Traders-

At times it feels like the market sell offs make no sense. This is one of those times. The bitter part about these sell offs that no one understands is that they can get deeper.

Now while no one claims to know what is exactly the driver behind it, we can form some educated guesses. Looking at the related markets, to me the following main factors are at play:

Ten year yields, fears of inflation (equities historically don’t do well when inflation is > 6-8%)

Market fears that the FED will start raising more than expected, sooner than anticipated.

Let us review 3 momentum darlings of S&P500 and see what they are upto to see if this sell off is over, or can it get worse.

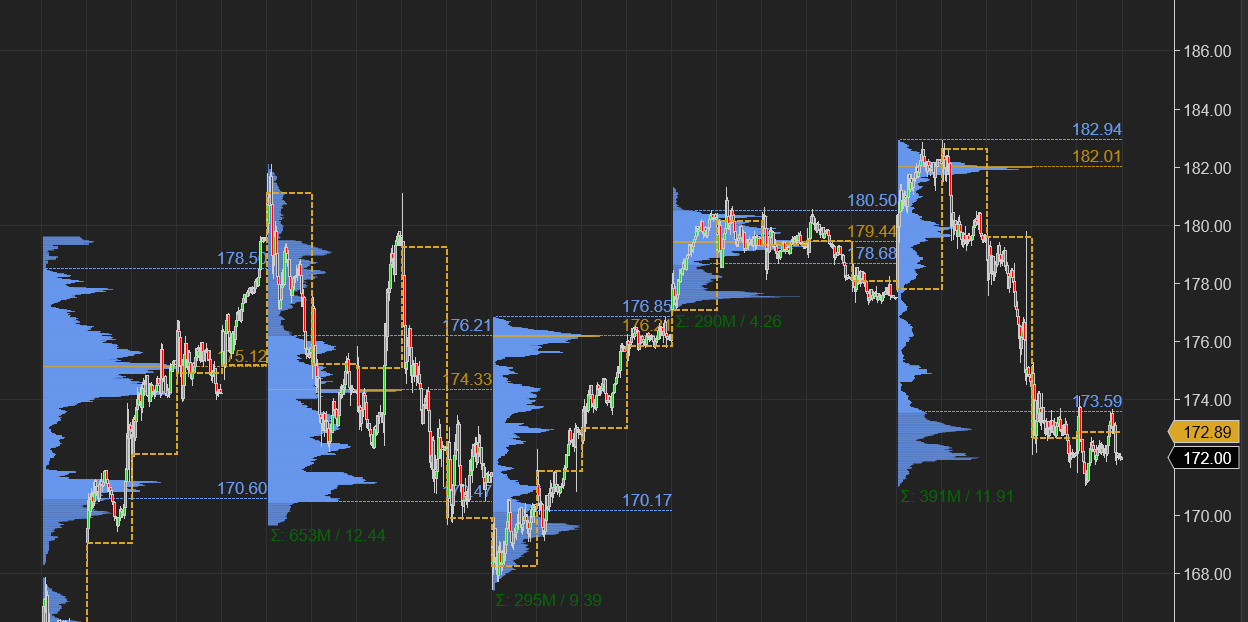

Let us begin with the mother AAPL:

I became bearish on this stock on the basis of valuations at 180. The stock drops about 10 handles from then and is now trading 172.

The stock has made a rapid descent into December lows which has quite a bit of HVN available to count as support. The next HVN support does not come in until 156-160.

TSLA:

I became bearish on TSLA after last weekend’s astounding delivery numbers at 1200.

The stock then sold off quite heavily and is now trading about 200 handles lower at 1020.

The weekly candle not only closed the gap, but actually closed below the lows of prior week.

NVDA:

NVDA made a heroic effort to rise from significant order-flow level 272, but the bounce netted about 10 points before settling down at 172

NVDA lately has made no qualms about even trying to take out the recent highs at 340 when it was widely touted by many to become a 10 trillion dollar company (now 0.7 trillion )

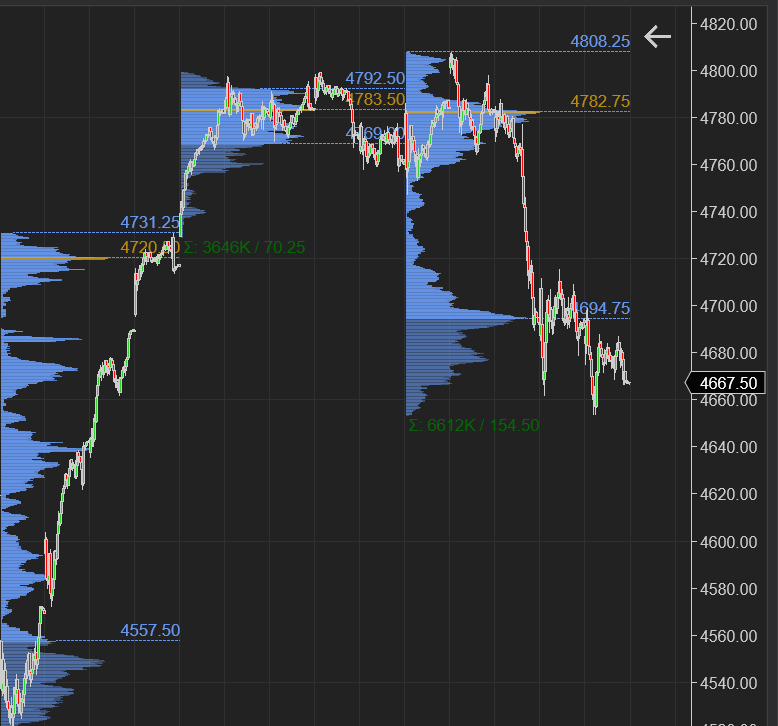

Let’s bring up a chart of S&P500 Emini …

What do we see?

A bi-modal distribution on the weekly time frame where prior support was. Looking at these 4 charts individually none of these inspire confidence to me, looking at them collectively they whisper heaviness.

Now having seen a preview of dark clouds brewing over equities, are there any positive factors? I think so.