Folks-

This was a pivotal week in the markets that presented us with data points which questioned recent FED assumptions about the state of inflation here in the US.

Once bitten, twice shy, the FED has been of-late reluctant to commit to any sort of rate cuts as it perceives a threat of inflation to rise again in near term. This type of inaction is common in organizations, like the FED, which are dominated by technocrats. Technocrats have an A type personality and they believe they can apply reasoning and data to solve complex system level problems with an immense number of moving parts. This rarely ever works though. This is why we get beauties like this from the Chairman of such an organization:

Inflation is transitory.

We are not even thinking about thinking about rate hikes.

I see neither a Stag. Nor a -Flation.

Putin did it.

The data however do not support FED’s views that the rates need to be kept this high longer. Whether it is the Non farm payrolls on Friday, or the recent services PMI numbers, or the productivity growth, or even the recent GDP, they all point to softening of the underlying web of economic activity, and hence prices.

Next week is going to be relatively light event risk week. There are no major planned news, other than the Wednesday 10 year auction, followed by the 30 year auctions on Thursday.

Below were highlights of my plan from last week (4/29/24):

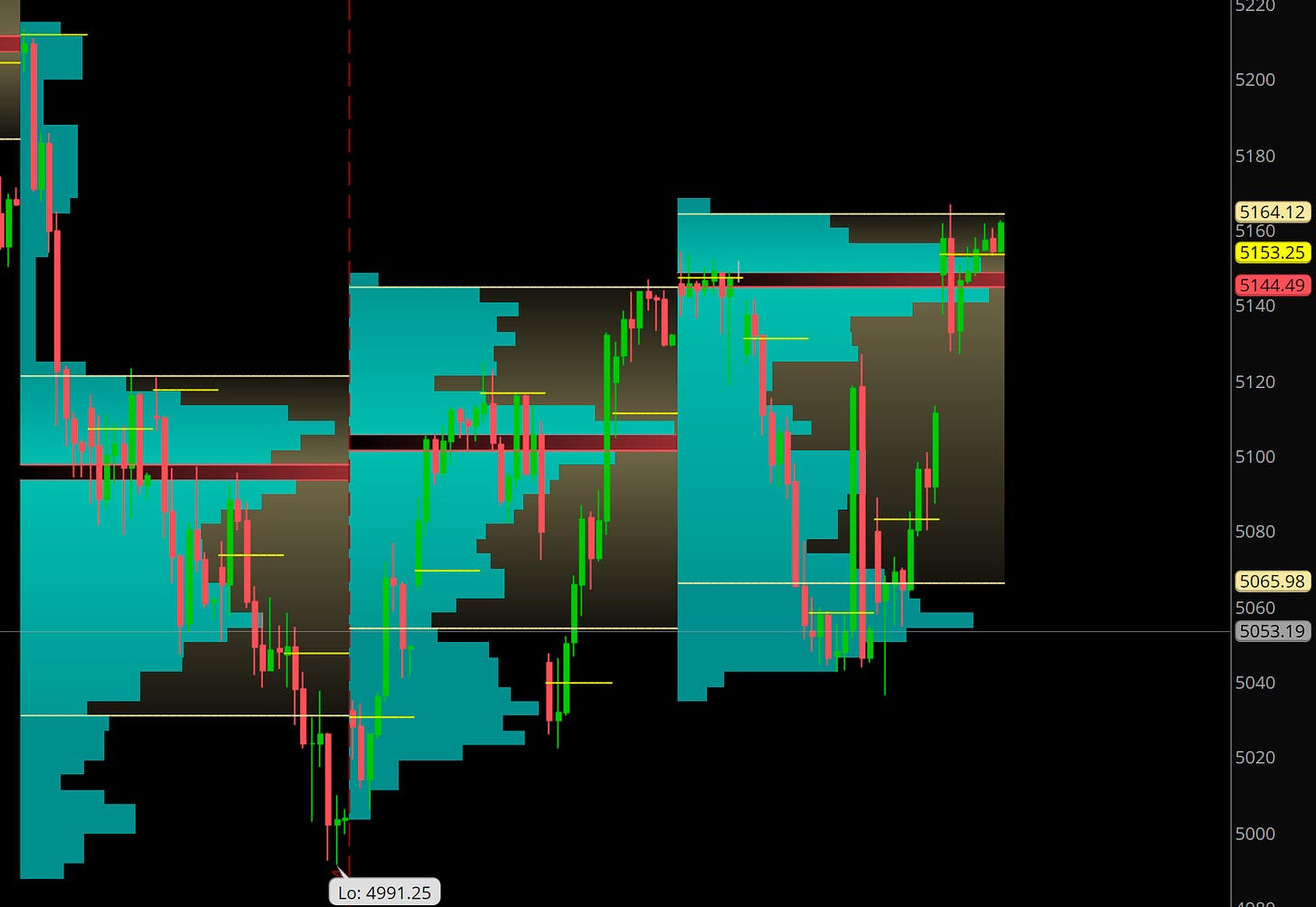

I expected the market to find sellers at 5160 for a trip down into 5050.

Then I expected the market to rally from 5050 back to 5130 due to the NFP. See below excerpt from my plan last week. Image A below.

In addition to this, I had a bearish view in SMCI at 900 for the ER, to trade down into 700. See image B below.

Other notable calls were bullish Bitcoin at 56K (it is about 65K now) and the 5/10, Weekly $1250 CALL in MSTR which I shared at 15 dollars for a target of $70. This was achieved on Friday as the stock rallied sharply from the lows, back to $1250.

