Folks-

Merry Christmas and welcome to another installment of my personal journal where I share my personal opinions on a variety of topics in the markets.

In this installment, my goal is to share 2 things:

How my 2023 Annual plan fared.

Share an educational POV on intraday trading time frames, more from a psychology perspective than technicals.

2024 is going to be a volatile year.

My goal it that I want to find atleast 24 MAJOR ideas throughout 2024 and share with subscribers. What will these look like? These could look like my call in MARA, or COIN or LULU or OPEN or CCJ.. or may be like dozens of other ideas I shared in 2023 alone. But my intent is to share them only with subscribers. So subscribe now and let us all look forward to an awesome 2024!

24 HUGE ideas for less than a dollar a day? Not too shabby!

Let us jump right into the 2023 recap.

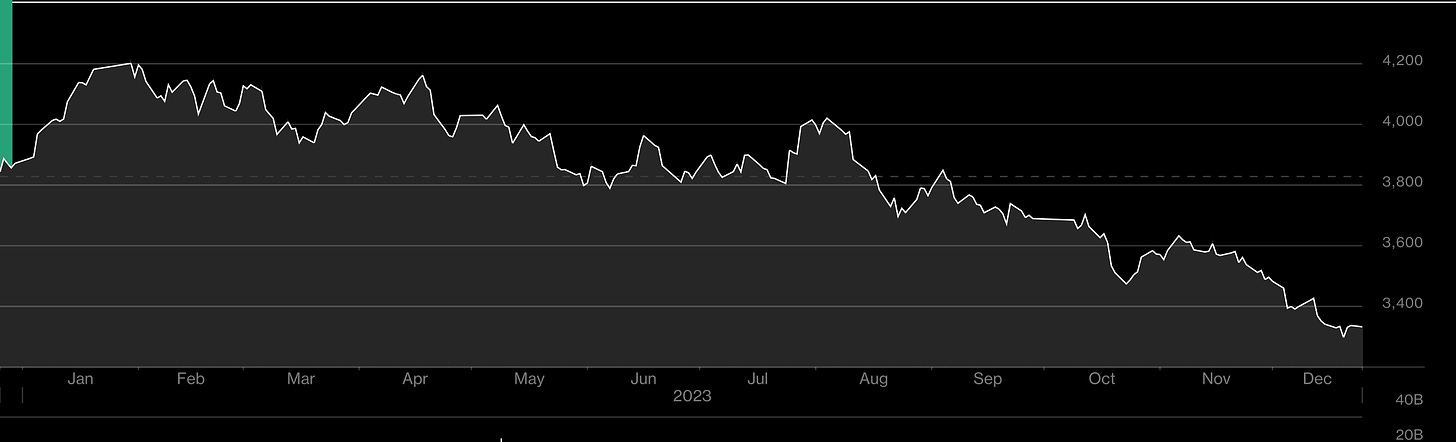

On the S&P500 side, I was bullish at start of the year around 3700-3800. I did not see much downside from the open due to stimulus aftershocks still being in the system.

The actual plan can be seen in the archives by Subscribers.

My main expectation was to see longer term sellers emerge at 4200 rather than at 3700 at start of the year.

This was true to a large extent. From that January open, we floated right up to 4200. And then the Small banks imploded in March. This nicely coincided with 4200 and this brought us down into 3800s again.

The small banking implosion was a pivotal moment in 2023. This led to the FED temporarily pulling back on QT, the financial conditions loosened and the S&P500 took off.

We rallied back to 4200 and after spending about 2 months at this level, we broke out of it. This was a key resistance for me personally and I always thought that if we break out of it, and if we retest this ever again, we could find support here.

This retest came just a few weeks ago. We traded down into 4130 in October, found buyers, and here we are, up about 700 points or 15% or so, within 8 weeks.

In part, this rally has been fueled by the FED Pivot to rate cuts next year. So in essence, the FED Pivot and the banking crash in March were the MOST important 2 events of this year in the S&P500.

