Hey OrderFlow traders-

This is going to be a good post and you do not wanna miss it. But before we begin, some housekeeping. If you have not yet, convert your sub to annual plan and start saving big. Substack has the best levels, these levels are not shared on X or Telegram which tend to be secondary levels. A subscriptions gets you early access to ideas like SMCI, NVDA, AMD, MARA, CVNA, COIN, AXP.

Let us kick off this weekly post with some food for thought. Do stocks really only go up? Or can they sometimes go down also?

To minimize the recency bias, let us examine data going far back and see how have the top stocks of the genre worked out over a very long time frame.

The tech stocks’ dominance in the US stock markets is a very recent phenomenon.

Remember there was no FaceBook, Amazon, ChatGPT a decade ago. AMZN I believe did not turn its first profit until 2016, if memory serves me right. Before these so called Magnificent 7 (Former FANG), who dominated the US stock market for decades and decades?

It was the likes of GE, IBM, Exxon, Walmart, Eastman Kodak, Microsofts of the world. Most of these are still around, but they are no where near their former glories when you measure them as a percentage of the total size of the US stock market.

There was a period of perhaps a decade of so in late 80s and early 90s, when Japan was going to take over the world. For a brief period we saw dominance of Japanese stocks like NTT, Sumitomo, Fuji Bank and Toyota motors become the most valuable companies in the world. Where are they now? If you recently started investing you have perhaps heard about none of these.

One theme that stands out for me is that when you have a stock reach the highest market capitalization in any index, it becomes a target of competition and wannabes.

It attracts all sort of copy cats, regulations, and eventually complacency from within which all but ensures that it loses its crown to other companies. Here in the US, the case of AAPL is a very recent one and an equally stunning one. Now while the data is very recent, may be only 2-3 months, I think the best days of AAPL are behind it, this is something I have been saying for a while now when the stock was at 200, and I think only now the script has started playing out in the earnest.

While these are all tales of high flying mega caps, in recent years, we have seen this behavior exhibited even by much smaller caps. Let us take a look at a whole category of stocks, the so called “innovators”.

Whether it is Zoom (ZM), or Unity (U), Roblox , Roku or Square, many of these are now down 80-90% from their highs set just a couple of years ago. If there is so much innovation in these companies, why are the stocks down 80-90%? I think these stocks will never recover their highs set during liquidity fueled mania of 2021.

The easy answer is the stock price or its market cap has got nothing to do with your belief whether the company is an innovator or not. It all comes down to cold, hard profits and a fair valuation. Good companies are making tremendous profits and are selling at a fair valuations. I do not need to put a subjective or a qualitative label of “innovation” on AMZN, AAPL, or MSFT. The market will take care of that.

A lot of these fund managers are like you and I too. They have childhood dreams and fantasies. May be they wanted to become a fighter jet pilot when they grew up or may be they wanted to find innovation.

So far if you are with me, then what have we learned:

Once a company becomes the largest market cap, it may not stay at that spot for long. In fact historically, the largest cap companies have underperformed the lower market companies when measured in same time period.

People love themes and occasionally themes such as EV, clear air, innovation, memes, crypto, take hold of public imagination and unscrupulous fund managers exploit this by pumping stocks they have purchased at cents on the dollar, and sell this to public at 100s of dollars. Just look at ROKU, ZM, CLOV, GME, AMC, SQ, TSLA- frankly there are endless examples.

Now is this phenomenon recent? Is it only in last 2,3, 40 years that we started seeing markets behave this way or have things always have been like this?

Things always have been like this.

You can go back to 1890s, you can go to 1900s, you can go to 1920s, in each of these decades. What we hear today about NVDA, AAPL, TSLA is rhymes with what was said about Standard Oil, Studebaker, United States Steel Corporation, Lorillard and Bethlehem steel a century ago. Yet, where are they now?

Now note my post is not throwing a shade at these stocks. It is simply in context of chasing FOMO and hype and getting into these stocks at the top tick just because some one on internet told you that stocks only go up. I have myself been bullish on ROKU at 40, SQ at 50, TSLA, ZM etc at some point or the other. Just not at the top tick. In that sense, this post is less relevant for active traders who will trade anything that moves, but mostly for those who buy and hold for years to come.

This phenomenon is what has caused the Gods of Investing world, such as Munger and Buffet to proclaim that no one can beat the market. And by that they basically mean that 99% of investing crowds should just regularly invest in a market index such as Dow Jones and S&P500. This by itself is not a bad strategy and longer term returns, over several decades of such a decade come close to 10-12% every year. On average.

Levels for this week

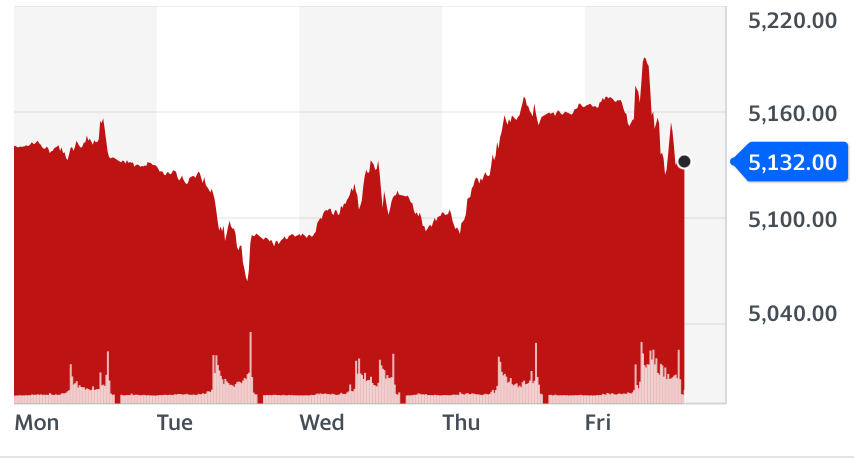

The primary expectation was to see dip buying into 5100 supported for a move higher this week. The dip came early around Tuesday-Wednesday time frame. Chart B below.

A quick shakeout of stops below 5100 before taking off to trade up 5200 or so.

Chart C above. Emini June Weekly Auction.

Friday was a violent session with stupendous moves both up and down, recapping a violent week but overall the market remain perched up above 5100 SPX.

What do we need to see happen this week for this market to start selling off? Subscribe and find out ;)

Folks on an admin side note, if you have any type of billing issues, please contact Substack support team on their email. I do not have any control over billing related issues but they are pretty good about it and can help resolve any issues.

From Chart C above we can see the market on Friday closed at the Weekly Value Area Low. There is quite a bit of Low Volume Nodes (LVN) below this area and for any further downside, we need to see some volume come in at these lows.