“The dilemma is this. In the modern world knowledge has been growing so fast and so enormously, in almost every field, that the probabilities are immensely against anybody, no matter how innately clever, being able to make a contribution in any one field unless he devotes all his time to it for years. If he tries to be the Rounded Universal Man, like Leonardo da Vinci, or to take all knowledge for his province, like Francis Bacon, he is most likely to become a mere dilettante and dabbler. But if he becomes too specialized, he is apt to become narrow and lopsided, ignorant on every subject but his own, and perhaps dull and sterile even on that because he lacks perspective and vision and has missed the cross-fertilization of ideas that can come from knowing something of other subjects.”

― Henry Hazlitt

Traders-

With the week that this was, we almost wrap up an amazing month for the bulls. This is a stellar month no doubt for any one who took a contrarian view from the majority a few weeks ago- not only in the indices like SPY, not only in the Blue Chips like AMZN, TSLA etc, not only in Crypto but also in a variety of other instruments, meme stocks, low floats, short floats - overall a great month for the risk-on party.

I was my self a bull at 3800 on the Emini and then again at 3900 before this move into 4100.

Stocks on my own watchlist had an amazing month.

To name a few, TSLA rallied all the way from almost 100 to 180. S&P500 Emini from 3800 into 4100. SQ from 50s to 75+. BABA from 70s to 120+.

The full list can be viewed here:

On the weekly time frame level, from my plan last week (link attached here):

My key levels this week were 3980-4060.

Both of these were lows and highs of the week until latter part of the week on Friday when we broke 4060 and it became support for rest of the session on Friday with highs of the session near 4100.

This is how some of the other names I shared last week did :

SBUX up about 3%

TOL up about 3%

TPR up by about a %

GOOG up about 1.5%

SCHD largely unchanged

NOC down by about 3% but was down into my levels which happen to be my LIS. This stock also popped about 5% before crashing back into the LIS.

This is an important weekly post that you do not wanna miss. I will be introducing a new educational indicator which is very powerful in longer time frames I think.

Subscribe below to get access (limited time only):

Before unpacking the levels and thoughts for this week, let me restate the longer term structure and some personal macro views

Remember - Macro can take a long time to play out. Market action in the short term may get dominated by shorter term FOMO, squeezes , liquidity crunches but eventually catches up to the reality on ground.

The stocks have benefitted (a lot) from the recent weakness in the Dollar index. The markets tend to be forward looking a few months out and the stocks have front run the demise of the Dollar which I called for a Dollar top here in the Substack around 114 level in the $DXY last year in the Fall.

While the inflation of 2022 was a pesky problem driven by Supply chain issues as some believe, and relentless easy monetary policies, the 2023 inflation may not be as straightforward as 2022.

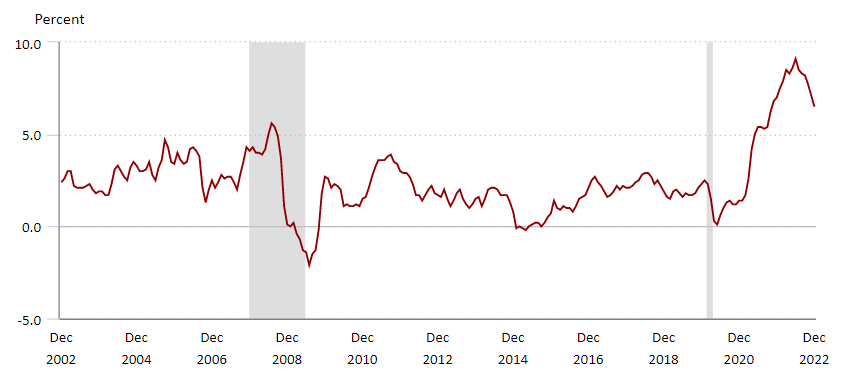

The US inflation peaked near 9 % and has been since then been steadily coming down to settle recently at 6.5%.

The biggest components of the US inflation are:

Energy

Shelter

Food

Services

Nearly all of these except Services have been coming down. The US rates have an impact on nearly any thing including the TOP components of the US CPI. For example, higher rates mean lesser demand for housing and that could mean higher supply and lower prices.

The market belief right now is that the FOMC on Wednesday could be the last rate hike in the cycle and the FED afterwards could begin cutting rates. The 25 BPS rate hike has been widely priced in and for me that is “neither here nor there” in terms of it’s potential to cause any major moves on Wednesday. I think what causes excitement will be the extent to which we see consensus amongst the FOMC voting members to keep raising rates and/or keeping rates higher for longer.

Personally my view is there is no reason for the FED to let off the acceleration:

Even at 5-6% , this is generationally high inflation. As folks get used to these higher prices, it could become endemic in the US. We could see years of 5% plus inflation in the US. May be decades. This is why it is crucial for this FED to crush the inflation back down below 3%.

I do think that inflation may soon actually uptick again. This could be supported by China reopening which I think is quite inflationary - after 3 years of dormancy, they will spend on multiple fronts and that spend may drive higher prices in key categories. Think of it this way - the world is still reopening after a massive man made shutdown. There is competition for scarce resources from everything from raw materials to human capital. Add to it the recent swoon in the US dollar . The US is an importer nation, it imports most of what it consumes. A weaker dollar leads to higher prices in imports. A weaker dollar also fuels more speculation. This means the prices which have been falling for last 6 months or so could actually reverse and begin going up again.

I do believe that if the FED even as much as hints at stopping now, this will unleash a major uptick in speculation in risk assets from housing to energy to precious metals to the stocks. This speculative activity will drive higher prices of every day items used in the households and drive inflation higher.

There has to be a motive or a reason for the FED to back off - that could be high jobless rate, that could be a crash in the stocks, or a crash in the housing market as that is what leads to political pressure on the FED to pivot. Even if the FED pivots , it could still be months before the markets settle down into a good low and begin a major uptrend again.

Due to these factors, I do not think there is any reason for this FED to lighten up yet.

When the S&P500 was trading near 3500, I had called for the FED funds peak rate near 5% and this had made me call a bottom in TLT near 90 bucks and a TOP in the Dollar near 114- this was my call that we could retest 4100 or so on the S&P500 again when it was trading near 3500.

The current ACTION I think is playing out still based on the assumption that peak is 5% AND we are now going to begin going down.

I do not agree with this now given how we have evolved in last few months with respect to the structure of the inflation, and the prices of key components of the inflation. I do not think this rate hike on Wednesday will be the rate hike. Further I do think 5-6% inflation is here to stay longer and this means we are soon going to see an uptick in recessionary forces in the US. Job losses are last sign of recession not the first. There are several signs already pointing to a US slowdown in few months. More on this later, to be continued.

Now, from my personal experience, I do not want to rely solely on the fundamentals, or only on the news, or the macro alone - this is why I use the key levels as a construct to measure the momentum. If the macro is very bad but then the momentum does not agree with it, then I want to either stay out of it or go with the momentum. We have seen this countless times - we saw this earlier last year at 3500. Most reentry we saw this last month at 3800! With this newsletter this is one of my goals to marry up the macro view with the levels and the technicals.

My Levels for the emini S&P500

Please note these levels are for the Emini which can be easily converted to SPY and SPX levels. There is not fixe spread but the spread can change day to day but conversion is simple.

Further, IB refers to the first hour of trading when the NYSE opens at 930 AM NY time.

Here is a link to abbreviations used and other educational content on tape reading:

I do want to be cognizant of my own time frames and biases.