Hi trader friends-

If you went away last Friday and are just logging in back to the markets, you did not miss much. Over last half a dozen or so trading sessions, the markets have carved out an extremely tight range here between 5980 and 6034 level which has held even at the time of this post.

From our weekly plan dated 11/16, we held the 5880 support remarkably well and then used the 5903 key orderflow level to launch a 150 point rally in the emini S&P500 index which took us as high at 6050 this past week only to loose about a percent on Wednesday.

While the S&P500 price action has remained fairly muted through the week, we did see some strong moves in mega caps such as TSLA, NVDA and AAPL. Due to this activity, I saw a lot of so called “internet experts” develop a fairly negative view here at the highs, and we started seeing some prognostication about impending “doom and gloom”.

Now let us examine some of these markets again and see if these views hold merit.

Note: I started writing this post early in the week but am only sending it now, so some of the price levels in this section may be outdated.

Starting with NVDA, which on surface looks shaky. However if you are too bearish on NVDA, you have to be cognizant you are forming your view based on recent week or two of price action and trading. This is a 10% trading range. From my perspective, for NVDA to incur damage to the downside, it has to give up that 130 handle. As long as this 130 handle holds, I cannot rule out further upside in NVDA.

If the general market remains supported going into Christmas and New Year, NVDA could remain balanced here in this range and a Credit PUT spread could make sense, as long as we hold 130.

AAPL, on a PE basis is the cheapest of these three mega cap stocks. After its most recent earnings, when this stock sold off into 220, I reiterated my bullish view on AAPL with a target of 240 which at time of this post, we are 4 points away. 220 coincidentally was the low of the move after earnings.

Then as far as TSLA goes, it remains the most expensive mega cap by several yardsticks. This stock has had some pretty wild swings. My support levels in recent weeks on TSLA have been around 300 dollars. I have expected this to push higher unto 400 dollar range but the highs have not held on TSLA. So there is obviously sell pressure on TSLA at range highs. And at the same time, there is support on the stock closer to $300.

Based on this price action in mega caps alone, I will conclude a couple of things:

A) the mega caps remain extremely over valued. Not just by a PE multiple basis but via a host of other factors.

B) Despite this conclusion, these stocks have had a remarkable resilience as well. I know it does not feel that way, if you just look at last couple of week’s of trading activity, but longer term this is true.

An expensive market can still get more expensive. A cheaper market can keep on going cheaper. Auctions 101. So if I am a bear here, I need to see more sustained sell off in these mega caps. At the very least, I will like to see TSLA shed that support at 300. I will like to see rejection in AAPL here at 240 which takes it back below 230. I need to see NVDA give up it’s 130. With this combination of price action, I think we can expect to see some real sell off in the main indices. Not these 1 or 2% moves.

I also want to briefly touch upon some execution concepts around our key intraday orderflow levels.

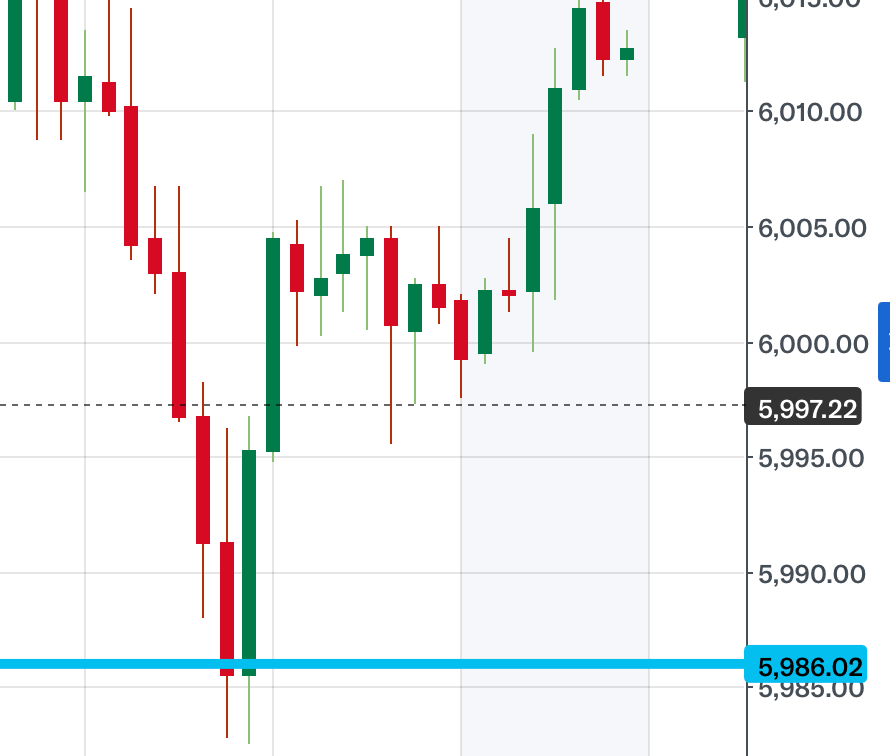

See Chart A below from the emini auction on Wednesday.

