Hey Traders,

Epic day for us! At yesterday’s close we did not believe in this rally and were prepared for this to falter at some point (4717) . The moment came and we did not step in front of it making illogical trades like buying calls at 4740 or buying TSLA at 1110!

Here as I have started drafting the trade plan, while I await the Asian session so I can observe the Asian opening orderflow, I cannot help but note how fickle the sentiment really can be.

Yesterday everyone and their dog was long at 4740, today after the crater, everyone is either short or devastated. Not sure which one is worst.

Anyways, I digress! This is the last installment of the trade plan before the long weekend. There will be no trade plan tomorrow but a wrap up of the session, followed by educational stuff and the weekly plan later on in the weekend for subscribers.

Let us get started with how we did today:

My primary expectation was if we opened above 4717, we may test 4740 and find sellers there. We did open quite a bit above and while we could not get to 4740, sellers entered the scene close to 4740 at 4736.

Emini traded down to 4717 shortly thereafter. I was already feeling quite bearish post PPI release and this confirmed my bias . More on that in the following section.

Once/if 4717 broke, my trade plan called for a test of 4689 and if broken, a trade of 4660 shortly thereafter.

This scenario worked rather well as 4717 wasted no time to be violated. We traded down into 4689 a few minutes later.. bounced for about 10 points and then gave all of those gains to trade 4660.

4660 broke, and emini S&P500 closed the session close to the lows at 4652.

Other ideas that did well today were crude oil which I soured on yesterday at 83 fells about 150 ticks today now trading down to around $81.5

Tesla TSLA I issued warning at around 1110 in trade plan and fell quite heavily today trading about 80 handles lower at time of this post. I seem to be getting quite good at calling these unfair TOP Tick TSLA prices 😂

Here is a copy of my older trade plan if you have not already reviewed it: Today's Trade Plan

