Tic's Weekly Notes

11/14/21

Good Morning Traders,

I have been up early and been spending the last few hours preparing for the week ahead.

Running my stock scanners, updating my levels, thinking about current events and what kind of news and releases, including earnings are upcoming next week.

As I prepare my personal trading journal, I am excited to share my thoughts with y’all. Please do note however, none of this should be considered financial, trading or investment advice. This is my personal blog and documents my thought process as I go about my week. Hope you enjoy reading :)

Drop me a line on Twitter what you think! And do not forget to subscribe and share as it lets me reach more traders, like yourself!

Going to change the format a bit by talking about a few stocks, followed by my thoughts on S&P500.

Those who want to get to S&P500 first should scroll all the way down to section E for S&P500 levels.

A) Paypal and Palantir

I was bearish on PYPL going into it’s earnings at 226 bucks. My target was $202 which was met last week. See below PYPL.

Stock is now trading at 208. I believe it may not be ready to bottom just yet and rallies into 210-215 may be sold. I think it may try to explore sub-200 and depending on what order flow it finds there, it may or may not find a bid just yet.

Now regarding PLTR, I have been quite bearish since 27 bucks. I believe this company will do well but its not quite there yet. The stock has been ranging from over a year now. I was one of the first to notice the order flow and share this at 12 bucks. However, of late, the stock has been stagnant.

Even now the stock is quite crowded and may trade lower to shake out some more folks. My target remains 20-21 dollars (now $22.5).

B) Chinese Earnings:

Depending on who you ask, there is either tremendous value in the Chinese internet stocks or more pain to come. It has definitely not been an easy ride for any one owning Chinese names like BABA and JD!

BABA which reports earnings on the 18th, along with JD, has quite a bit of PUT activity for 150 monthly strike (now $167).

My play on this will be to wait if BABA dips into 146-155 handles, and get in on a daily close above 157.

On the flip side, if we take off after earnings to trade above 187-192, that may lead to higher prices into the 203-210 range.

The Chinese ETF, KWEB which was shared by me at 45 , remains a buy for me on dips as it carves out a long term bracket. Now $52.

C) TSLA:

Tesla absorbed about half a dozen billion dollars in selling by it’s own CEO/Founder and ended the week about 15% lower at 1033. This stock found sellers at my $1234 ORDERFLOW level and has remained within the order-flow range of 1000-1064.

I expect more range bound action from this stock with 990-1000 on the lower end and 1100-1100 on the top end.

D) NVDA, RBLX and SQ:

NVDA has been on a tear. This is my stock originally shared around 200 handles and then reiterated at 272. Now trading $303.

I am quite bullish on this stock and it remains a buy for me on any dips into 272-280 range. The company reports earnings on the 17th (Wednesday) and may cause some short term volatility.

RBLX yet another one of my TOP names. I shared this at 80 bucks before a break higher into $110. $90-92 was resistance on this for a long time and I think this level may become a support going forward.

NVDA and RBLX may be the BIG winners from AR/VR trends.

