The week we all anxiously awaited for months has finally arrived. The long wait is over.

In less than 2 days, America goes to vote for one of the most hotly contested and most consequential elections.

This is going to be a slightly abridged post as I am gonna wait out the week to get a firmer picture of price action and orderflow, but nonetheless I am happy to share few thoughts on related markets.

While the risk-on markets have had a muted week, you could argue that under the surface of seemingly calm waters, some seismic changes are going on. First off, the largest of all markets, the US Bond market is exhibiting signs of some stress. A few weeks ago, when the 10 years were yielding 3.62 percent, I called for a bottom on the rates for a move back to 4.2% area. Remember this was AFTER the FED cut rates by a 50 BPS, not before. Since then we have not only come all the way back up to 4.2% but actually crossed it. TLT as a proxy for wider bond market is under quite a bit of pressure, having traded down from that 100 into 90 at time of this post.

Then the other elephant in the room is the US Dollar itself. At the time when I called for a bottom in the yields, I also called for a bottom in the US dollar at 100. It is now trading above 104. Both these calls made no sense then, but yet here we are now. A 4% move in the Dollar index in a month or so, is a large sigma move. This does not happen very often.

Against such a backdrop, you have arguably the lowest volatility in stock market. Yes I know we have had a rough couple of sessions in the stocks, but these moves really are within the acceptable band of volatility- nothing too drastic. Yet.

If you dissect the action in bonds, without understanding the auctions in the US dollar, you can be forgiven to think that the Bond market is expecting an impending US debt failure. Why will you lend it to the US government at 3.5% for decade, when there is no end to the shameless borrowing and spending by the Government? This bond market tells us it is in no mood to lend money to Uncle Sam at 3-4% unless there is a significant premium for taking such a risk. 5% is fair I ask?

Personally unless there is a complete reset, I think even a 10% yield is not appealing enough, if you consider the wildly unsustainable path the US government is borrowing and spending on causes, which frankly offer very little in return for people like you and I. This insanity has to stop!

Ok, so this all seems very reasonable and logical to me, but then if this is the case, why is Dollar also so strong? I scratched my head all day and the only logical conclusion I came to was that this is in bond market anticipation of a Trump win on Tuesday as well as Global hoarding of the US dollars ahead of the inherent uncertainty from next week. If this is indeed the case, we should soon see this trend reverse- which is to say Dollar decline should resume and the bonds should bottom at some point this month. 87 has been a decent support on TLT in recent memory.

But what if it does not? What if we continue to see both yields and the Dollar grind higher? What happens then? I think in this scenario we begin to see things take shape which most of us have neither experienced in our lifetimes, nor most of us are prepared for this scenario. What makes is even more full of angst is that I don’t think there is even an explanation for this. Feel free to let me know if you have a theory for this market phenomenon where the yields and dollar are both rising, at this point in this bull lifecycle?

To summarize this section: The action in Dollar and Bonds is perplexing but we could try and explain it away due to election uncertainty. If this is the case, logically we could expect a reversal in these 2 important markets. However, if this trend deepens, where we begin to see Dollar rise above 105 and stay there and we begin to see TLT chip away below 87, I think the FED will have to move in quickly and do something drastic to stop the ramifications of this. This could be a severe risk-off environment if we do not see this trend reverse here in a couple days from now.

In next few sections, I am going to share few price action thoughts on the emini S&P500 and then share few things I like in terms of bullish set-ups. Note that to build this framework of levels and setups, I am using the assumptions already made by Mr Market about the Presidential election outcome. If these assumptions do not pan out on Tuesday, we will need a Plan B. The majority of the newsletter today is leveraging the current market assumptions on election outcome. If these assumptions fail, I will revise some of the premises used here.

In case the market assumption is wrong, and we begin to trade outside of these parameters on Tuesday night, I may send out my levels where I am gonna buy the dip in the Chatroom below. Yes, I will be buying the dip, if there is one. Make sure you install the chat room and have notifications on.

War Stocks

With these Aerospace and defense type names, when the Biden admin took over, I was bullish and these stocks have done quite well in last couple of years, up anywhere from 50 to 100%.

RTX is now trading 120 and I think this may fill the gap near 100-104 if Trump gets re-elected. You can definitely count on a wind down of global conflicts for next 4 years and this is not a great backdrop for these defense names. This is not to say you will see some sort of a bear market suddenly in defense stocks, but I think it can be had for may be 10-20% cheaper.

If I go and search for some value in this sector, and this is after all an important sector, a lot of these names are up but you can’t say they are up a lot.

And at the same time, you have names like Boeing which are in a dump for what seems like a forever.

Boeing gets no love from the analyst community as well, they keep lowering their price targets and the stock is now in the dumps at 150.

Sometimes this is a perfect opportunity to find value.

