Session Recap (12/10)

Traders-

A quick session recap for today before next week’s plan and thoughts are published tomorrow.

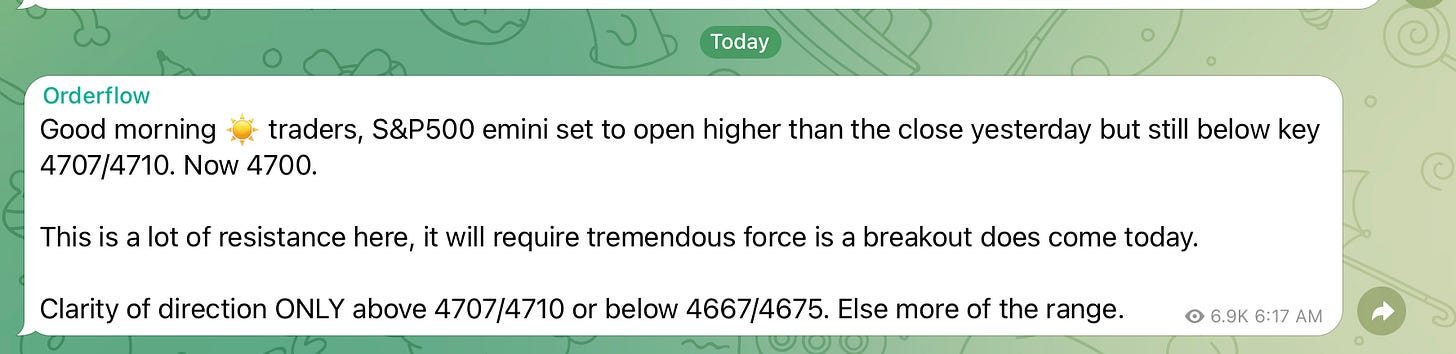

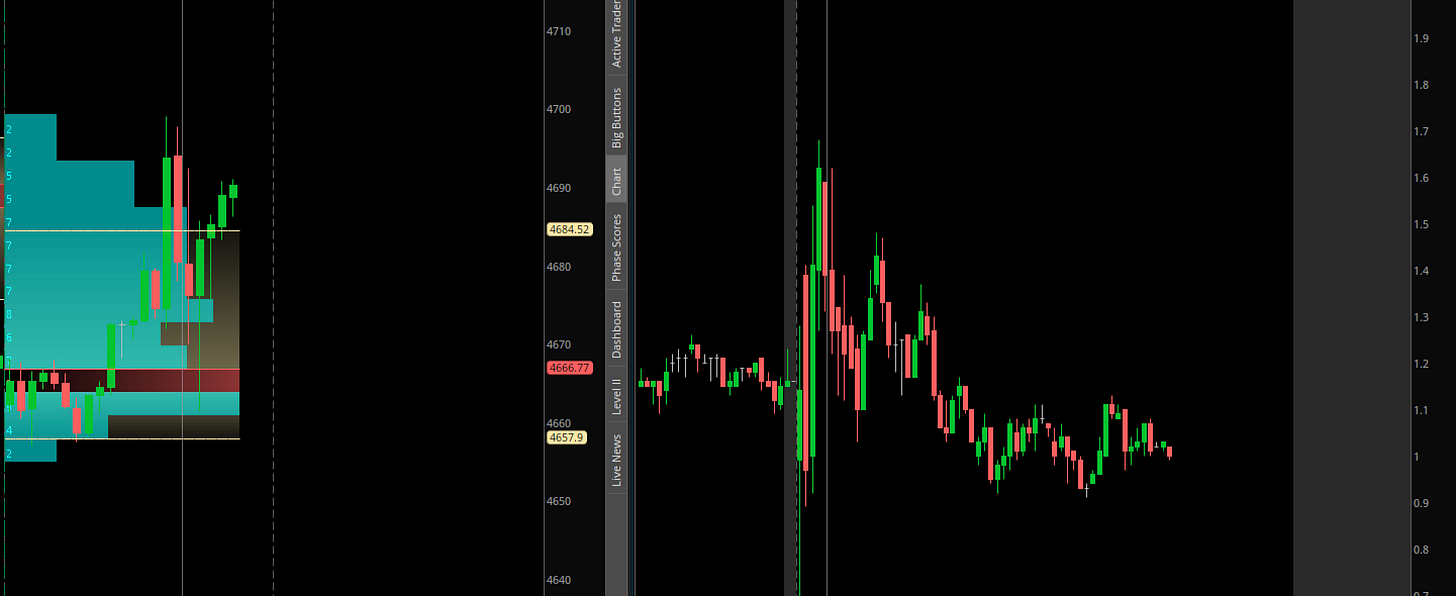

My primary expectation was a trend day above 4707/4710 or 4667/4675 AND a range bound day if we opened or remained below 4707 and 4667/4675 per the trade plan for today. This is exactly how it went down. The open was at 4699. The HIGH of the day was 4707 and the low of the day was 4670 (range trading parameters)

Note that I have now rolled over to March and all subsequent levels will be quoted for the March ‘22 contract.

