Hey folks-

Pretty balanced week despite all the news event risk and mega cap earnings risk, with the exception of the Sunday night trading which saw us sell off about 3% in the indices on back of that Deep Seek news. On Sunday night we bounced off that key 59XX support level I shared earlier in the week but then most of the week we balanced narrowly in a 100 dollar range. I would say most of the week had a bullish tone with the exception of that Sunday night session and then that Friday latter half of the session.

You saw some more volatility on Friday with the tariff news coming out of White House with the markets shedding about a 100 dollars in late Friday trading.

With news like this, how can one protect themselves?

I will use a stop loss. Other than that I don’t think there are any protections unless you are using hedging constantly during the day thru options or pairs trading etc. This is just the nature of the game. This is unlikely to go away for next 4 years. So we have to adapt.

One thing you can do is determine if this is going to be a benign pullback or if this is indeed a proper bear market? Then you can also focus on segments of the market where there is value. There are over 4000 common stocks in NYSE. There are millions of option chains on top of these 4000, you just have to find out decent setups rather than focus just on run of the mill 4-5 stocks that every one else buys at the tops and sell at the bottoms.

I have said this before and will say it again, trade what you understand. Don’t follow and chase stuff that does not make sense to you. It is far easier to find your niche in 15-20 names than random noise.

In any given moment of time, there will always be setups on the long side. When we are in a bear market in the indices, there will always be good setups on the short side. You can see this most recently in TSLA stock. It was selling off for many weeks now and then all of a sudden the sell off stopped at our order flow support level. We saw this in AAPL. Sell off stopped at our orderflow level. So be patient. Be observant. Identify stocks you like and mark your key levels somewhere where you can reference them quickly and frequently. Trade what you see. Not what you think or assume.

I want to kick off the post with a few observations and thoughts on recent actions of Trump admin, how I view them in terms of their impact on the markets, both short term and long term.

Look, on surface some of the actions of Trump and his admin may appear to make no sense to many, but don’t forget this is what he has been elected to do. This is his mandate from those who voted for him. This is the exact populist platform he ran on so it should not surprise anyone now. If you are reading too much into his or Elon’s actions last week, and trying to think this is bearish or what not, know that a lot of this may already be priced into these markets. What this is basically are austerity measures.

Now Austerity measures like this can be a shock to the markets in near term. Because it cuts off supply of liquidity to certain sectors and organizations. You can argue short term these DOGE actions can be bearish.

Tariffs on the other hand side, I see them more of a negotiation tool to bring the other party to the table and set a tone for conversation. This is a geography problem. What you have is a very rich country in the US that has contiguous neighbors like Mexico and Canada where some American companies are using them as sort of sweat shops to export the US jobs near shore. They use the cheaper labor to assemble products like cars & widgets and ship them back to the US. This is an arbitrage that hurts the American labor. These sort of selective tariffs may force these companies to bring these jobs back onshore. This is the main thought process behind the tariffs.

The third aspect of this is the geopolitics drama around Greenland and Panama Canal for instance. Again in context of last decade or two of history, this seems extremely arbitrary and may be even a power grab. But this is not something that has not happened before. Don’t forget the US (still) is a global empire. International laws are simple paper weights which in many cases have been drafted and funded by the US. In the long run, owning Panama Canal, having control over Greenland is perceived by many as a positive for the long term national security. These are not some sunny tropical atolls in some remote continent. These installations are pretty much right next door to the US and I think this helps the US in the long run in terms of trade security. If you don’t agree, then consider a scenario where a hostile power takes over Suez Canal and blockades the movement of goods and oil thru the waterway. What effect do you think it will have overnight on prices of energy and goods in the Western countries some of which see as much as 40% of their imports pass thru Suez?

My conclusion from this thought process will be that yes this is a lot of uncertainty in the short term, but it is arguable that this is not already priced in. I will further submit that we are looking at long term overhaul of the trade and economic policy which will have global effects. Trump v2.0 does not care about stocks at the moment. The focus right now is in overhaul of the system and this could help strengthen the US in some sectors like financials, manufacturing and energy for the long haul.

Now while this is a generic statement, I want to proof this with some price action levels in the short term which may be high probability levels for next week or two’s market action in subsequent sections.

Now this week’s events provided some more directional clarity for me in some areas like TSLA.

So with TSLA, you have the earnings risk now eliminated in short term. In TSLA, most recently I have had a bearish bias in the short term when this stock was around 450s and I thought a dip of 10-15% could be possible on TSLA. Furthermore, I recently shared a support level in TSLA which happened to be the exact low of TSLA stock but it had very little inventory at that price. So not much volume traded there when we traded that level on earnings day and then we just took off.

The stock is now trading around $400.

Musk has promised a robotaxi as early as June to be launched in Texas first where regulations around pedestrian safety tend to be minimal. The entire cities in Texas are designed around the automobile and very little thought is given to the pedestrians, bicyclists etc.

This is a strategic move which should generate excitement around the robotaxi even if the taxi itself is not that good. Then you have potentially positive effects for TSLA due to the tariffs as the cars for most part are assembled here in Fremont and Austin.

I think TSLA stock is headed back towards 430-450 area unless we take out the earnings lows.

I am also using this as an example where you want the price action and orderflow to confirm your assumptions rather than make wild theories about a stock based on news or social media. You don’t need anything other than orderflow to design good investment and trading strategies.

