Tic Toc Weekly Thoughts

Time to Go Down

Good Morning Folks:

Santa Claus did deliver the goodies. Right before the holidays, we marked 4620/4640 as a key orderflow level and called for Santa to come knocking on a daily close above 4640. This was sent at 4590, right before a 200 point vertical move. I was fairly confident in the importance of 4600 and remained quite bullish at the lows 4525/4550 that the upside narrative was alive and kicking. Luckily for me, the market gods agreed and we ended the year up 29%.

My sub-stack stocks continue to do very well: whether that is a COST, NEM GOLD, or HD, or a VISA V, or a SBUX to name a few. The fundamental theme , which I shared months earlier with the subscribers is the stocks making good profits will do well in this environment, I steered clear of high flying, high revenue but no earnings names like PLTR, NIO, PTON etc to name a few which have hemorrhaged a lot of money this past year. Even some of my momentum names like AEHR which I shared at 15 bucks did very well rising all the way to 25 recently .

Long before the crash in small caps and momentum darlings started, we were able to use intermarket analysis and the tape to see the relative strength in our names and avoid trouble (for most part). I think I started unwinding momentum names back in September and started getting into the defensive plays early October which marked pretty much the highs in these momentum names.

Powered by Orderflow. Shared with traders like yourself here in Substack regularly.

Looking ahead at the brand new trading week and the Monday session:

Selective sectors and stocks look poised to do well.

Overall, I do think the broader market which is really 60-70% of small to mid caps will struggle given the uncertainties around FED, Coronavirus , GDP etc

In other words, I do not think the recent trend of strength in selective sectors and stocks while most of the market lingers at the lows, it’s not going to change any time soon. This is not a broad based bull market but really a stock pickers market. Strong rotations are still ongoing. Guessing when this ends is a suckers play. If you manage to find out, do let me know 😊

Making money in stocks will not go to 0, it may just become harder and the moves may become smaller - because this is how stocks like COST WMT and HD move. They do not go up 50 points in a day but they move slow and steady march towards new highs…anyone can spot these names, as long as they stay open minded, and observe the world around them without unnecessary biases.

So what are these names?

I shared a few of these plays here yesterday: Tic Toc Stocks . Not all of these are defensive plays, I did include a TDOC and a ZM to mix things up a bit as I think a few of these names are unfairly sold too low.

I do think the market belief of high running inflation with FED inability to do anything about it , is firmly in the driver’s seat at the moment. This is showing time and time again in related markets, whether that is the 10 year yields, TLT, or Gold prices.

Who benefits from this? I shared this months ago, but to reiterate, some winners in this mix can be Real Estate, Gold, stocks like the COST and HD of the world! Within the RE sector, there will be winners and losers as well. I think outright residential RE is potentially a bad bet at this stage in cycle. More REIT focussed names like the American Tower AMT may be a shade better due to not one but 2-3 supportive factors at play. See my post from yesterday for additional context.

I like utilities and oil companies as well. At the end of the day, a lot of FUD was created which depressed the real economy - stuff that is made and sold with hands.

Factories are behind by a couple of years. Car plants, Semiconductor labs, Roads, Houses.. they are all behind schedule and need energy, materials to make on top of labor. I think there is enough pent up demand once the politicians realize their own folly and course correct to create yet another extreme in next 12-18 months.

Anyways, back to S&P500 emini what I am watching this week:

