Hey traders-

There is a lot to unpack this week, you do not wanna miss this post.

So we are done with the mega cap earnings for the quarter, and some very interesting themes have emerged.

The markets did not like the earnings from majority of the mega caps with names like TSLA, AAPL, MSFT, GOOG and AMZN all selling off after the earnings. This was an expected reaction for the reasons I cover in subsequent sections.

You have to be careful when analyzing these earnings and specifically look for fluff, red flags and things which are actually important.

Why I say that?

When a company is smaller like a PLTR, these type of companies are run by visionary leaders. They are smaller, they are agile and they are hungry. The focus is on grabbing as much market share as possible, to grow as fast as possible so the others cannot catch up.

Revenues and earnings are life blood of a stock. Unless you are a cult stock run by a man child who builds castles in the space and never delivers.

The larger companies, like AAPL are now established monopolies. When these companies become larger, and are monopolistic, the focus now is on maintaining that size rather than growth. Growth becomes harder at such large scales. So look at last 100 + years- US steel, Standard Oil, Burlington Northern, Xerox, IBM, Ford Motors, South Sea company. Endless examples.

So there is a subtle but definite shift in such companies where the mantle of leadership passes from visionaries and product leaders to accountants and bean counters.

The end result of this is that most product people take a back seat when it comes to decision making, and the companies are then run by sales and marketing people. You can see this in these companies in a form of how often they release a new product. Are they releasing new products or are they selling the same product over and over again with fancy gimmicks.

So for a Coca Cola, a new product comes every 10 years in form of a different size soda bottle. For Apple this now means they release unfinished phones with a new colorful animation to entice people to buy the latest and greatest iPhone which is really is the same iPhone from 5 years ago.

Investors are slower to react to such changes. They are happy as long as the stocks continue to churn out free cash flow year after year, quarter after year.

The shock comes when the free cash flow drops or stops.

And this is exactly what we saw in this quarters earnings with some of the companies like GOOG, AMZN, AMD etc

These 3 big corporations will spend in excess of 300 billion this year to prop up their infrastructure to get in shape for the upcoming AI race.

In rest of the section I am sharing my views on what this means for the mega caps, specific Emini S&P500 levels such as 6112 which saw us sell down some 70 handles on Friday. Options ideas like RCAT, PYPL, PLTR, SMCI. This is prime opportunity to learn markets before the AI takes hold in next 3-4 years. Time is running out. Tick Tock.

To understand the direction for next week or two, let us focus first on mega caps as the general market moves nowadays come down to the mega caps and not much else.

Not all mega caps are equal right now though. There are key differences. For the sake of this talk, I am going to use an example of AAPL, TSLA, and META. This is just an example, you could probably do this same exercise with any other name.

AAPL from the 2022 bear market lows is roughly up about a 100% . At the same time, their revenues have pretty much flat lined. The revenues are not going higher than about a billion dollars a day. So you can see that the 2022 bear market was perhaps an over reaction in AAPL stock price and may be these prices here round 200-220 or so are fair value. Is there a future risk to AAPL earnings and revenues? Personally I don’t see one, and if you are in the camp that see one due to dropping iPhone sales, I think they will make up for these lost sales elsewhere in subscriptions or cloud business. I yet don’t see a meaningful bump in earnings from their AI shenanigans either. Atleast not yet.

Same exercise you do with TSLA. TSLA laughably at one point was up 500% from its 100 dollar low which yours’ truly shared as a generational wealth TSLA low here in this Substack. If you look at its profits, the profits have actual shrank year over year basis. This company barely makes any money, and when I say that, please take this in context compared to its size, which at time of this post is pushing 1.5 trillion dollars.

This is like saying AAPL at 3 trillion valuation only makes 30 billion in profit. AAPL is twice the size of TSLA and brings in 600% more in profit each year which arguably will stay constant or may be even grow. Can I say that TSLA will grow its sales and earnings in near future? I do not have a reason to say so at this point. If anything, I think these profits will shrink more. However, this stock thrives due to hundreds of thousands of smaller investors supporting it due to whatever pipe dreams they have.