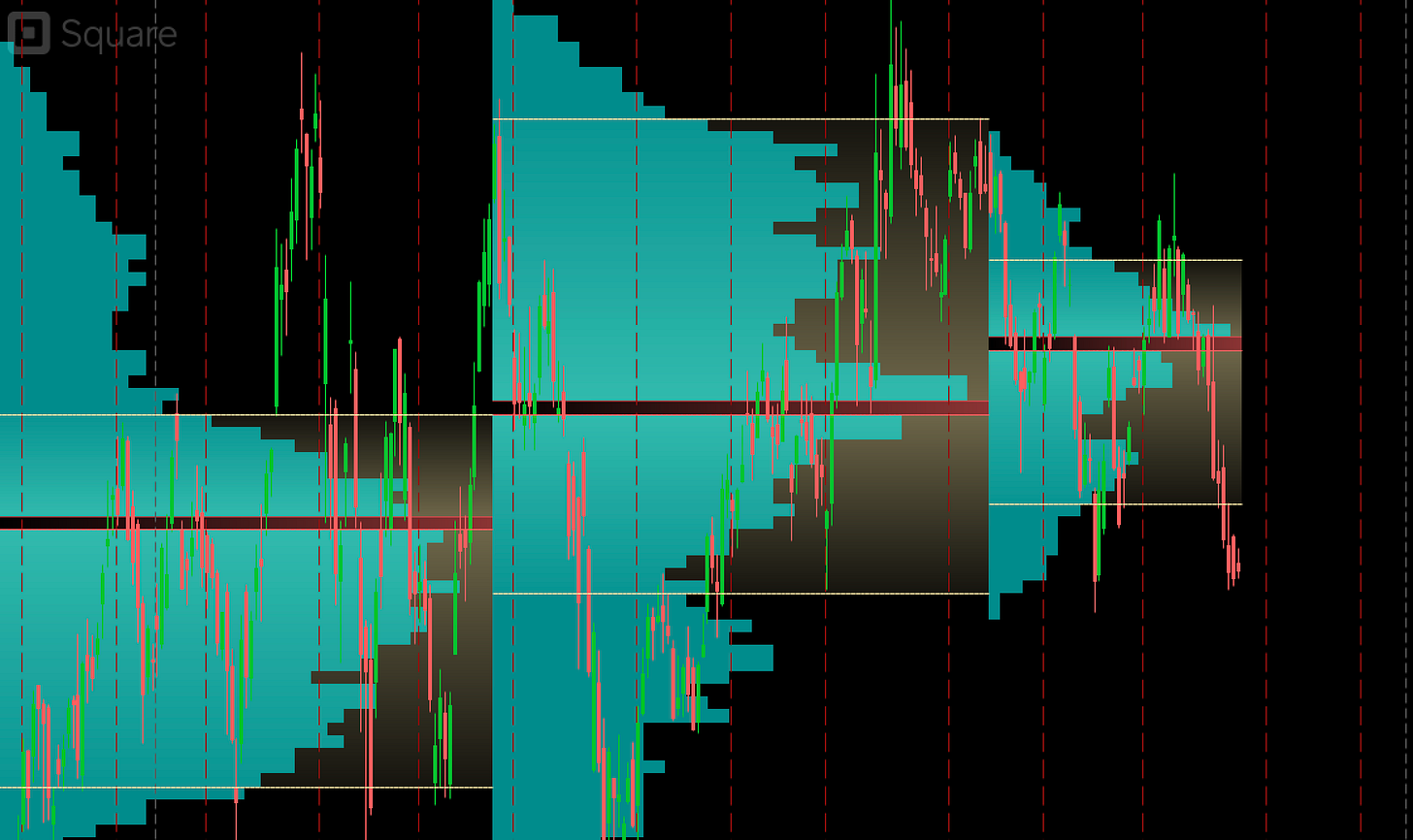

SQ has been languishing in range bound action for several weeks now , closing at 227 last. I believe it is quite close to major support at 222-226 and should hold. This is a long term play for me and I believe it is a better option than PYPL in that space.

E) S&P500 Weekly levels:

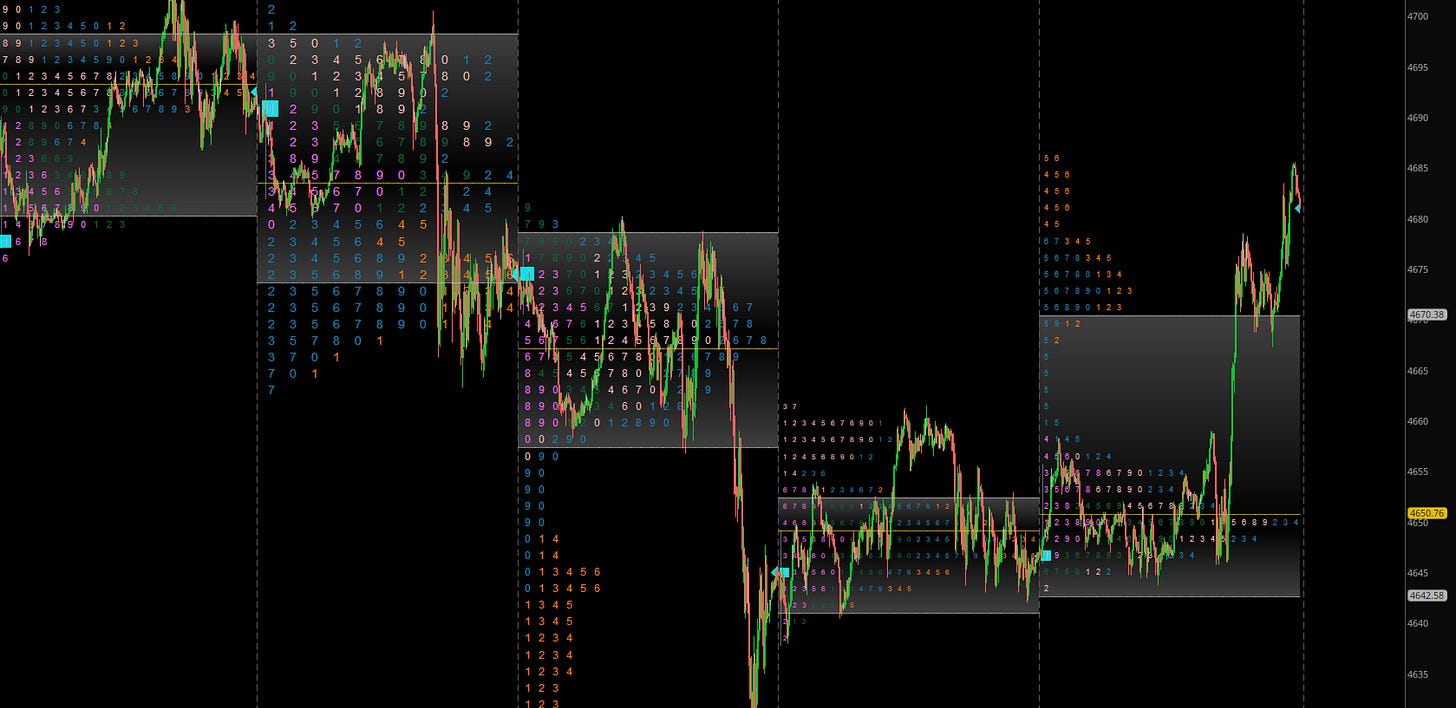

For the week of 11/8, Two of my key levels did very well, providing numerous swings. 4696 and 4660. 11/8/21.

Late on Friday morning, 4660 level broke and we moved higher into 4680 handles.

We are about to open the new week of trading stuck between the two significant order flow levels. Below are the main risk events for the week ahead:

Monday: RBA governor speaks. Of late they have been hawkish. However, it will be interesting to see their take this time given the commodities’ swoon. Aussie dollar is a carry and risk currency and therefore can impact S&P500 Emini, at least during Globex session.

Retail sales on Tuesday: could have an impact on recent high flyers like $AFRM and AAPL. Key level on AFRM to watch is 148-151. My short term target is 132 dollars.

Wednesday: just a lot of FED speak. Definitely a day to watch for in S&P500 Emini for surprise moves.

With this background, there are two key zones I will be watching.

Overhead resistance at 4696-4703: As long as we do not close above 4703, on strong volume, a risk of falling back down into the 4660 zone remains. With Monday being a relatively low noise (event risk) day, I would be looking for signs of order flow at 4696-4703 that could indicate a balance or downtrend day and lean against it for selling. This zone has been considerably hard for the bulls to overcome, let us see if that changes this week.

Support at 4660: right below 4660 is the FOMC repair work that was completed this week. It could offer potential support; unless we close on daily time frame below 4660. However I believe, any dips into 4660 on Tuesday/Wednesday (if it dips) that are not promptly bid up may cause a retest of 4627-4633.

So yeah not a whole lot of references to work with as the weekly range was rather small. So, these two zones are what I will be leaning against to make sense of what’s going on.

That’s it for me for now. Updates and other posts will be sent to my subscribers throughout the week so don’t forget to hit that subscribe button. I am going to be watching the earnings reactions on NVDA, BABA, WMT and keep an eye out on recent breakouts like GOLD, NEM, MARA etc

Have a great week. Stay safe!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. You may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Good morning and thanks Tic! Love and appreciate your sub stack 🐤🐤

Nothing better to kick off my Sunday morning. Would love to see Tic publish a real printed newsletter.