This plan was reiterated by my Telegram post, 13 minutes before open for my subscribers. See below.

If you have not yet, join my Telegram by clicking on this link: Telegram Link

Primarily today was a internals driven day. See figure A.

We had a strong open in TRIN after which we sold off in S&P500 emini down to my 4670 support.

Once TRIN started downtrending, emini started a slow but steady trek up. At time of this post, S&P500 emini is trading 4700. Again for a strong directional day, I believe we get one only above 4707 or below 4667 (December ‘21 levels).

Overall, I did ok. However I am not a fan of these ultra low vol days. I hope I get a big break early next week.

BTW for those who do not know what is a TRIN, see this post: Tic explains what is TRIN

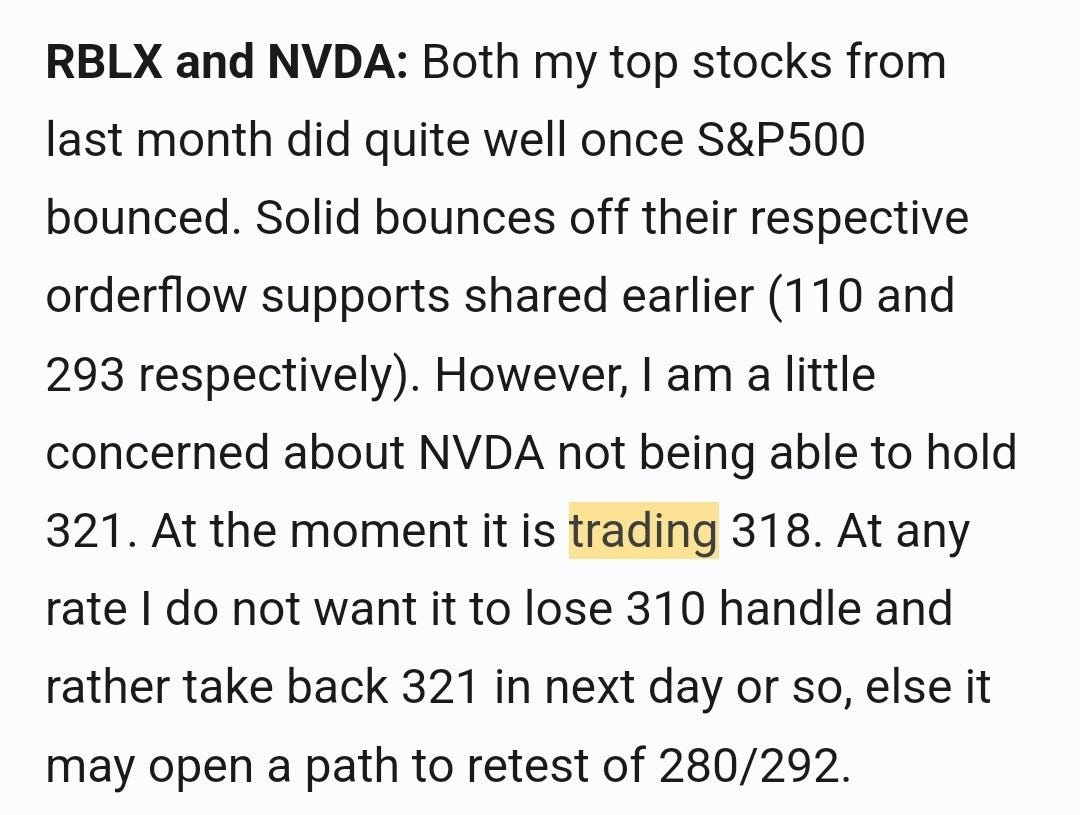

Personally, I suspect the TOP is getting quite heavy. Key stocks like NVDA are not inspiring confidence. We need new leadership and we need it FAST! See my post below regarding NVDA sent to the subscribers only a few days ago. It is down below 300 now. Let us see what the next week brings. BTW TSLA did another 40 pointers off my 980. The gift that keeps giving .

These slow days test our patience. However if we keep our cool, and keep our gunpowder dry when things do start trending, we will get enough opportunities. This is it from me. I will be back with more for subscribers. If you liked my posts this week, make sure you share them and join my list below as it help me get to more traders like yourself, with the message of the tape (order book).

Take care,

Tic Tic

Further reading: Sample Daily Plan 12/10

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Thanks for the warning on NVDA. Cut a little too late, but definitely saved me some pain!

Hi Tic! A question. We nearly closed the gap on December contract (vs Thu close) but left 2-3 points to fill. Some who already rolled over to March claim the gap was filles with March contract (but looking at Dec levels).. does this make any sense?

On SPX there is still a gap..

On the other hand, while the gap was (?) filles with March contract, the tape got light with bida and market rallies to 4700+

So did we close the gap or not?