So my purpose for this exercise really was to contrast 2 most prominent mega caps and show you in terms of fundamentals alone why the picture is so muddy when making huge bearish calls here based on a bunch of chart patterns. This is also an educational concept to wrap your heads around why there is significant volatility in stocks like TSLA and why the stalwarts like AAPL tend to be stable runners.

So which mega caps will I still buy here at these levels and which I will shun?

While AAPL looks robust on paper, it does not mean that this is a great buy for me here for the long haul. There are some better candidates in my view which I share below.

But first let’s talk about a stock which I have been bullish on for a few months and on Friday we saw some pretty good news coming out for this stock.

This is Uber.

I have been bullish on this stock since it was 30 and on Friday it closed near 70 bucks, partly in due to the news that a major investor took a large stake in the company back in January.

The bearish case on Uber is simple and perhaps it’s too simple minded. The bears say that Waymo and Tesla’s FSD will drown UBER. I beg to differ.

Let us not even talk about Tesla FSD as it’s not even a player in this segment yet. Let us compare Waymo to Uber.

Uber does 33 million paid trips here in the US every single day. This is an unimaginable operational scale, you are doing more than a 1 million paid trips every single hour. Waymo? It does less than 20K paid trips each day. SO there is a lot of catching up to do.

Also, just because you have self driving software does not mean you automatically win this race. Uber has the network effect. It has 200 million registered subscribers. It has relationships with local city level regulators. It has a favorability rating from customers and most importantly you have a very focussed and capable CEO at the helm who is a great manager.

I think UBER still looks good here around 70 bucks and if one is waiting for a significant dip, that may or may never come. I think UBER revenues are gonna explode at some point and this could mean this company has a lot of room to grow. I am personally not worried about any autonomous driving impact on UBER. For one, I think autonomous driving done at scale, is about 5 years away. Yes you could have fan boys drive in local Walmart parking lots, but it does not mean you can deploy it in next year to drive on city streets. And then I think autonomous driving will be licensed out and will be offered by all major auto makers as a service. Any one of these companies can offer a fleet arrangement with Uber where they share revenue. Also, remember these AI and LLM models are gonna be everywhere soon. They are gonna be dime a dozen. I don’t think any one company will have any monopoly over AI LLMS.

Take a look at Uber and lemme know what you think?

On the short term side, these March 21 $75 CALLS which are right now $3.5 look nice to me. May be they could be nicer if a shallow pullback and they are around 2.5-3?

