Traders-

Coming into the session today, my Line in Sand (LIS) was 4426. My expectation was that the rallies into LIS may get sold and that 4350 may be tested but will be hard to break.

Both turned out to be on point. Though both levels traded over night and the cash session could not quite get to either of them - with lot of chop, there were a few tradable sets ups in between once Tic TOP indicator became clear. See below.

Click this link to get a copy of Tic Top Indicator: Tic TOP Indicator

Here is a link to my weekly trade plan if you have not yet reviewed it: Weekly Plan

Bids were getting very thin when I sent this note at 9 am :

A few minutes later, Tic TOP Rolled over leading to about a 60 point dump in S&P500 emini within minutes, supposedly on Ukraine-Russia news.

Another development today was that XLE cooled down - which was a plus. TRIN remained under stress , but indicative of smaller stocks selling off and may be a clue that we may be rotating into the mega caps.

XLK did ok, but was not enough to prop up S&P500 above 4400. What did not help either was fake news coming out of dubious sources regarding the Ukraine and Russia conflict.

Another positive for the market was that we had positive days in some of the more speculative names, whether that is a SQ, ABNB or NVDA. A couple of days like this and things start looking up for the S&P500 and other general markets like the Russell and Nasdaq. The fact that these names did well today with the 10 year yields rising above 2 % was a little interesting.

A look at few other related markets:

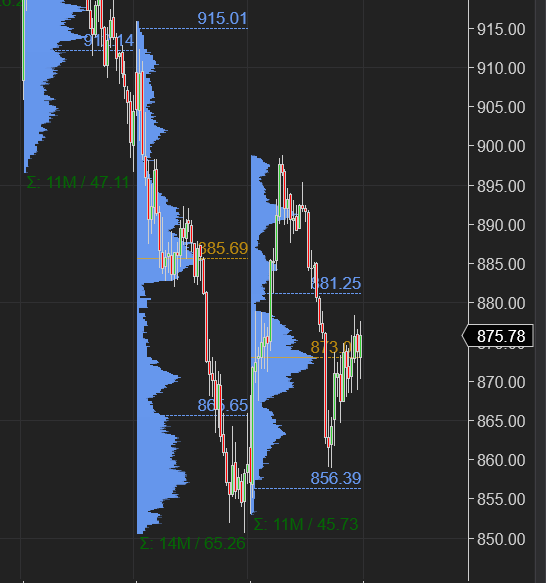

TSLA

Coming into the session today my Line in Sand on this was 899 which coincided to be the High of the Day (HOD) on Tesla today before a 25+ point sell off.

I think the chart still looks little weak and do not see a resolution to this unless close back above 900.

Some other mega cap names like AAPL, MSFT also remained under pressure and I think they may have few more weak days ahead of them.

Putting these together, I have the following context and price scenarios for the USA cash session tomorrow:

Bullish Factors:

Technically I like the fact that (as expected) Emini could not take out 4350 lows. This keeps the narrative alive for 4450. See context below.

I liked the fact that the Nasdaq $NQ futures despite ten year yields crossing 2% were able to hold the lows at 14000 today! I also liked the fact that despite the weakness in AAPL (Which BTW I got bearish at 180, now 168) did not cause a bigger sell off.

Bearish Factors:

The fact that the rates have been staying above 2%

The fact that Nasdaq NQ has been selling off below psychologically important 14820 level.

As far as the risk events go, at least the planned ones, we have the PPI tomorrow (Producer Price Inflation). I think over night the market may chop around awaiting this news.

Piecing all of these things together, my current thinking is there is probably a little more selling left to be done before we can meaningfully bottom. I do not think selling is done yet. However context without levels is dangerous, therefore I have a couple of price scenarios for me tomorrow:

Another interesting correlation I think in play currently is between S&P500 and Triton (TRTN), which is the largest container company in the US. Probably globally. They report earnings tomorrow and I think if they sell off after earnings may lead to some pressure on S&P500 . Conversely a rally in TRTN may lead S&P500 rally as well. The stock traded about 62 bucks at close today.

My KEY price scenarios:

My Line in Sand is 4406/4408 for tomorrow.

Scenario 1: I think an open or offers below 4406 tomorrow may be bearish and may target recent lows at 4350. I will confirm this with Tic TOP indicator making new lows and trading in excess of -2/-3. Note Tic Top has been in a range today, sort of an inside day.

Scenario 2: If we open or bid above 4408, I think the market may have sights on 4426. This level then becomes important as I expect sellers to emerge there and take us back down below 4400.

