Hey guys,

Let us recap what worked today and what did not go per my Wishlist.

At the close yesterday at 4662, I was bearish and I was expecting more selling if we managed to take out 4633/4634. The levels and playbook of correlated stocks was shared last night here: Playbook + Levels . The levels worked like charm, my bearish expectations fell short of realization.

The overnight session was quite bouncy and found sellers at 4689 my level which was given as a resistance in trade plan, and it managed to sell right down into 4633 right at time of Powell’s testimony.

At this point what I wanted and expected was for 4633 to break and trade lower levels at 4610 - this did not happen. Or could not happen.

Why?

Extreme bipolar commentary from Powell. He was extremely dovish which was polar opposite of December FOMC.

At the start of the testimony , barely 10 minutes into it, he already started taking about asset purchases, he made several references to how they the FED will remain accommodative even after removing “substantial accommodations policy”. What does it even mean?

Anyways, if his goal was to get a bid for S&P500 at key order flow level 4633, he managed to get a bounce of almost 50 points. At time of this post, S&P500 rose from 4630 all the way up to my orderflow level 4689 before slumping a bit.

Is he hedging in case he turns out to be wrong again about inflation? Is he really a dove in a hawk’s feathers? Is he really naïve and clueless? Well who knows, it could be either or all of it.

However, the good thing is we have order flow levels and context to make educated guesses on what may be at paly here longer term rather than have to rely solely on schizophrenic utterances of the FED chair.

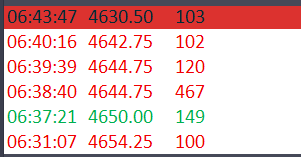

Initially, the larger players seem to have agreed with me at 4645 by hitting very large sized trades on BID side. We did sell down about 20 handles after this trade posted (see screenshot below) however Chairman Dove Powell undid this and we floated up after IB period was up.

BTW I sent this trade at Telegram almost real time it happened- and many guys were confused the moment they saw the BID word they assumed its a buy trade.

Not quite. An AT-BID Trade is a SELL trade executed by some one in a hurry to get out or establish a new short. An AT-ASK trade is a BUY trade. Sharing for those who do not know. FWIW.

