Traders-

When I sent that update last night, I felt a lot of folks will come in very hot in the session today, thinking that the worst is perhaps behind.

A fatal error.

I was simply not feeling it. I was feeling it when MSFT was sup 400. When NVDA was almost at 100. When TSLA was about as low as 210.

However, I did not like the close yesterday so close to the IB high, and my levels were tested, took some heat in the morning, and then the floor caved in.

We sold off a 160 handles- the largest drop in over 2 years and to rub the salt in for the “rate cuts are bullish” camp, the flood gates of the sell off were opened on same day as the FED confirmed first rate cuts. How ironic.

This is not a new position on my part- I have been saying for several weeks now that confirmation of rate cuts could not be taken kindly by these markets built on carry flows into the US markets. And this was confirmed with Dollar weakness.

Folks- this is an important update. So review carefully.

I want you to take a look at this weekly chart below.

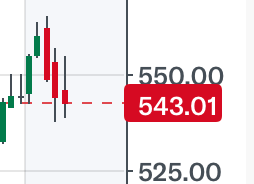

543 is the current SPY Close. However, SPY is a little down after market as I send the newsletter out.

This sort of corresponds to 5480s on the Emini September index. So this is going to be a key level. Ok, the bears do not want to lose this 5480 handle tomorrow, else look at the chart above. This is a not a bearish close for the week, assuming today was Friday.

However, it is not, hence I think this 5480 will be key tomorrow. In fact if we remain above it and close above it, I will think it is a bullish close on the week. We are now about 5450.

On the downside, one week ago I said if we hold 5430 thru all this drama, it could be mildly bullish. Let us assume we do not hold that 5430 tomorrow. In this case, what is driving this market?

Market is obviously not too happy with the FED. FED has given it the first rate cut, and it sells off more than 3% (High to Low).

It is obviously not the big tech earnings- decent beats by META, GOOG, MSFT. Just not enough to keep this market happy.

Yields are dropping. Dollar has been dropping. Clearly not enough to appease the equities.

So I think it is a matter of valuations. May be this market thinks the valuations are too rich. This becomes a value play if we begin to drop below 5430 tomorrow. In this case, I think this market finds some attractive valuation around 5200 level. If traded, this could be an insane move for that December Far out of the money PUT I shared around 4 bucks which is now 8 bucks.

TO SUMAMRIZE:

My key levels tomorrow will be 5489 and 5422.

While the tape looks weak, I cannot be bear as long as 5422 holds and could be support. This level has been a pain point for bears in past and needs to be overcome. We have to follow the price action and we have to wait for this level to break in anticipation of more volatility here.

The bears need to defend 5489 else it may lead to a test of 5540s again.

NVDA

I like similar sort of action in some other names like NVDA for instance.

August 30 NVDA 126 CALL I like it in case there is more volatility and this call can be had for 3 or less. It is 3 and change right now.

IWM

212-214 is a recent breakout level on IWM. It is 215 at the moment.

If 212 holds, I think we could head higher into 225s from here.

Much more to come stay tuned. A lot of setups will be created in next few days and weeks.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.