Hey Traders!

Very excited with the return of this volatility. I am absolutely loving it and this is the type of environment which I think is great for potential opportunities.

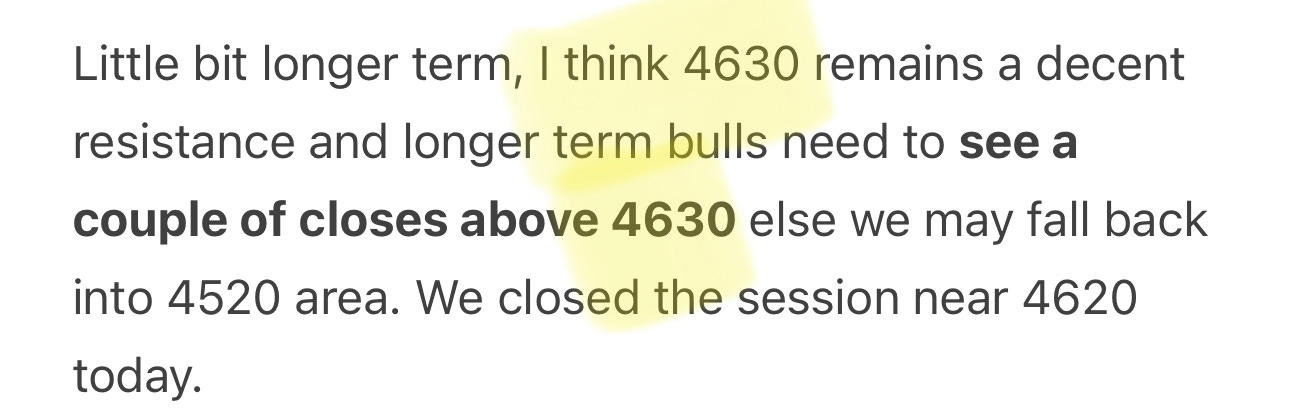

Last week, I had expected a test of 4520 as long as 4630 held. See below.

This was a good call as we barely did ANY trading above 4630 and got to 4520 by middle of the week. It here that the market spent last couple of days balancing before a minor break to the lower side on Friday afternoon. In this installment I am going to share where I see the S&P500 and QQQ headed next. So stay tuned.

Quickly, I want to get some admin stuff out of the way. I am raising the current prices by about 10% to 40 dollars. This will NOT impact any one who is currently subscribed and does not resubscribe. This is part of my roadmap for this newsletter where I see prices rise to about 100 dollars a month by next year, again not impacting any one who is currently subscribed. Do NOT miss this chance to get in at potentially 60-70% discounts compared to future values.

The intraday chat room is 100% free for any one who subscribes and can be accessed by installing the Substack app. This Substack personal journal is unlike any other - there are some which are focussed on macro, some that only share futures levels, yet some other which are focused on stocks and fundamentals, short term, long term- this one covers everything. It is one stop shop!

I had called for return of this volatility and this underscores why I have been saying what I have been saying about the structure and valuations of this market.

It is one thing to be bullish on TSLA at 100 dollars and be an AMD, NVDA, AAPL bull at 50, 150, and 120 respectively and it is whole another thing to be bullish on these stocks at their tops. This is in context of someone who is brand new bull at these recent highs.

The uncertainties in markets never really go away. There is always some thing worrying the market participants, whether that is high inflation, deflation, recession, wars, famines. You name it.

In my personal case, uncertainty does not bother me. I am ok with it. However what bothers me is uncertainty coupled with valuations. So two scenarios below.

High uncertainty + low valuations = no worry.

High uncertainty + high valuations = bothers me.

Now the valuation aspect and how to valuate is beyond the scope of this newsletter, however, I do share my thoughts from time to time where I see value and where I see fluff.

However it suffices to say that when a TSLA is trading at 100 or even 150 dollars, it is another universe, it is day and night different than when it is trading a 300 or a 400 for that matter. Why? Because there is going to be a much stronger order flow support near 100 than near 300.

There are several ways to measure fluff:

S&P500 to Gold price ratio

Market cap to GDP ratio

P/E of mega caps compared to PE of the general market

P/E of the market compared to long term averages

There is no one right size fit all. However since I watch pretty much all the markets all the time, I have good feel for where some of these levels are. Which I do not mind sharing when it makes sense.

In this newsletter today, I will not only share my levels for next week but I will also share some of the names on the small/mid cap side which look nice to me.

However, before we go there, a quick recap of what worked well last week:

My AMZN Credit spread idea was good as the spread expired pretty much unchanged.

I had expected AMD dips below 110 to be bought post earnings which was indeed the case as this rallied about 10 points from the dip.