I would rate below calls by me this year pretty stellar-

The bullish bias at the 3800s back in January

The bearish view at 4200 in March

The bullish bias at 4130 in October

The following calls by me NOT SO much:

Bearish bias near 4500 late November

You could argue that 4200 bearish bias after March was a bad call but for what its worth, the market did spend 2 months at this level, giving many opportunities to play both end of the range.

Below are my other calls which I shared at start of the year. These are mainly bullish calls in context of investing time frames and I think if I look at the YTD performance numbers for these, they look pretty incredible-

INTC Bullish call at 25. It is $48 now.

SMCI bullish call at 80. It is 290 now.

O Bullish call at 50. It is now 56.

SCHD Bullish call at 67. It is 75 now.

MARA Bullish call at 3. On Friday it closed at 27.

SQ Bullish call at 50. It is 77 now.

META Bullish call at 120. It just closed near 350.

AMD Bull at 64. It is 140 now.

RBLX Bull at 28. It is 44 now.

CME Bull at 168. Now 214.

GNRC Bull at 80. It is about 120 now.

MMM bull at 120. This is down now into 106 but it was down quite a bit more into 80s.

These are from the starting January newsletter. You can read all about it by opening the 1/1/23 dated newsletter.

There were perhaps 2 dozen other great calls by me throughout the year, for instance most recently when it comes to OPEN and HIVE in last week or so alone. I think the below were some of my BEST calls during the year:

PLTR Bottom call around 6

CCJ Bottom call around 20

AMD swing low at 90

META swing low at 290

GOOG swing low

Other notable calls in AMZN, NVDA, TSLA throughout the year

COINBASE LOW call

MARA swing low at 9

KRT LOW AT 17 (BOBA TEA)

Cyber security stock low calls

AVGO low called at 600

SAP Bottom

NEM low at near 35

CVNA bottom call at 5

ROKU Bottom

XPO

GNRC bottom at 90

LULU bottom call in 300s

MRNA bottom call around 70

ENPH bottom call at 70

Several more

My bullish calls in BABA at 80 was a mixed bag. It did rally to 100 but has since then given up those gains as China stock market crumbles.

My call for strength in XOM and OXY has also been a mixed bag as these 2 have languished for most of the year.

My bullish call in defense names like RTX was MEH.

I think the reason there were so many good calls was just because the market was so oversold at start of the year.

Can this continue this year too?

I have no idea.

But I do know one or two things. First off, if there is a good set up I come across, I will not be shy from sharing with subscribers. Second off, the subscription prices have to go up. I feel I am giving away this research for free and it is only a matter of time before major price hikes go into effect. Most likely the price of this blog will go up to 50 as this is heavily focused on swing time frame ideas AND I will launch a new chat only + OPTIONS newsletter for about 2X for intraday time frames. Old subscribers should be grandfathered in.

My main MACRO calls AND LEVELS for 2024

I use Macro assumptions to build my views, bullish or bearish on a variety of names.

Below are my main macro assumptions headed into 2024:

Inflation peaked but will not be back down to 2% any time soon.

Oil prices have found a new long term range between 60-90.

Due to these factors, I think the long term yields in the US will remain at or above 3%. It is about 4% at the moment. This alone is a tectonic shift as we have had near 0 rates in the West for almost 15 years now.

Taken on their own, these 3 factors are bearish for growth stocks like TSLA for instance.

However, I am always upfront about sharing the unknowns for me. These unknowns are below -

How far out will the FED go with their QT program? Will a sudden geopolitics event like a new war, make them end QT and start QE instead?

However, since the former is a known and the latter is an unknown, I will still like to use these assumptions to make a few level based calls.

A few levels to start the year

My key levels to start the year will be 4850 and 4600. These are emini ES levels but corresponds to about 4800 on the SPX.

My current bias is heavily influenced by the range bound conditions in oil and the strength in Gold and Silver markets.

Scenario 1: I think we have seen a swing high in the S&P500 here near 4850 (Emini). If I am right, I expect us to trade down into 4600-4630 area which could be the next main level.

