Traders-

While a lot of participants geared towards longs at 4660 on Friday , my weekly trade plan said very clearly I cannot be bullish, unless we open or bid above 4667. This was no surprise to my regular readers who know I have been bearish on S&P500 since Day 1 in January this year from 4810, all the way down 250 points today at 4560! I do not see this change next couple of sessions either as I am expecting more downside to come in S&P500.

Here is a link to my Weekly Plan: Weekly Levels 1/16

Sunday night auction high of the session was 4670; between that open and today’s lows, we dropped some 110 points!

Cash session opened way below my initial targets at 4622/4631. A few minutes before cash market opened, I sent this tweet reiterating my bearish bias:

We opened at 4604 and afterwards soon traded down about 30 handles to 4580, at which point I remained bearish for rest of the session. Market traded as low as 4660, which was the level provided during the session and carved out the low of the day ~ 4560, rising about 30 handles from there.

I also shared an intraday level in $NQ at 15420 which pretty much held any advances in session for both NQ and ES , and in-fact preceded a more than 200 point sell off in NQ NASDAQ. See below.

Turn on my notifications to receive these tweets the moment they are posted.

I provide 5 such plans every week for my sub-stack following, and I decided to open this plan up for everyone today, in light of considerable volatility. Consider joining my substack if you want to receive these emails the moment they are published.

Some other recent wins for me and the Orderflow substack:

Netflix bearish shared at 525 before meeting my target of 510 today.

DWAC Bullish scenario shared at 36 dollars before a massive run upto 90 bucks today . See my DWAC plan here: DWAC Levels

LMT another one of huge winners of substack, reaching from 340 to almost 380 today.

AMZN bearish at 3250 trades 3150 today. PLTR bearish at 16 now trades 14.X handles today. Several more.

Crude oil another big day today when I shared this originally at 79, then at 83 trading as high as ~ 86 today.

Current thinking and 10000 feet market context:

I still think rallies in market get SOLD for an eventual retest of the recent lows at 4500-4525. However, I also believe a few names start looking very cheap for me around these levels like $GOOG at 2700 (now 2730), MSFT around 288 (now 303), I think AMZN around 3000-3070 starts looking attractive to me , now 3150.

Overall I think Nasdaq is now headed very close to 14700-14800 lows were there may be a sharp rally (At time of this post it is at 15200) due to positioning if nothing else.

Macro POV, the 10 year yield is an issue - however I think it settles around 1.74 on lower end and 2 % on the upper end for a few weeks which may offer market some support.

Technically, the market is oversold, but it is not too oversold. However, if S&P500 starts trading 4500/4525 prints later this week, it gets in too oversold territory for me, technically and ripe for a 100-130 point bounce.

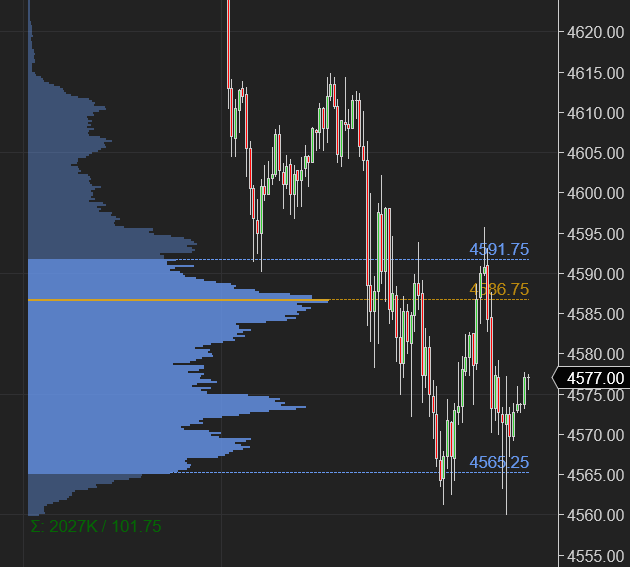

At these levels, which is to say so close to my orderflow level 4558, market may find balance, unless we open or offer below 4558 early on in tomorrow’s auction. Otherwise I see a test of recent highs at 4600/4611.

Tech has been the worst performing sector this past few weeks- I think if the ten year rates starts settling around 1.74-1.8%, the odds of a sharp reversal in tech names becomes likely.

No major news events this week, but do note that Bank of England GOV Bailey speaks tomorrow around 6 and then ECB’S Lagarde speaks on Friday around 4 AM. Both of these pressers, have the potential to move equities- especially if they come out to be too dovish or too hawkish.

See below chart (Chart A) of S&P500 emini where I think a formation of a b shaped profile may indicate presence of patient buyers or at the very least beginning of process of accumulation. This needs confirmation with levels. See the following section.

With this context and background, here are my MAIN price scenarios for tomorrow:

I want to lean against NQ again as a barometer of general market health. Key levels for me in NQ are 15238 where it closed today and my orderflow level 15420 from this AM. This corresponds to 4568 in S&P500 emini on lower end and 4600/4611 on the upper end.

Scenario 1: If we OPEN between 4568 and 4611, I expect a balance day of trading with a tendency to test and find sellers at 4611. For any more meaningful downside, my 4558 level must be broken.

Scenario 2: Therefore an open or offers below 4558, I think will lead to softness spreading pretty early on in session which targets recent lows at 4525.

Scenario 3: In an unlikely event 15420 on NQ or 4611 on S&P500 gets taken out tomorrow, it may lead to some excitement among the bulls and a short squeeze for the bears, leading to a retest of 4640 on upside.

A couple of names that can rally hard IMO if the market were to find a bottom interim:

TSM: This name had a very good breakout on strong volume recently above 130, however it traded down due to current TECH weakness and is now trading around 130. I think as long as it holds 126/127, it may make a retest of 142 and break it.

GOOG: My FAV 🥰 tech stock . Enough said. At 2620-2700 it becomes very attractive to me. Now 2730.

MSFT: Now 303. I will let it digest the ATVI news but I will be keeping an eye on 288/292 zone. If that holds in near future, it may make a run back into 314/322 bucks.

Again the operative word in this will be let some signs of life emrge in broader market like S&P500 which for now seems to be headed down into oblivion.

This is it. If you enjoyed this post, you can share it which will help me get to more traders, like yourself ☺️

Take Care,

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Thanks much Tic!

Thanks Tic. This newsletter provides a lot of clarity in an easier to understand language. Hope to see more such simpler and clear newsletters