I had expected SMCI to rally back to 350 from near 300 and this was indeed the case.

Many more.

My levels for next week

While we have sold off about 150 points from my levels this week and we have sold off quite aggressively, what happens next in the short term may come down to next Thursday’s CPI print.

These short term factors matter for short term price action. For instance, it can be argued that this week’s sell off was motivated in large part due to the mega cap earnings, and exacerbated by those of AAPL on Thursday.

Outside of these short term factors, the longer term theme in the US remains the impact of these high interest rates which may remain higher for longer.

Average rates in the US in last 10 years or so have been closer to 0 than to 5%. This has been generally good for the risk on assets and the dips have been bought. Couple this with low inflation, it has been a goldilocks for the stocks.

Now can the market do well when the rates are around 5% for potentially next 2-3 years?

There is a precedent for that. We have seen the markets do well when rates were actually higher than where they are at now (5.5%). However, two things were very different then-

The national debt was closer to 2 trillion dollars (it is 32 trillion dollars now).

The gap between real wage growth and inflation growth was much smaller.

Why is this important?

It is important because it will decide if the economic data (and hence the S&P500 profits) remain strong or they collapse.

Outcome 1: Rates remain high near 5% as well as economic data remains good. This could support risk on assets.

Outcome 2: Rates remain high AND the economic data gets much weaker. This outcome I think is decidedly bearish for the risk on assets. In fact in this scenario I think even if the FED cuts rates even then it will be a bearish scenario.

Next week, outside of the CPI there is not much Econ data on schedule other than the UOM consumer sentiment. The main data print is actually on Tuesday on the 15th with release of core retail sales.

It used to be that bad news is good for this market. I think this correlation now has flipped due to what I discussed above. I think the reverse is true now. Good news is good for this market and bad news is bad for this market.

So good retail sales and good consumer sentiment = bullish. And vice versa.

The main question now is can the consumer sentiment and can the retail sales remain strong when the rates are this high and the consumers are maxing out their credit cards and dip into last of their savings?

In the short term, I think it can remain buoyed by spending by those who still have the resources to spend. In the longer term, I think this will catch on to a larger population.

This is why I am not in a hurry to declare that my lower levels will not be tested at some point later. I am not in a hurry to declare there will not be a recession. I think both of these will happen in due course. And when it happens, I like to be prepared.

Now as far as short to medium term price action goes, below are my key levels and context for this week:

Technically this 4470-4500 area is quite important. From a news perspective, there is really not much until Thursday with the CPI and Friday with the consumer sentiment.

So I personally think there is some support here at 4470, until here is none. And I think for this support to break, we need to see consumer sentiment sour quite a bit and retail sales on the 15th to disappoint by quite a much.

With this said, below are my 2 scenarios this week:

As long as 4470 support holds, I think we could float back up to 4550.

Directional move I think will come on break of either of these two levels. We closed near 4500 on Friday. Levels are for emini September contract. For $SPX levels subtract about 20. For $SPY levels, divide by 10.08.

Now slightly longer term, the earnings boat has sailed for most part and we have held 4490 technically speaking. The margin of holding are slim. The bears would have felt better if we closed way below 4490 and the bulls would have felt better if we closed above 4550. Both left high and dry as we close almost at 4490.

My view is that yes we have seen the swing highs at 4630 IFF (if and only if) we begin to see a deterioration of the Econ data. This will probably hold sway even if the FED begins cutting rates tomorrow.

IF the Econ data remains strong (and we will see a chance to see this on Friday), I think we could still retest 4630 area.

Now back in 2021, before the 2022 sell off started, we saw an extremely long term balancing where the market really did not go any where but ranged in a tight zone of about 100-200 points for over 2 months. Is this where things could be headed again?

Could be.

Why do I say that?

Well for one, I am not enthusiastic about mega caps like AAPL and MSFT- and I think a lot of other folks can say the same now after Q2 earnings. So if AAPL and MSFT were to remain directionless, that could mean SPY also remains directionless. BTW see the list below for some names that I still do like.

These things can take 1-2 years to percolate in the plumbing of financial system. Habits of decades die hard. For a bottom in the market, I need to see the Fed panic and begin bailing out the US and the US Banks. It is not happening yet. Well, it has not even started yet. What do you think? Let me know.

Personally I do think if we end up trading near 3600 or so, I will be quite bullish on the US stocks. I think once we begin dipping into 3400 handles, it becomes attractive prints which I do not see it as same level of attractiveness at 4500. This is really not a short term call which means it is not easy to time such things. Really the only way I see myself benefit from a such an event is to have dry fire powder and buy when I see such levels trade. Now I do not see this as a day to day, weekly or even a monthly happening. Having said that will I buy a 1% or a 2% of my account if I see something make sense to me even now? Yes. But this will not be the money I need today, tomorrow or even next year.

