Uncertainty is something which no one really likes. You can embrace uncertainty to some extent, but you can perhaps never truly learn to like uncertainty. Most of our time is spent trying to remove any and all uncertainty from our day to day routines. To some extent, most folks are successful in removing a lot of uncertainty, atleast in things they control- like their commute, their dietary habits, the TV they watch, the friends they hang out with but not without significant mental effort.

However, when it comes to the market, the desire to remove uncertainty presents a conundrum. You want to create certainty in a place where certainty does not exist. I firmly believe that the very reason we have a functioning market is due to the uncertainty. Higher the levels of uncertainty in markets, better the moves in markets. Lower the amount of uncertainty, the choppier the markets.

If there was absolute certainty in markets, things won’t move and hence, there will not be a reason to have a market. Think about it, when you already know what is gone happen next, you already know what the price of something is going to be in future, you really do not need a market. A financial market atleast.

Uncertainty, rewards and risk are one and the same thing, just two sides of the same coin.

Removing uncertainty and therefore removing all risk from the markets, simply does not exist.

If you were to remove all risk from marketplace, you will have to know before hand, in real time, who is going to buy and sell, at what time and in what quantity. You will have to know the buyer and seller motives even before they even make their moves.

This sounds silly because it is very silly. Yet, the internet, and TV media is full of experts trying in vain to do this all day. It simply does not exist. It is a mirage.

So is market always random and senseless?