6010 is our key level on the day for Wednesday’s trading shared here in Substack on Tuesday night. This level gets tested in first hour of trading. What do we see? We see a very sharp 10 point rally here which then fails to hold the highs. And actually closes almost where it opened.

In auction terms, this is not exactly a great bullish signal. We then give up 6010 and then trade a 10 dollars lower at 6000 where we see a candle with a long tail form.

Long tails on candles, or Low Volume Nodes in market profile generally mean “less inventory”. This is usually a rejection signal. In other words, long tail at lows closing near highs can be bullish. A long tail at highs closing near the lows can be bearish. To validate this further, we see more candles form at 6010, in other words we see “acceptance” at this level again, indicating potential bottom formation.

These auctions unfold like a mystery novel. To understand them, you have to first learn the auction language. After this formation, we are now seeing about a 20 dollar rally at time of this post as we are back up to 6030 on Wednesday night.

This is one way to validate a level. The other way is to just buy the level with the expectation that there may be some heat against the level. So I may decide, I wanna buy one lot at 6010 and another at 6000, with an average fill of 6005. This gives me about a 500-750 dollar risk based on 2 lot fill. Again, this is expecting that I am willing to take about a 500 dollar risk on this trade.

The other way ofcourse is more time consuming and slower- I am validating using the price action, if a support is holding or not, and in this case, I may take a smaller risk of about 3-4 points which is about 150-200 bucks assuming one lot fill. I personally favor the latter, now the downside is that you sometimes won’t get a fill. You also have to baby sit this by observing the auction as it unfolds. The biggest benefit of this approach is smaller, much more well defined risk.

Here is another example below from Tuesday. Chart B.

Our key level was 5992. We sliced thru it. Traded 8 dollars lower and then took off rallying.

Based on my experience, nearly all orderflow traders will place trades based on acceptance and rejection concepts. Which in other words means you are observing the auction develop below or above key levels and then trading the edges of this range, rather than blindly buying or selling a level.

Time frame really does not matter as long as you understand a 10 point stop on a one minute auction or a 1 point stop on a one hour auction are both foolish and unlikely to yield good results.

Generally speaking, you will need to develop your personal trading methodology around these key levels which can yield 5-6 or more trades per session. If I am only one trade a day trader, the win rate will be quite low. We are talking about less than 40% on a long term average. However, the win size to loss size ratio will have to be extremely high, we are potentially talking a 300% or even more.

The reason I can’t bottle this all up in a neat little formula is because markets are made up of perspectives. There are millions of perspectives, if not infinite. Me or you or anyone else, cannot neatly package this in a formula, which indicators basically are. Hope this made sense.

If it did not, sooner or later it will. Stay tuned.

Some pitfalls to watch during the cash session

With a market like Emini, there are a few tactical things you can watch out for, during the cash session-

The first hour is extremely important, and generally unless I have a very strong reason to, I will not trade it.

In the first hour of cash open, you will have very large traders, who will sell and buy, due to no directional intent whatsoever. This could be offloading overnight hedges, winding down pair or spread trades, it could be n number of things. Bottomline is first hour can be very choppy and will run most people’s stops.

When the first hour is over, on most but not all days, it can be concluded that the first hour trading will provide a reference for rest of the session. So, whatever the first hour’s highs and lows were, these could be important reference points for rest of the day, unless it is a trend day. If it is not a trend day, you can see the selling or buying outside of the first hour’s trading dies down. If it is a trend day, you will see sustained selling or buy pressure even outside the first hour of trading. If it is a sell trend day, the retracements will be very shallow. If it is a buy trend day, the pullbacks will be very shallow.

Another thing which is key to master is to figure out who is driving the markets? Is it bring driven by large institutional traders or smaller day trader? Think of it this way- is the market in price discovery mode, or its simply the every day normal ebb and flow? 7 out of 10 days the markets are stuck in a rut with no “price discovery” flows. These days tend to be balanced days. There are a handful of sessions in a month when some sort of new information has entered the mix. This is your FOMC, CPI, NFP days. You do not wanna get steamrolled on these days.