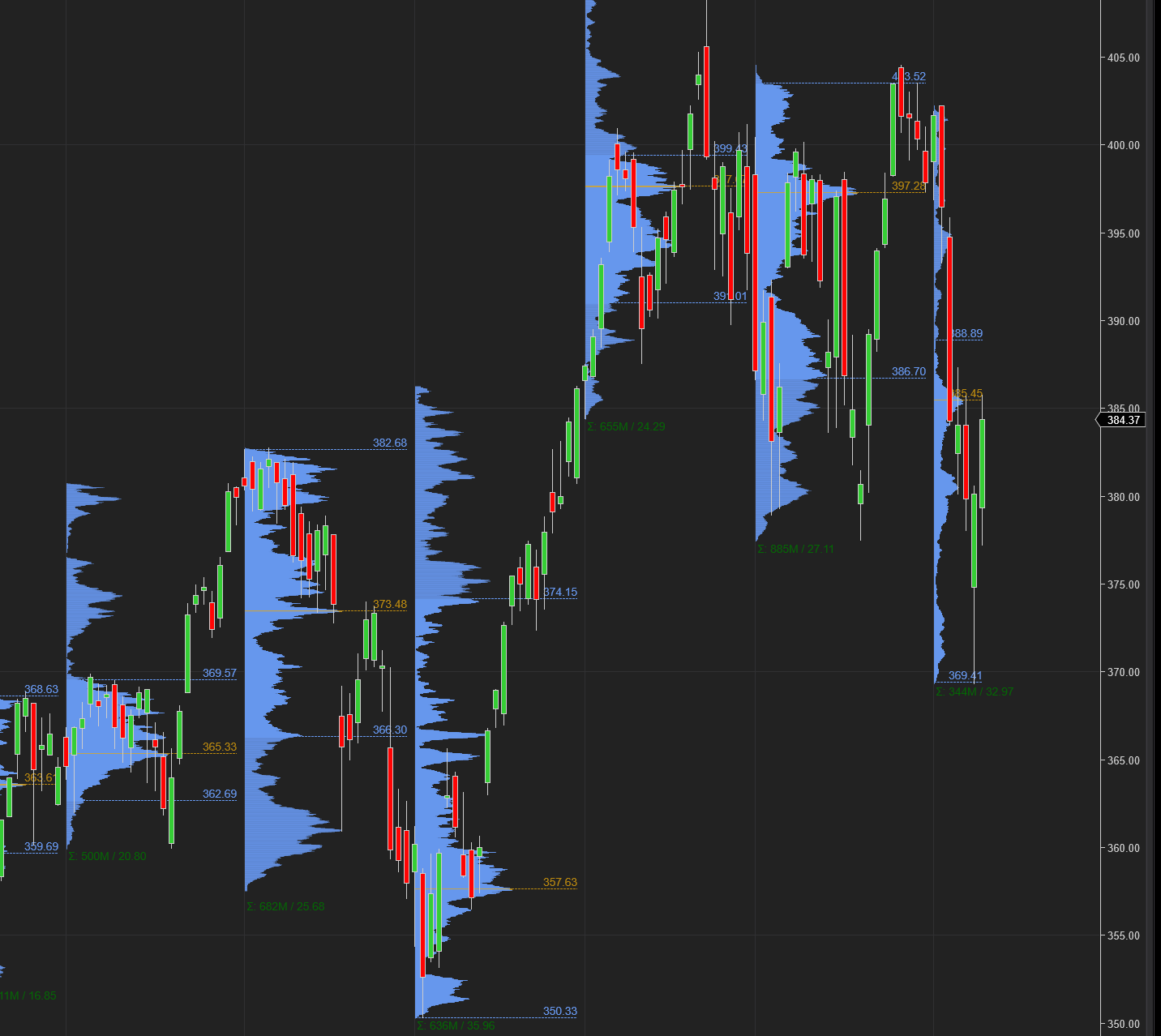

QQQ seems to be having a very nice day as well. If you look at the Candles Chart alone, you will be forgiven to think that the tech has regained its prior bracket.

However, the Volume Profile does not look so sure. I would think it all comes down to CPI tomorrow and the delta between Expected vs Actual prints. I think some surprise may already be priced in at these levels. A surprise greater than the expected surprise may take it to the shed. An actual which is less than expected probably gonna light a fuse underneath the Q’s. As always I will be covering the numbers, the reaction and what it may mean for the market in my Twitter.

Here is what is going on IMO:

Regardless of what Jerome says, the inflation juggernaut is underway. Inflation has consistently surprised to the upside from last several months, and therefore S&P500 has been deflated and spent for several sessions.

TLT has also risen today about half a percent, giving credence to the fact that the inflation may come down tomorrow. However again I do think this is going to reverse shortly.

I do not think this is bound to change tomorrow. Eventually I think inflation will subside due to lack of demand and glut of product- will that be good for stocks is another conversation. However for tomorrow, the numbers may still come in hot.

The numbers may come in hotter than expected for next several months. The million dollar question then is how much of that has the market already priced in at 4680?

Obviously if the number is less than expected, that is gonna light the fuse under market - even if it is for short term, takes us to 4744/4750.

7.1 % IS PRICED in . Less may be bullish. More may be bearish. See you tomorrow at 730 AM. One hour before cash open.

The BEST case scenario for me:

Listen I wanna get in to AMZN, and GOOG and some of these names like MSFT as well. But I do not wanna pay current prices which I feel are unfair at the moment.

I do not think inflation or deflation really means anything for GOOG with its products like Maps, YouTube, GMAIL, Search etc. their only true cost is labor which is not a huge cost at end of the day- they can hire and retain talent globally at any price they want. They need no materials. They own entire towns like Mountain View and Austin, they dont need debt, flush with cash.

And I would like to buy a GOOG at 2570-200 (now 2800), a MSFT at 288-292 (now 316)

Personally, I really do not think I have seen the end of volatility yet. I am not 100% sure how high this market can go, but I do think there may be unfinished auction at 4480-4525 from last month.

How will I separate my Wishlist from my execution:

To be able to execute in short term, I have the following scenarios outlined for the session tomorrow:

The market - as expected has stayed capped between 4633 and 4689 today. This despite uber dovish and easy FED chair.

This is a good confirmation that my bracket may still have validity and utility.

With this said, if we manage to take out 4689 early on in the IB session or open above it, I think 4703-4722 become at play. I think 4717-4722 level if taken out may also set in play a test of 4750 where I think longer time frame sellers may enter the house.

An open below 4689 that then takes out 4660 without much volume coming in at 4660 is my signal that 4633/4634 may be tested. I think if 4633 is tested again, it may also yield me 4610 which then will be a bearish event for rest of the week/month.

What supports my thesis is at time of this post, TSLA and major stocks like AAPL, NVDA are not showing a lot of bullish activity even though S&P500 has risen about 50 points off the lows.

BAC is hanging at 49 dollars, I personally think much gains in Big Tech will be harder to come if BAC refuses to trade down below 47/48 dollar mark.

At time of this post, S&P500 Emini BID 4689.

Further recommended reading:

Daily Trade Plan for 1/11: Trade Plan 1/11

Follow up for Daily Trade Plan to 1/11 : Follow UP

What else?

My XOM and CVX had another good day today outperforming most others. XOM in particular now crossed 70, I shared here at 60.

BABA which I gave a very clean cut plan on a close above 125 finally clears 132 handles today. I think if we can get a close above 141/142, BABA can shine thru the Chinese FUD clouds. Read this to know more: BABA Playbook

Look at my stock DWAC. Another stellar day! Now crossed 60 bucks, I gave this at 36 dollars. Read below : DWAC

Overall, I continue to find some opportunities in this chop fest and I share as and when I can with Substack followers.

Do not forget to enter your email by clicking the Blue Subscribe button to receive 5-6 similar posts every week + some educational stuff.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Tic we closed at 4713 today. Does that change anything?

Tic (or anyone), embarrassed to ask this question as I’m a bit of a newbie but here it goes. Went long & hard into Aehr Test Systems when Tic highlighted it a couple weeks back. Seemed a great price at $20 & the closer we got to earnings, the more it kept rising. After earnings, a lot of people cashed in & it plummeted to $14. Silly me, I held on to it since it seemed like a great company & earnings call. Currently sitting at $15.17 & not showing any positive signs in the last 24 hrs. Any thoughts on what should I do as I’m quite a bit in the red. Clearly need to conquer my fears ☺️