Traders,

At any given time, I have a universe of 200-300 stocks from which I pick what I want to trade. In this post I am sharing what personal screener settings I use to create this universe.

What are the benefits of a personal stock universe:

Offers an objective criteria to shortlist potential opportunities rather than reacting to news, furus etc

Filter out the riffraff. You don’t want to waste time on stuff that’s not going anywhere.

Provides an opportunity to shortlist and get familiar with a small, quality slice of vast Wall street Jungle (NYSE alone has ~ 3000 stocks)

Keep a pulse on what’s moving the markets

Personally, having a screener has allowed me to find winners before they make major moves and keep a tab on what my stocks are doing over a long period of time.

Now these are my settings based on how I view the market from a lens of momentum as I am a momentum trader. For someone who is a fundamental trader or a value trader, these specific settings may not make sense. Which is not to say they cannot create a screener for themselves, it's just that their screener settings will focus on fundamentals and value parameters respectively.

Without further ado, here are the three (3) key components of my screener:

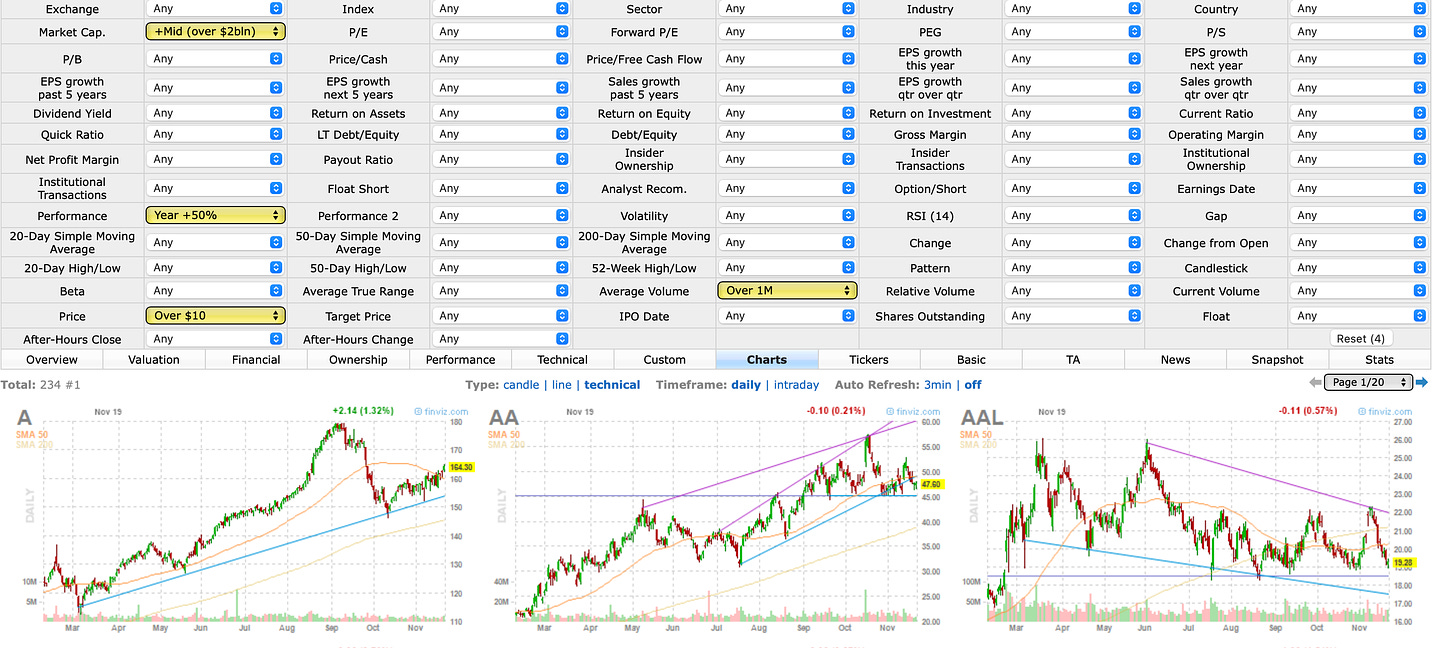

Performance: This is the most important aspect of screening. I eliminate anything that’s not going anywhere. The current setting I use is minimum of 50% up on the year. Now note this number can be dialed up or down based on what kind of year we are having, like in 2013 or 2016, I would have used 10%, as that would be a more realistic number, However in these crazy times where stocks can rise or fall 20% in a session, I believe 50% is a more optimum number.

Market capitalization: market cap filter allows me to not waste time on junk trading at less than 2 billion dollars in market cap. A lot of these small caps are driven less by demand and supply but more by chat room pumps and dumps. I avoid them by screening for companies with a minimum 2 Billion Dollars in market cap. Optionally, I also put a price filter to ignore anything less than $10 apiece.

Volume: this one is key. Before the internet was a thing, it was wiser to find stocks with low-average volumes. This meant you saved yourself from crowded WS names. I believe that is not the case any more. I screen for stocks with very high average volume. My current setting is 1 MILLION or more average trading volume per day.

Putting this all together: All said and done, my screener page looks something like Figure A below.

After I run this screen, I end up with 230+ stocks. This number can be higher or lower, depending on how well the overall market is doing.

I can now start using this universe of 230 stocks to further filter and shortlist about 20 names! Clues and patterns I look for are consolidation, accumulation, distribution etc. My follow-up post will be to pick a couple of names from the results of my screener and do a deeper dive on those to define and refine levels, targets etc.

Don’t miss my follow up email, subscribe to my newsletter. If you liked this post, don’t forget to share as it lets me reach more traders like yourself :)

The screener settings I used are very common and available in most charting and broker platforms. The example I used in Figure A below is from Finviz.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Good Morning Mr. Tic, what a detailed screener settings details, very helpful & easy to understand. Thank you. 🙏

Hi Tic, could you make an in-depth post on consolidation, accumulation, distribution models or recommend some texts where i can learn more about the topics? A thousand thanks