 5060 area to feel confident that we may be headed higher in names like NVDA, SMCI etc. Minus that, I like to focus on names with lower beta or those that are less tightly correlated with the general index, like TLT.

TLT

I do like the TLT technical set up here, as long as it holds 90-92 level. It is about 93 at the moment. I think if 90 were to hold, we can retest 99-102 area.

DWAC

With DWAC, I shared this around 26 dollars and is now pushing into 50s.

I like this higher high and higher low set up in DWAC but this is a very volatile stock due to the nature of underlying thesis. I am bullish on DWAC longer term but expect this to remain very volatile with 20-30% weekly moves possible.

Short Squeezers

I have had a bullish bias on both HOOD and CVNA which saw good rallies from my levels recently. They are now trading 14 and 69 respectively.

I think there is little bit more juice to squeeze out of this short squeeze. My key levels on the 2 will be 12 and 50 respectively. I think if these levels hold, we are headed higher in both and will not be surprised at a test of 17 and 85 respectively.

Have a great week ahead.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Yahoo, Google. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.