Folks-

3 topics in today’s installment of the trade plan.

A) My insights and trade plan for tomorrow

B) Order flow Tuesday deeper dive

C) I told you so rant on TSLA

My email subscribers get up-to 5 similar emails every week, if you are interested as well, hit that subscribe button below.

A) Wrap up of trade plan and my levels for tomorrow:

Yesterday’s trade plan called for a test of 4800 if we opened or bid above 4771. This target was met overnight. This has been the theme for last couple of sessions that my targets are hitting in overnight trading.

I then sent an email early morning that the futures looked quite strong and a pullback into 4789/4793 may be supported. The pull back came but did not hold at all. I got out for about -6 here.

I then added that I do not want to linger below 4789. Once 4789 failed, we traded down to my 4771 area quite rapidly.

I was able to send an update in my Telegram just in time for the subscribers at 4782 that I thought we may sell lower. We did and at time of this post 4782-4789 have proven to be resistance. See below link for my Telegram post:

Now for tomorrow, at time of this post 4771 appears to hold. I think this level will play a key role this week.

Looking at related markets, and other factors, I want to be bearish now….BUT what I REALLY need is a technical confirmation which IMO could be a D1 close below 4771 today or tomorrow.

With this background, if we open or bid above 4771 tomorrow in the IB period, I want to be bullish for a target of 4800.

If within the IB period we start trading below 4771 or open below 4771, I want to lean against shorts, target 4746, followed by 4723.

Tomorrow is the FOMC day. So additional volatility may come due to that, the minutes come out at 1 PM CST. Something to keep in mind.

Emini last traded 4780 at time of this post final draft.

Updates if any will be issued for subscriber on Telegram or Twitter or both.

B) Order flow Tuesday deeper dive

This morning I asked folks if they want me to analyze a stock. Several dozen responses came which made me think it can be a weekly thing where I do a deeper dive based on popular requests. I was surprised but I think TSLA and BABA were the 2 most requested tickers; I decided to go with BABA .

BABA Technical:

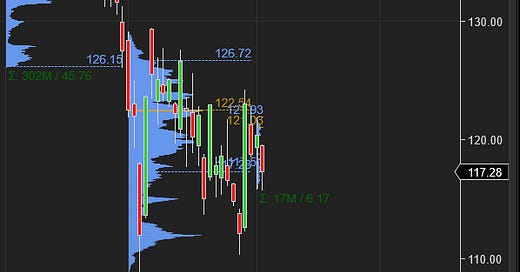

BABA has been in a vicious downtrend, having lost 50% of its value in a year.

December was one of the highest volume months last year with a monthly low around 110 dollars.

Stock is now trading at 117 dollars. BABA has impacted several investments like KWEB as well.

BABA fundamentals:

The stock is selling at a 17 multiple which is more than half off its long term averages. Basically it is a steal here, if you go with fundamentals alone

As of most recent quarter, it generated 10 billion in profit on sales of about 30 billion USD.

China is resilient, they are hard working people and their country’s economies getting better every year. Expect revenue to grow not shrink.

BABA other factors:

One risk BABA has is delisting due to ongoing cold war with China.

If it does, it gets listed elsewhere. They do very little business in the US, most of their sales are out of US.

My Summary of BABA:

While BABA valuations are extremely juicy, technical are not fully ripe yet IMO. BABA for short term trading is in a no man’s land right now. At 117, it may fall into 100 dollar range. See bullet point # 4 for my context.

If I was buying BABA for less than 1 year or even 2 years, I will not buy BABA.

If I was buying BABA for next 5 years or next 10 years, BABA is very attractive here at 117.

Technically, since BABA is in a free fall, to reduce or cap my risk, I will do this:

A) Let BABA fall into 100-104 dollar range and get in there with my LIS below 86/87 bucks.

B) Alternatively, wait for BABA to close above December VAH at 125 dollar with my LIS below December lows at 108 dollar.

See Figure A below for technical chart and my levels in context of profiling.

If you enjoyed my BABA analysis, feel free to share this with other traders like yourself.

C) I told you so rant on TSLA

Now let us talk about TSLA. I became quite emotional last night, not my usual self, when I saw many folks commit Call Buying Harakiri last night when Tesla was trading at 1210 dollars.

I sent like a dozen tweets that 1200 is not a fair price for me that I wanna get in at lower prices.

I think a lot of folks, goaded on by their amateur furus ignored me and got wrecked this morning when TSLA fell almost 100 handles lower.

See Figure B below. TSLA has a bulbous formation at the 1200 handles after a massive gap up. This is the average Joe 0DTE call buying which the MM are selling into. Promptly TSLA sells off 100 handles in one day!

Looking ahead: look at today’s action. Slim profile. Volume node at the lows. This is most likely, but not certainly, this portends further weakness IMO. We shall see. Now 1151.

Moral of the story: when a stock gaps up, be very careful what prices you pay both for direction and volatility premium increases!

Read more about Volume Profile on my latest educational article here.

Join my sub-stack for more educational content if you are interested in order flow.

This is from me for now. Much more fun stuff coming for subscribers. Enjoy rest of your day!

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Tic, it was me did the thread via twitter (@longhaulusa1) on your thoughts on price. If you enjoyed, would love to make more of these in the future!

Hey Tic, any update on BABA now that its trading above 125 and has huge orderflow for KWEB and BABA. Appreciate it man!