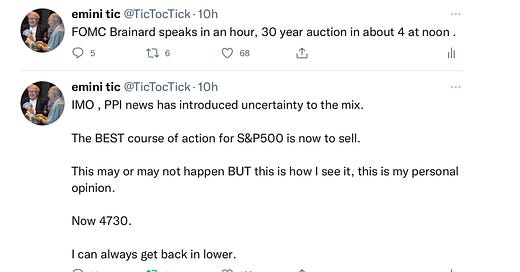

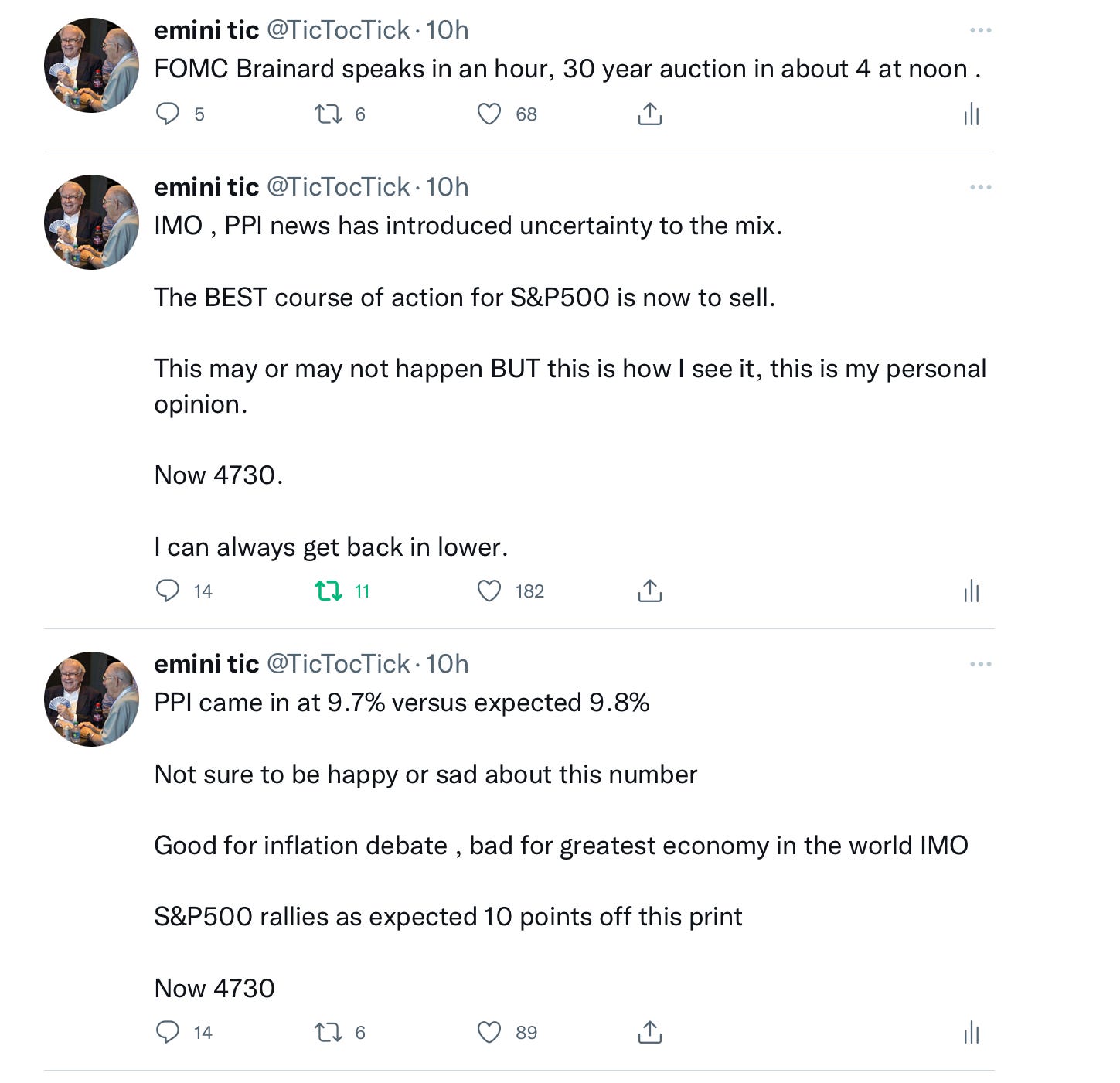

Why did I get bearish at 4730, after the PPI number came out:

Around 540 AM , a few minutes after the PPI numbers came out, I sent these couple of tweets as I felt the numbers were bearish, even though the market was rallying on this news.

Note I will usually send an update to these plans about an hour before open on my Twitter and/or Telegram. Make sure you join me there and have the Notifications on atleast pre market open ☺️

Main reason for my bearish bias was that while PPI came in lower than expected, the euro dollar spiked for a moment and then started trading down. If this read was indeed so dovish , then the USD must have really sold off. That was my first clue.

The reason I thought the euro dollar sold after this news was nothing to do with the rate hikes or taper, but as safe haven (risk off) behavior by the dollar. The market thought of this print as uncertainty and the markets do not like uncertainty.

Second clue for me was the inability to take out the prior high. If CPI was only marginally better than expected and the PPI was actually a lot lower than expected, I would have thought S&P500 would have rallied a lot higher even before the open and taken out the prior high of the day (PHOD) at 4740. That did not happen.

And once we started trading below 4717 in the IB period, that was all the confirmation I needed. For those of you who do not know what is the IB period, it stands for Initial Balance and denotes the first hour of cash session trading. It is the most important hour of all day IMO.

Let us look at some factors at play before we go into tomorrow’s price levels and scenarios:

Right now the sentiment is very bearish on FinTwit. It has turned bearish within one session when everyone was quite bullish yesterday. Nothing wrong with it- it is just that experience has taught me so many people cannot be all right at the same time.

We closed quite close to the 4660 level- there’s substantial congestion here from November/December time frames.

While my ultimate target are 4480-4525, I think the new bears here will not win without significant fight. See following sections for why I think so and how I prepare for this tomorrow.

Let us look at a few charts..

Figure A. NQ Closed very close to that 15500 level which failed to hold the bullish momentum post FOMC from Tuesday and Wednesday. If I am a bull and I am gonna fight the bears, I am gonna fight them here.