I also had a tremendous call in AAPL ER. It traded up to 185. See below. This call was shared weeks and weeks ago here in the Subsatck.

Subscribers get access to all my ideas. Subscribe now not to miss an update. As more features are added by Substack, and as I myself develop other systems, like if you notice I have been sharing more intraday, short term OPTION ideas in the Chat room below, I automatically share these features and ideas with SUBS. Going forward, if you are a FOUNDER tier member you will receive more OPTION IDEAS via the Chat feature. In particular short term options like intraday SPY ODTE calls for instance. If you are active in short time frames, perhaps upgrading to FOUNDERS TIER now is not a bad idea. It is cents to the dollar when compared to other similar services. I think it is a no brainer. I do however ask that you upgrade only if you have found value thus far as a regular tier member. If not yet, then continue on a lower tier until you feel there is value for you personally.

The churn in these similar services is very high. In this publication, the churn is very low. For a reason- readers find value, and many have been able to develop their own methodologies and systems using the concepts laid down here.

Now as far as the frequency goes, I want to be very clear that I do not share something every single day just for the sake of it. I am more active in chat room when volatility is higher. This means usually when market is selling off or we are in earnings season. So out of 52 weeks a year, I am perhaps most active in 8-12 weeks out of that a year (in the chat room). This is consistent with my view that 80% of moves in markets happen in 10-20% of time. Daily Plan is sent every day. 252 days a year.

With this admin bit out of the way, let us look at some earnings and interesting levels for this week:

