Hey guys-

Quick recap from few ideas I shared during last couple of weeks.

I was bullish on both COIN and MARA and these two had a rather good week. COIN was up 15% and MARA was up 20% on the week. Longer term I have been a bull on crypto sector. I shared FDIG as a proxy for the nascent crypto industry near 10 dollars last year and it has been on a roll since then. It has a little bit higher expense ratio but it is forgiven when it rises 100% in a year.

I was a RIVN bull as well and the stock rallied about 10% on the week. I favored RIVN more than TSLA, in the same time frame, TSLA was up barely 1 %.

The other notable call was in PLUG which I shared $3.7 as support. This stock was up a whopping 30% on the week.

Other good calls were in NEM and GOLD. Both up about 10% for the week but NEM is up about 20% from my master support level of 35 dollar.

This week I may not have a lot of calls due to the general market index which remains obfuscated as far as I am concerned. Just a heads up.

Talking of the main index, the primary expectations was to see 4600 cap rallies and support to come in near 4530.

This was an ok call on the weekly time frames, as we did not do much trading above 4600, fell from this level quite a few times. At the same time, we were not quite able to test 4530, missing it about 15 handles on Thursday.

Outside of the week to week calls, some longer time frame targets hit like XPO. I shared XPO around 60 bucks and after some hiccups this stock is now trading up at 90 dollars.

AMD traded up from my 90 dollar level support to almost 125, missing my 130 target by 5 bucks.

SNAP is now up almost 100% from my $8 bottom call and is now pushing past 14. Same story with PINS, which now managed to clear 35. With SNAP, any anti TIK TOK story is a plus for this stock. The CEO has been extremely pessimistic on this stock which has keep it bottled else it would have cleared 20 by now.

I had a LULU bullish call around 370 bucks with a target of 500. This week LULU came within 30 dollars of that target and close for the week near 470. Several other notable calls which the subscribers can read in the archives.

On the macro side, the highlight of the week was the Powell commentary on Friday. Powell put his foot down and warned about possibility of future rate hikes as well as vehemently warning against any premature hopes for a rate cut, any time soon.

This warning was briskly shrugged off by the equity bulls as the markets rallied about a % from his comments. I think he is bluffing and is in no position to do any more with rates.

Key events for next week

The most important risk event is going to be the next Friday’s jobs report. I think this jobs report is going to be more important than the ones in recent months for a number of factors.

First off, it will offer important clues into the FED funds rate situation for next year. I have said many times I do not see the FED increase rates any more than where they are at the moment. I think we are at peak of the FED rates.

The part that is not very clear to me, and I assume to many others is that if these rates will stay at these peaks for longer. This jobs report may offer clues into that.

We have few clues though on correlated markets though.

So are there any clues hidden somewhere that the FED is to embark soon on a rate cutting mission? I think so.

It is no secret that the treasury yields have been pushing higher relentlessly in last few months, a trend which only recently reversed in last month or so.

Theoretically, you can imagine treasury yield curve to be future expected FED funds rate, plus/minus a certain premium.

The first part of this equation is quite straight forward and it is based on what rates the FED will set in near future to control monetary policy. The FED advertises this almost every month.

The plus/minus part is where things get a little tricky.

In layman terms, this can be thought of as an extra cushion or a premium that the bond investors demand or expect in order to hold longer term maturity instruments to account for various risks like inflation, government spending etc. There is a lot of geekiness that goes in this, the math there is something I will reserve for the PHDS amongst us to read into, but the good thing is the FED itself publishes these numbers on its websites. Do not ask me the math behind these models which is quite complicated but any one interested can read up all they want on the FED on how they calculate their term premium models.