Scenario 2: I think the action near 4600 could set tone for rest of the year. Generally I think if we hold 4600 by end of January, I believe this could signal another test of 4800-4850. However, if we begin trading below 4600, into 4556 and below by end of January, I think we have seen major highs and could retest 4300s.

The IF statements are really key. Read them again.

In my view since a lot of folks actually watch OrderFlow levels, once they break, the moves can be quite drastic. This is one of the reasons we see often the support becomes resistance and resistance becomes support.

When do I know I am wrong in my bias? If we begin trading below 60 in Oil. If we begin trading above 200 in AAPL (It is about 192 at the moment). If we take out 270 and start trading above it in TSLA. These are some of the early signs that I am wrong in my assumptions.

What to do when we are wrong?

Well the first thing to do when wrong is to stop being wrong.

And the next thing we do is look for next setup or opportunity.

The beauty of trading is when the market becomes irrational, we don’t have to stay irrational. We can just step away and wait for the market to come to its senses. We do not have to change our methodologies to accommodate a temporary phase in market structure. For that is exactly what it is- any one who thinks this type of conditions are here to stay, knows very little about the auction markets. Sooner or later the chicken will come home to roost and sense will prevail.

A note about mindset in execution

I have written extensively about mindset. I place mindset as the most important factor in success, several times more so than that of technical knowledge.

The reality in my view is that it really does not matter what technical methods you use, if you have a good mindset, you will do well and if you have a negative mindset, results will not come. What separates bad days from good days is the fear or lack thereof. You have to execute from a point of no fear. Where there is fear, there can not be creativity and where there is no creativity, there can not be any results. So in intraday context, it is not about my levels or the RSI or the trend line or head and shoulders. It is all about state of mind. For some reaching this state of mind may take a few months, some take a few years and then some may never get there.

Let us talk about Oil for a moment.

I personally think Oil is overlooked in its importance here in the US atleast, and we can be cognizant of this at key levels. Oil (or energy in a more broader sense) is NOT something that is optional. It is not an iPhone that if you don’t buy for 2 years, you will not die. It it not a shiny new car that you can postpone for a couple of years and will still live to buy a new one after you get promoted.

Oil is essential to our day to day life. Beyond all the current foolishness and hubris in energy policy, I think Oil will remain in demand for decades to come. Harder it is to get out of the ground in the US, more devalued the Dollar becomes and more de-globalized the world gets, these are all positive factors for oil (and energy).

One of the great ETFs out there for this is VDE. Even VYMI which I shared around 60 bucks is a good ETF but has Dollar as extra risk factor.

With VDE, is is near 115 now, it has almost 4% dividend, and let us say Oil collapses due to recession or Trump winning 2024, as these 2 could be bearish for Oil. Then what? VDE drops to 80? To 60? This is NOT a bad thing in my view, if I plan to add more VDE on lower levels as it has a very well define, very long term range and macro to support it.

In current world we live in, with all the geopolitics risk, plus the domestic policy here in the US, I think Oil is being offered almost for free here at 70s. Ideally I want to see Oil clear 120 and stay there.

If and when this happens, this is the point where a lot of my longer term calls, specifically about a lost decade in the tech heavy S&P500 begin to take shape where these could just languish for a long time. This is also the point where I will begin to be less bullish on energy and begin to be more bullish on S&P500/Nasdaq types. Right now I am more bullish on energy and less bullish on the Nasdaq types.

INDA

Any OIL theme can not be complete without also talking about India which is one of the largest consumers of OIL, right after US and China.

I shared INDA at 20 bucks and it is now trading about 48.

INDIA is a debtor nation and has a lot of headwinds from stronger Dollar and rising interest rates.

However, I believe it is also now in the strongest phase of its history since its Independence 75 years ago. For decades, the country saw Political gridlock with dozens of regional political powers. That all is rapidly changing in last ten years under leadership of Moodi.

I think Indian industrial development is just beginning and next decade belongs to India.

One way to play this is to pay attention to INDA.

It is about 48 now but I think downside on this could be limited and it may be supported if it dipped into 36- 40 or so. Thematically I will place bullish India on my TOP ideas for next decade.

