Folks-

Not a tremendous day for me as there was not much of tradeable set ups for me intraday. My LIS for today was 4403 and once it broke at the open, we kept moving up one way within the IB and after the IB there was not much action all day - with a formation of a P shaped profile in the afternoon.

At the close yesterday my bias was bearish. It did work overnight as at one point we traded down to 4370 for 40+ handles.

However at the open my assumptions were blown to smithereens as we saw a very sharp 1.5% rally in the S&P500. I suspect this is just a dead cat bounce which was due any ways due to some major names being at a good support- however I do not think it is sustainable and I think for Investor Tic time frames, these are NOT the best prices to be had yet. More on that later.

Volume, just like yesterday was anemic. Nothing home to write about. Mega caps had a good day- to my chagrin as I am not a fan of these names at these levels. Once bid above 4403, there was not much fight offered until 4450 orderflow level to trade the session at 4463 at time of this post.

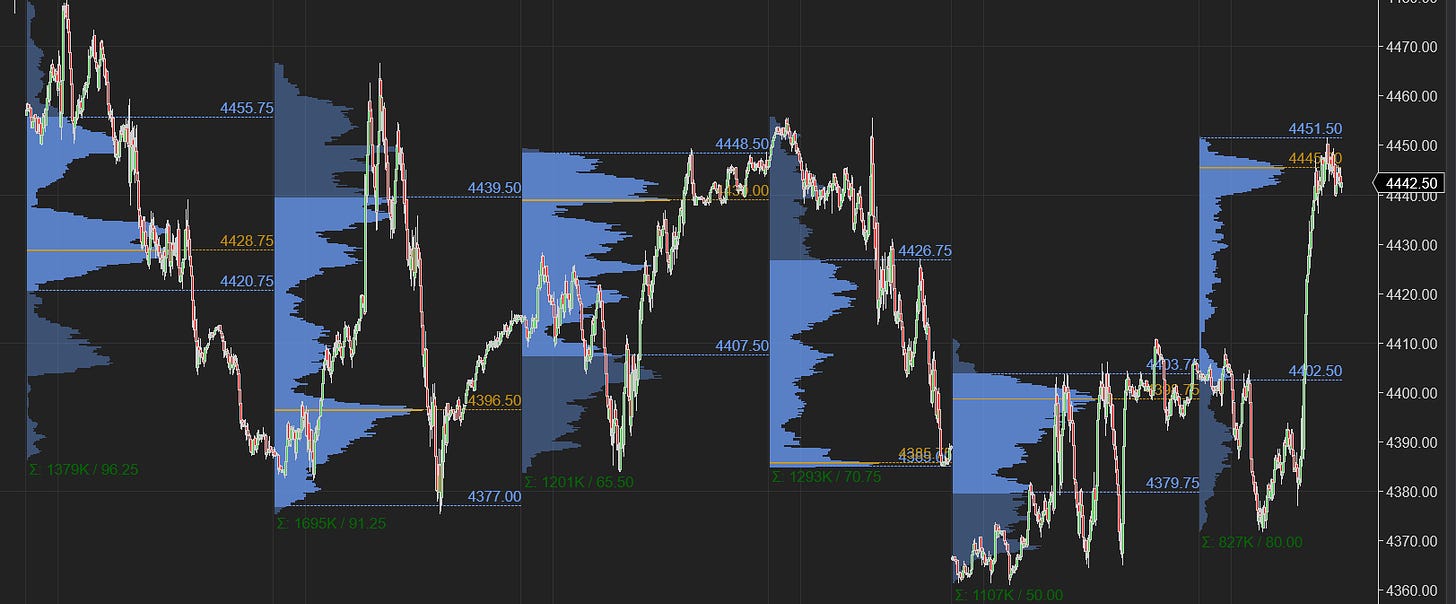

Chart A: ES Intraday below. Despite all the drama, we were not able to take out the multi day highs here on low volume. I would have considered the auction today a good bullish auction if the volume was stronger.

In terms of technical structure, we are still consolidating and I think a move lower can not be ruled out. I think once the bears take back 4403, a very large sell could come.

Low as the volume was, some technical damage has occurred to the bearish narrative. I thought the bears will fight harder at 4425 but they did not. This means on the shorter time frames, like the intraday time frame, I will be careful being bearish unless we take back 4428 tomorrow. I think S&P500 is ever so slightly completing the distribution process. These prices around 4400 while enticing, are not very enticing from a monthly to a quarterly time frame and certainly not at all very appealing for me from an year + perspective.

Those prints for me come in at 4250-4300.

However, we will talk more about it if we get there, when we get there. For the shorter time frame auctions for tomorrow and what is left of it this week, currently these are my levels below:

My Line in Sand for tomorrow will be 4450.

Scenario 1: I want to play on the bearish side, targeting 4400 as long as we open or remain offered below 4450. Bearish momentum can accelerate on a close below 4400, which may break the recent lows at 4360.

Scenario 2: In an event we manage to open or bid above 4450, next resistance comes in at 4480 for me. At time of this post, Emini is trading 4463.

The mindset that all the stocks have to go up at all the times is a time tested mindset which has worked for last 14 years.

But like all good things it must come to an end as well. My view from almost 7-8 months has been that the selective stocks will go up but I will not expect everything to go up at the same time. I do think S&P500 4580 is a formidable level longer term and with it being rejected 3 weeks ago, I think the lower levels at 4250-4300 are favored due to this key rejection.

These rallies in ARKK and NFLX and many of these speculative fluff stocks are like waves… they come and then they go away. I am looking for a very specific indication that this low may be in, and I have not found it. If some one has, then power be to them!

This is not to say they are wrong and I am right. This is just to say, based on my methodology, I am not there yet. It could very well mean that I am wrong- and if so I will pay. But I will not have conviction in many of these names anyways, UNTIL I see it based on my own analysis and methods. So missing the boat for me is better than getting in and have no conviction.

Now let us say we close above BOTH 4425 and 4450 today. That could likely put the new bears from 4400 under some pain. But if I am a long term bull, as long as that 4580 stands, I will not get my hopes too high. There is resistance lined up at 4480, 4560 etc.

I think the best outcome from my perspective will be for the market to let go and trade down into 4250 where many of the names start making a lot of sense from a longer term time frames.

Tomorrow is a MAJOR earning for TSLA. The stock is now trading around 1030, up another 50 dollars from my 980 over this week. It is kind of quite up from my perspective, considering my thinking on the general market. I will expect and wait for a drop into 900/936 orderflow levels if I were to get into TSLA here as a brand new bull.

NFLX also reports after hours today, in about half an hour. While it has had an impressive rally , and is now trading around 350, I will pass it as I think even if it rallies after earnings, it may find sellers around 380. I will consider it around 296.

To wrap up, I am not YET perked up to a lot of these names at these levels as I do think I can get lower prices around 4250 for longer term plays. I will wait for next week or so, I think there may be opportunities in a couple of weeks. My assumptions were tested today as S&P500 broke 4403 and traded as high as 4450. There is some overhead resistance at 4500 and then at 4560.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thank you for this analysis. I can hear in your words the disappointment in the day. Frustrating as it was, it is perfectly fine to not be right everyday...means you’re human, and I dig that about you man...much love 😊

Thank you Tic, saved from Netflix call buying;) at this level, is it enticing to start getting into Netflix for long term?