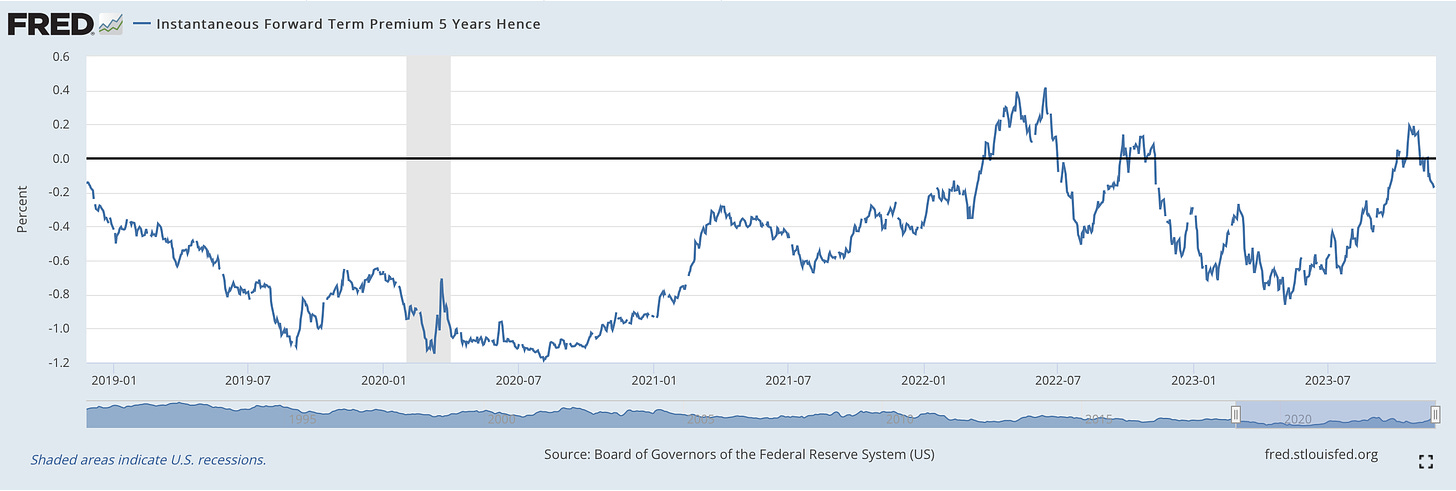

For purposes of this conversation, Chart A below suffices.

This is a quite robust, inversely correlated indicator with the S&P500.

As it makes lows, the S&P500 seems to like it and heads higher. When the premium makes new highs, the S&P500 drops like a rock.

Chart A just shows that the current 5 year yields are higher than what they ought to be in near future. Think of this as lesser pressure on yields going forward.

If the FED is going to keep rates higher for longer, then why is there no premium on this chart?

This can be seen across a spectrum of different maturities not just the 5 years.

If this thing holds, which I think it will, there are 2 major implications from it in my opinion:

I think the FED is soon going to cut rates like crazy, despite just saying on Friday that it won’t. It means there is no “higher for longer”.

This may suggest that a recession could be nearer than expected with a generous helping from a drop in prices aka deflation. Why else will the FED cut rates?

Due to these factors, I think: A) the FED is done raising rates. B) it will cut them soon.

Now with Friday’s jobs report, if the report is weaker than expected, it could lead this discount to grow bigger and strengthen my theory.

If the jobs report is stronger than expected, this may throw a wrench in my theory and we could see the discount narrow or even disappear altogether in next month or so.

If I am right, then who could benefit from this?

I would think in such a situation, the bonds could rally some more and yields could drop some more.

Let us take TLT as a proxy for these bonds for a moment.

It had a nice sell off from the 93 level but then managed to close back near 93 again on Friday.

Due to these factors explained above, I think TLT if it gets pulled back into 90-91 could find support for a push higher into the 100+.

Notably I have been a TLT bull from quite a while now and I called for a low in the TLT at 80 bucks before this current rally. Same dynamic helps Gold bulls as well IMO.

Now can the same dynamic apply to the QQQ and SPY as well?

Well, yes, but it is a little complicated. Let me try and explain why.

My aim is to share out of the box research and find out of the box themes and trends which may be impacting risk flows. If you want to learn more about this and visualize the market from a different angle than just chart based “head and shoulders” then subscribe and share below.

This can be bullish for the stocks as well but there is an additional unknown that does not affect the bonds in same way. This additional unknown is what is making the tape murkier on SPX IMO.

What is that?

If the premium is collapsing due to rate cut bets and the underlying reason is impending recession, then this is not the same for the stocks and this could be bearish.

However, if the rates come down due to deflation and the economy remains supported, then this could be mildly bullish for stocks as well.

This is why while I think the trend higher is clearer for the bonds, this same logic is NOT as straightforward when applied to the more risk on assets like Nasdaq and S&P500.

This is a nice segue into the levels for next week

As I said earlier, I do not see any major news events until Friday with that Non Farm Payrolls. There are no major earnings either until the 7th.

This type of macro backdrop could lead to more range bound action until Friday.

Friday’s close was right at the psychologically important 4603 level. From bullish perspective, there is also some support from related markets like the TLT and Gold as they are both trending up very hard, again from the lows shared by me here in this newsletter.

Now the reasons for rallies in Gold and the bonds could be very different, and actually be sinister for the SPY bulls in the longer run, but in the short term the market does not seem to care about it. Yes, Gold has a direct correlation with S&P500 for most of the times, however at times Gold is also a classic “flight to safety” instrument used under extreme duress and conflicts.

I would go as far to say that if we begin to see Gold clear 2100-2130 in the near term, I would think that is acting quite like a $VIX above 20 and that could be bearish for the S&P500. Remember Gold is the original VIX. It was the VIX when there was no VIX. So any unexplained moves in Gold need to be examined, especially when the US dollar also is still above 103, it is not even below 100, then ask you self, what is going on with Gold?

I am not complaining though. Note that I have been a long term Gold bull and most recently I reiterated this at 1900. This move of almost 200 dollars has come within weeks and it has been an extremely swift move. At the same time, the Dollar has not gone anywhere. S&P500 knee jerk reaction has been “ok let’s go up too”. But I think it is without merit.