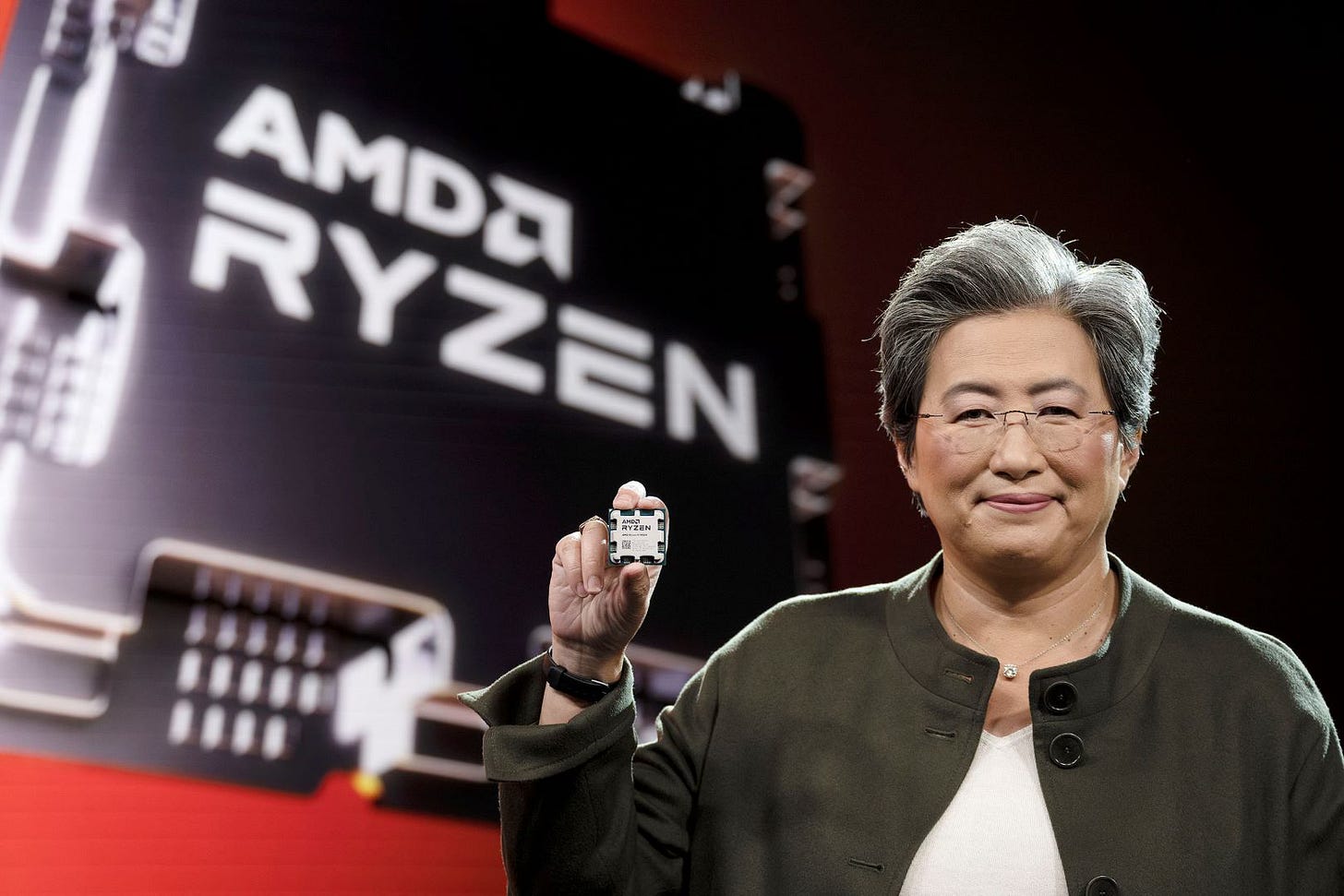

AMD

If you are willing to take a 3-5 year view, take a look at AMD here around 100.

What do you think? Lemme know.

I would think the momentum is quite strongly negative, it could shed another 10-20%, but I personally see downside at some point run out of steam, I think this could retrace to some of the highs near 150-160 if not more. Again this is not a short term call and could be a couple years or more in the making but I sort of like the set up from risk to reward here so close to 80-100 in AMD 0.00%↑ .

For all of these stocks shared here today, you may wanna review my take below on the structure of general market. These are high beta stocks and tend to move in tandem with the general market.

Other mega caps

In other mega caps, I still like a few names. And this is the dichotomy that I have. If I still like these mega caps, then that means I don’t yet have a full catalyst for a bear raid. Now that may change next week, but here in this moment as we gear up for Monday, I do like these names.

Now do note that there is structural weakness in general market at my 6112 level from Friday which does needs to be overcome by the bulls for any of the other names shared below. If weakness is not neutralized, I will not be surprised by a few more percentage sell off from these levels.

Folks, on an admin side note, a lot of folks ask me for discounts. If you have not noticed yet, I do not do discounts. There are no 70% Black Fridays here every Friday. Never will be. But I am communicative of future price hikes so you can get in at lower cost. In this sense this is a massive discount already. I believe I have now a quorum of hard core and dedicated orderflow traders in my subscription who are here to stay and grow. I focus on quality not quantity and as such, I am incentivized to shut off new members pretty soon by means of higher cost. Most of you can vouch for quality of our ideas, and it is in all of our best interest to keep the quorum smaller to a set of serious traders. I will rather see my traders grow & prosper long term, than other furus’ MO which is to harvest a newbie’s subscription dollars only to see the subscriber bagged after 2-3 weeks.