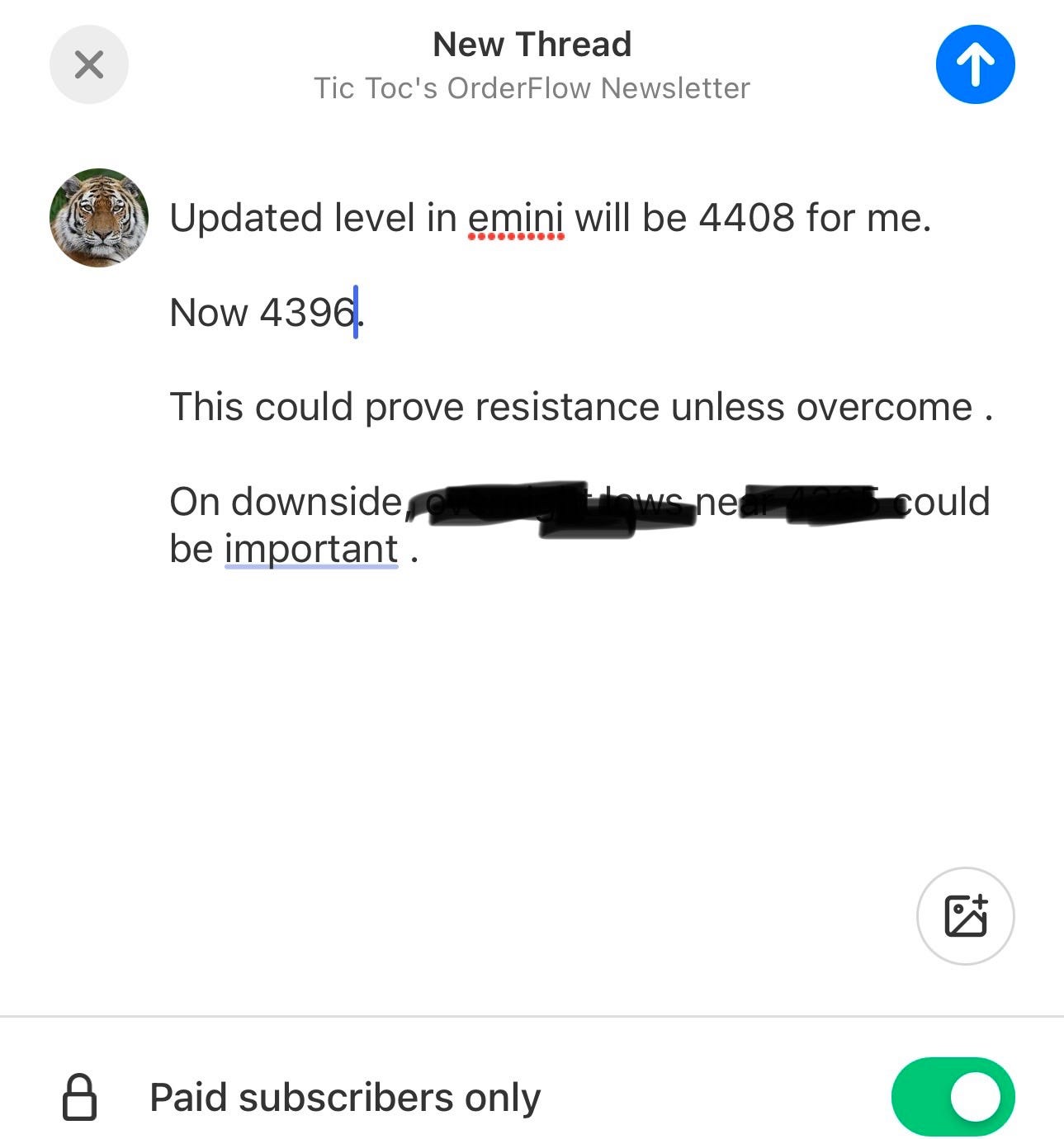

Now, when you take the time as a whole, and slice it into small pieces. there can be correlations and patterns that can develop for a fleeting while for someone smart enough or experienced enough to detect them and know for a fleeting moment that chances of one thing happening over another are greater. For instance, on Friday, I sent the below note in my Substack chatroom.

The fact is this was sent just a few minutes before the open, and despite the consumer sentiment uncertainty, this level indeed turned out to be high of the day. No guessing required.

Now can this be done every day, at all times? Nope, I do not think so. It is in moment of time when a lot of factors just line up, when you can potentially have probability of event x to be higher than probability of event y.

This is all there is to it. Any one saying they have figured out a chart or an indicator that is right all the time is simply a charlatan.

BTW this chat was sent to my subscribers. Install the app below and start receiving alerts too. Do you really want to be left out in the cold when earth shattering events and moves are happening? I did not think so either.

Now why do I bring this up today? May be you already knew this. May be you are fresh to all this and are only now beginning to figure out the math behind MACD and RSI and Bollinger.

Look the problem with classical technical analysis in short term price movements is that it assumes all short term price movements are created the same.

They are not.

There is a character behind every tick which is unique to it. In the short term, like day to day action, volatility, inter-market relations and volume controls everything. It has got nothing to do with indicators. They are all based on history, and bad history to start with- they assume each price print is the same. That is never the case. All price points are never the same!

Now in longer time frames, like weekly and daily, the price action smooths out over a long enough time line and I believe there is some merit to traditional technical analysis using indicators like RSI and Bollinger, and longer term charts.

Once you realize a simple fact that there is no way in world, you (or I) can in any way know what any one else is gonna do with his or her order, you stop wasting energy on chasing certainty and you begin to see the market as a giant probability equation.

In a probability driven world, there are chances. There are IFS. There are no guarantees. Guarantees do not even exist in marriages now a days, and you are seeking it in futures markets? How silly this sounds?!

Guarantees only exist in 9-5 jobs and even those are dicey nowadays at best with AI looming; they promised us work from home forever and now are demanding you come back to office 3 days a week ;)

4408 Friday resistance was not the only good call I had on the week.

In my weekly post, I had expected Gold support to come in and support did come. We saw a non stop move of about 130 points in Gold at time of this blog from my post last week. This week finally saw us decouple from Gold and Stocks. Whether that holds or not remains to be seen. However, I think Gold is in a long term bull market and could remain supported for many years to come, eventually targeting 5000 dollars, once 2200 level breaks on the upside.