Scenario 3: If we open or close above 4426 within the IB period then I think the market may be in rally mode and take out what is out there at 4450/4456. This will be confirmed with Tic TOP making new highs, with reads in excess of +2/+3.

At time of this post, S&P500 emini is trading 4404.

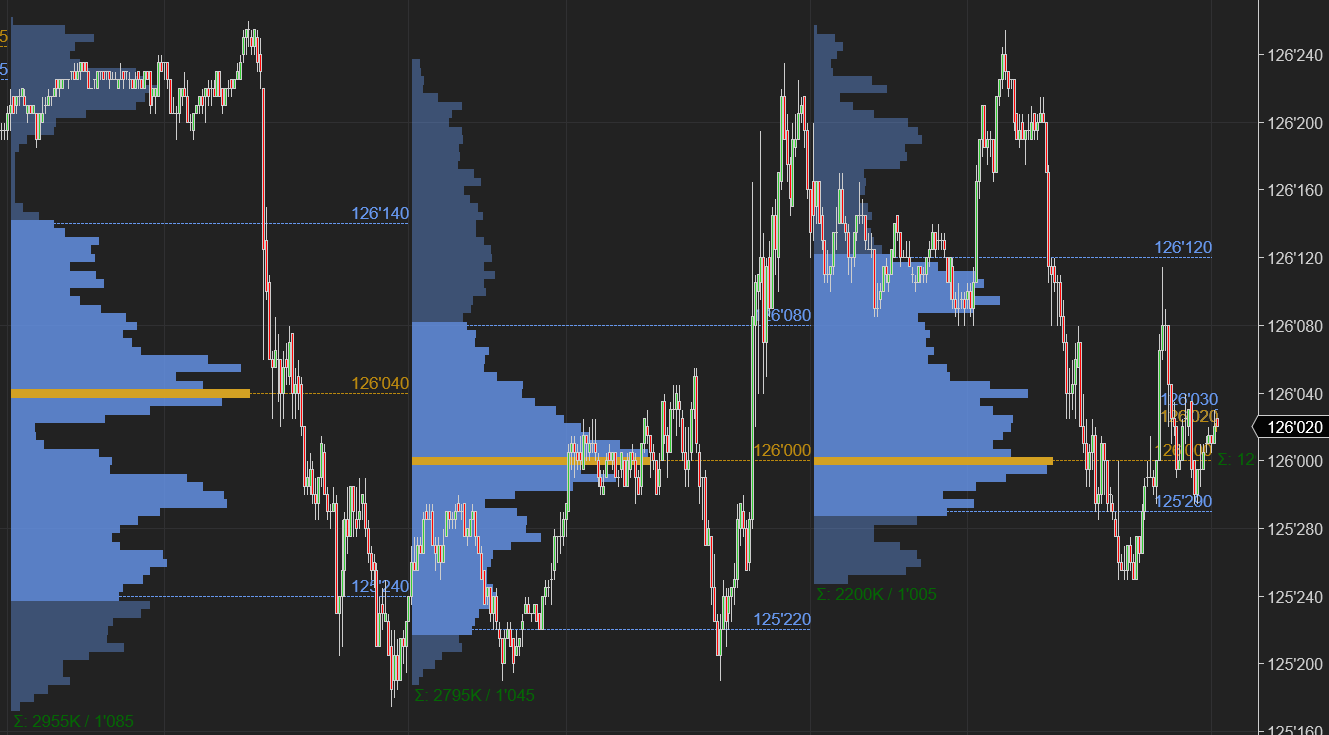

Chart C below of the ten year bond futures (ZN, TLT). While this is consolidating here , I think it may be signaling a further jump in ten year yields, which the tech and spooz S&P500 are not going to like a lot IMO.

To Summarize:

Tech rallied today while the energy and banks were subpar. These may be the very first signs of some sort of bottoming process in the S&P500 but I don’t think we are quite there yet.

I expect more selling unless we could manage a close above 4426 tomorrow.

I am expecting climactic selling action which will leave very specific profile parameters at the bottom - more on that later when/if it comes.

Once this climactic action does happen, there are a few names on my radar which have become quite attractive.. such as ADBE, PYPL, FB. However, I am avoiding the rush right now , stay tuned for my updates when I feel more confident on these names.

This is it from me for now. Much more to follow.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Thanks for your detailed plan. If there is no invasion of Ukraine tomorrow (nothing will happen tomorrow, I think) can be the catalyst for a one or two week rally.

Any thoughts on $RBLX, $UPST earnings?