Traders-

There are 4 distinct forces acting on the market right now, which do not appear to wane next week or two.

Specter of a hawkish FED

While I will not go into the deep end of FED analysis as I have covered that in previous posts, my belief in FED’s leadership and it’s ability to do any kind of sustained tightening is shaky at best. Given the state of politics right now, no one has the guts to do the right thing and this FED is no different. I do not expect Volcker style fights with inflation where he ends up raising rates as high as 20% to combat inflation even if that means killing the economy and market in the short run. It had longer term benefits. It is not even clear if the inflation is as rampant.

Perceived impact of Omicron on Supply Chains which is causing some stocks to sell off

There are several indicators which point to the fact that globally supply chain constraints might be easing. Whether that is shrinking Delivery lead times or Shipping rates or prices of some $SOX components. If true, this may lead to easing inflation in several categories in the next 2-3 months. There are also several indicators about the mildness of the Omicron variant. For instance, in South Africa even as the virus cases surge, the hospitalizations continue to go down. But for now, some people continue to beat the dead horse of Coronavirus for their vested interests.

Expectation of Santa Claus Rally which is typically the last two weeks of December

Never say never but there has never been a case as far as I know going back to 2008 where the market underperformed during last 2 weeks of the year. May be the 2018 year could have been an exception to this rule and that was the “taper tantrum year “ as well. To what degree that impacts the S&P500 next week remains to be seen but needless to say there will be some people positioned for this. And some people are positioned to fade it!

Tax loss selling. We had noticeable effects of Quad Witching and Rollover this past week which are behind us now.

December is also the month of booking losses for tax reasons. Looking at a few names, this may be waning. Read on for more insights what may benefit in the ultra short term from this.

While this is the macro background, here are some technical conditions which appear to be impacting the market action:

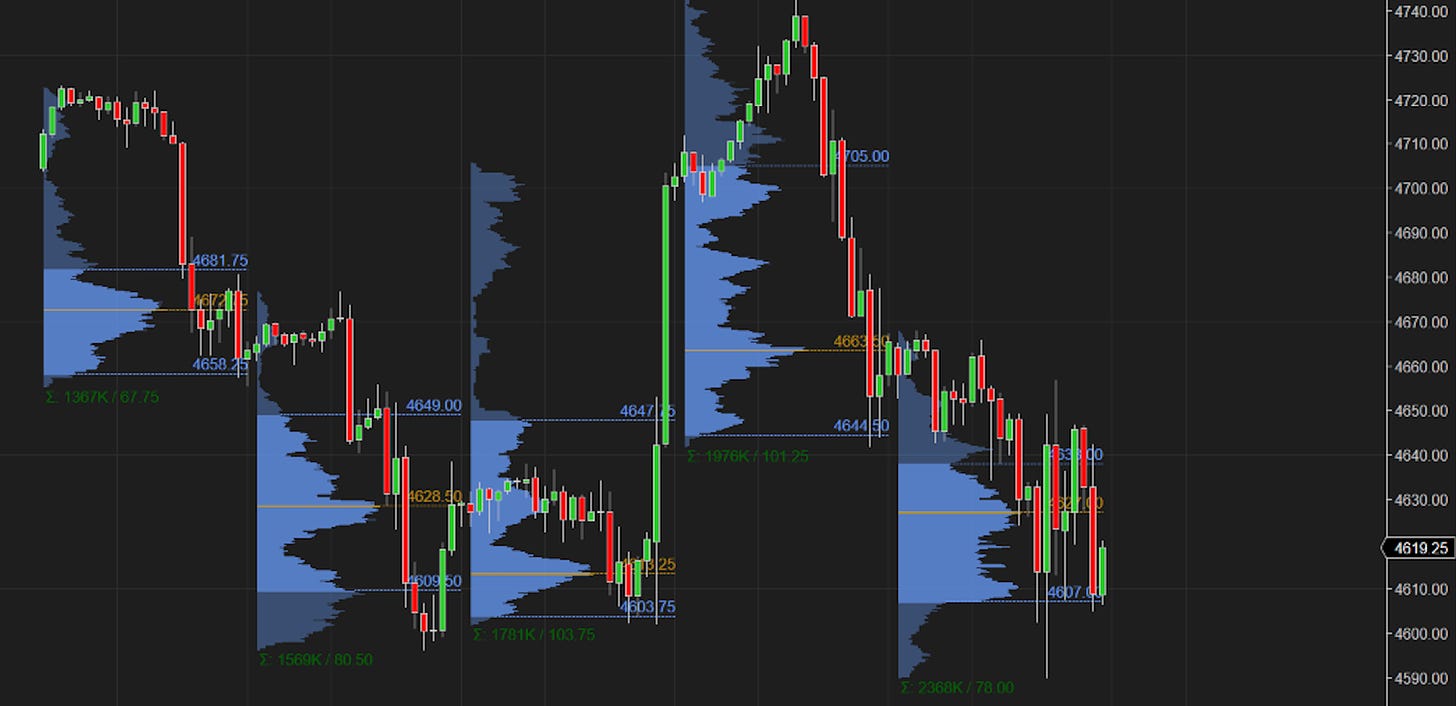

Persistent lack of follow through at 4700 highs. This has created a substantial volume shelf right above where S&P500 closed on Friday at 4620. This may act as a barrier to some effect.

Then there is a volume shelf right below us at 4600 pre-FOMC which has been acting as support all throughout the past week.

Read my past couple of Daily Newsletters for more context on these volume formations but here is an excerpt from my most recent Daily Newsletter, delving deeper into the phenomenon.

Weekly Recap from prior Week:

Before I go into my levels and plan for next week, I want to do a quick session recap of how my previous weekly plan did . Prior weekly close was above 4700 and my expectation was we will rally after the FOMC as long as we stayed above 4667.

The week tended to be quite volatile and we actually opened below 4667 on the day of the FOMC at 4610. However as soon as the FOMC minutes were released, S&P500 staged an impressive 125 point plus rally trading as high as 4740. However on Thursday it failed to hold that vaunted 4667 and traded back below the range described earlier. Here is a screenshot from my last weekly update:

My Levels and Plans for Next Week:

4620-4640 remains a key zone for me at this point. See Figure A for more context.

As long as we remain below this zone or within this zone, the risk of retesting the recent lows at 4580/4590 remains high IMO. With this said, if Monday open is below this zone, and internals are bearish, I want to align on the side of bearish bias with target of 4580.

If however, the Monday cash open is above 4640 or if we BID above 4640 on strong volume or bullish internals, I want to lean on the bullish side for a retest of 4672/4683.

In a longer time frame, a market that refuses to close below 4600 keeps the bullish narrative alive going into next year. However if we start seeing consistent closes here at the lows, 4500 is not out of the realm.

Again, personally for me, Omicron is a non-factor, if it leads to sell off, that is an unfair sell off. Personally I think housing and stock market asset inflation will continue to run with no end in sight. I do not believe inflation in energy , shipping, everyday household items is going to be consistent inflationary. Yield curves, TLT, Gold Miners like NEM seem to agree with me on this.

Figure A: S&P500 Emini has on Friday settled within the 2 day balance pre-FOMC. This is potentially bearish, unless, we now close above 4640 next week, ideally on Monday. This is why I said 4640 may offer resistance. Image courtesy of Ninja Trader.

Other Thematic Ideas:

Cathie Woods, whose embattled ETF ARKK is now down 30% + on the year, came out on Friday and made a case that “the Truth will prevail ''. While I understand politicians and tweeters like me want to make such statements, I did not appreciate a fund manager quoting the holy verses. Anyways, it prompted me to look at some of the really beaten down ARKK stocks and made me think if the tax loss selling is over, or is about to be over soon, the most losing trades may see a short term bounce. ARKK traded $97 last on Friday.

I looked at these names below and thought they look oversold (technically oversold, but they may still be overvalued fundamentally)..

HOOD at 21 bucks

COIN at 240 bucks

ZOOM ZM at 200 bucks..

Again this is extremely short term pop and may or may not even last a few sessions.. I would not risk more than 8-10 % on any of these.. so if I have HOOD, I am risking 2 dollars on it with LIS right below 19 dollars. They may be helped if S&P500 doesn’t outright crash through 4580 on Monday.

Another way to play this may be through the Social Media ETF, ticker symbol BUZZ. It is trading at 23 and change at the moment ..

This is it from me for now. Let me know what you think. Add any more names I may have missed that you think may do well. Subscribe in case you want to get upto 5 similar posts with my thoughts and levels every week.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

tic, I think substack has turned out to be a great platform. One where you can more fully flesh out your rationale and perspective on the market.

Many thanks for guidance/direction.