Earlier I thought de-globalization will hurt India. But I was wrong. DeGlobalization which is in full swing now and will continue for next 20-30 years will hurt China the most and will benefit India the most. As Modi and his cohorts consolidate power in most backward of Indian provinces, this will be huge plus for Indian economy.

So, have I been wrong?

In parting thoughts, I want to share my views on if I personally think I have been wrong in my longer term view that the lows from 2022 around 3500 can be revisited.

In timing terms, I have been off.

However, this was never meant to be a very precisely timed call. The way I prepped myself for this was to raise cash to buy more if and when we get there. In that sense, Cash is an option with no expiry date, so I did not really miss out on a lot.

Like it or hate it, my view has not really changed in 2024 and if anything it has strengthened. I view everything, not just as markets, as fair valued or unfairly valued.

I base my views based on longer term trends and research. I am not looking at a price chart, which obviously looks very very bullish, but I am instead asking myself - is there fluff in the system?

So, is there fluff in the system?

To answer this, we do not even need to look at something like CVNA which is debt ridden, loss making enterprise which is up 1200% this year. But let look at the pinnacle of high quality, well run, respectable companies, like Costco.

I understand Costco model very well and I understand this business quite in depth. As of today, it is trading near a 50 forward PE. It has a Price to sales ration almost touching 1.5.

Mind you this is a glorified warehouse operation and now it has same PE as a growth stock like AMD.

Costco is a great company but in what kind of reality does it make sense for it to trade at a 50 multiple?

Now let us not even talk about Dogecoin.

So, to me it is clear there is enormous amounts of fluff in the system. This bubble will pop but I do not think any one can call when. However for some context we can look at similar related markets. If you look at FTSE index, I called this to rally from its lows despite the inflation picture in Europe a couple of years ago. Rally it did and it is struggling now near prior highs.

SPX is now looking more and more as same near its prior highs. For further gains, it will have to break these highs and start accepting value above these levels. Until that happens, I reserve my right to be skeptical.

Other names

SNAP

Readers know about my SNAP bottom call this year at 8 and the stock is now up to 17 at time of this post.

With SNAP near 18 now, I think it is looking a little overbought. I still like it longer term, but can use some cooling down here.

For February 16 MOPEX, I like the $15 PUT which is now offered around 90 cents.

CVNA

CVNA no doubt has had a great year with it being up 12 times this year alone.

I was original bull on CVNA at 5 before it became a thing.

Now I have been bearish around 60 and the stock has been facing some resistance now.

My theme with CVNA is that yes it is a high short float stock, yes it has a negative outlook from professionals, however if the general market begins cracking in 2024, CVNA could drop like a rock.

Recently I have shared 42 January put on this around 1 dollars. It was up about 40-50% and it is still up around 1.4 dollars, however if the stock slips again in next couple of weeks, this I feel remains priced on the low end.

What is weird to me is that despite having such high volatility for this stock, I think even puts like 40-45, about 3-4 months out are priced slightly cheap IMO (for no one expects it to trade even 45 ever now ;)) and at the same time, these calls around 40-45 are priced at nose bleed prices, at 16-20 bucks! In my view this is a recipe that these prices will probably trade. However for a high beta like CVNA, the general market is a major factor. God forbid if we see a 2% down day ever again in S&P500 now, what does that look like for CVNA? A 5- 6 or a 10% down day?

I am not seeing a whole lot of other set ups at the moment to be frank and I think that could change if and when we trade down into 4600s. Just to share ideas for sake of it does not make sense for me. So stay tuned, a lot more to come but it is just not today.

On an admin side note, if you have not noticed, I am sharing more and more insights on option pricing. This is a brand new service but is included for any one who is already a sub. However for new subs, this will cost around 200 a month soon. Many of you are on extremely low introductory pricing. To keep that pricing, make sure you update your payment method before it expires. Once the payment method expires, there is nothing I can do as Substack controls all aspects of billing.

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Yahoo, Google. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.