With this out of the way, which are some of the small caps and mid caps that I like?

Well there are a few. However, I do want to share one topic which has been interesting to me. This being is crypto a fad or is it here to stay? And if it is here to stay, what are some of the ways for me to partake in it?

So right off the bat, I am not a big fan of crypto coins whether mainstream or alt coins or whatever other incarnations they have. These coins in my view are all the same with no differentiators. I believe eventually all coins will be replaced by your country’s Central Bank Digital currency. It is about 2-4 years out but it is coming. This means a much tighter control over what people get paid, what they spend on and much tighter taxation with great surveillance and tracking of the individual citizens. Once the CBDC takes hold, any one who partakes in any other coins could be deemed a felon. Imagine when the US dollar was first rolled in and you were caught with bank notes of your own. You would be penalized heftily as a counterfeiter back in the day. We can agree to disagree but I feel strongly about this subject. So when I say I am a crypto bull, I do not mean any coins, but I mean I am bull on the industry.

The industry is still very nascent. This is reflected in low number of mainstream banks that cover this industry. We can also see this as a lack of meaningful ETF in this space. The two main ETF I know about are BLOK and FDIG.

I do not like BLOK because it holds as its number 1 holding a company which I think is going to 0. I think it is a matter of time. Now I like it because it is much more diversified. But the reason for dislike is so strong that I will not touch it personally.

Its competition is FDIG. Its main issue is that it is more concentrated with some holdings as much as 15-17%. This could be a good or a bad thing. However, I like FDIG more than I like BLOK for the reason I mentioned. Now if MSTR were to be # 1 holdings in FDIG, I will sour on it too. I hope it does not happen.

FDIG has companies in it which I like. It has companies in it which I think will go to 0. On balance, this is a very nascent ETF. I am not in it for next 2 years but for next 10 years. If I throw in 1-2% in it, I forget about it and I do not check its price every 3 minutes.

So it already covers these miners and payment processors in it. I do not need to look for other names in that space. I complement this with something like a regulated exchange for instance CME. If crypto grows, then the derivatives trading on it will also grow. So whoever wins in the long term as far as the coins are concerned, they will probably end up trading on CME infrastructure.

Then I do like to have exposure to computing power itself. In that sense, I like AMD. I think SMCI could be a big winner too. Now when you look at AMD at 110 and SMCI at 300, and when you look at next 1-2 years, these may be extremely overbought. That is common sense. But if you zoom out 10 years, then may be they are cheap at even these levels. So if I had a 1% exposure on these, then I am comfortable if my time frame was 10 years. If you are a regular reader though, you know I had shared AMD when it was 50 bucks. So if I had it at 50 then my 1% is now 2.5% ;)!

Outside of payments, mining, computing, exchanges the other leg that crypto stands on is the virtualization itself. Not the computing virtualization but virtual reality etc.

So in that sense, I think both META and AAPL can be leaders. Now long term readers know my support on AAPL is at 100-120 bucks. It is at 180 now. So again, based on my time frames, those numbers can be seen as cheap or expensive. If I am retiring next year and I have just bought AAPL at near 200, then I don’t know. But if I am a 30 year old guy that is a different topic. I shared META bottom bias near 90 back in August! It is over 300 now!

So really price + time frame = location or context. And as we know, location is everything. Price is not the only thing in this equation. The equation is completed only when I mix time with price. It sounds simple but very few can understand this.

To summarize, yes I am a Crypto bull. The way I see crypto is that it stands on below 5 legs -

Payments - COIN

Mining/INFRA - MARA, HIVE/RIOT

Exchanges - CME, COIN

Computing - AMD/SMCI

Virtualization - META, AAPL

Add any more I missed.

Now some folks think more regulation is bearish for crypto stocks. I actually do not agree. I think more regulation is better for these stocks as it weeds out the bad Wild West type players and instills discipline in what remains.

What else I like?

SMCI

Old timers will know I shared SMCI at 65 dollars before it ran up to 350 + within a year.

Recently I shared 300 level where it had a decent bounce and it is now around 340.

I remain constructive on this young company and I think it can trade 800-1000 dollars or more. I think if it dips into 276-300 it may remain supported. Just because some thing is up a lot , I do not believe it is expensive. There has to be a valid reason for me to think so.

BTW, to gain maximum value out of this blog, make up your mind to be a reader for a year or more. I do not say that because it helps me, I mean that is not the only reason. I mean it. A lot of folks jump from one service to another and that really does not help any one. This blog has one of the longest reading subscribers and there is a good reason for that. Most gains in life come from compounding.