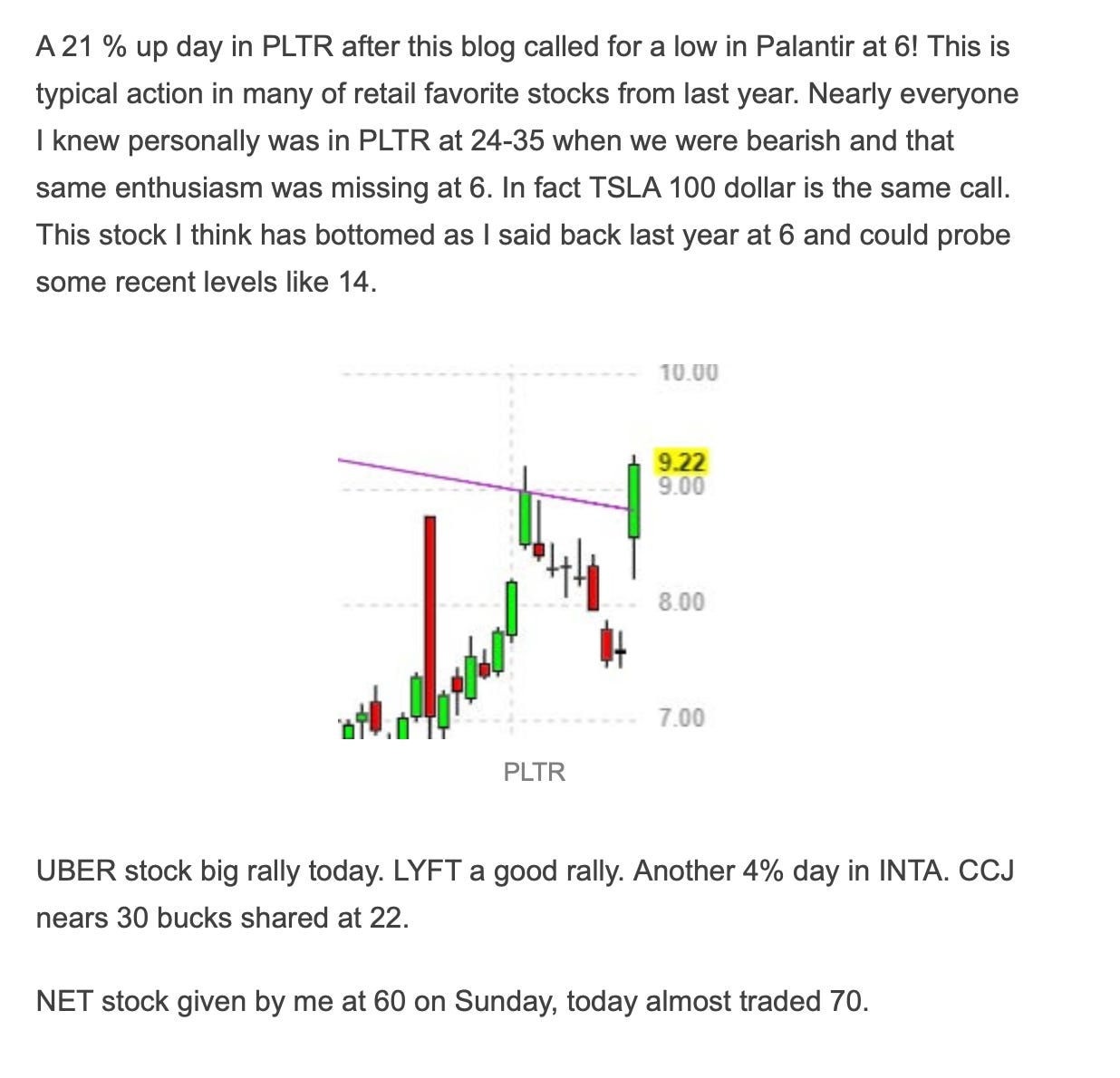

Let us talk about PLTR earnings for a bit..

I have had a tremendous bullish view of PLTR when this stock was at 6 dollars here in the substack. It is 24 or so now. See below.

Longer term I think PLTR is headed to around $30. Now readers know this blog is all about long term investing and short term tactical ideas.

Now as far as something tactical goes, Options are a good way to express that sentiment. Edge is what matters most in options, not certainty. Edge is simply probability of something happening times potential reward if that happens. I personally always try to avoid super expensive options as most options expire worthless anyways. This is why when I share an option, I do not know if it will work or not, but I do know that the option price has a mis-pricing by the MM which can often show up in greeks like the Delta, gamma etc. This is the exact opposite of what most other furus do. A lot of option experts chase options when they are extremely expensive like right after a major rally (or dip) or right before a major news- both of these situations are worst times to buy an option but could be great for selling one.

Having said this, one such option is 5/10 $21 PUT.

On Friday close, the PUT is priced at 66 cents. Come Monday open, this could very well fall down to sub 60 cents. Now note that long term I expect this stock to do well. However, in short term there may be some volatility and this option could rise in value. I also do not like the fact that this stock sells at almost 25 price to sales. It is really very high for such software stocks. So a little cool down does not hurt it. I like this PUT if had for 0.60 or les, for a move into $1.2 or more.

Now let us say, if this stock rallies 15% which is what the option market expects it to due to the earnings. If this gets into 26 area, I think this becomes very close to resistance and it may then fade towards 23-24. It is now around $24.

Now as far as the Emini levels go, we are going to leverage Chart A below to construct some levels.

Outside of the macro context, below are some thought processes used in this:

We see about a 20 day balancing here above 5000 but this is below 50 DMA.

The Week of 4/15 was the most aggressive week which carved out LVN at 5211 which has not yet been filled. 15 days and counting.

The market itself is making shallow “higher highs and higher lows” indicating bullishness.