Traders-

Today was one of those day when both Investor Tic and Trader Tic had their say.

Trader Tic was bearish yesterday at 4220 and his targets were met at 4165. Investor Tic wanted to wait until 4080-4110 and his levels also came about . Overall, a great day to snap some names like GOOG, MSFT, HD, ADBE, AXP at fair prints. Also a wonderful session to trade - both sides of the bid and offers.

Here is the plan from yesterday if you have not read it yet- DAILY PLAN 2/24

Here is the weekly overarching plan for those who have not yet read it- WEEKLY PLAN

Personally I had been waiting for GOOGL to trade under 2500 for several weeks now. That was today. 2470 was the low in move and at time of this post it rose almost 200 points to close the day at 2670!

MSFT was another name I had my sights on if it offered at 265-270. It had a mammoth day close at 295. PM did very well rising from almost 100 to 108!

PLTR oddly had an awesome day gaining 15% after Cathie decided to cut the stock at the lows.

ADBE I had been expecting that the overall market may find a bottom if/when Adobe traded $420. That day was today before Adobe roared more than 45 points!

AXP I had been eyeing sub 180 prints and they came today, before the stock exploded about 10 points higher. I can go on but the the crux being if you had a shopping list, if you had the levels, if you had the context as Investor Tic did, some of these names were slam dunk to pull the trigger.

Unfortunately this was also a day when the West surrendered to aggressions of Putin and company. I had been saying this for a while now that I do not expect a very hard line response to this saga. Now Russia has been adamant about not wanting to have any Western presence on it’s shores. So the way they acted in aggression to make sure this does not happen was not a surprise. What surprised me more was the fact that they faced so little consequences of their aggression, a mere slap on the wrist.

Anyways, I do not want to get into the weeds of this as the discourse gets exhausting; I expected this course of action. The events went my way, and this gave me an added confidence that my view that 4080-4110 will be some sort of a bottom in SPX proved to be right.

Looking ahead, in terms of technicals I think the play is straightforward. What may make it complicated is the news on and off out of the ongoing conflict in Ukraine. Powers that be will try to milk this unfortunate crisis to their maximum advantage - and I will not put it beneath them to use fake news to cause bouts of volatility as we go through next few weeks.

Now for good or for bad , we can not predict what course these manipulations will take , but we do control our levels and preparations. These are complicated geopolitics scenarios. The winners and losers are not always apparent immediately.

As for the rally today, it was a fairly broad rally with everything from the tech names, to ARKK, to Semis , to Biotech and everything in between had a good day. Now as we go forward I think some of these will drop off while others continue to do well.

Going forward, I expect S&P500 to build on the momentum today-albeit with the caveat that there will remain some volatility and raids down due to the fake news factor I mentioned above.

Chart A below shows Emini Daily Auction. A strong close in prior balance.

My two main scenarios for tomorrow are listed below. Any tertiary scenarios or an update to these will be shared on my Twitter. Stay tuned.

I am expecting a continuation of momentum to test what is out there at 4330. An open or bids above 4274 may create a trend upside day with minor resistance at 4300.

However an open or offers below 4274 may mean we trade down a bit into 4220-4224 to find buyers.

At time of this post, S&P500 Emini traded 4269.

From a macro perspective, we have the PCE data an hour before market open. I do not want that to be too hot . Lower the better to keep the bullish momentum going.

On balance I remain bullish if we dip back below 4200 on any FUD inducing news or fake news. However if we do dip below 4200 again, that is bound to cause some volatility and will share updates in that case in my Telegram or Twitter.

Going back briefly into the events of the day, I was already bullish about half an hour into the session as we were making session highs at 4160. I got very strong confirmation when Biden started speaking around 4170. Essentially, the admin has abandoned Ukraine to their own device. I am not sure they had many other options either. West’s hands are tied in all this.

Now this did open up a question from many if China taking Taiwan is next? While no one has the crystal ball to predict these kinds of events- I do have an opinion.

My view is while this is inevitable, China is in no hurry to execute on this . They are playing a very long game. From Putin’s perspective, his time frame and scope of influence is rather small . He mostly cares about keeping NATO out of his backyard. This is not the same as China that wants global dominance and for them , it is in their best interests to delay the inevitable. Therefore this is supportive of the market action we saw today.

One thing that stood out for me from Biden’s presser today was when he said how he is in consultation with the Big Tech about cyber threats. This is the moment when things really took off.