Personally, here is what I think, under Trump Presidency, if he gets there, you have less motivation for global conflict and more impetus for domestic rebuilding of aerospace and defense sectors. In this Boeing wins big. I think if this goes thru, BA looks appealing here at 150 for a push higher into 200s.

Another decent defense play which I think is cheap is LDOS. I think if we hold 168-170 on LDOS, we may be headed higher into 300s. It is now 182.

Tech

In big tech, I continue to like big tech like AMZN and NVDA.

NVDA is now 135 and I think it is consolidating for a move higher into 150s.

For the week, I like the 131-132 level which may be supported. If supported early on in the week like Monday or Tuesday, I like this 140 CALL which is now around 1.8.

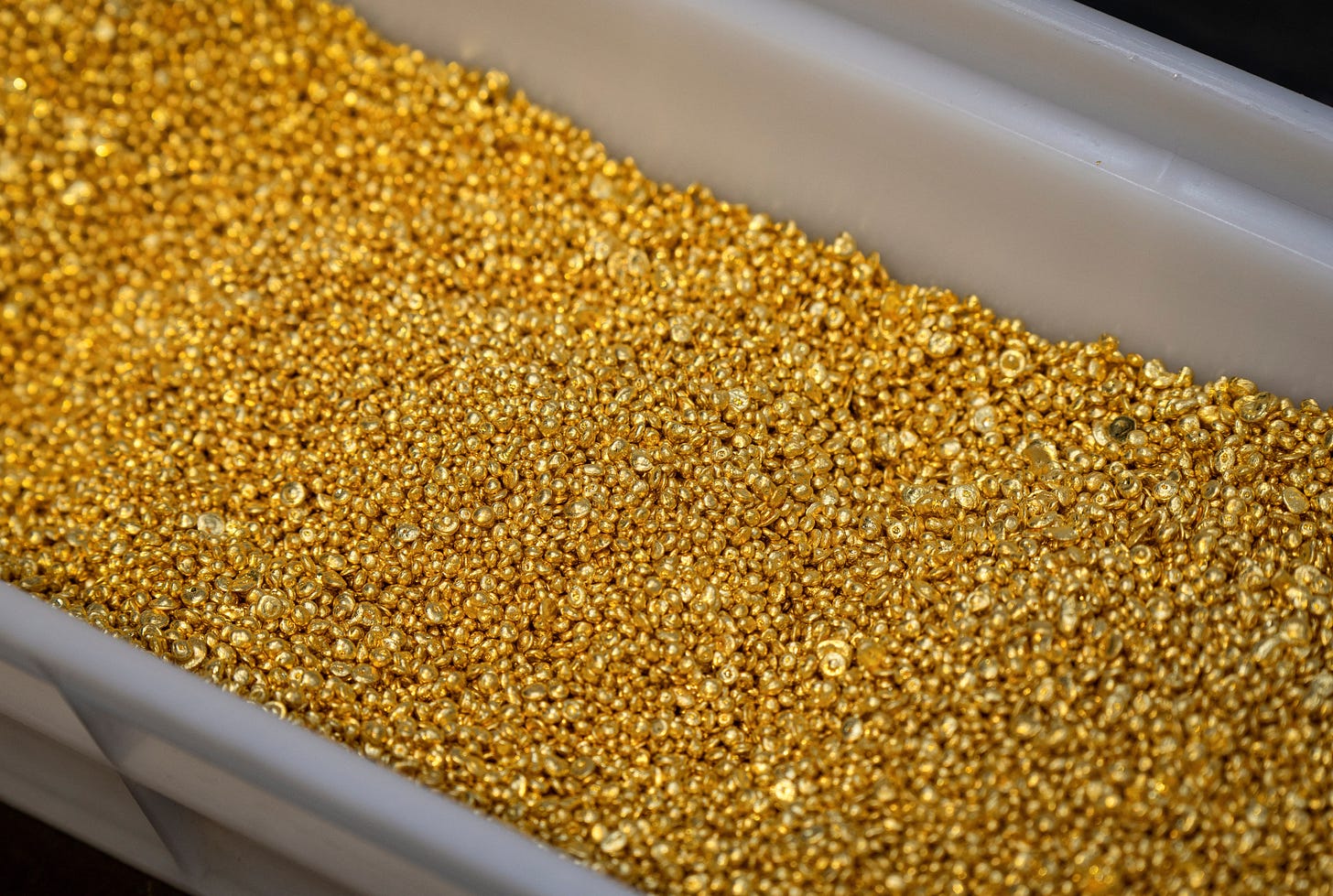

Gold

Regardless of who wins, I think Gold and Silver could be asymmetric wins. Gold has a lot of tailwinds- not only here domestically but also some seismic geopolitical shifts, for instance the ever increasing cuddly relationship between Russia and China.