So if there is one key takeaway from this, rather than jumping head first into first hour, develop a habit to observe it. Most professional day traders will enter the picture during 2nd or even the third hour where the intraday volatility dies down and they can move larger size, instead of going for larger moves.

Remember, we want our folks to have longevity. We want to develop a long lasting community and develop traders, rather than harvest your subscription and move on to the next newbie unlike some other furus. The only way to survive these markets on a long time line, is to understand the market. Understanding comes from deeply knowing the driving mechanisms. Not by becoming a good chartist or knowing all the indicators. Charts are created by price action. Charts do not create price action.

At end of the day, there is an awareness and attention context to understanding these markets that cannot be understated. Because the understanding comes from understanding your self rather than some fancy indicators or chat rooms. It is often tough to articulate such views because this is all so personal. Everyone is different. However, the bottomline is you wanna approach the markets without any set perception about yourself. You wanna be an eternal student of these markets. The moment you approach these markets with an air of being an expert, or a Mr/Miss know it all, that is exactly when you will be schooled and humbled by Mr/Miss Market. Just be observant at all times. Be flexible mentally to allow for new information to be perceived. The markets are always broadcasting information to any one willing to receive it. In coming months, I am thinking about publishing a Kindle ebook with more exploration of this thought process. The book will be included for free for all our subscribers as a PDF.

Folks on an admin side note, some folks asked me why we don’t offer any big Black Friday sales and such like other publications which are offering 50-90% off.

The answer is simple- exclusivity.

I actively look for opportunities to make the publication more exclusive for serious, hard core traders and those interested in becoming one. And pricing strategy is one tool to accomplish that. These levels are just too accurate and can’t be openly shared with anyone and everyone. Having said that, I do wanna encourage serious traders to join us. Use the massive discount code below and get grandfathered in before 2025 price hikes which can EASILY take this publication to be price around $100/month if not more.

You can also now gift the publication to anyone who may be interested in great out of the box thematic ideas and trends.

Levels for next week

During this shortened holiday week, I was bullish on pretty much every dip and pretty much every dip was bought all 3 trading sessions of the week, and we traded a high of about 6060 at time of this post.

For instance, on Wednesday, my expectation was for any dips into 6010 to be bought for a test of 6057.

While this did not come about on Wednesday, we were able to trade this level early on Friday.

For the week ahead, there are a couple of factors at play.

First off the tariff rhetoric is ratcheting up. I personally do not read into this much, in terms of it being executed in an orderly and consistent manner. This however does not mean that this cannot create volatility.

So with the latest tariff statements, this could be a plus for the Dollar. I have been a Dollar bull from the 100 area, and it last traded a high of about 108.

Let us say this news spikes the Dollar above 110. A lot of trading algos are programmed to react to these levels automatically and in theory, this can be bearish for the stocks to begin the week. But I think unless we give up 6000, these dips could be shallow and supported.

Outside of this, the main risk event for the week will be the non farm payrolls on Friday.

6000 will be my main level on the week and my main expectation is that unless we begin to close below 6000 on the Daily time frames, we could see support come in at 6000 for an eventual push higher into the 6100 area.

Scenario 1: If we remain bid here above 6033-6037, this could favor the bulls to push higher into 6071-6074. We last traded 6045 at time of this post.

Scenario 2: If we see a liquidity driven move lower below 6033, we may expect some support at 6000 for another retest of 6030s.

These are emini levels, for SPX, subtract about 20 or so, so 5980 being the key level on the SPX for the week. These levels will be supplemented with daily and intraday levels via Daily plan and the chat room below. You all have access to the chat room. If you trade SPY, QQQ, or SPX, the chat room is sorta important.

With this out of the way, let us talk about few setups I like in TSLA, NVDA, AAPL, AMZN and some other names in crypto area

AAPL

If you recall, AAPL sold off after its most recent earnings early in November, into 220 and I was bullish despite this at 220, expecting a retest of 240 at some point. Well, this target was almost hit on Friday, and we closed the session at 237.

I am bringing AAPL into the chat to highlight the oversized impact these stocks like NVDA and AAPL have now on the S&P500.

You can see that AAPL now is at fairly decent resistance here, near 240. This could in theory provide resistance for S&P500 as well and watching the action in AAPL could signal if there will be a pullback and how severe this pullback will be.