Folks-

If you have not, join the chat room below where I share updates most mornings with the subs.

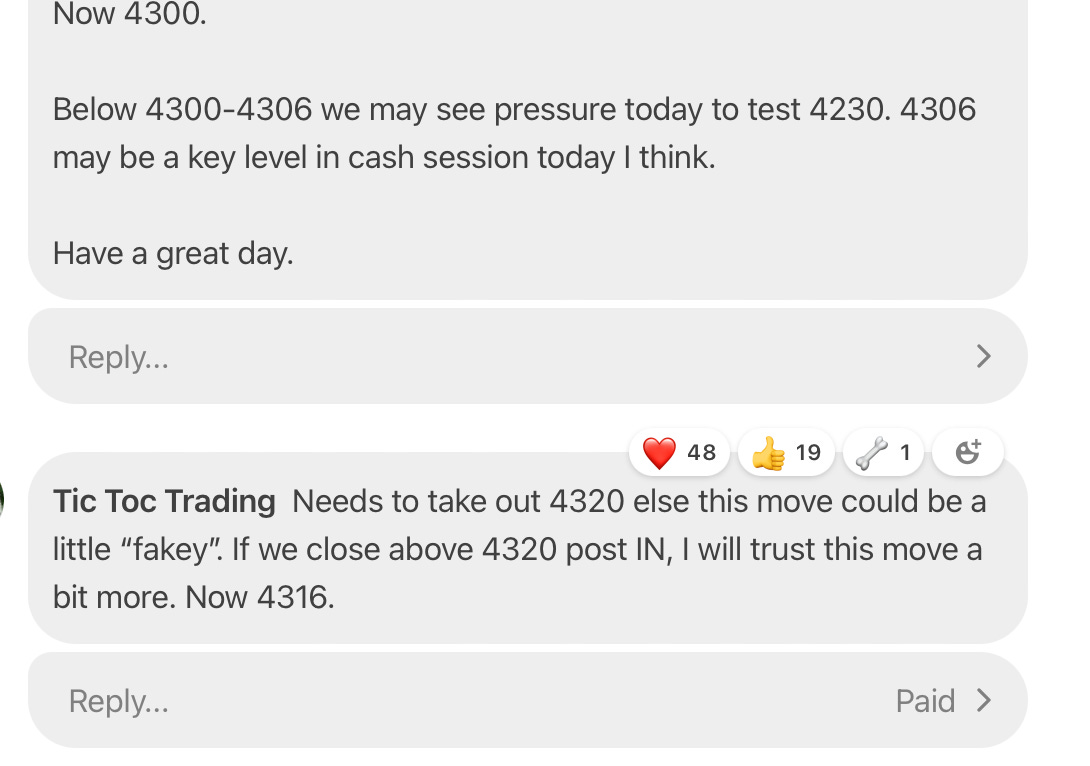

See an example below.

Today was a pretty wholesome sell off in the stocks, pretty much every sector was impacted with some being hit much harder.

Though the Dollar did not do much today, some other names like the bonds got absolutely hammered. What a time to be alive, the bonds are getting killed, TLT dropping more than the SPY and QQQ!

TBT flying!

On the bonds side, really the issue is a triple whammy. First off the FED is saying it may do another rate hike but then it is also selling off assets due to QT. Not a great combo, on top of weak technical momentum.

Now technically, in the S&P500, I think some of these levels are near good intermediate term support. However, the related markets like TLT is a huge wild card. When you have the technicals in favor but the related markets are so out of sync, then in my experience, the market is in a price discovery mode, not necessarily being run by technicals.

I do think if the bonds were not in such a ruin, we could have seen a better tape in the SPY and QQQ.

My levels for tomorrow

Will the selloff continue? Can we see limit down tomorrow?

I think the commentary from the FED Powell has a lot of role to play in this sell off.

I had been warning about the distribution near 4600 for several months now and I suppose one of the reasons for delayed commentary may be to allow the big wigs to offload and distribute to smaller retails.

This had been a very unnatural tape for several weeks and results are always clear in the hindsight. Here we are now at 4200 with a very conveniently timed sell off and hawkish commentary.