I do think this means we see strong follow up moves in GOOG, MSFT etc . GOOG for instance now trading back above 2660. I think this has very much the potential to make new 52 week highs again very soon. I do think several other names like AXP, MSFT, even AAPL as it had a strong bounce off my 155 level has the potential to do well in next few weeks.

One unlikely winner out of all of this was ENPH, amongst other solar names. I am not a big fan of it’s current fundamentals but if we get a prolonged period of energy inflation and Russian sanctions, I think some of these stocks have another 15-25% juice in them. Technical chart attached below.

In other news, Gold shined today really bright, trading as high as 1976 before sheen came off and it settled at 1910. I think it was the speculators taking profit after the military confrontation became unlikely between the US and Russia.

I think even if gold cools off in next few sessions, it remains on target for a test of 2200. NEM which I shared earlier at 50 bucks continues to do well, now closing at 68.

To summarize:

Exceptional market action today, not seen by me in last 2 years since March of 2020.

My thesis is effect of Ukraine conflict on the US equities for most part is priced in as the biggest risk was military confrontation between Russia and USA and that risk has been removed today AFAIK.

This means the market can base here for few days and make a test of the bracket upper end at 4500. However, the caveat for me is there are currently active players in the market who are causing bouts of short term sell offs by misinformation and I think that will continue. These dips as long as we respect the wider bracket which is 4200-4500, IMO will continue to be bought.

While I do not think Taiwan is a risk right now, I do believe there is a chance that the US wages a proxy war against the Russians. While this does not change my thesis we are going to balance here for a while, if this gets prolonged and bloody, this has the potential to retest 4150/4160 area from today.

Remember this post and the levels are static. The order flow and context does change all day. And I primarily use Twitter and Telegram to communicate when this has changed plus any new updates. See below examples from today. Make sure you are on my Twitter and turn on notifications. At times, there is some noise on my Twitter as it’s one of the larger accounts with diverse range/interests of followers. To address this I am working on to get a “Super Follow” which hopefully will allow me to keep the noise down and target specific topics related to themes covered in this newsletter. More on that later. Stay tuned!

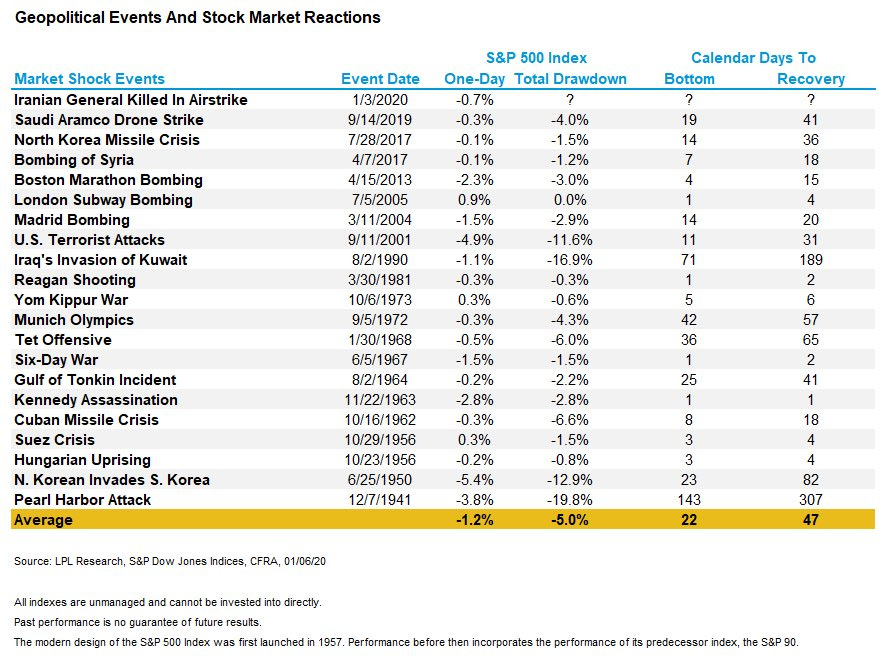

Various GEOPOLITICAL events and average time it takes to recover. h/t: Brian Option and LPL.

War dips are bought, on balance. Source: NOD008 on Twitter.

Subscribe to my newsletter to receive up to 5 similar posts every week.

~Tic 🍀

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Tic, do you think TSLA has bottomed or do you think sub 700 prints will be explored later when volatility hits? Thanks

Great read as always killed it today! Oh can I be on your super follow master tic😋