Folks-

Let’s cut to the chase.

The daily range today was one hundred and fifty points. This is extreme intraday volatility. While it has it’s benefits, it does take it’s toll on you if you are not careful or not on the right side of the market.

For me personally, I was chopped around this morning at the open. Open was below 4327 . I did not get a strong read on tape until I sent this message in the AM at 4355. After this was posted, the market started it’s slow but steady decline to 4260.

Biden spoke an hour or so before the close, his prepared remarks pretty much capped the downside in emini S&P500 , leading to a 70 point rally off the lows. Only thing that stood in between new session highs and emini was 4327- before she settled at 4301.

There are a few distinct themes appearing from current geo-politics crisis:

Some actors are playing the fake news to their advantage in S&P500 futures markets . I alluded to this earlier in my weekly plan: Weekly Plan

Based on US response so far, I do not think there is a risk of further escalation, at least from a military perspective. Right now Putin controls the narrative, he controls the ground game 100%.

What this means is , in my view, the inflation picture back home is going to get a little murkier before it gets better. I think the biggest benefactors of this are going to be commodities, commodity producers , precious metal miners and some big US corporations with few exceptions. More on that later.

For tomorrow, there is not much planned US event risk. My Line in Sand (LIS) for Emini is 4300.

I think if we open above 4300 or if we BID above 4300, we may run into strong bids wanting to go higher. I will confirm this with technical indicators like Tic TOP, TRIN etc

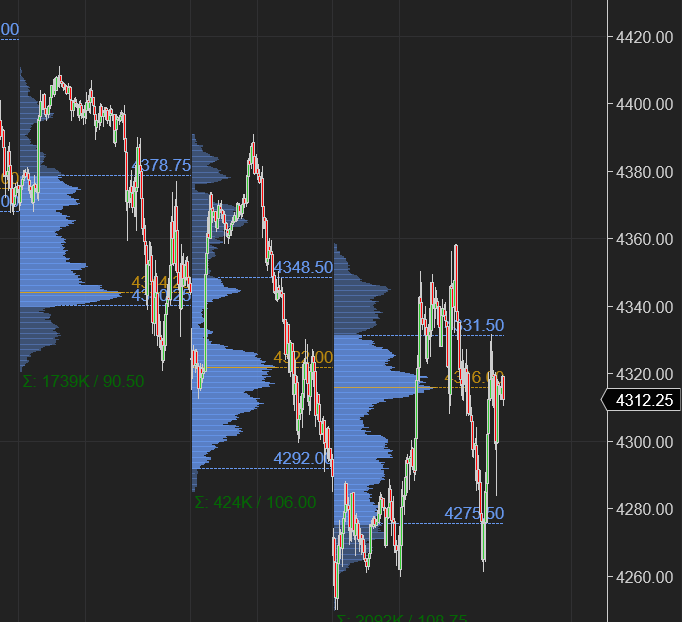

Chart A: S&P500 Emini Daily Auction.

With this context, here are my two main price scenarios:

OPEN or BID above 4300: this is the bullish scenario for me with some minor resistance at 4327 Target may be 4352.

OPEN or OFFERS below 4300 but above 4271. Lows of the day today may be tested around 4260. I do not expect much downside action below 4260. But if the Tic TOP starts reading extreme values of -3/-4, I may revisit this premise.

At time of this newsletter, Emini last traded 4312. Any updates to this plan will be issued on my Twitter/Telegram. So make sure you join me there as well.

Click here to learn more about Tic TOP indicator: Tic TOP Script

Subscribe to my Substack to get upto 5 similar posts every week.

Now going back to my previous point about inflation getting hotter, I thought both Soybean and Wheat had good days today. The charts look solid for a move higher in next few sessions IMO.

Chart B: Good move in commodities like Wheat. I think there is some support at 826/830.

Commodity plays like VALE and RIO also had solid sessions. I think these are poised to go higher along with other miners like NEM. RIO did cool off in 2nd half of the day after Biden’s speech. 10 year yields have been cooling off, I think that may be due to current geopolitics. more than any thing else.

Longer term, I think there is this tug of war between folks who believe FED can control inflation & it will actually do something about this AND the camp that believes though FED wants lower equity prices , it wont do any thing to rein inflation in. I am in the latter camp.

I think pretty soon it will be evident to other players as well and inflation will run rampant at 8 % and above. Once this becomes evident to more people, these miners and some of the other plays like GOOG will do very well IMO compared to their peers.

In other plays, both SQ, PLTR as well as their mothership came under pressure again today. Here is my detailed analysis on this over the weekend: PLTR What's next

DWAC also had a superb day. I do think DWAC will have a hard time finding suitors above 112. Here is my analysis on DWAC: DWAC Deeper Dive

Tic.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Tic how about TSLA? You said you will discuss something today on TSLA

Hey tic; excellent analysis as usual. Had a quick question; IK you mentioned how your levels come as a result of intensive observation of the DOM and tape. What exactly are you looking for in particular to generate such levels, it is where a lot of friction is occuring at a specific price you notice in real time or an abnormal number of market orders coming in around a specific price? Any input would be appreciated:) best- Deep