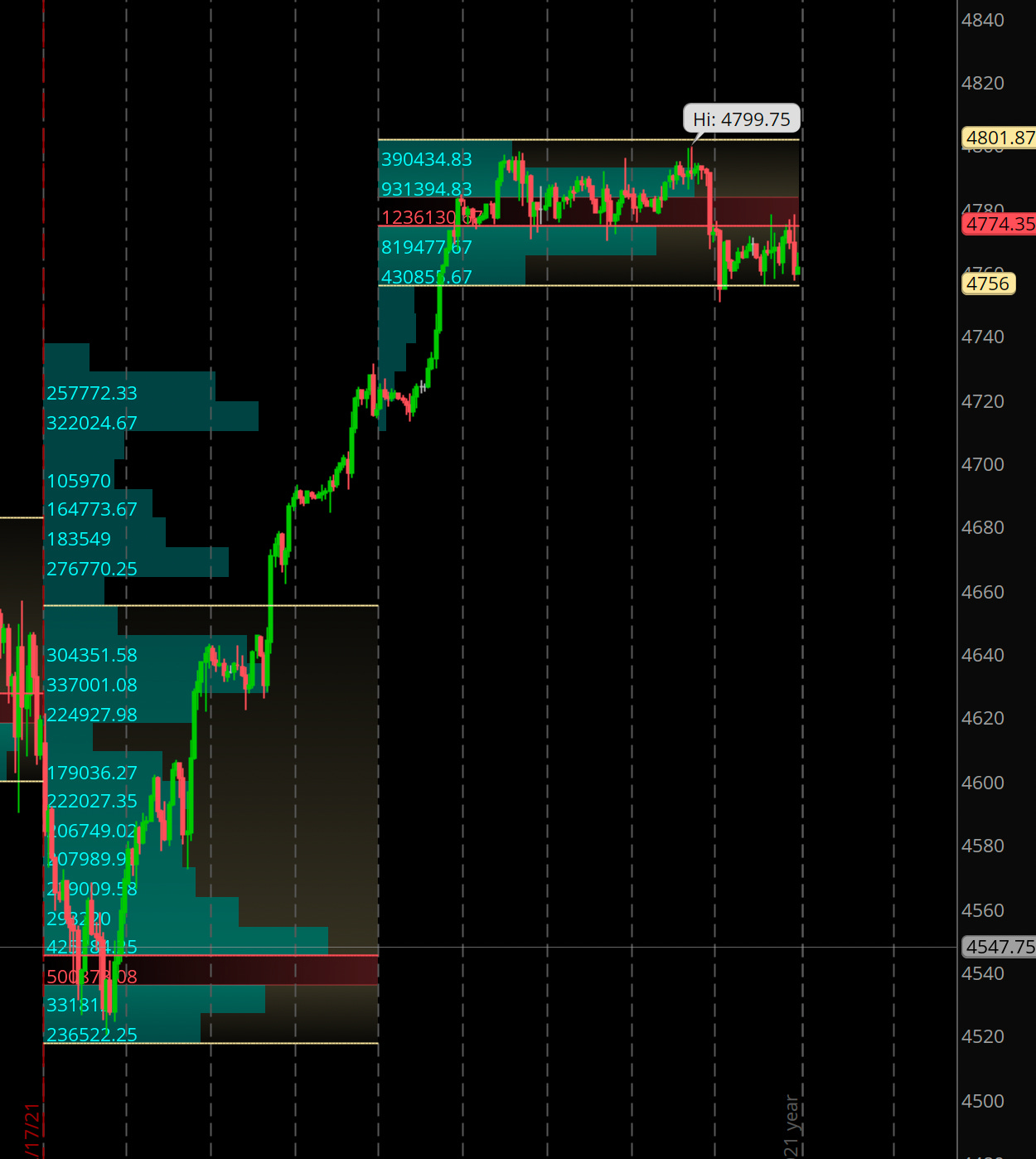

S&P500 staged an impressive rally off my 4590/4640 and traded as high as 4800 this past week, however the rally did not have enough juice. Volume was anemic.

While this in itself was not bearish, Daily session closes below 4767/4771 caused some volatility on the last trading session last week, settling the week around 4760.

I do think unless that 4767/4771 level is taken out again and a D1 close achieved above it, there may be incentive for the market to explore what’s out there at 4700/4711. While I am not firmly entrenched in the bear camp at these levels, I do think 4700 level needs to hold.

I personally think the market tries to move higher into 4792/4800 on Monday and next few days will depend on where we close tomorrow. A close above 4771 is positive for me. A close below 4771 may cause some volatility. Daily plan will provide updated levels through the week.

If 4700 trades this week also releases some fluff out of the market and sets the stage for an eventual test of 4833/4900.

On the other side of the ledger, once/if we start closing below 4683/4700, I think the market may find 4620 orderflow level as a desirable place to take it’s next stand.

At the time of this post, S&P500 emini last traded 4760.

On an additional note, TSLA is one of my main stocks for 2022. See the Full List here: Tic TSLA 2022

They had an 87% YOY increase in Unit Delivery. They delivered 1 Million cars in 2021 compared to 500K in 2020. This is MASSIVE despite FUD, COVID, SUPPLY CHAIN WOES. The stock may move higher tomorrow, however be careful if the S&P500 softens, it may spread to TSLA. I do think a patient TSLA investor may be able to get lower, more favorable entries around 867-891 (now 1070) . I personally will not chase it here at 1100+ especially if I did not buy it a couple weeks ago at 899 🤔 when I was screaming 🙀 from the rooftops how good $TSLA is .

This is it from me this morning. Look forward to another year of trading, learning and collaborating on ideas. I am always interested in any new exciting ideas so if you have one don’t keep it to your self, feel free to share with me here below or send me over on Twitter. If you have not already , join my email list below to get similar updates about 5 times a day. And don’t forget to share and check my latest educational post here: Tic 101

~ Toc 🍀

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Great substance as always! You’re the only follow anyone ever needs. Thank you so much for all the effort you’re putting in for us. Be blessed!

Visa is still great with inflation, think of the extra cut, BB is just waiting for the supply chain crunch to be over before it virtually goes into every EV.