Traders-

A quick recap of last week, and then we jump into levels and context for next week.

On the Emini S&P500 side, my main expectation from last week was to float up to 4200, break it and then trade 4400 shortly thereafter on swing time frames.

This was quite alright as we gapped up Sunday night, after my plan was published.

Did not ever fill that gap during the week and then after a few hiccups, drifted up to close the week about 20 handles from that 4400 level. There was an intense bearish sentiment at start of the week and I saw that unable to hold prices lower as the boat got too heavy on one side and had to capsize with the majority of newly minted bears at the lows in it.

Pretty much last 10 days or so, I shared my views almost on a daily basis that I did not see much bearish auctions near that 4100-4200 area and the results are for all to see in less than two weeks.

In this weekly plan, I am going to share my own personal opinion and analysis on where I see the next 200 points come in the main S&P500 index as well as some thoughts on price action of some other key players, like NVDA, Gold, AMD etc.

Below were some other calls that I shared in this Substack-

Dollar

I called for a local top in the US dollar at 106 as well as a top in VIX near 21. Both of these were good calls against a backdrop of the action in S&P500 and QQQ. I do continue to think that the DXY has topped and should soon begin a longer term bearish trend.

META

I was bullish on META earnings at 290. This stock dipped briefly below 290 but was immediately supported after its earnings swoon. I shared my bullish bias on this to target 320 and this last week we came about 4 dollars from this target, with the stock closing near 320.

LULU

I had a bullish bias on LULU at 386 last week with a target of 420. This instance also we came about 2% of my target and the stock closed strong near 420.

AAPL

I shared bullish opinion on AAPL at 160s with a target of 178. We traded up to 178 and closed the week near 178 on Friday.

XHB

XHB is a good example of where this Substack offers out of the box, unique insights which are not found in traditional technical analysis.

I used my research into paucity of land auctions, to highlight bullish bias for XHB at 67. Within a couple of weeks we have now floated up to 77 on this name.

This is just one example. If you would like to receive more such insights delivered to your inbox every week, please consider sharing and subscribing my newsletter as it is a great motivator for me to continue to share great research for folks.

AMD

AMD was also a tremendous call with this stock rising about 17% within 5 sessions. I shared my bullish bias on this right after the earnings near 95 and as of this blog, on Friday, AMD closed near 115.

These are but a few examples of recent calls. You can see others like VDE, XOM, VFC, PINS and XPO etc in my previous few weekly and daily plans.

A couple of names that had good week as well were CVNA and AFRM. Note that I am a bear on these on longer time frames, having shared a bearish view on CVNA at 55, for instance.

This action was strongly to the upside but despite solid action, these 2 stocks have closed very near to the key levels shared by me in form of LIS or Line in Sand.

What is a LIS? It is the level where if I begin to see successive closes above on Daily time frames, it is a signal for me that my view was wrong and the market is headed in the wrong direction from what I expected.

There is a lot more to cover after we get into the weekly levels for the S&P500, but let me first share few events next week which I think are important.

The real macro for next week happens to be on Wednesday and Thursday when the FED chair Powell will testify.

