Traders-

As we enter the last few trading days of the year, let us briefly look at some of the catalysts and where things stand as I see them.

Last week was meaningful event week which helped clarify some of the questions that I had.

I want to for a moment unplug from simple one dimensional thought that rate cuts always equal bullish and instead ask ourselves a few questions to try and figure out where the puck could land next year.

Let us first start with the FED Chair’s commentary last week.

Powell came out to be quite dovish, ever more so than I expected and declared an end to rate hikes and signaled a beginning to a generous rate cut regime, starting next year. This narrative was later pushed back by some other FED high ranking officials but damage was done by Powell and I think it is safe to say that the FED will begin rate cuts next year. I have been predicting this for quite some time where I called an end to rate hikes a few months ago and I do not see that change now.

The market calculation now is to see rate cuts start as early as March 2024. This is where I differ slightly where I believe there will be rate cuts but they will be in the second half of the year, rather than in the Q1. This is my first key assumption.

The second key assumption is that the customer spend will drop rapidly as we enter early months of next year. This should take the starch out of consumer facing sectors, from automobiles to electronics to other discretionary customer spends.

The third assumption being that a lot of good news by this market has been priced in here 4700-4750 area in the SPX.

This leaves me with two things which are not 100% clear-

To what extent can the FED continue to do Quantitative tightening before something breaks? Quantitative tightening pulls liquidity out of the system and it increases a risk of something breaking in the system like we saw earlier in March.

There is a breaking point in there somewhere in long term yields where roughly 6 trillion in money market funds will need to get out of the money markets and find home elsewhere. The ten year yields are already pushing below 4%. So what is this breaking point? Are we there yet or will it need to see a further breakdown in yields to get there?

Let us talk about the yields for a moment.

I was amongst the few to call a low in TLT around 80 bucks here in this Substack. TLT has since rallied about 25% to close near 100 on Friday. The strength of the rally has been fueled by bets that we are now on our way to sub 2% rates.

I personally think the long term rates in the US are not going to go back to 2% any time soon. Or at all.

I think the 2% inflation target for FED is and will remain a pipe dream. Due to this reasons, I think the terminal FED rate for years to come could be near 3% rather than 2%.

The main reason why I think this will be the case is that I have a bullish energy bias. If I have a bullish energy bias, I can not see a 2% inflation any time soon. Add to that if we continue to see robust rally in tech stocks, this could create a feedback loop where services inflation could also remain high for a long time.

Whether you like it or not, a floor under the rates keeps a ceiling above liquidity. I personally think it is highly unlikely that there will be liquidity conditions like we saw in 2020-2021 any time soon, unless something major breaks in the system. Yes, there is going to be wasteful spend on the Fiscal side but this could be very sector specific, clean energy for instance, but I do not see a market wide liquidity feeding frenzy any time soon.

Powell risked stoking animal spirits last week but I think it stopped shy of an all out mania like we would have seen only a year ago.

My view is that yes inflation has cooled down but in absence of higher unemployment rates, and especially in presence of higher asset prices like that of Nasdaq, housing and S&P500, we could continue to see a push higher in the services inflation. Even if I buy the argument that inflation is now dead, in theory, as reported by official CPI numbers, it does not quite pass the smell test in real life.

While I watched in amazement the FED chair declare win over inflation, I think to myself, what is so wrong about a couple of years of negative inflation? Why really stop at 2%? The price hikes in last few years have made everything expensive. Even if inflation is 0%, these high prices are here to stay.

Combined this with my view that the consumer spend is going to wane sharply, we could see a situation of slow growth as well.

Low inflation + low rates = bullish asset prices.

Low inflation + low rates + lower growth does not equal bullish asset prices necessarily.

I am wrong, if # 1 transpires above.

However, I think I will be very right in my assumptions if we begin to see a pattern emerge where # 2 is more likely.

I do want to address the assumption if I am what is called a “Permanent Bear”.

I am not. I am far from it which has been shown in my bullish bias for numerous stocks which are up several times this year alone.

So what really is my plan as I wait for my thesis to play out?

To be upfront, let us say I have a 100 dollars to invest. I am very shy about putting all 100 to work here at S&P500 4750.

What I am not shy about is that I may buy 5% at 4300, another 5% at 4100, and another 10% at 3900 and so on.

Let’s say doing so, I end up with an average price of 3800-3900. This is just an example to illustrate my view point. The actual average price may be +/- 100.

I use this example to demonstrate that I am far more comfortable with an average price of 3800 than an average price of 4700 if I were to put all of my money to work now.

I may also look more of a genius if and when the S&P500 pulls back to near 3500.