The main issue with Gold is that there is a faith in the US dollar. For whatever reason, the world out there believes so much in the US dollar that it accepts it without hesitation as the Global reserve currency, which I think is laughable when you look at the amount of debt the US system has. You also have to weigh in the intentions of the political class in the US. They do not see any issues with borrowing more and more and more, to support causes that help no one in the US, except a very very tiny elite minority. Like 1% of the 1%.

Is this sustainable? Or wise?

Eventually, the US dollar reserve status will end and once that happens we will see Gold in a different zip code altogether. It may not even be a 4 digit price tag.

That may be longer term, however, in the ultra short term, the main catalyst in my view for Gold’s ascent is that the US may get involved in the current Middle East conflict. Now with the US sending multiple aircraft carriers to the region, there is always a chance for major escalation. This I think keeps Gold supported, and we could see 2000-2050 tested on the metal.

Obviously, on the downside, Gold is not very scalable. It is one thing holding 7 gold coins under your pillow, it is whole another thing conducting billion dollar business with Gold which is logistically hard to store, transport and exchange.

I was also an Oil bull from as long as I can remember, and similar dynamics to Gold apply to Oil as well in my view (IMO). The US market consumes about 20 million barrels of Oil per day. Iran produces roughly 15% of this on a daily basis, though it may not be a direct seller to the US consumers, that is still a very large percentage.

If this capacity goes down, even temporarily, we could see a massive surge in Oil prices, to even trade as high as 120 a barrel (WTI). Now whether any shots are fired or not, the threat of shots being fired could keep this market on tenterhooks and I think Oil could remain supported until we see some sort of ceasefire.

Is there a case for ceasefire?

Yes.

Now remember the main thesis for me for both Gold and Oil is based on the degree to which the current Middle East conflict escalates. While Gold could remain supported regardless due to demand, Oil has weakening demand scenario but is supported by geopolitical unrest in the region.

From a US history perspective, the US filled the void in the region left when the UK pulled out after World War 2. The US needs Middle East, but it also wants it to remain volatile.

This region was not always this volatile before 1960-1970. There used to be fairly good amount of cohesion and unity in the region which was disturbed once the US started exerting more influence in the area post 1960-1965. To some extent, the US interests in the region depend on some sort of ongoing conflict in the region (divide and conquer is classic tactic used by superpowers like Russia, UK and US), however, with elections fast approaching, gas prices already hitting 6-7 dollars in some states, the admin may not want to rock the boat too hard. So there is that.

I also had a tremendous call on TSLA which I turned bearish on swing time frame near 270 and we saw complete sell off in Tesla off this level, to close near 250 for the week. Tesla moves can be very clean technically as there is such a wide band of opinions about its intrinsic value.

When you talk to your typical TSLQ type doomsday, conspiracy theorist, for them TSLA never produced a single car and fundamentals don’t exist and should go to 10 dollars.

When you talk to the fanboys, they are always bullish on TSLA, fundamentals don’t matter and it is all about 0 to 60 in 1.99 seconds.

The reality is somewhere in the middle. This is why it is such a nice stock which has tremendous moves of 5-10% a week or even more. Despite being a mega cap.

In the longer term, I continue to believe TSLA will retest some of the lower levels I shared earlier. I think once it gets there, it will have great multiples, at par with its fundamentals which I think will continue to improve.

However, in the short term, I do think that 240 level remains paramount. I think it will be frustrating for bears as long as this level stands and I think we can retest 270 as long as 240 holds.

Friday close was near 250.

In addition to this, I had some good calls on Oil, Target, ENPH, SMCI, NVDA. To name a few.

For foreseeable future, I intend to continue to share my thoughts on a variety of things. If you are already a subscriber, you will be grand fathered against any future pricing shocks. Subscribe now and receive up to 4-5 newsletters every week, plus chat room access for cutting edge, real time levels.

This is an important post and you do not want to miss it as a lot of folks have made up their mind what is gonna happen next week, but I beg to differ.