In rest of the section, I am sharing few themes which should be relatively inured from tariff wars, some levels on NVDA, some earnings like Google and PLTR etc. Consider subscribing and sharing as it helps make the newsletter better.

Roblox

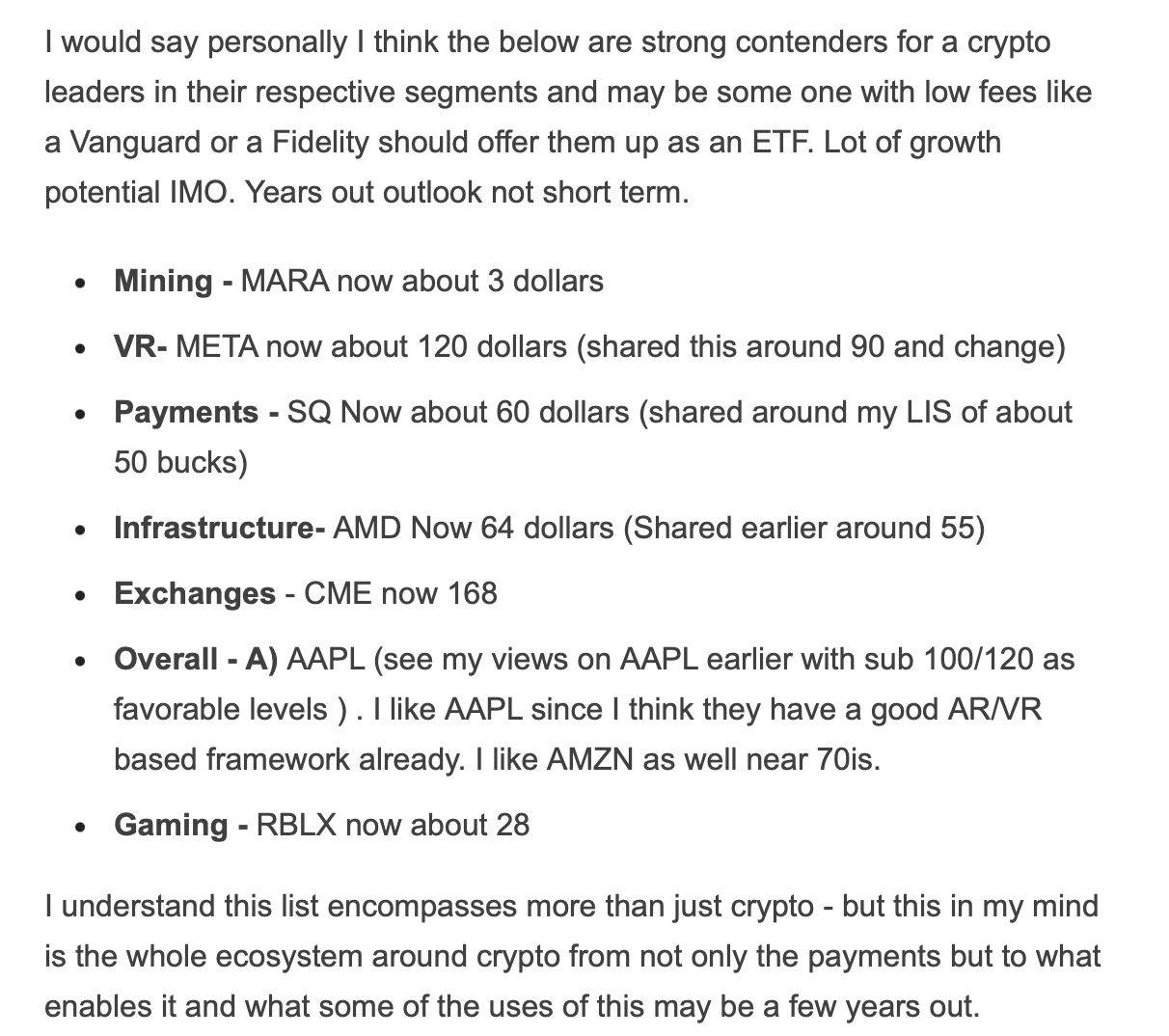

Roblox is an older orderflow stock which I shared around 30 bucks back when. RBLX was one of my strongest growth momentum stocks shared back in early 2023 and you can see my levels on this stock at that point in screenshot below.

This just shows the importance of a long term mindset in these markets. Just look at support prices below and compare them to where these stocks are today. Within 2 years!

This stock is now trading at 70 dollars and earnings are next week.

I will not rule out probable more upside on RBLX here into 85 and beyond.

However in the short term, if there is sell off, I see this supported on pullbacks sub $60.

The options market is pricing in a 15% or so move in RBLX but historically this stocks tends to move more than that on earnings. If you look at $62/$63 weekly PUTS, just as a lotto, if this moves more than expected, these PUTS could make sense. They are priced like a dollar right now. Pure lotto.

Is NVDA dead?

NVDA took it on the chin with the Deep Seek news and had a really bad week closing at $120. I covered in detail why this news was perceived as bearish due to the cost structure of Deep Seek which was revealed to be only $6 million.

Personally I will be a little wary of these claims. I will not rule this out as a negotiation warfare ahead of the tariff conversations and also while China gave us the highly addictive Tik Tok, don’t forget it also gives us spurious Coach handbags and Louis Vuittons. For NVDA, below is my thought process at the moment.