Now the flip side is that we may never get there. That is always a risk.

May be we never trade 4600 ever again now. If that is indeed the case then well I will have to replan. That is a risk I fully understand and accept. I am comfortable with that.

These are some of the questions that every long term investor has to grapple with, not just me.

Now of course this is a perspective of a longer term investor. If I am a day time frame or a weekly time frame trader, does any of this really matter?

Not really. In the intraday time frames, I am not looking anything beyond a handful of points here and there. I do not think about FED funds rates, inflation or where the bonds will be 3 years from now.

To summarize this section -

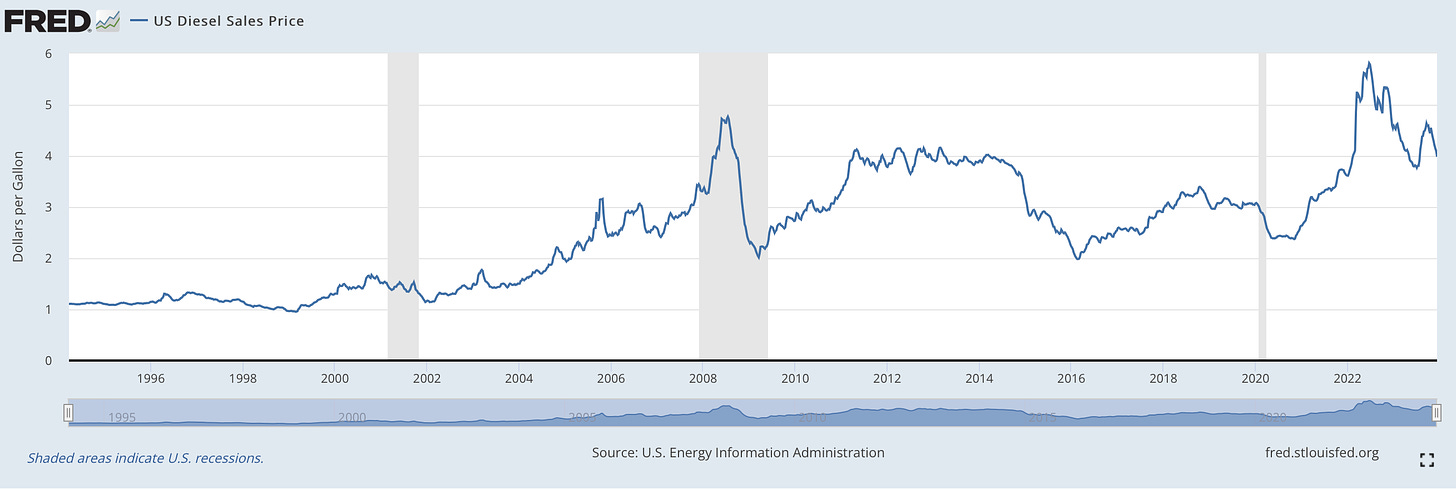

I am calling for a recession next year. I do not think the US will be able to avoid it and achieve the so called “soft landing”. I think higher energy prices are a real risk to the economy and a lot of folks are not considering this. While gasoline prices have dropped, if you look at diesel prices in the US, they have remained fairly steady.

I am calling for a floor beneath the long term US interest rates near 3%. I think we are closer to that floor than we are to 2% inflation. If this actually happens, I think this one factor alone has major ramifications for several current macro models.

I am also calling for a delayed gratification from the FED. I do not think we see rate cuts in next 3-4 months but may be around late Spring to Early 2024 Summer.

There are BOLD bulls and there are OLD bulls. I prefer to think I am the latter. Not in terms of age but rather in terms of longevity. At this point, based on my personal situation, I am more in favor of anticipating and preparing for next 2-3 years rather than in reactive mode based on day to day policy handicapped, bipolar FED. If the FED indeed has decided to cut rates, I will like to ask them what is this decision based on?

Have we solved the affordability crisis in the US and elsewhere globally? If I am the only one seeing pain amongst folks when it comes to reduced affordability, whether that is rent, insuring your belongings or at the grocery shop, then I have been very wrong.

I have tried to explain my view point thus using the current dynamics, as well as laid out my long term plan on how I will address anticipated price action in the markets.

This is a longer term view of 2-3 years out. As far as daily and weekly time frames go, I have not been strongly bearish or strongly bullish in last couple of weeks but before that I had beens strongly bullish around 4100.

In the daily and weekly time frames, I only lean against the levels, like the ones I shared this Friday, which were both low of the day as well high of the day.