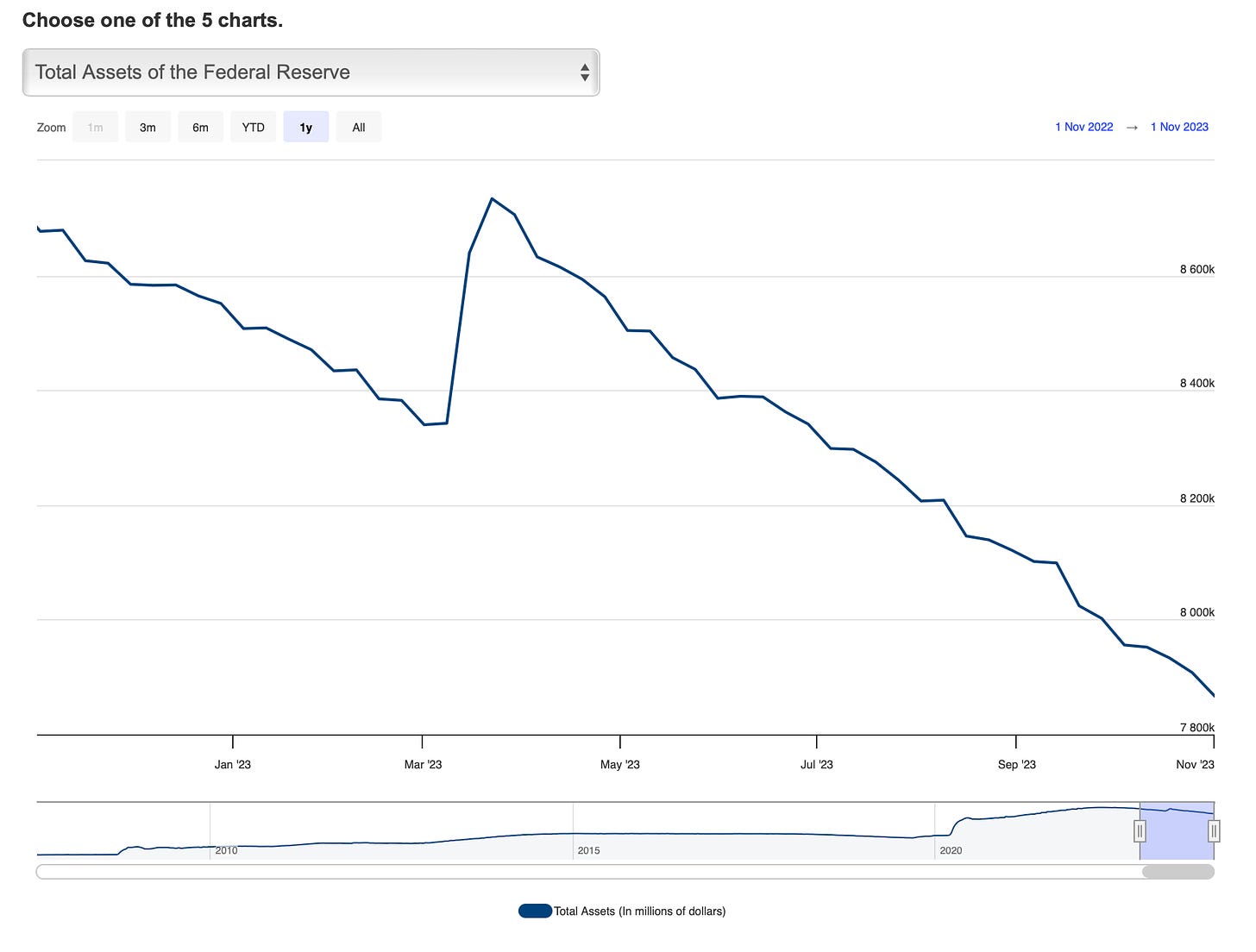

In my last weekly plan, I shared how Powell almost always has a hard time convincing the QQQ and SPY bulls that the current monetary policy is NOT sufficiently restrictive. This almost always causes a rally in the risk on assets based on a belief that the worst of the quantitative tightening is behind us.

This FOMC was no different. Even though there was no mention of rate cuts or even a pause to quantitative tightening, Powell was simply not able to do a good enough job to convince the market that there is room for more policy tightening.

Now, Wednesday and Thursday is his opportunity to undo some of that damage. In past, I have seen some of these gains reversed when Powell speaks the week following the FOMC.

Will this week be a repeat?

I do not know but here is my 2 cents- I thought Friday’s non farm payrolls (NFP) were very important and were an outlier from last few months. I called this on Wednesday with the ADP release that the NFP numbers were to tow the line set by ADP and that was indeed the case.

Now the NFP was weak across the board- whether the jobs gained, or the unemployment rate, or the wage gains. This is why the markets were so robust. Is not the bad news still good news for the markets, or has that changed now?

So, I think there is a possibility that On Wednesday, Powell may come across as more dovish than hawkish due to this softness in the NFP from last week. I think he is going to be prudent not to sound too callous on Wednesday when the jobs data is softening at the same time. This is going to be one of the themes and contexts for my emini levels shared shortly in the subsection below.

Then on Friday, the consumer sentiment numbers are out. This is also an important economic data print but outside of this, I do not see anything major except a few treasury auctions.

My levels for this week

My main assessment for this week is the continuation of the recent action. I am going to share a few levels which I think will invalidate the current uptrend, however on the flip side, as long as these levels hold, I do think we get to see higher rates in the emini S&P500 index.

On Friday we closed at 4380.