A lot of these countries, after sanctions on Russia, view Dollar suspiciously. In their view, these sanctions were arbitrary and they want to move away from relying on commerce solely based on Dollars. This is a slow and painful decoupling but will continue.

If you think Gold has finished its move then consider that it has got to 2700 with Dollar at 105. What happens when we see a meaningful bear market in Dollar? Where will Gold trade if Dollar begins trading sub 100, sub 90? Is Gold 5000 possible? I think so. Is Gold at 10K possible at some point?

I have been a Gold bull since it was 1500 and is now trading 2700. I have been a Gold miner and silver ETF bull as well when they were 28 and 17 respectively but with a miner, you have inherent issues like cost and all. This is not to say that the miners won’t be at play, I think they still could be, but are there other ideas in this space?

It is like Bitcoin. If you are a Bitcoin bull, I think it is a no brainer to hold Bitcoin rather than a myriad of miners and ETFs. With crypto it is far easier to own it and store it.

With Gold, it is not so easy. You have to figure out a secure way to buy, transport and store it.

SGOL 0.00%↑ solves a lot of this. This is an ETF backed by physical Gold. There is an equivalent one for Silver as well, but I am more of a Gold guy myself.

SGOL is now taking around 25-26 and I think remains quite undervalued considering everything else.

Zoom

With ZM, I have had a bullish view on this stock since 60 and is now trading 75s.

These are erstwhile momentum darlings which are now dead for all intent and purposes. With ZM, you still get a 10 billion dollar or so in enterprise value, is selling at a 10 Price to free cash, and actually makes money. Contrast this with a PLTR which is a 150 price to free cash.

So I think if we hold 70 or so, there is some value in Zoom, and I will not be surprised if we push higher into 90s in Zoom as long as we hold these recent lows at or near 70. It is 75 right now.

Diabetes

In 2024, as we sit here, believe it or not, Diabetes care is a market on its own. And this market I think is bound to grow by leaps and bounds in decades to come.

NVO is a major player in this and I think it should continue to play a major role.

The stock has some other things going for it as well, for one, it is not a US stock, the US stock market, in my view remain extremely overvalued.

As a Danish company, I am getting this at a fairly nice discount of 25% or so from its highs, I think it becomes even more attractive longer term if it falls into 100 area. I shared this back when it was 90 dollars here in this Stack. It then rose to 150 and has since sold off and is now trading at 110. In intermediate term I see this recoup some or all of its recent losses back to 140 but in long term, I see this as a $300 stock, if not more.

Folks, on an admin note, some folks told me their payment method expired and will like to sub at prior prices. I have no control over billing, if you run into billing issues, please contact Substack support. They are very good at it. As far as lower prices go, that unfortunately cannot happen. Prices can only go up. If we ever lower the prices, it will be because I decide to split the publication in two- one for stocks and another one for futures and options. Minus that, these prices here are extremely low considering the accuracy of levels shared. If your payment method expired, please use the below one time code to get in at lower prices.

RE

In RE, this is not a new position but I have maintained this for some months now. In case of Trump Presidency, expect a renewal of the midwest region which has been marred by exodus of populace to the sunbelt. This is potentially a 8-12 year renaissance of American Midwest. If Trump gets reelected, he will consolidate his grip on the region for decades to come.

You do not wanna be bearish on the Midwest region, in case of a Trump Presidency. So the whole Greater lakes region, Ohio, Michigan, Iowa, Indian should see a resurgence in industry, farming and real estate sector in the region.

Warren Buffett raises $325 Billion cash pile

While a lot of us are fearsome that we will miss out on new highs in stock market, there is one player who has quietly amassed a one third of a trillion dollar cash pile, oblivious to the fears of looming inflation apparently.

From a Buffett perspective, cash still pays 5% as far as I know. And even a 10% drop in stocks by end of next year (I am being conservative), gives him a 15% head start just by virtue of waiting.

This in my view is a legit move. From last one year or so, I have maintained this is a stock picker’s market. SO even when you see the stocks as a whole make new highs, you don’t see the usual suspects like GOOG , TSLA and MSFT join the party. It is mostly asymmetric ideas like the ones we have been finding whether it is NEM or CVNA or dozens others like it. This is unlikely to change in my view. Now do you think even a 5400 is possible between now and December 2025? Is a 4700 possible?

All of these are very well in realm of possibility and if you agree, you can see the rationale behind Buffett’s moves whether it is cutting exposure to winners like BAC and AAPL, or stock piling cash like there is no tomorrow.

Levels for next week for Emini and TSLA

There is going to be a tremendous number of opportunities created in next 4 years. The markets are very active right now. You need to be actively learning about markets. This is the ripe time for it. Being active in markets and being good at markets can be a one way ticket to the financial freedom. Once bear market begins, it becomes harder. This is a perfect time.