Recap of recent ideas

SPX

On the SPX side, my main expectation from last week was to rise into 4630 area from prior Friday’s close at 4600, find sellers to test 4580 area.

We traded up to 4630 AND found some degree of reaction to trade down right into a few handles above 4600. But that was about as much downside as we got. This 4630 level was tested again shortly after and resistance broke to become support and we spent most of the week above 4630, to close the session near 4720 this Friday.

Other ideas

I shared 4 other ideas last week which all worked out quite well. At some point in the week, a couple of these were up as much as 35%.

COIN sold down into my support level at the very start of the week and then rallied after finding support at the OrderFlow levels.

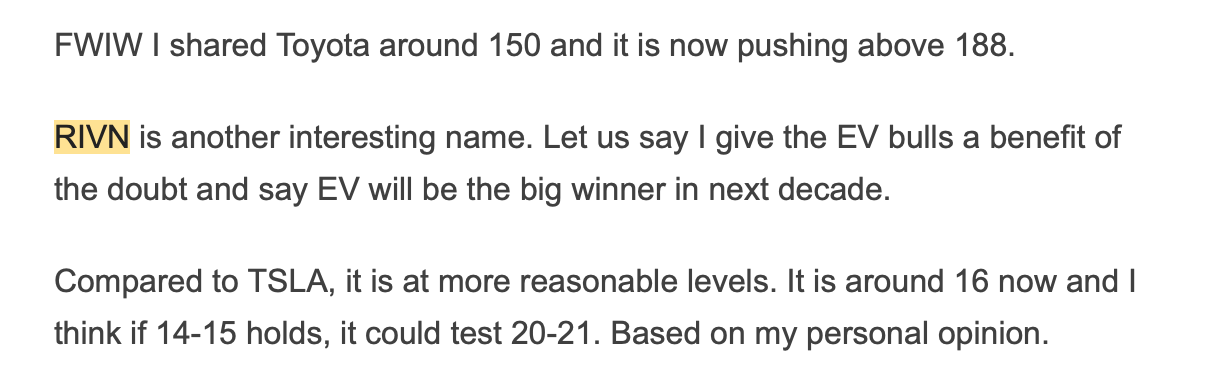

RIVN

Cyber Sec

Cyber Security stocks have been on a tear. I shared these a few weeks ago with subscribers how I see support come in for these names, such as PANW, CRWD etc.

PANW at the moment of this blog is now trading above 300 bucks. Very strong technical action.

ENPH

ENPH was yet another one of my ideas I shared with folks near $70 as potentially being oversold.

This stock had an insane week with the ticker rising about 20% on the week alone.

KRT

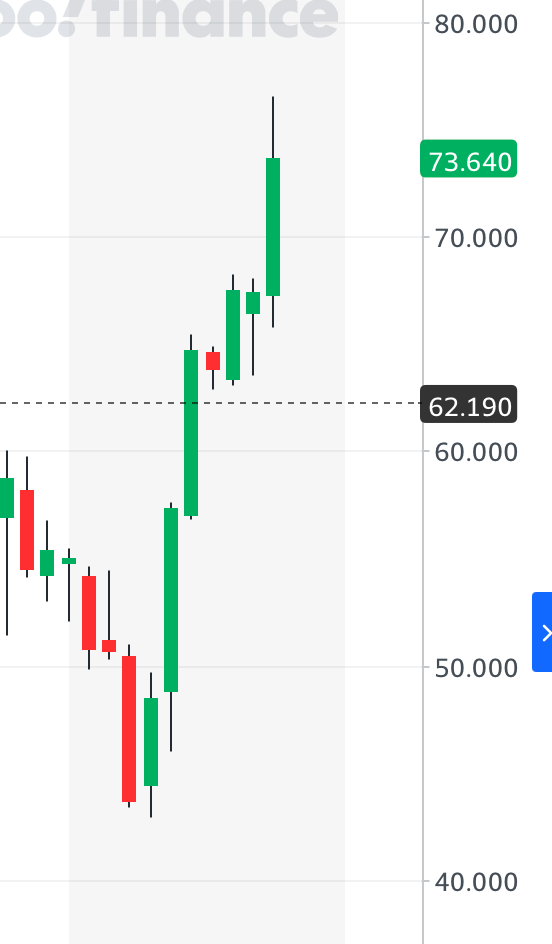

Can OrderFlow concepts only work on the popular names or can they have application elsewhere? Take a peek below.

I shared the Boba tea stock KRT near 17 bucks. The stock pulled back into this 17 handle and as if magically found support to now trade slightly above $23 area.

