Hey traders-

So the level I sent at the market open in the chat room below was indeed the low of the session and we did trade unto 5800 a couple of hours later. Tremendous day.

I mean this was an absolutely insane day for any one who held on to stocks like NVDA, TSLA, META, BMA, PYPL, CVNA, BABA, SE etc.

Levels for tomorrow

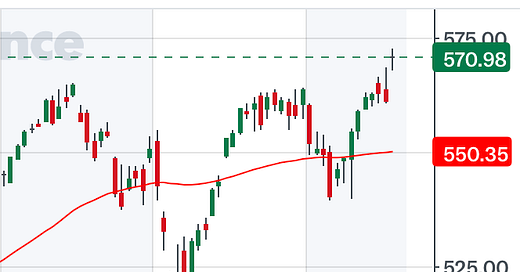

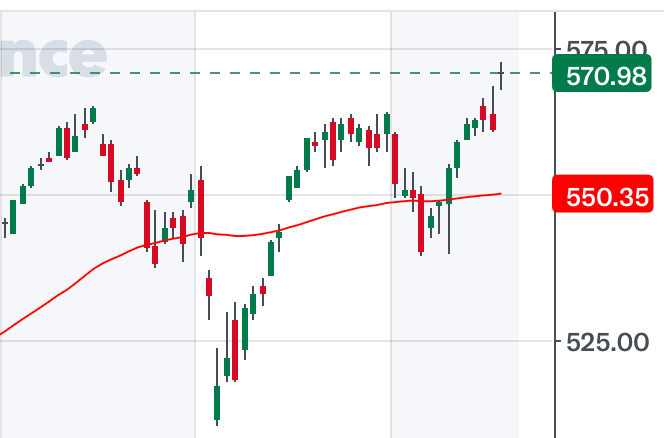

Take a look at Chart above. This is where we are in structure. We are going to need some participation from AAPL above 230, TSLA clears 250, and NVDA take out 125 to break this and hold this.

I felt that though we took out the highs from yesterday but could not quite clear it meaningfully.

In this instance, I like to think 5780-5800 may be important.

Scenario 1: If we remain below 5800 tomorrow, I like to see a retest of 5745-5746 tomorrow.

Additional scenarios may be shared in chat room at around time of cash open, based on overnight auction.

I also want to talk a bit about shorting the index naked, on one off events like the FOMC.

In short, this is a a bad strategy IMO. For shorting the index, I need to see some tell tale signs of weakness- this could be new 52 week lows for instance. Are we making new 52 week lows today? There has to be a well thought out strategy for shorting the index and we aren’t there today. This is why I have shied away from being bearish for months now. I need to see prop indicators turn red before I am convinced that the top is in.

Let us talk about Price Hike for subscription so this does not come across as random and arbitrary.

Pursuant to my note earlier on Telegram, I am executing another price hike, effective 10/1. This will bring the service cost to about $50/month. If you are subscriber, nothing to worry, you will continue to pay what you always paid- just keep your payment method updated. I have 0 control on billing, so if you run into any issues, please contact Substack back office.

So why increase price now that we are in a recession supposedly?

As markets become harder to trade, and indicator based amateur furus flounder, we will continue to get more and more interest and more folks will subscribe to the Orderflow methodology. This is good and bad. It is bad because the more number of folks you have follow any one level, the harder it becomes for such a level to hold. This also adds a lot of pressure on publication to continue to add value. Smaller the footprint, more value and more nimble we are. I have shared this before why but in short this makes such levels a magnet for stop hunting. So we need to have a decent barrier to entry- this also keeps non-serious folks out. 99.99% of our folks are serious about trading and take a long term view to markets but occasionally we do get the riffraff and this in my view will filter that noise and keep it out.

The secondary reason is the sheer number of ideas shared in recent weeks makes it extremely hard for me to offer the publication for such low prices. I cannot justify such a low price when the value being offered is more than $400 a month services. At end of the day, this is a financial publication. It is not an OnlyFans that you can get access to for $3.99. I know for a fact there are services with only the Emini SPX levels which cost $50 a month and that was like 10 years ago. So pricing has to reflect value and I feel this is a good price point. In this sense, it has become important for me to increase the prices. This should not be a shock to anyone as I have said multiple times I see an ultimate price of $100 a month once all the features I want have been implement by Substack.

If you are unable to afford it at $50, we will reassess the pricing in future years if we feel value add is not commensurate with the price. Stay tuned.

~ toc

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.