Traders-

Hope everyone had a good Thanksgiving holiday and are getting ready to crush the trades this week!

While the market made new lows, I have been working on a couple of new educational posts for my subscribers. I am almost ready, giving it a few finishing ✅ touches with real life examples. Here’s what’s in my newsletter today:

A) What I have been working on for subscribers

B) What’s interesting to me this week

C) My S&P500 current thinking

D) Some levels

A) In next week or so, I am excited to share these 2 posts with you:

A primer on Depth of Market (DOM): Personally, I execute trades using only a Level 2 DOM. I will be introducing folks to the DOM 101 and a couple key patterns I watch for on an every day basis (absorption, breakout etc)

Emerging trends: of late there has been a lot of hype on meta-verse. While I played some of the stocks very well (RBLX from 80 to 140), NVDA (from 200 to 345+) , I wanted to understand it a bit more and try to figure out if the hype is real or fake. Once completed, I will share my thoughts on if meta verse is ready for prime time, separate out the charlatans from real opportunities. More to come shortly!

These posts will be a continuation of my educational series. Check out the prior installations below, if you have not already:

This will be subscriber exclusive content, so you may want to make sure you are subscribed and on my email list when the newsletter goes live by clicking on below 👇 link:

B) On the S&P500 front, I ran my weekly stock scanners a few minutes ago and I did not find anything worth jumping in at this very minute.

Yes there has even been some short term moves in some pandemic names like Zoom ZM and PTON but I will not be jumping up and down to get a longer term position on them yet.

For me the following few names make more sense even as S&P500 struggles:

AFRM: Affirm finally met my target of 130 dollars and rose higher to 137 even as S&P500 fell. Inline & Retail shopping at the stores is down massively this season and most of this may benefit stocks like AFRM and UPST which are trading 137 at the moment.

PFE: Finally broke out of my $51 resistance and is trading ~ $53 at the minute. As long as the breakout holds, this stock may continue to float higher to my $63 target.

Bitcoin: despite a big drop last week, Bitcoin has relatively performed quite well in my opinion. It's trading 54000 right now. Support below at 47000. Bitcoin is showing signs of growth and I would not be surprised at an eventual test of 70-74K at some point in near future.

Industrials , Energy and Financials are really hit hard with most major airlines now negative for the year . These stocks may be extremely oversold right now.

Within energy space, I like XOM as they are diversifying . It's at 61 right now but I think once/if it overcomes 64 dollar resistance, it may trade higher into 68-70 handles.

BAC remains my favorite bank, now at 45 and change. I would be bearish on banks if I thought recession was here but I think we are still ways from it.

Another discretionary name that made a big move on high relative volume is Clorox CLX. It is at 174 dollars , above key 171 resistance. If it holds here, I think it makes a run for 185-188.

C) My S&P500 thoughts and levels for next week:

We fell about 2 and a half percent on Friday. This was huge by any standard. This year we haven't had a single 3% drop and this could very well change this next week if we start slipping below 4540 (see more below).

See this post from Friday and this one from Lack of HVN Wednesday to understand the context and background for my latest weekly plan.

Here are a few contextual levels I will be watching:

4612 is my most important order-flow level for me this week. I cannot be bullish on a swing basis as long as we remain below this level. There are 3 key factors adding fire to the weakness in S&P500 emini:

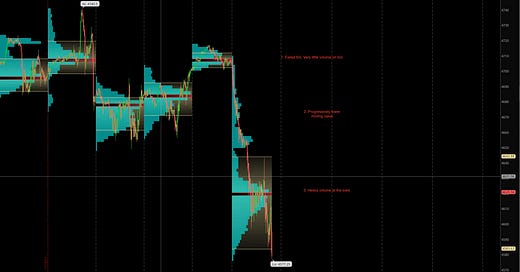

Failed breakout above 4696, on a measly volume. This indicates FOMO money rushing into the market while the market fails to hold at new highs.

Value is progressively moving lower. In my Tuesday newsletter last week, I indicated I want to see solid value form above 4692-4696 which never materialized.

Last but not the least, heavy volume came in on Friday’s shortened session around 4596. This led to a bounce of about 25 points. However, the market failed to hold this bottom and we traded down into 4580 towards the end of the session.

These 3 factors to me indicate the possibility of further weakness.

D) So what can be expected on the downside ?

As it is, the markets are extremely oversold right now. There is 50 Day MA which every one and their dog is watching around 4540. 50 Day MA tends to be key as a lot of funds watch it and trade around it.

4540 is a fairly decent support also in orderflow terms. If the bulls are going to come in, this is a natural place for them to stake their claim. 4540 may act as a magnet for price action early this week.

Ideally , I want to see climactic action around 4540 tomorrow, find buyers and close right above 4600-4612 for a trip back above 4700 for the year end.

Now on the flip side, if 4540 handles do not hold, if we make a couple daily closes below 4540 this week, my main fear is this will create a lack of confidence in market participants. Since everyone is watching these levels, they will be the first in line to sell to create a vacuum of bids which can lead to drastic moves within a short span of time.

If this were to manifest, I am afraid 4326 is not implausible on an extreme impulsive move. While low probability, this is not entirely unlikely given current volatility and state of the related markets (VIX, Dollar, Oil and Bonds)

S&P500 emini closed at 4580 on Friday.

This is it from me for today. Weekly plan will be supplemented with detailed, daily plan at close of session tomorrow. Market reopen for a full week of business in a couple hours. Excited to be able to trade this volatility and happy to share some levels with you. Make sure you share my newsletter and help it reach more traders like your self 😊

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Hey Tic, thank you for your thoughts. You're helping me become a better trader every day. Sitting on $100k but looking to take that to 7 figures over the next few years. Thanks man!

Mr. Tic, today’s few finishing touches with real life examples were great & will be more helpful for learning daily from your knowledge sharing.