SPX/Emini levels

The medium term primary technical context on both the Nadaq as well as SPY is that of a range breakout. On the short term, the market has important level right above Friday’s close which is at 4730 for the SPX and 4780 for the Emini. Going forward I will just be quoting from the EMINI. Right now the spread between SPX and ES is quite large but as we get closer to the rollover in 2024, these spreads should narrow. Right now the delta is about 50 dollars.

My key levels this week will be 4790 and 4760 (Emini S&P500).

Scenario 1: I think we could see resistance come in near 4790 for a move down into 4760. This could correspond to AAPL 200 as potential resistance.

Scenario 2: For downward trend move, we could see 4600-4630 tested, if we begin to see Daily closes below 4760. This may correspond to AAPL 190-192 which if traded could offer some st support.

Generally I think that the bulls have an edge this week as long as they remain above 4710 (SPX). Whereas if they lose 4710, I think the next level of interest could be 4600. This corresponds to 4760 and 4650 on the Emini March ‘24.

For any one super new to this blog, I want to add a note on how not to read these scenarios. If I think 4790 is a key level, it can work both ways. While my initial thinking is we can see some sort of reaction at 4790 for a move down into some of the other levels I mentioned above, let us say we gap up above it on Sunday night and come Monday AM, we are not even able to test this in the cash session.

At that point, at a minimum I am looking for some intraday closes below 4790 to reinstate my belief that we can see some bearish action at this key level. So in other words, if I do not see any reaction/rejection at this level, if we slice thru it with no fight, gap up above it, remain above it for entire week, those are some of the telltale signs that invalidate my view point. Many times in such cases, 4790 now becomes a support level for me in the short term, rather than continuing to be a resistance.

For example, 4600. This was a great level as long as it held. Now on FOMC day we are above it. We are now at 4620, 4650. Is is still a great resistance? My initial thought will be that it could be a great support now that it is broken. And for it to be resistance again, the price has to be under it, not above it. TA 101 but very easy to forget.

Other things on my radar

FOUR

It is a payment processor and like my bullish call on SQ 0.00%↑ at 50, it is also having a good week or two.

My Line in Sand (LIS) on FOUR will be around 65. I think if it were to pullback into 65, 64 area may be, it could be headed higher into 85-86.

What is LIS? It is my stop level where if we begin to see closes below it on a successive basis, it means I have been wrong.

Folks, my newsletters take a lot of time to prep and research. If you like what you see and it is helpful in any way, please consider liking, sharing and subscribing. The newsletter is made possible by support from traders like your self. As long as we have folks support the publication, I will continue to share my thoughts in one form or another.

DOCU

I have been a DOCU bull quite a few months ago and now with buyout rumors swirling the stock was up big on Friday to close near 63 bucks.

With Docusign, I think any pullbacks into 59-60 could be supported. I think this may want to target 70 area as long as this 59 or so handle holds on it.

OXY

I initially shared my OXY bullish bias here in Stack around 30 but in recent weeks have reiterated it around 55. I remain a long term OXY bull.

Personally I think if you look at traditional fundamentals and macro picture, there seems to be absolutely no reason to be bullish on oil.

I think that is a good thing.

Stocks like OXY are in a very long term tight range and I think once this range breaks, either to the upside or the downside, this could be a very large move.

The lower end of this range appears to be around 55 and I think this is a decent support. It is now around 58.

Buying OXY because someone like Warren Buffet bought it too, is a wrong reason I think. Everyone should have their own reasons to do anything.

Buffet also has a few billions parked in preferred shares of OXY which the common retail can hardly get access to. These preferred shares pay about 8% in yield a year. So to base any idea on what Buffet does is not very productive in my view. A lot of time Buffet buys stuff so he can earn an income in form of dividends. He is probably not in OXY so that it can “moon”.

BLK

I am a BlackRock Bull and the stock is my long term investment watchlist. I share these long term watchlists from time to time with subscribers so make sure you never miss another post from me.

Interest rate collapse is good for something like BLK but you could argue how much of great news is priced in?

Having said that, I think if this gap near 770-780 is filled, this may be a decent support level for this to push into 900. It is about 820 at the moment.

770 will be my key LIS on BLK 0.00%↑ .

A fresh look at BABA

I have had a bullish bias on BABA at $80 and it has had taken quite a bit of heat trading down into almost 70. For what is worth, the stock did rally almost above 100 from my $80 level before surrendering to bears again.

It has since found some fervor and is now up at 74.

My updated LIS on this will remain at 70. I think as long as it holds 70, there is a chance we could see 90-95 tested on BABA in near future.

This is it for now. Have a great week ahead.

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Yahoo, Google. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.