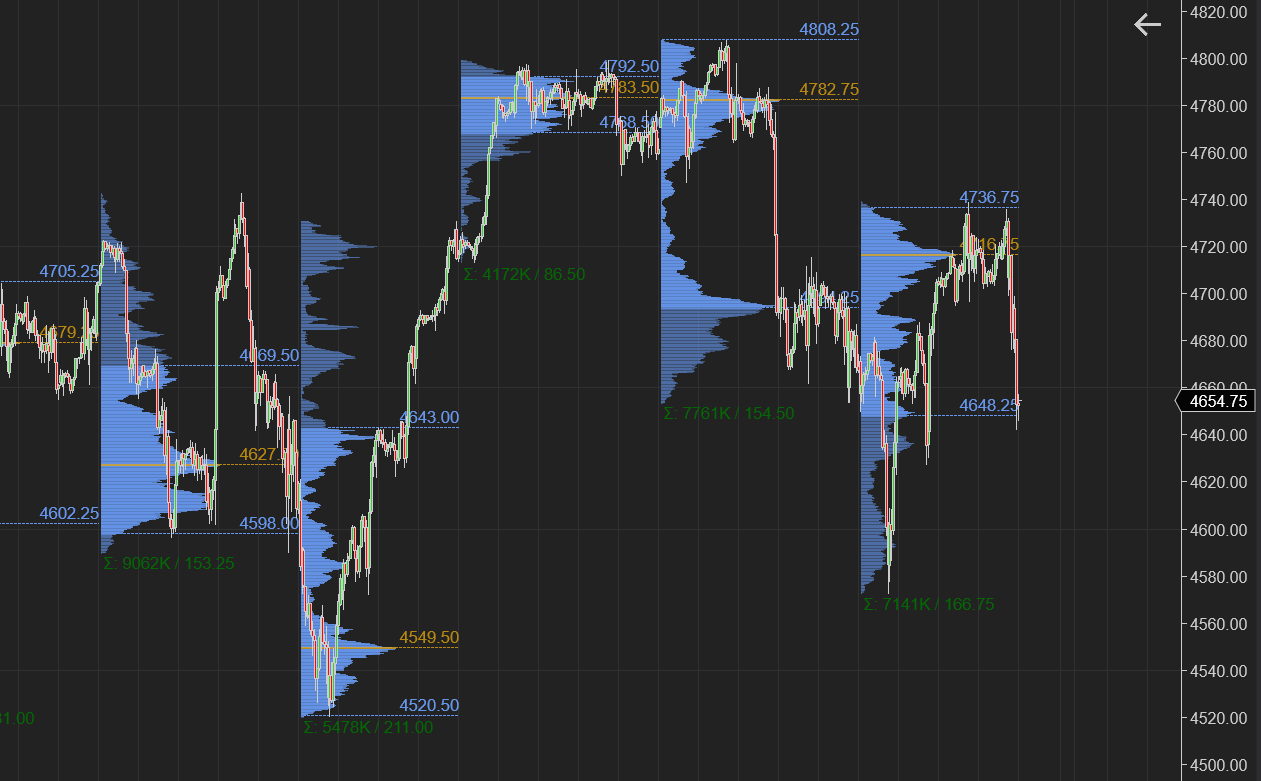

Figure B. Weekly ES Auction.

Two things that stand out to me are:

A) Extreme congestion. See how busy this whole zone between 4600-4700 is. Directional move will come but will come outside of this range, not between it.

B) This week’s VPOC and prominent HVN is at 4720. This may act as a magnet for price action, unless a new HVN is developed here at the lows which given what we have left of the week, may be hard to attain here.

I remain hopeful that 4480-4525 is a decent, fair area and should trade at some point. I remain negative on QQQ and NQ and I think it makes sense if 14000 traded (now 15500)…

However, January 21 ‘22 is a major OPEX. Directional clarity may not come until that week IMHO. Which means folks on both end of 4500 and 4700 may get whipsawed with a weekly close at or around 4598-4610 seems to make most sense to me at this moment. Selling pressure may exhaust that week with an intense selling climax around 4500. While this is my opinions and wishlist, see the following section to see how I am preparing to trade tomorrow’s session and my tactical thought process.

With this technical context, I have the following price based scenarios for tomorrow’s session:

4659-4667 is key for me in tomorrow’s session. At time of this post, S&P500 emini is trading 4645.

I think there is an incentive for the market that if it opened or bid above 4667 early tomorrow, we may see a test of 4694-4696 and could find sellers there. This will be a better signal for me if TSLA cooperated and traded above 1060 (at time of this post it is at 1030) and NQ did not lose that all important 15500.

If however I see we open below 4667, NQ is already trading 154xx handles, TSLA starts chipping at 1016-1018, I would think more volatility in session that may take me down to test 4611 handles on the spooz. If 4611 trades, I think it can cause a strong buying reaction tomorrow unless we get there overnight or early in the IB hour. In particular TSLA below 1018 causes damage to not only S&P500 but NQ as well IMO.

An open between 4659/4667 imo may be inconclusive and more than any thing may lead to a balanced session. If we open between 4659/4667 it will require me to investigate the session a bit more for edge or avoid it altogether.

Now tomorrow’s playbook should also keep an eye on the dollar. If safe haven thesis is correct, I would think dollar will really firm up. It should! If not, then I guess there may be another reason for the S&P500 to open above 4667 and try that 4696.

On a side note, rotation into strong DOW names is still alive and well with names like ARKK getting no respite. See my detailed write up on ARKK bears at 85 dollars here (now $80): Tic Toc Weekly ARKK

Again do note that I only trade 6 hours during the cash session. The levels based on close and open , are geared towards that time frame and while they may work outside of that time, I personally do not trade it.

At any rate, Asian markets catch a cold the moment US RTH session sneezes. I would think Frankfurt and London session may be a better tell than the Tokyo session tonight which may get hammered regardless due to the sudden drop in S&P500 today.

To summarize:

Orderflow correctly nailed the top today at 4730 and while expects more sell and thinks 4480-4525 is a decent area for BTFD , it will not be surprised if we chop around here for few more sessions.

In particular, 4700 may be sell zone. 4600 may be bounce zone until the major OPEX on the 21st.

4559/4667 will IMO play key role tomorrow. This will be confirmed with related markets like TSLA (see above section for context) and the US dollar.

Personally , I feel if you are a strategic bear, you whipsaw more folks here, you spend couple of sessions here between 4660-4700 and take everyone by surprise middle of next week, take out that 4525. But that’s just me how I would do it if I could 😉

To end on a philosophical note, the markets are fluid. Try as we must, they do not always go per our plans . They do not ever go easy on us. They make us work for a dollar! Those of us who recognize the finicky nature of markets will prosper. In a game where darkness lies an inch ahead, you the player cannot be finicky, you must be stead fast and react , be nimble. Let market be the finicky one as we all dance to her tunes.

Good luck! Feel free to share my channel and post if you would like.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Typo I meant to say Euro USD not USD. Thanks .

Hi Tic, what’s “BTFD” in your summary mean? “ while expects more sell and thinks 4480-4525 is a decent area for BTFD”